REPORT

Banking Climate Failure

How Australia’s big four banks are still funding new fossil fuels

Executive Summary

Banking Climate Failure examines how Australia’s big four banks have been using smoke and mirrors to continue funding new fossil fuel developments, locking in decades of emissions and worsening risks to the climate and the economy.

Our latest research reveals that ANZ, Commonwealth Bank, NAB and Westpac continued to pour billions of dollars into the companies expanding coal, oil and gas between January 2021 and December 2022.

In the last two years, the big four banks loaned a combined $13.1 billion to the fossil fuel industry. The banks also arranged $2.2 billion through the bond market for fossil fuel companies during this period.

Key findings

All of Australia’s big four banks have poured billions of dollars into the fossil fuel industry over the last two years, and none have ruled out funding all new and expanded fossil fuel projects and the companies developing them. All four banks are therefore acting out of line with the most credible pathways to achieve the Paris climate goals and net zero emissions by 2050.

Beyond that overarching finding, the following key trends in the banks’ fossil fuel financing have emerged:

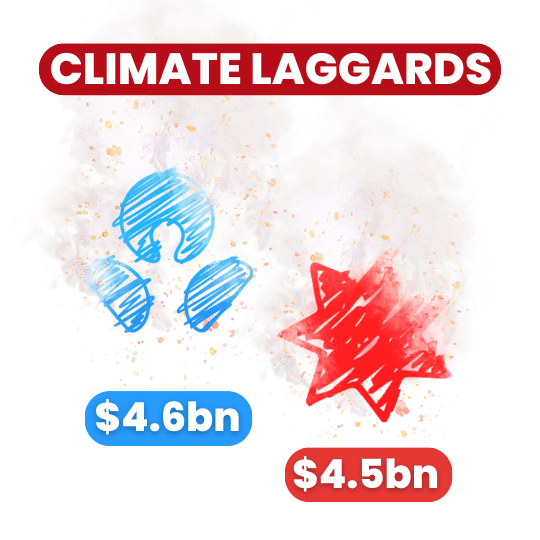

- ANZ and NAB are Australia’s climate laggards: ANZ and NAB have been by far Australia’s biggest backers of the fossil fuel industry in the banking sector, more than doubling their counterparts lending in Commonwealth Bank and nearly doubling Westpac.

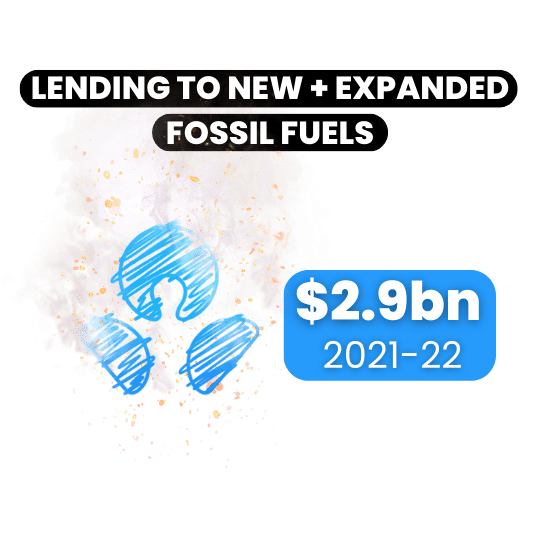

- ANZ is Australia’s biggest lender to new and expanded fossil fuels. ANZ provided a

total of $2.9 billion to new and expanded fossil fuels across 2021 and 2022. NAB

provided the second most with $2.4 billion.

- Commonwealth Bank has reined in fossil fuel lending. Commonwealth Bank was

Australia’s biggest fossil fuel lender between 2016-2020, but has reversed that

trend, lending the least of the big four banks to fossil fuels in the last two years.

- NAB has been Australia’s most regressive bank. Despite attempts to paint itself as

a climate leader, NAB has been the most regressive bank in the last two years,

increasing its funding of the fossil fuel industry to be on-par with perennial climate

laggard ANZ.

- Westpac has lost its previous title of lowest lender to fossil fuels among the big

four Australian banks over the last two years. Westpac continues to finance

Australia’s most egregious climate wreckers, with active loans to Whitehaven Coal,

Woodside, Santos, and the dirty Pluto 2 LNG project.

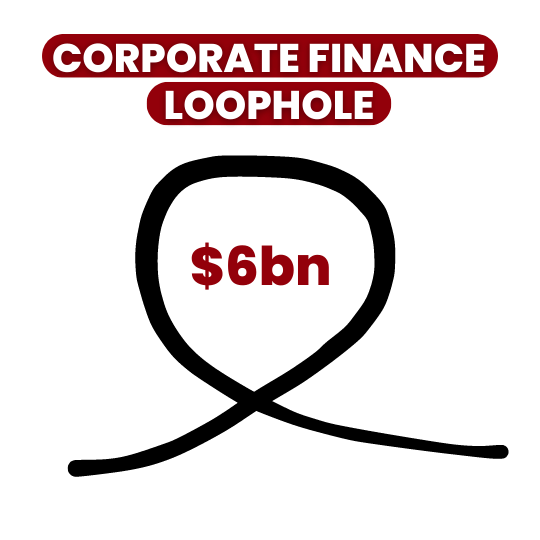

- Corporate finance is the banks’ big loophole enabling fossil fuel expansion. While

the banks have introduced restrictions on direct funding of some new fossil fuel

projects, they are more than willing to continue providing corporate finance –

which accounts for almost 70% of their total fossil fuel lending – to the companies

building such projects.

Banks fossil fuel lending (2021 – 2022)

Australia’s big four banks want you to believe they are serious about taking climate action.

ANZ, Commonwealth Bank, NAB and Westpac all support the Paris climate goals and have

committed to net zero emissions by 2050. But the latest financing data shows those

commitments are little more than greenwash. In the last two years, ANZ, CommBank, NAB

and Westpac have given:

$13.1 billion to the fossil fuel industry, including:

-

- $1.9 billion to coal,

- $11.2 billion to the oil and gas industry, including $4 billion to LNG

- $1.6 billion directly to new and expanded fossil fuel projects, enabling an additional 2.4 billion tonnes of carbon dioxide (CO2) emissions, over 5 times Australia’s emissions in 2021.

- $6 billion to fossil fuel companies pursuing plans completely out of line with achieving net zero carbon emissions by 2050, including to some of the most climate-destructive companies in Australia; Glencore, Woodside, and Santos.

- This corporate lending to companies with fossil fuel expansion plans is more than three times the amount loaned directly to expansionary projects.

