Company profiles

Whitehaven Coal

Whitehaven’s record of climate and nature destruction, and the financial institutions enabling it.

Whitehaven has three thermal coal projects in development, in addition to two of the largest greenfield metallurgical coal mine proposals in Australia. Whitehaven’s plans to massively expand the coal industry are completely at odds with the Paris Agreement goal of limiting global warming to 1.5ºC. To justify these plans, Whitehaven refers to coal demand scenarios that would see well over 2.4ºC of global warming.

In July 2023, Whitehaven was unable to secure refinance for a revolving corporate loan that it had on its books for a decade. The list of financial institutions willing to back an undiversified coal miner with no plans to shift away from coal grows shorter. But there are still institutions financing Whitehaven’s dirty coal. Just four months later, Jefferies Group and Bank of America loaned Whitehaven US$900 million as a part of a deal to acquire the Daunia and Blackwater mines from BHP. A few months later in December, that loan was quickly replaced with a syndicate of private creditors including Ares Capital, Farallon Capital Management and Canyon Partners. Any financier that backs Whitehaven with its massive expansion plans is undermining the Paris Agreement and net-zero by 2050.

As the latest climate science makes clear, there is no time to waste. It’s time for these financiers to walk away from Whitehaven.

Take Action

Send a message to the banks funding Whitehaven, Jefferies and Bank of America

+ other potential bankers Citi, Goldman Sachs, JP Morgan Chase, Mizuho, Morgan Stanley, SMBC

Financiers that have loaned to Whitehaven Coal

In February 2020, a group of 12 banks refinanced a $1 billion corporate revolver loan for Whitehaven Coal. This loan was first inked in early 2013, with Commonwealth Bank and ANZ dropping out of the loan in 2015 and 2020 respectively. Also in 2020, Nippon Export and Investment Insurance (NEXI), a Japanese state owned insurance corporation, along with MUFG and SMBC, participated in a separate $52 million loan to Whitehaven for mining equipment.

In July 2023, Whitehaven was unable to secure refinance for its corporate revolver. The loan facility included lending commitments from Australia’s big banks NAB and Westpac, as well as Japanese megabanks Mizuho, MUFG and SMBC among a group of 13 total lenders. This failure to renew marks the end of ten years of financial backing from major banks.

In October 2023, now forced to go overseas for finance, major US banks Jefferies Group and Bank of America provided a bridge loan to Whitehaven for $900 million as a part of a deal to acquire the Daunia and Blackwater mines from BHP. Whitehaven is confident that with the addition of metallurgical coal to its portfolio, it will be able to attract finance from overseas. However, in November Whitehaven was unable to refinance the bridge loan with other major institutional banks, instead turning to the private credit market for finance. Financial sources reported a syndicate of over 10 private creditors including Ares Management, Canyon Partners, Farallon Capital Management, and GIC (Singapore’s sovereign wealth fund).

Whitehaven has also repeatedly declared its intention to raise up to $1 billion in the bond market. In 2021, Deutsche Bank was reportedly arranging this finance, but has since abandoned the deal. It is not known which other banks may be involved.

Any bank still willing to finance Whitehaven with its existing coal expansion plans is undermining the 1.5ºC goal of the Paris Agreement and net-zero emissions by 2050.

| Year | Loan amount (AUD) | Banks Involved | Status |

|---|---|---|---|

| Dec 2023 | $1.1 billion | “More than 10 private credit lenders,” including GIC, Ares Management, Canyon Partners and Farallon Capital Management | Active, $5.5 million expires Dec 2026 and $5.5 million expires Dec 2028 |

| Oct 2023 | $900 million | Bank of America, Jefferies Group | Retired |

| 2020 | $52 million | Nippon Export and Investment Insurance (NEXI), MUFG, SMBC | Active, expires Mar 2028 |

| 2020 | $1 billion | Bank of China ($195 million), SMBC ($115 million), Industrial and Commercial Bank of China ($110 million), NAB ($110 million), Westpac ($110 million), Mizuho ($100 million), Bank of Communications ($80 million), MUFG ($50 million), Caterpillar Finance Corporation ($40 million, Credit Suisse ($40 million), Deutsche Bank ($30 million), China Everbright Bank ($20 million) | Retired |

Planning for climate catastrophe

Many of the banks and investors financing Whitehaven have publicly stated their support for the Paris Agreement and the goal of achieving net zero emissions by 2050. The International Energy Agency reiterated in its 2023 update to its net zero roadmap that reaching net zero emissions by 2050 means no new coal mines or expansions can proceed:

No new long-lead time upstream oil and gas projects are needed in the NZE Scenario, neither are new coal mines, mine extensions or new unabated coal plants

In stark contrast, Whitehaven is planning to spend around $4.5 billion1 on three new coal mines and expansions by the end of this decade: Vickery, Narrabri Stage 3 and Winchester South. In June 2023, the company lodged an application to extend the life of its controversial Maules Creek coal mine by another nine years. Additionally, in its acquisition of the Blackwater and Daunia mines from BHP, Whitehaven confirmed one of the other assets it received was the mining tenements for the Blackwater South project, a huge mine that would see Whitehaven mining coal until 2121 if approved, and is estimated to cost over $1 billion to develop (see Blackwater South tab below for details). If all of these projects proceed as planned, when emissions from digging up and burning the coal are added, over their lifetimes these mines would unleash some 3.6 billion tonnes of carbon emissions, the equivalent of more than 7.5 times Australia’s annual emissions.

