28 January 2016

Around the world, pressure is building on the insurance industry to divest from fossil fuels, while back home we are ramping up our campaign to stop Australia’s major insurers shooting themselves in the foot by investing in climate change’s drivers.

In the latest international development, California’s Insurance Commissioner on Monday asked all insurance companies currently operating in the state to sell off their coal investments, citing the risks posed by climate change and the rapidly declining state of the coal industry as motivations for the call. In his statement, Commissioner Dave Jones also flagged incoming rules that would force insurers to disclose all fossil fuel holdings, indicating that coal could be just the first step to total fossil fuel divestment.

Jones’ comments come two months after the money management arm of Allianz – the world’s largest insurer – announced its plans to divest from coal. According to chief executive Oliver Baete, the decision was made with “an eye on the 2°C goal of the Paris climate negotiations as well as the economic risks involved.”

In September 2015 the Bank of England’s Prudential Regulation Authority (PRA) published a report, which found that insurance losses from natural disasters in the UK have increased five-fold since the 1980s, and predicted that these losses will only become more significant in a changing climate. The report also highlighted the insurance industry’s conflict between paying out on climate change impacts, while investing in its drivers.

Links between climate change and insurance

As flagged in the PRA report, insurers have a special interest in the effects of climate change. As climate change causes increasingly frequent and severe weather events, insurance payouts on natural disasters are growing alarmingly. In fact, these payouts are exceeding expectations, with risks are currently underpriced by insurance companies as they fail to keep up with the changing environment.

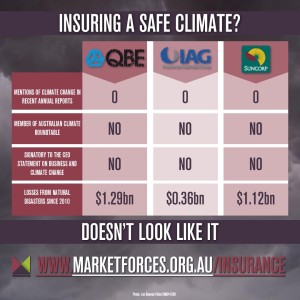

As a result, each of Australia’s major general insurers has recently suffered heavy losses where natural disaster payouts have far eclipsed provisions. Over the past five years QBE has lost $1.29 billion, Suncorp $1.12 billion and IAG $364 million for this reason.

With such significant financial pain being inflicted by climate change, you would think Australia’s insurers would be on the front line when it comes to tackling the problem, right?

Developments in Australia

Well, unfortunately Australia’s insurance industry has been far too slow to react to their losses, and haven’t heeded the recommendations made nor action being taken overseas. Not only have our local insurance companies failed to champion moves to curb climate change, they have actually supported the industry that is driving it by choosing to remain heavily invested in fossil fuels and underwriting major coal and gas projects.

We are currently writing a letter to the Australian Prudential Regulation Authority (APRA – the national asset management regulator) calling for a directive similar to that made in California earlier this week. We need insurers to take their rightful place in the fight against climate change and divest from fossil fuels. You can also get involved by using the form above to send a letter to each of Australia’s major insurance companies calling on them to divest and rule out underwriting any future fossil fuel projects.