Banks lending to fossil fuels – breakdown (2021 – 2022)

| Bank | Total lending to expansionary projects | wdt_ID | Non-expansionary fossil fuel lending | Total lending to companies expanding fossil fuels | Average | Trend | Total fossil fuel lending |

|---|---|---|---|---|---|---|---|

| ANZ | 0.6 | 1 | 1.8 | 2.3 | 0.00 | 0.00 | 4.6 |

| Westpac | 0.3 | 2 | 1.1 | 0.9 | 0.00 | 0.00 | 2.3 |

| NAB | 0.7 | 3 | 2.1 | 1.7 | 0.00 | 4.5 | |

| Commonwealth Bank | 0.0 | 4 | 0.5 | 1.1 | 0.00 | 1.6 |

Corporate finance has accounted for almost 70 per cent of the money the big four banks have loaned to the fossil fuel industry since 2016.

The big four banks have no policies to limit their funding to companies expanding fossil fuels, and they are exploiting this policy loophole to continue pouring customers’ money into companies steering us towards climate catastrophe.

This reckless financing of fossil fuel expansion, despite the banks’ own climate commitments, is occurring whilst the world’s leading experts are imploring financial institutions to cut the greenwashing and end finance for new coal, oil and gas.

The Intergovernmental Panel on Climate Change (IPCC) has declared that the world has already warmed by 1.1°C and is hurtling towards exceeding the maximum emissions possible if the world is to meet the Paris climate goals and avoid the worst impacts of climate change.

In March 2023, United Nations Secretary-General António Guterres summarised the findings of the latest IPCC report by saying there can be “no new coal”, and that “ceasing all licensing or funding of new oil and gas” were crucial elements of defusing the “climate time-bomb”.

The statements echo a UN expert group declaration in November 2022: <“Non‑state actors cannot claim to be net zero while continuing to build or invest in new fossil fuel supply”.

The findings are clear. Banks are greenwashing unless they end finance for new or expanded fossil fuel projects and the companies pursuing them.

Banks fossil fuel lending since the Paris Agreement (2016-2022)

In the seven years since the global Paris Agreement to limit climate change was signed, the big four Australian banks have loaned a whopping total of $57.5 billion to fossil fuels. This includes:

- $19.2 billion to companies expanding fossil fuels

- $9.5 billion to fossil fuel expansion projects

Banks lending to fossil fuels – by year (2016 – 2022)

Banks lending to fossil fuels – breakdown (2016 – 2022)

| Bank | wdt_ID | Non-expansionary fossil fuel lending | Total lending to expansionary projects | Total lending to companies expanding fossil fuels | Average | Trend | Total fossil fuel lending |

|---|---|---|---|---|---|---|---|

| ANZ | 1 | 7.5 | 3.0 | 8.1 | 0.00 | 0.00 | 18.6 |

| Westpac | 2 | 4.0 | 1.2 | 3.8 | 0.00 | 0.00 | 9.0 |

| NAB | 3 | 7.3 | 2.2 | 4.6 | 0.00 | 14.1 | |

| Commonwealth Bank | 4 | 7.1 | 3.1 | 5.6 | 0.00 | 15.8 |

Policy loopholes enabling fossil fuel expansion

The banks’ key fossil fuel policy approaches – project finance restrictions and financed

emissions targets – leave major loopholes enabling them to continue pouring billions into new

and expanded fossil fuel developments.

Close a window, open a door

The big four banks have committed to not providing direct finance for new thermal coal

projects, and all except ANZ have restrictions on project finance for new oil and gas fields,

although these are opaque and littered with caveats.

Yet none of the banks rule out financing the companies that are developing these new fossil

fuel supply projects and are therefore continuing to fund this activity. It’s also

worth noting that none of the banks exclude finance to new fossil fuel transport or

processing infrastructure, such as LNG terminals, despite these projects being out of line with

global climate goals.

The figures below reveal that since January 2016, just after the signing of the Paris

Agreement, corporate finance has accounted for 69 per cent of overall lending to the fossil

fuel industry by the big four. Direct project finance by the banks is becoming rarer and tends

to be for existing projects.

One of the worst examples of corporate financing of fossil fuel expansion came in March 2022 when ANZ, NAB and Westpac all provided an ‘acquisition loan’ to Global Infrastructure Partners for a 49 per cent stake in the proposed Pluto 2 LNG project, enabling Woodside to go ahead with Pluto 2 and its associated new Scarborough gas field, one of Australia’s most disastrous new gas projects and one that would be ruled out for direct project finance by NAB and Westpac’s policies.

Corporate finance facilitating new projects is not limited to the big four banks. A report from Global Energy Monitor published in October 2022 stated that almost 80 per cent of global finance for planned coal projects comes from corporate loans.

Each bank has a policy in place that only requires their heaviest emitting clients to have published transition plans in 2025, giving another two years for climate wrecking companies to establish disastrous new fossil fuel projects. And even then, without any indication of what an acceptable transition plan would be, there’s no guarantee the banks will even consider cutting ties and ending finance for companies expanding fossil fuels.

Banks project finance policies

| Bank | Link | wdt_ID | Coal project finance policy | Oil and gas project finance policy | Loopholes |

|---|---|---|---|---|---|

| https://www.anz.com.au/content/dam/anzcomau/about-us/anz-climate-change-commitment-2023.pdf | 80 | "Our exposure to thermal coal will continue to decline in line with our existing commitments, which includes no longer onboarding any new business customers with material thermal coal exposures, or directly financing new thermal coal mines or power plants" | "We acknowledge oil and gas are still needed as we transition, especially gas as ‘firming’ for renewable energy and in industrial uses. We will continue to assess the role of oil and gas within the context of the broader energy market, public policy developments and stakeholder and shareholder expectations." |

Policy rules out project finance for new thermal coal projects but not corporate finance for companies developing them. Policy does not rule out project finance for new metallurgical coal mines, or corporate finance for the companies developing them. ANZ’s policy does not rule out providing project finance for new oil and gas fields, and associated infrastructure like pipelines and LNG projects. ANZ’s policy does not rule out providing corporate finance to companies developing new oil and gas fields, and associated infrastructure that unlocks them like pipelines and LNG projects. |

|

| https://www.commbank.com.au/content/dam/commbank/about-us/download-printed-forms/environment-and-social-framework.pdf | 82 | "provide no project finance to new or expanded Thermal Coal Mines, nor to new coal-fired power plants" "reduce our existing project finance exposure to Thermal Coal Mines and coal-fired power plants to zero by 2030" "reduce our corporate and trade finance exposure to existing Clients who derive 25% or more of their revenue from the sale of thermal coal to zero by 2030." "only offer corporate or trade finance to existing oil and/or gas producing, metallurgical coal mining or coal-fired power generation Clients after an assessment of the environmental, social and economic impacts. From 2025, we will expect these Clients to have published Transition Plans." "only provide project finance for new or expanded oil or gas projects after an assessment of the environmental, social and economic impacts of such activity, and if in line with the goals of the Paris Agreement" |