In the last decade Whitehaven has more than doubled its production. With its acquisition of Daunia and Blackwater, Whitehaven has again doubled its managed production. Whitehaven’s expansion projects, Narrabri Stage 3, Vickery, Maules Creek Extension, and Winchester South would see another massive expansion in its coal production, with the company’s own data showing plans to sustain very high levels of production through to 2040 and beyond.

Whitehaven’s historical and projected coal production

Saleable coal, equity-weighted

Note: Assumes Whitehaven’s five-year production forecast for Blackwater and Daunia continues until end of operations. Blackwater South first coal in 2031 as per initial project documentation. Narrabri Stage 3, Vickery (full scale) and Winchester South are assumed to receive FID in 2024, 2025 and 2027 respectively.

To justify its dirty coal expansion plans, Whitehaven refers to coal demand scenarios that assume substantially higher coal consumption than in the IEA’s STEPS scenario, which would already result in 2.4°C of global warming by 2100. Even at 2°C of warming, the expected increases in temperatures, drought conditions, bushfires, extreme storms and flooding in Australia would be devastating. Global warming of 2ºC would also spell the death of the Great Barrier Reef.

Put simply, Whitehaven’s business model depends on catastrophic ecological, social and economic collapse.

Whitehaven’s coal expansion plans

Vickery Coal Mine

In 2020, a class action challenging the Vickery coal mine expansion was brought by a group of eight young people from across Australia, represented by Equity Generation Lawyers and assisted by their 86 year-old litigation guardian, Sister Brigid Arthur. The case sought to prevent the federal environment minister from approving the proposed expansion.

In a world-first ruling in May 2021, Justice Bromberg of the Federal Court held that the environment minister has a duty of care to protect young people from the harms caused by climate change. The Court found that the impacts of global warming on young people “might fairly be described as the greatest intergenerational injustice ever inflicted by one generation of humans upon the next”.

Although the Full Federal Court overturned Justice Bromberg’s decision for legal reasons on appeal, the Court’s factual findings about the catastrophic consequences of climate change were unchallenged. The case has laid the foundations for further legal challenges to coal mining approvals.

Federal environmental approval for the Vickery expansion was granted in September 2021, the final approval necessary for Whitehaven to proceed with construction. In June this year, Whitehaven commenced “early mining” operations at Vickery to try to take advantage of high coal prices, while leaving a final investment decision on “full scale” Vickery until later.

When emissions from digging up and burning the coal from Vickery are added up, the mine would unleash around 388 million tonnes of carbon emissions over its 26-year lifespan, or more than the UK’s annual emissions.

Early mining at Vickery.

Image credit: Wando Conservation & Cultural Centre Inc, January 2024

Winchester South Coal Mine

Whitehaven’s proposed $2.9 billion Winchester South coal mine involves plans for a large open-cut coal mine in Queensland’s Bowen Basin. Despite publicly referring to the mine as a “metallurgical coal mine”, the mine will in fact produce at least 42% thermal coal according to government department documents. However, this figure could be a gross underestimate, as analysis by Energy & Resource Insights shows Whitehaven has consistently underestimated thermal coal production at its Maules Creek coal mine.

Winchester South would involve mining approximately 215 million tonnes of product coal over a 30-year project lifespan. The mine would impact over 314.5 hectares of endangered Koala habitat, or the equivalent of 155 Melbourne Cricket Grounds. When emissions from digging up and burning the coal are added, the mine would unleash 558 million tonnes of carbon emissions in total, more than Australia’s entire 2022 emissions.

In February 2024, the mine was approved by the Queensland State Government. The project still needs Federal approvals and has not reached a final investment decision.

Narrabri Stage 3 Coal Mine

Whitehaven’s proposed $600 million3 Narrabri Stage 3 project (also known as Narrabri South) would extend the life of the existing Narrabri coal mine from 2031 to 2044. The mine expansion would result in an additional 105 million tonnes of product coal being mined. When emissions from digging up and burning the coal are added, the mine expansion would unleash over 455 million tonnes of carbon dioxide.

According to energy think-tank Ember, the Narrabri expansion could be the most polluting thermal coal mine in Australia, based on its fugitive methane gas emissions. At its 2021 AGM Whitehaven revealed it plans to fund Narrabri Stage 3 off its balance sheet with the capital expenditure expected to be available for early mining to proceed in FY2024

Image Credit: Lock the Gate Alliance, Sept 2022

Maules Creek Extension Project

In June 2023, the company lodged an application to extend the life of its controversial Maules Creek coal mine by another nine years. This project would see Whitehaven mining at Maules Creek until 2043 and release another 266 million tonnes of carbon emissions.

