4 June 2014

Are your personal finances helping to damage the climate? Chances are they are, without you even knowing it. Do you have a bank deposit? Are you a member of a super fund? Do you own shares? If so, your money is probably being used to finance the companies that extract, transport and burn coal, oil and gas and cause climate change. Emissions from fossil fuels are the main cause of climate change – threatening damage to ecosystems, human health and economies.

Market Forces and 350.org commissioned The Australia Institute to produce a report outlining the steps individuals can take to switch to ‘fossil fuel free’ finance options. Encouragingly the report found that it can involve little cost or risk to your financial wealth, while protecting your finances from the long term risks of the carbon bubble.

The report findings are summarised below. You can also download the full report: “Climate proofing your investments: moving funds out of fossil fuels“.

The problem of unburnable carbon

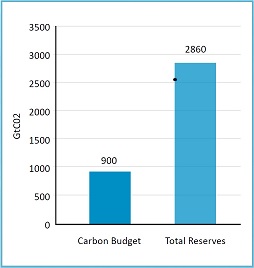

There is now a growing consensus that stopping catastrophic climate change means most of the world’s coal, oil and gas reserves must remain in the ground. At the UN climate talks, countries have agreed that average global warming must be kept below two degrees Celsius to avoid dangerous climate change impacts. This two-degree limit sets a ‘carbon budget’ for how much more greenhouse gas we can emit from burning fossil fuels. But fossil fuel companies plan to extract and burn more than three times this budget.

At present, fossil fuel reserves are counted as assets in a company’s share evaluations, but in future it is likely that these listed companies will have to write down, or leave ‘stranded’, a substantial portion of their reserves. This would have a big impact on the value of those companies. Many institutional and personal investors are now evaluating their exposure to the ‘unburnable carbon bubble’ and taking steps to reduce their exposure to the fossil fuel sector.

Cleaning up you share portfolio

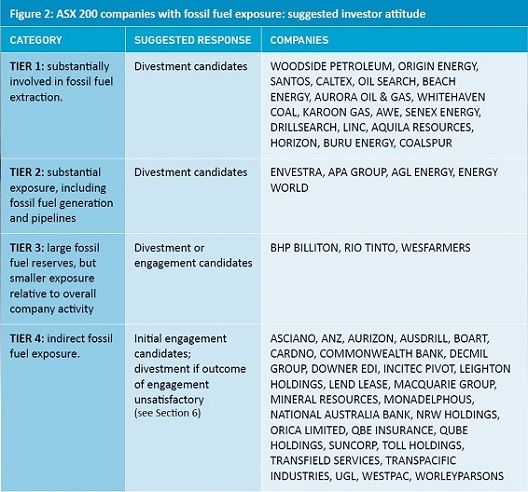

The Australia Institute examined how individuals investing in the Australian Stock Exchange (ASX), either directly or through a super fund, can screen out companies closely involved with fossil fuels with a business model dominated by fossil fuels without compromising financial returns or increasing risk. A diversified portfolio of at least 15 to 20 companies that excludes any or all of the fossil fuel companies below can earn risk-adjusted returns on par with the market if held over the business cycle for seven years or more.

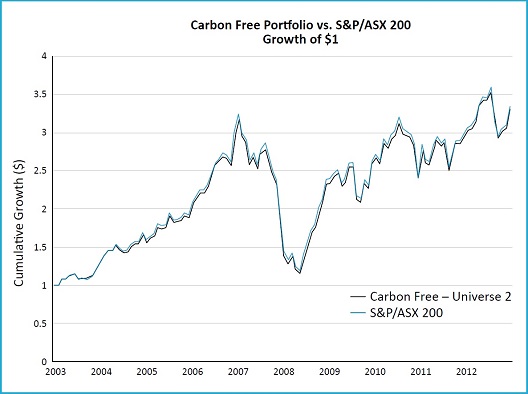

In order to undertake this analysis the Australia institute first categorised companies on the ASX 200 by their level of fossil fuel exposure (Figure 1). They then selected 21 ‘Tier 1’ and ‘Tier 2’ companies with a business model dominated by fossil fuels and removed them from the ASX 200. Aperio Group then constructed an ‘optimised’ a portfolio based on the remaining shares in the ASX 200, and ran a simulation of investment performance over a 10-year period, comparing the screened portfolio to one consisting of all companies listed on the ASX 200. The results show that screening out fossil fuel extraction and downstream industries can have negligible impact on financial performance.

The results simply illustrate a well-established result from a substantial body of theoretical and empirical literature: ethical screening doesn’t need to impact returns.

Switching to a better bank

Many of us have bank accounts and mortgages with one of the big four Australian banks (Westpack Commonwealth, NAB or ANZ). Since 2008, the big four have together loaned close to $19 billion to fossil fuel projects such as coal mines, coal-fired power stations, coal ports, gas plants and gas export facilities. This includes projects threatening ecosystems such as the Great Barrier Reef and NSW’s Leard State Forest. Without the involvement of the big four banks, these projects would be far less likely to go ahead.

There are many alternative banks, credit unions and building societies that have publicly stated that they are not involved with financing fossil fuel projects. A full list of banks can be found on the Market Forces website and a ‘How to Switch Banks and Make it Count‘ guide can also be downloaded.

Superannuation and Managed Funds

There are a growing number of super funds and managed funds that offer products with either certain fossil fuel sectors screened out (e.g. brown coal, thermal coal, oil sands) or no fossil fuel exposure. Some examples include:

- Australian Ethical Investment (Superannuation and Smaller Companies Trust)

- Hunter Hall (Deep Green Trust)

- Ethcial Investment Advisors (Mid-Cap Separately Managed Account)

- Perpetual (Wholesale Ethical SRI fund)

Engagement and Advocacy – Talk before Walk

Going fossil free is not the only response available to concerned individuals. Rather than ‘walking’ away immediately, there are a range of avenues for first ‘talking’ with companies, banks or funds. Talking with institutions and companies will raise internal awareness of the issues, hold them to account and put pressure on them to change.

There are a range of ways you can undertake engagement and advocacy.

- If you bank with the big four ‘Put Your Bank on Notice‘ using the Market Forces website and switch banks if you are not happy with the response

- Contact your superannuation fund using the Market Forces website to ask them how they are managing climate risk and consider switching funds if you are not happy with the response

- Contact companies you hold shares with and ask them how they are responding to the challenge of climate change and the carbon bubble (all public companies will have ‘investor relations’ departments you can contact)

- Attend annual general meetings (AGMs) of companies you hold shares with and ask questions of the board about how they are responding to the challenge of climate change and the carbon bubble