"only provide project finance for new or expanded oil or gas projects after an assessment of the environmental, social and economic impacts of such activity, and if in line with the goals of the Paris Agreement" |

Commonwealth Bank’s policy does not rule out providing corporate finance to companies developing new thermal coal projects. Commonwealth Bank’s policy does not rule out project finance for new metallurgical coal mines, or corporate finance for the companies developing them. Commonwealth Bank’s policy does not rule out providing corporate finance to companies developing new oil and gas fields, and associated infrastructure that unlocks them like pipelines and LNG projects. |

|

| https://www.nab.com.au/content/dam/nab/documents/reports/corporate/2022-climate-report.pdf | 84 | “NAB will not finance new thermal coal mining projects or take on new-to-bank thermal coal mining customers” “NAB recognises that currently there are no readily available substitutes for the use of metallurgical coal in steel production. NAB will continue providing finance to its customers in this segment, subject to enhanced due diligence which further considers underlying environmental, social and governance risks." “NAB will not finance new or material expansions of coal-fired power generation facilities.” |

“NAB will not directly finance greenfield oil extraction projects or onboard new customers with a predominant focus on oil extraction." "NAB will only consider directly financing greenfield gas extraction in Australia where it plays a role in underpinning national energy security." "NAB will not directly finance greenfield gas extraction projects outside Australia.” |

NAB’s policy does not rule out providing corporate finance to companies developing new thermal coal projects. NAB’s policy does not rule out project finance for new metallurgical coal mines, or corporate finance for the companies developing them. NAB’s policy does not rule out providing corporate finance to companies developing new oil and gas fields, and associated infrastructure that unlocks them like pipelines and LNG projects. |

|

| https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/ic/Net_Zero_2030_Targets_and_Financed_Emissions_our_methodology_and_approach.pdf | 85 | “Zero lending exposure to companies with >5% of their revenue coming directly from thermal coal mining by 2030. We updated our thermal coal mining definition to align with the NZBA guidelines on the required scope of target setting for thermal coal mining.” | “We will only consider directly financing greenfield oil and gas projects that are in accordance with the International Energy Agency Net Zero by 2050 (IEA NZE) scenario or where necessary for national energy security.” |

Westpac’s 2021 Sustainability Supplement stated, “We will limit support for thermal coal mines or projects to existing basins.” The latest policy update does not mention this, but Westpac says its latest position statement sets a higher bar than its previous approach. Westpac’s policy effectively rules out project finance for new thermal coal projects but not corporate finance for companies developing them. Westpac’s policy does not rule out project finance for new metallurgical coal mines, or corporate finance for the companies developing them. Westpac’s policy does not rule out providing corporate finance to companies developing new oil and gas fields, and associated infrastructure that unlocks them like pipelines and LNG projects. |

Climate impacts off the books

The banks have also adopted ‘financed emissions’ reduction targets for the coal, oil and gas

sectors. ‘Financed emissions’ are those attributable to a bank’s lending portfolio, for example

the emissions of a coal power station while a bank has an active loan to that power station,

proportional to the amount of finance that bank has contributed to the loan.

However, the banks can meet these targets by simply ensuring some loans have been repaid

by their target date (2030), meaning their financed emissions targets do nothing to stop

lending to new fossil fuel projects and the companies building them today. If built, these new

and expanded projects would lock in decades of ‘real-world’ emissions, regardless of whether the bank has an active loan in 2030 or not.

Total corporate and project lending (2016 – 2022)

| wdt_ID | Bank | Corporate | Project |

|---|---|---|---|

| 1 | ANZ | $13.4bn | $5.3bn |

| 2 | Commonwealth Bank | $10.9bn | $4.9bn |

| 3 | NAB | $8.8bn | $5.3bn |

| 4 | Westpac | $6.6bn | $2.5bn |

| 5 | Total | $39.6bn | $17.9bn |

| 6 | Percentage | 69% | 31% |

Banks corporate finance policies

| Bank | Link | wdt_ID | Corporate finance policy | Companies with expansion plans the banks have loaned to (2021-2022) |

|---|---|---|---|---|

| https://www.anz.com.au/content/dam/anzcomau/about-us/anz-climate-change-commitment-2023.pdf | 80 | "By 2025 we expect our existing energy customers to [e]stablish specific, time bound, public transition plans and diversification strategies” “Our exposure to thermal coal will continue to decline in line with our existing commitments, which includes no longer onboarding any new business customers with material thermal coal exposures” “We may decline lending to projects and customers – new or existing – that do not meet our expectations.” |

Woodside Santos Global Infrastructure Partners Glencore Medco Energi Internasional CLP Group China Gas Siemens Gas & Power Alinta Energy United Tractors Beach Energy Viva Energy Cooper Energy |

|

| https://www.commbank.com.au/content/dam/commbank/about-us/download-printed-forms/environment-and-social-framework.pdf | 82 | "Only offer corporate or trade finance to existing oil and/or gas producing, metallurgical coal mining or coal-fired power generation Clients after an assessment of the environmental, social and economic impacts. From 2025, we will expect these Clients to have published Transition Plans." |

Santos Glencore Harbour Energy Norwegian Energy Company (Noreco) Beach Energy Viva Energy |

|

| https://www.nab.com.au/content/dam/nab/documents/reports/corporate/2022-climate-report.pdf | 84 | "NAB will continue to provide corporate lending to existing oil and gas customers. From 1 October 2025, new lending and renewals will require oil and gas customers to have a transition plan in place" "NAB has capped thermal coal mining exposures at 2019 levels and intends to reduce these exposures by 50% by 2026, to be effectively zero by 2030, apart from residual performance guarantees to rehabilitate existing thermal coal mining assets." |

Santos Global Infrastructure Partners Glencore Beach Energy Viva Energy Dalrymple Bay Coal Terminal Company Cooper Energy |

|

| https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/ic/Net_Zero_2030_Targets_and_Financed_Emissions_our_methodology_and_approach.pdf | 85 | "We will continue to provide corporate lending where the customer has a credible transition plan in place by 2025, and will work with customers to support their development of credible transition plans prior to 2025." “In our 2020 Position Statement, we committed to supporting thermal coal mining customers transition in line with a commitment to reduce our exposure to zero by 2030. Consistent with the NZBA guidelines, we have updated our position to define thermal coal mining customers as companies with more than 5% of their revenue coming directly from thermal coal mining. We will seek to continue to work with customers affected by this revised revenue threshold to meet our new 2030 target.” |

Woodside Santos Global Infrastructure Partners Beach Energy Viva Energy |

Continuing to fund climate-wrecking companies

Three Australian companies stand out as the worst when it comes to investing in new fossil fuel projects. The scale of the projects being pursued by these companies is aligned with catastrophic levels of global warming and the banks’ ongoing funding of these fossil fuel companies is enabling them to do so.