Whitehaven’s Maules Creek mine top left, next the Idemitsu Boggabri mine, then Whitehaven’s Tarrawonga mine bottom right corner all eating into the Leard State Forest.

Whitehaven’s Maules Creek mine top left, next the Idemitsu Boggabri mine, then Whitehaven’s Tarrawonga mine bottom right corner all eating into the Leard State Forest.

Maps data: Google, © 2 July 2020 Maxar Technologies, CNES / Airbus

Blackwater South

The Blackwater South Project was initially developed by BHP as a distinct project from its Blackwater mine. This is one of the largest metallurgical coal mine proposals in Australia, with a planned 90 year life span. Both Whitehaven and BHP confirmed at their 2023 annual general meetings that the mining tenements for this project were a part of Whitehaven’s acquisition of the Blackwater and Daunia mines from BHP. A full economic assessment of the project is not yet available, but the current planning documents estimate costs to “exceed $1 billion”. Should the mine go ahead, this would see Whitehaven mining coal until 2121, threaten 6,800 hectares of koala habitat, and over the course of its lifetime the project would unleash 1.9 billion tonnes4 of carbon emissions, or four times Australia’s annual emissions in 2022.

Approximate location of Blackwater South project. Coordinates sourced from initial advice statement. Maps data: © 2023 Google Earth, Landsat / Copernicus

Destroying the environment and breaking the law

Whitehaven’s existing Maules Creek coal mine is one of Australia’s most controversial mining projects and was strongly opposed by local farmers and Gomeroi traditional owners. Despite a massive community campaign that included a two year blockade, Whitehaven bulldozed hundreds of hectares of critically endangered forest that provide important habitat for rare and endangered species like the Superb Parrot, Regent Honeyeater and Squirrel Glider.

Whitehaven assured the government that it could “offset” the loss of this woodland by buying and protecting other areas of habitat. Six years later, Whitehaven had not kept its promises, even after being granted multiple extensions by the federal government. In 2021, after a legal challenge by the South East Forest Alliance, the government again varied Whitehaven’s conditions of approval to grant the company a further three years to secure the necessary offsets.

Farmers near the Maules Creek coal mine are also deeply concerned that Whitehaven’s water use is drying out streams and bores. Local farmers have been repeatedly outbid on water licences with Whitehaven paying five times the market value at times for water. In April 2021, Whitehaven pleaded guilty to taking one billion litres of water during a severe drought in New South Wales.

This is not the first time Whitehaven has broken the law. The company’s mines are renowned for a litany of environmental breaches, many of which Whitehaven sought to keep secret. The incidents range in severity but many involve breaches of conditions that are imposed to protect communities and the environment from the impacts of mining. In August 2021, Whitehaven was fined $372,500 for 19 breaches of its licence, including failures to rehabilitate drill sites and drilling bores that did not meet approval conditions.

As of September 2023, Whitehaven was still in court, this time for four different allegations, one being “blasting in an incompetent manner” that allegedly impacted a worker 3 kilometres away at another coal mine in Boggabri.

Lock the Gate Alliance has compiled a comprehensive list of Whitehaven’s law-breaking over the last 10 years. This compilation shows the company and its subsidiaries have been found guilty or investigated 35 times and incurred almost $1.5 million in total penalties.

2 Capex incurred by the end of 2030 including inflation. Incorporates spend on ‘early Vickery’.

3 Capex incurred by the end of 2030 including inflation.

4 Based on annual product coal production of 8 million tonnes for 90 years, using stationary combustion emissions intensities from the Australian Department of Climate Change, Energy, the Environment and Water.

Investor briefings

Latest Whitehaven Coal news

NAB fails to address fossil fuel lending loopholes at 2022 AGM

16 December 2022 NAB faces shareholder backlash over continued support for new fossil fuels at...

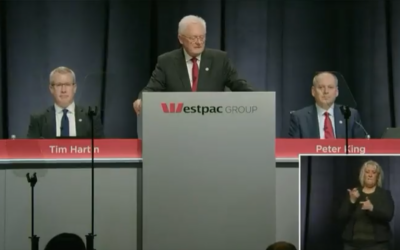

Westpac’s ‘laughable’ greenwashing called out at 2022 AGM

14 December 2022 Over 10% of Westpac's shareholders defied the board to support a formal proposal...

More than 20% of Whitehaven shareholders reject climate-wrecking new coal plans

26 October 2022 Whitehaven Coal faced backlash from big investors and community members both...

Coal miners looking to self-insure new climate-wrecking projects

Since 2021, coal miners, including Adani/Bravus, New Hope and Whitehaven, have complained openly...

Shareholders demand coal wind down plan from Whitehaven

Media release: 25 August 2022 - For Immediate Release Market Forces and Whitehaven Coal...

Legal advice says Deutsche Bank breaching own coal policy by financing companies building new coal mines

10 August 2022 As a lender to Whitehaven Coal and Adani Enterprises, both companies investing...

Join us

Subscribe for email updates: be part of the movement taking action to protect our climate.