If the new projects of Woodside, Santos, and Whitehaven Coal all go ahead, the cumulative impact would be 4.2 billion tonnes of carbon dioxide (CO2), equivalent to more than 9 times Australia’s 2021 emissions.

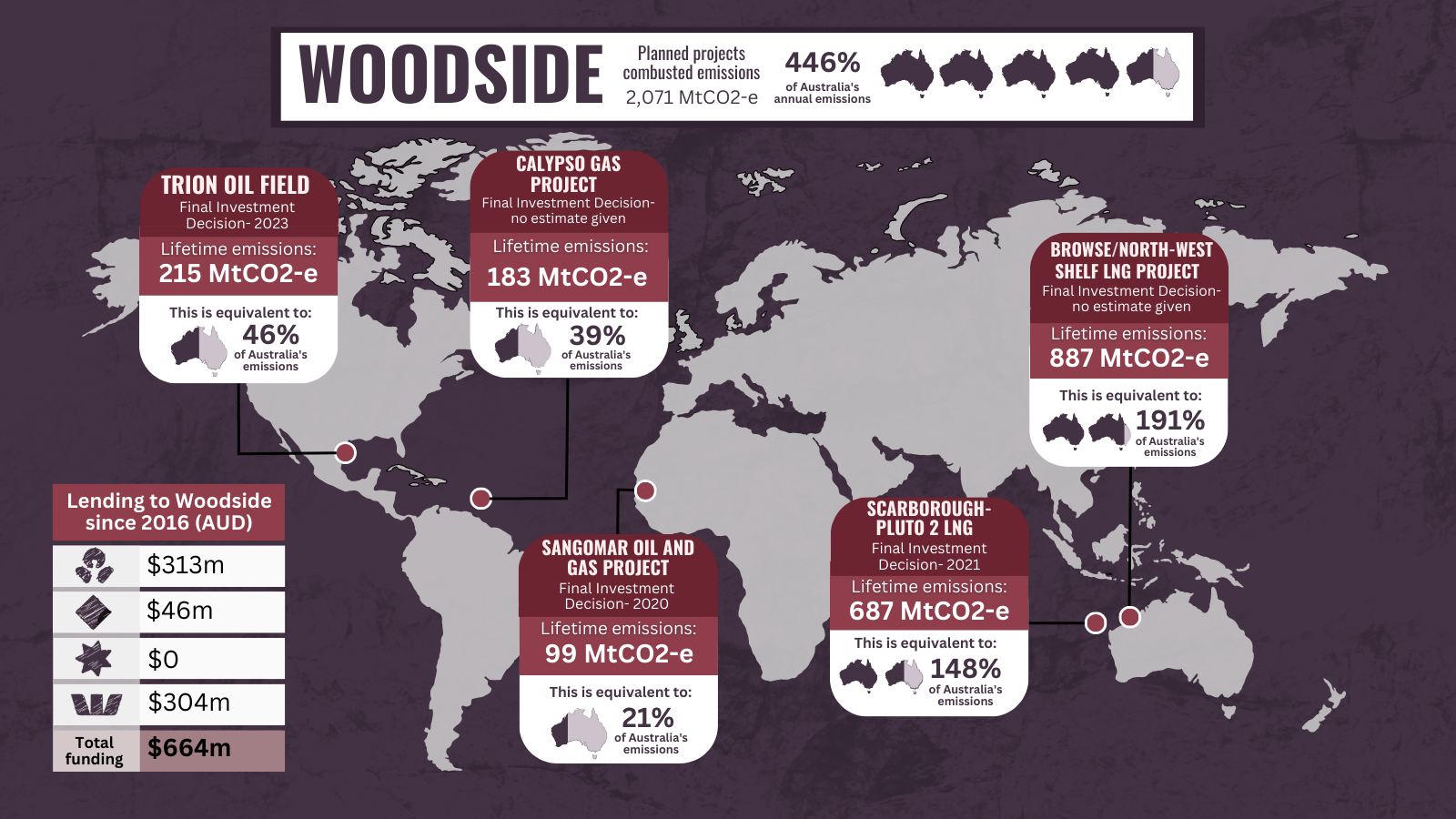

Woodside – Funded by ANZ, NAB and Westpac

In July 2022, ANZ and Westpac loaned $125 million each to Woodside as part of a $1.76 billion general corporate loan.

Woodside is Australia’s largest producer of gas, and is pursuing massive expansion plans completely out of line with global climate agreements. Woodside’s business plans would see it bring on five new oil and gas projects currently in its pipeline. By 2027, the company is aiming to increase production by 45 per cent, and if it gets its way, their proposed projects would see an estimated 2 billion tonnes of harmful CO2 entering the atmosphere.

Gas flaring at Woodside’s Pluto LNG processing facility. Image courtesy of the Conservation Council of Western Australia (CCWA).

Case study – Scarborough Pluto 2 LNG project

One of Woodside’s pipeline projects is the monstrous Scarborough-Pluto 2 LNG project. Pluto 2 would process the gas from the Scarborough gas field which would then be exported overseas.

Independent analysis by Climate Analytics, a non-profit climate science and policy institute, has concluded the project “represents a bet against the world implementing the Paris Agreement” and Carbon Tracker has stated Scarborough “is not competitive even in the

International Energy Agency’s 2.7°C warming scenario] STEPS – that is, a world that utterly fails to decarbonise”.

Yet in March 2022, ANZ, NAB and Westpac all financed a $4.6 billion loan to Global Infrastructure Partners to facilitate an acquisition of a 49 per cent stake in the Pluto 2 LNG project.

The gas produced from Scarborough-Pluto 2 would, when burned, see an additional 687 million tonnes of CO2 enter the atmosphere. First gas from Scarborough is expected to come online in 2026, a full five years after the International Energy Agency (IEA) declared that there is no room for new oil and gas projects in a world hoping to achieve net zero emissions by 2050.

Woodside’s Scarborough-Pluto 2 gas project is not just a climate disaster, it’s also a cultural heritage disaster.

Scarborough is located approximately 375 km off Murujuga, also known as the Burrup Peninsula. Murujuga country is home to some of the world’s oldest rock-art, dating back at least 50,000 years. First Nations Traditional Custodians have described the rock art as

Australia’s “pyramids of Egypt.”

A recent peer-reviewed study revealed evidence that industrial pollution in the north-west corner of Western Australia is causing damage to the rock art in Murujuga. The study concludes: “A reduction in industrial emissions is considered essential if damage to

the rock art is to be limited and this iconic cultural place is to remain largely intact for future

generations.”

Not only does the project violate the banks’ commitment to the Paris Agreement and net zero emissions by 2050, it also violates the rights of Traditional Custodians. Murujuga Aboriginal Corporation has stated: “If research finds that emissions do have an impact on the state of preservation of rock art, then MAC will expect the state and commonwealth government to adjust any existing approval to ensure the protection of cultural values at Murujuga”.

Source: Company announcements and annual reporting, Australian government

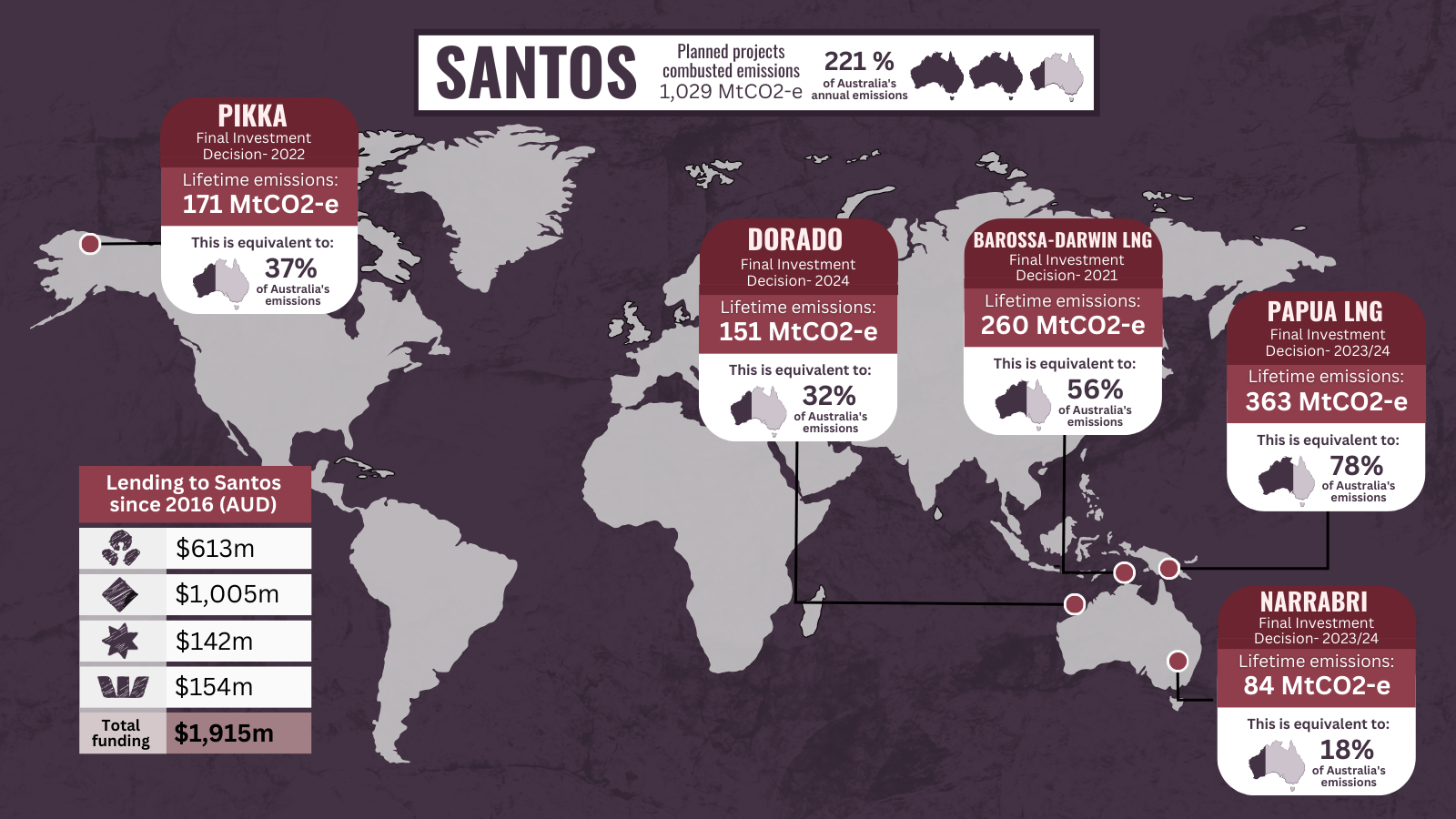

Santos – Funded by ANZ, CBA, NAB & Westpac

In August 2022, all big four banks participated in a $1.8 billion loan to one of Australia’s biggest oil and gas companies, Santos. The loan was partially related to Santos’ highly controversial Barossa gas field. The banks each contributed the following amounts the loan:

Contribution to most recent Santos loan

| Bank | wdt_ID | AUD (m) | Average | Trend |

|---|---|---|---|---|

| ANZ | 1 | 145 | 0.00 | 0.00 |

| Westpac | 2 | 65 | 0.00 | 0.00 |

| NAB | 3 | 72 | 0.00 | |

| Commonwealth Bank | 4 | 109 | 0.00 |

Santos is one of Australia’s largest oil and gas producers, and is pursuing massive expansion plans, which undermine the Paris Agreement and the chance of achieving net zero emissions by 2050. The projects that Santos has in its pipeline would see Santos increase its annual emissions by 40 per cent from 2022 to 2030. In the IEA NZE 2050 Scenario, emissions from oil and gas use fall 29 per cent this decade.

Despite the IEA’s finding that there is no room for new oil and gas fields in a world hoping to achieve net zero emissions by 2050, Santos is pushing ahead with plans that would add an estimated 1 billion tonnes of CO2 into the atmosphere.

One of Santos’ projects, the Barossa gas field, is so emissions intensive that John Robert, a leading economist from the Institute for Energy Economics and Financial Analysis described it as “a CO2 emissions factory with an LNG by-product”.

Meanwhile, Santos’ Narrabri Gas Project would see 850 gas wells drilled throughout the Pilliga Forest, sacred to Gomeroi Traditional Owners. This project has been opposed for years by local farmers and the Gomeroi Traditional Owners.

Despite Commonwealth Bank, NAB and Westpac all having policies that restrict project finance for new oil and gas fields, the banks continue to hand over tens of millions of dollars of their customers’ money to a company committed to destroying the climate and local environment.

Source: Company announcements and regulatory submissions, GaffneyCline, Australian government

Case study – No Free, Prior and Informed Consent for Barossa-Darwin LNG project and the Tiwi Islands

By September, the Court had ruled in favour of the Tiwi Elder and invalidated Santos’ approval to drill for gas in the sea north of the Tiwi Islands. It was a landmark decision for the rights of Traditional Owners in the fight for cultural heritage protection.

The banks loaned to Santos while the court case was ongoing, and as such, must have known of Traditional Owners’ opposition to the Barossa project.

The fact that such a clear lack of Traditional Owner consent slipped through the cracks of the banks’ human rights policies shows Australia’s biggest financial institutions are failing to take their own commitments seriously.

Australia’s big four banks all have policies requiring them to act in line with international human rights standards. All of the banks’ policies either include a direct commitment to the principle of ‘free, prior and informed consent’ (FPIC) or refer to the UN Declaration on the Rights of Indigenous Peoples, of which FPIC is a key principle.

The impacts of the Barossa gas field and associated Darwin LNG expansion project on the local environment and cultural heritage of the Tiwi Islands, Larrakia Country and surrounding sea country would be far-reaching and disastrous. Traditional Owners have stated that the project risks disruption to songlines, sacred sites and cultural practices, as well as spills and pipeline ruptures in the local marine and surrounding environments.

In response to the banks’ financing of Barossa, Tiwi Islands and Larrakia Traditional Owners lodged formal complaints against ANZ, Commonwealth Bank, NAB and Westpac in April 2023 alleging that the banks breached their human rights commitments. These grievances are the first filed by Traditional Owners in Australia against financial institutions.

The complaints demand the banks pull out of the existing loan to Santos and commit to not funding the proposed expansion of the Darwin LNG project, which would be used to process and export gas from Barossa.

Traditional Owners Carol Puruntatameri and Paulina Puruntatameri are amongst those opposing the gas project.

Support Traditional Owners! Demand the big banks live up to their human rights responsibilities by pulling out of the Santos loan.

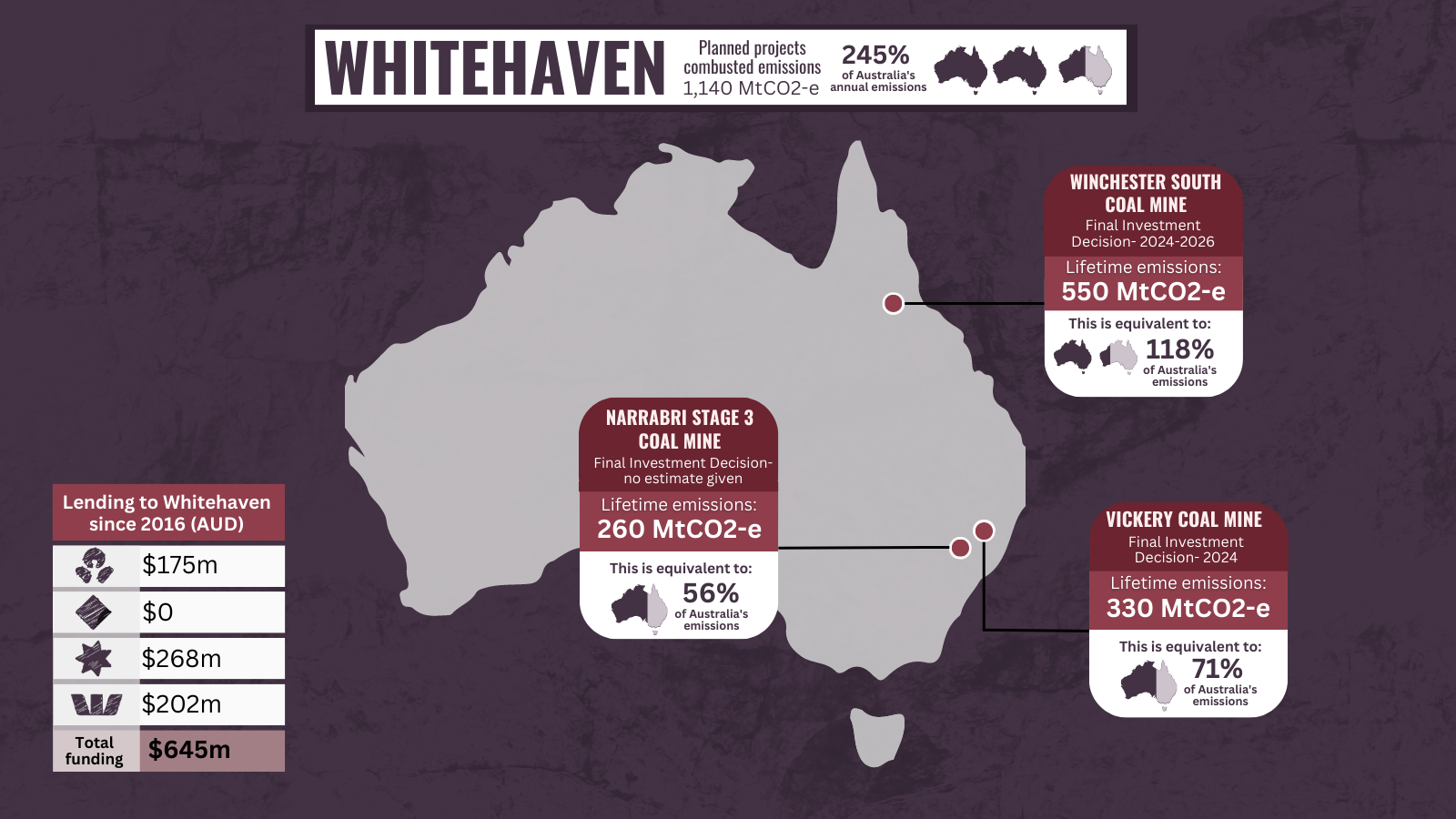

Whitehaven Coal – Funded by NAB and Westpac

Whitehaven Coal is the largest undiversified coal mining company on the Australian share market, and has plans to massively expand the coal industry.

Whitehaven’s dirty expansion plans fly in the face of the world’s scientists, who say coal use must decline dramatically if we are to avoid the worst impacts of climate change.

Coal use must fall 75 per cent by 2030 and 95 per cent by 2050 to align with the IPCC model for keeping global warming to 1.5ºC.

Whitehaven has no plans to transition from coal mining. Instead the company is justifying its plans with coal demand scenarios consistent with a catastrophic 3ºC of global warming.

The company is pushing ahead with three new coal projects, Vickery, Narrabri Stage 3, and Winchester South.

When emissions from burning the coal from these mines are added up, over their lifetimes Market Forces estimates they would unleash at least 1.2 billion tonnes of carbon emissions, the equivalent of more than twice Australia’s current annual emissions.

Whitehaven’s banking syndicate of 13 international and Australian banks loaned a combined $1 billion to Whitehaven in February of 2020. NAB and Westpac both participated in the loan, each committing $110 million.

Whitehaven revealed at its 2022 AGM that the company plans to refinance the facility before it matures in July 2023, leaving the door open for NAB and Westpac to provide more finance.

If the banks refinance Whitehaven, it will be a clear example of banks still funding new coal through corporate financing.

Whitehaven’s monstrous Maules Creek coal mine, which has destroyed swathes of the Leard State Forest, NSW. Image courtesy of the Lock the Gate Alliance

Environment & community impacts

In addition to its worsening impacts on the climate, Whitehaven has a long history of destroying the local environment and breaking the law.

Whitehaven’s neighbours, organised by Lock the Gate, have kept a long list of Whitehaven’s environmental breaches, which have threatened local livelihoods and critical habitat for endangered species. The company and its subsidiaries have been found guilty or investigated 35 times and incurred almost $1.5 million in total penalties.

Arguably the most appalling of Whitehaven’s crimes concerns water. The Liverpool Plains are some of the most fertile agricultural lands in New South Wales. Farmers in the region are deeply concerned that Whitehaven’s water use is drying out streams and bores.

Local farmers have been repeatedly outbid on water licences with Whitehaven paying five times the market value at times for water. Worse still, in April 2021, Whitehaven pleaded guilty to taking one billion litres of water during a severe drought in New South Wales.

Both NAB and Westpac say that they consider environmental, social and governance risks when lending to clients. Whether the banks do in fact refinance Whitehaven’s loan this year will be a test of the bank’s policies around climate, environmental and social concerns.

Source: Company regulatory submissions, Australian government

Individual banks lending detail

ANZ

Australia’s bank of gas and the biggest lender since Paris

ANZ has been the biggest backer of the fossil fuel industry since 2016, loaning $18.6 billion.

Between 2021 and 2022 alone ANZ gave $4.6 billion to fossil fuels, the most of any of the big four.

ANZ has been Australia’s banking partner of choice for companies seeking to expand the gas sector.

ANZ participated in at least 22 loans and 7 bonds for companies and projects expanding the gas sector. ANZ gave $2.9 billion to the gas industry alone in the last two years.

ANZ loaned $3.6 billion to the coal industry between 2016 and 2022, the most of any Australian bank. $736 million of this came in 2021 and 2022.

To find out more about ANZ visit our ANZ webpage.

Financed emissions targets vs. client’s emissions trajectory

Commonwealth Bank

Door left ajar for increasing fossil fuel lending and new projects

Commonwealth Bank has reversed the trend observed when Market Forces first published Funding Climate Failure.

Between 2016 and 2020, Commonwealth Bank loaned a whopping $14.2 billion to the fossil fuel industry, providing the most of all four banks to fossil fuel expansion projects and companies with plans consistent with the failure of the Paris Agreement.

During 2021 and 2022, Commonwealth Bank came in as the lowest lender to the fossil fuel industry, at $1.6 billion.

Particularly encouraging in this trend was the bank’s reduction in lending to companies with expansionary plans, where Commonwealth Bank also loaned the least of the big four.

However, Commonwealth Bank’s policy leaves the door open to undoing its recent improvements, with no restrictions on corporate finance for companies expanding fossil fuels or project finance for new fossil fuel transport and processing developments.

To find out more about CommBank visit our CommBank webpage.

*Note that the graph below is set from a 2022 baseline, whereas Commonwealth Bank’s target is set from a 2020 baseline. The reason the chart below shows Commonwealth Bank increasing its oil and gas sector financed emissions between now and 2030 is that Commonwealth Bank exceeded its 2030 target in its 2021 reporting year, and has not re-baselined to set a more ambitious target as a result. As it currently stands, Commonwealth Bank’s target would enable the bank to increase its exposure to the oil and gas sector between now and 2030.

Financed emissions targets vs. client’s emissions trajectory

Source: Commonwealth Bank 2022 Climate Report, Market Forces analysis of STO reporting, IEA projections are originally

based on a 2021 baseline from the NZE2050 Scenario outlined in the World Energy Outlook 2022. Commonwealth Bank’s projections are originally based on a 2020 baseline and the company’s 2022 reporting.

NAB

Australia’s most regressive bank – a climate laggard trending backwards

When Market Forces published Funding Climate Failure, NAB came in as a distant third behind Commonwealth Bank and ANZ for its lending to the fossil fuel industry, lending $9.5 billion between 2016-2020.

In the last two years NAB has been Australia’s second biggest backer of the fossil fuel industry.

During 2021 and 2022 NAB loaned $4.5 billion to the fossil fuel industry, almost three times as much as Commonwealth Bank and nearly twice the finance provided by Westpac.

NAB’s lending in the past two years was on par with perennial climate laggard ANZ.

To find out more about NAB visit our NAB webpage.

Financed emissions targets vs. client’s emissions trajectory

Source: NAB 2022 Climate Report, Market Forces analysis of STO reporting, IEA projections are originally based on a 2021

baseline from the NZE2050 Scenario outlined in the World Energy Outlook 2022. NAB’s projections are originally based on a 2021 baseline and the company’s 2022 reporting.

Westpac

Australia’s third biggest backer of the fossil fuel industry

Westpac is Australia’s third biggest backer of the fossil fuel industry.

Between 2016 and 2020, Westpac loaned the least to the fossil fuel industry of the big four, at $6.7 billion. It has now lost this position to Commonwealth Bank. Between 2021 and 2022, Westpac loaned $2.3 billion, compared to Commonwealth Bank at $1.6 billion.

It is concerning that Westpac has not substantively changed its year-on-year lending to the fossil fuel industry since the signing of the Paris Agreement.

As Commonwealth Bank has now taken legitimate steps to reduce its overall lending, Westpac cannot hide its lack of climate action any longer.

In 2022 alone, Westpac provided finance to Woodside, Santos and to Global Infrastructure Partners in a loan that enabled Woodside to reach a final investment decision on its climate-wrecking Scarborough-Pluto 2 LNG project.

Westpac remains exposed to Whitehaven Coal from a loan in February 2020, where it loaned $110 million. This loan is up for refinancing in July 2023.

To find out more about Westpac visit our Westpac webpage

Financed emissions targets vs. client’s emissions trajectory

Source: Westpac Net-Zero 2030 Targets and Financed Emissions, Market Forces analysis of STO and WDS reporting, IEA projections are originally based on a 2021 baseline from the NZE2050 Scenario outlined in the World Energy Outlook 2022. Westpac’s projections are originally based on a 2021 baseline and the company’s 2022 reporting.

Tell your bank to stop financing companies expanding coal, oil and gas!

Methodology

Scope

Lenders: ANZ, Commonwealth Bank, NAB and Westpac

Assets: Fossil fuel companies, fossil fuel projects, fossil fuel commodities traders

Fossil fuel sub-sectors: Exploration and production, processing and distribution, utilities, equipment supply to extractive industries, oil field service companies,

Timeframe: 1 Jan 2021 – 31 Dec 2022

Finance type: Project and corporate loans, bonds

Transaction type: Primary, refinancing, acquisition

Market Forces obtained primary data from finance industry databases provided by Bloomberg, IJGlobal and Refinitiv. Further primary data was sourced from company filings, reports and market disclosures. Figures were cross-referenced for consistency and verified against secondary material. This report presents a synthesis of this material.

Data presented in this report from 1 Jan 2016 – 31 Dec 2020 is unchanged from the original Funding Climate Failure report published in 2021.

Some changes have been made to the methodology of reporting in this iteration. For the 2021-2022 figures, we have now tracked the bonds arranged by the banks for the fossil fuel industry, in addition to loans. As bond arrangement does not necessarily involve the banks’ own capital, they have been reported separately to loans in this report.

For corporate finance, we first assessed whether the loan was explicitly for fossil fuel activities and if this information was not available, apportioned the value of that loan to reflect the proportion of the company’s business that is involved in the fossil fuel supply chain. We based these calculations on the company’s most recent revenue information; in certain cases where this was not available, we used production or capacity instead.

Dollar values represent the sum of committed loan amounts and are presented in Australian dollars unless otherwise specified. We used exchange rates from the RBA as of the financial close date of each deal.

We have tried to capture as much information as possible in this study but a lack of transparency about fossil fuel lending means it will only ever be a partial picture.

Exposure vs. lending

We also present the banks’ own reporting on their ‘exposure’ to fossil fuels. Their methodologies vary, but as a rule capture the amount of money currently ‘on their books’ to fossil fuel companies and projects. If a bank refinances a loan but maintains the amount it loaned initially, their own reported exposure would be unchanged. For example, if a bank lent $100 million to a fossil fuel company in 2020, and refinanced the loan with the same $100 million commitment in 2022, the bank’s reported exposure would still be $100 million at the end of 2022.

By contrast, we consider refinancing of existing loans to be an additional commitment of finance, and therefore the money loaned in a refinance is considered additional money; hence our methodology would in the above example report $200 million loaned by the end of 2022. We use this approach because (1) we consider each refinancing a conscious decision by a lender to continue supporting a company or project, and (2) the lending group can and often does change upon refinancing and we wanted to capture this.

To see each bank’s reported exposure, visit their respective webpages on our website (linked above).

Classifications

Expansionary lending: There are two ways a loan can be classified as expansionary, (1) if the loan is for the purposes of a new fossil fuel project, which includes upstream, midstream and downstream or (2) if the loan is to a company which is currently building or has plans to build new fossil fuel projects. Company filings, reports, and market disclosures, as well as data from financial sources Bloomberg, IJGlobal and Refinitiv were used to determine whether the company has plans to build new projects or increase production at existing facilities.

Corporate and project finance: Where available, market disclosures by the issuer were relied upon to determine what the proceeds would be used for. If that source was unavailable, Bloomberg, IJGlobal and Refinitiv were used as secondary sources. Occasionally a loan that was classified as ‘corporate finance’ in the original sources (for instance, for an acquisition of a stake in a new project) was reclassified as project finance due to the proceeds going exclusively to a single project.

Commodity traders: Commodity traders such as Vitol, Mercuria, and Trafigura have been included in this dataset. The reason behind this is that these companies derive a large (greater than 50%, in some cases greater than 90%) of their revenue from trading fossil fuel commodities. These commodity traders also often have offtake agreements with new fossil fuel projects – enabling the expansion of the fossil fuel industry.

Calculations and assumptions – climate impact of new fossil fuel projects

Calculations and assumptions

Emissions

Due to the number of companies and new projects proposed or under development in this analysis, emissions from all companies with expansion plans were not attempted to be quantified. Instead, Market Forces has focused on the projects of the Australia ‘climate pariah’ companies listed in the report – Santos, Woodside and Whitehaven. Emissions were also calculated from projects that the banks financed directly.

Note that emissions from Whitehaven Coal’s proposed projects have previously been calculated and have been published on Market Forces Whitehaven Coal webpage.

In calculating the emissions accounted for in this study, Market Forces has made a number of conservative assumptions. Details on how the emissions were calculated are as follows:

For each of these companies’ proposed projects, Market Forces has taken projected reserves or resources disclosed by the companies themselves for each project; the source material is linked below. Market Forces then applied the relevant stationary combustion emissions factor for the fossil fuel product involved in the project. Emissions factors used are from the Australian Government National Greenhouse Accounts Factors and the Intergovernmental Panel on Climate Change Guidelines. Note that our estimates cover product combustion only.

When calculating emissions from power generating units Market Forces has taken capacity factors from the US Energy Information Administration and the Australian Energy Market Operator.

Woodside

Santos

Whitehaven

Expansion Projects

Black Point Power Station Additional Gas-Fired Unit (600MW)

Olive Downs Metallurgical Coal Mine

Snapper Point Gas-Fired Power Plant

Pluto LNG Train 2 (Scarborough)

Join us

Subscribe for email updates: be part of the movement taking action to protect our climate.