Woodside Petroleum is Australia’s largest producer of gas, and is pursuing massive expansion plans consistent with the failure of the Paris Agreement.

According to the International Energy Agency (IEA), reaching net zero emissions by 2050 means no new oil and gas production can proceed. The United Nations Environment Programme (UNEP) has also confirmed that limiting global warming to 1.5°C in line with the Paris Agreement means “global fossil fuel production must start declining immediately and steeply.”

It is abundantly clear that achieving these climate goals and a stable climate future leaves no room for the expansion of the oil and gas industry. Despite this, Woodside is pursuing massive new oil and gas projects consistent with the failure of these goals, such as the massive and highly controversial Scarborough gas project. Many Australian financial institutions continue to support Woodside and its climate-wrecking projects.

Almost every super fund in Australia invests members’ retirement savings in Woodside, and at least 27 Australian and international banks—including ANZ and Westpac—have provided finance to the company since 2018. Many of these financial institutions claim to support the Paris Agreement and net zero emissions by 2050, yet continue to support a company pursuing plans consistent with the failure of these goals.

Woodside is undermining a stable climate future by pursuing new oil and gas projects. Our super funds and banks must stop investing in Woodside and its climate-wrecking projects and plans now.

TAKE ACTION!

Tell your super fund to stop investing in Woodside and its climate-wrecking expansion plans

Almost every single Australian super fund invests in Woodside, using members’ retirement savings to support its climate-wrecking projects and plans. A handful of super funds have either substantially divested from, have some form of exclusion on, or have plans to phase out oil and gas producers, meaning that we are starting to see a trickle of divestment from Woodside. However, this divestment is not happening at the scale nor pace commensurate with the climate crisis we face, and all super funds need to exclude companies like Woodside from their portfolios altogether.

Of Australia’s biggest 30 super funds by assets under management (AUM), only one has implemented an exclusion on oil and gas producers, meaning the rest of these funds are using members’ retirement savings to support Woodside’s massive expansion plans. Worse still, several super funds have voted against shareholder proposals calling on Woodside to wind up its oil and gas production in line with the climate goals of the Paris Agreement.

We have also calculated and presented the below funds’ investments in Woodside as a proportion of each fund’s total allocation to Australian listed equities (shares listed on the Australian stock market), as this allows for direct comparison between funds. Other data points, such as investment exposure as a proportion of the total fund, or dollar value of investments in these companies are incomparable because funds have different allocations to Australian listed equities and different amounts of money in the investment pool.

Has your super fund failed to rule out investment in Woodside? Check the list below and take action!

Investment exposure to Woodside of Australia’s 30 biggest super funds by assets under management

| wdt_ID | Fund | Investment option | Investment exposure (% Australian listed equities) | Total member accounts | Total assets under management |

|---|---|---|---|---|---|

| 1 | Active Super | High Growth | 2.80 | 87,000 | 13.6 |

| 2 | AMP | MySuper 1970s | 3.83 | 1,060,000 | 106.5 |

| 3 | Australian Retirement Trust | Lifecycle Balanced Pool | 3.41 | 2,216,000 | 247.4 |

| 4 | AustralianSuper | Balanced | 5.06 | 2,876,000 | 271.7 |

| 5 | Aware Super | High Growth | 2.88 | 1,155,000 | 150.7 |

| 6 | Brighter Super | MySuper | 3.45 | 128,000 | 32.5 |

| 7 | CareSuper | Balanced My Super | 2.80 | 219,000 | 19.8 |

| 8 | Cbus | Growth | 2.59 | 870,000 | 72.6 |

| 9 | Colonial First State | FirstChoice Wholesale Growth | 3.87 | 850,000 | 102.1 |

| 10 | Commonwealth Bank Group Super | Balanced | 2.44 | 68,000 | 12.5 |

Holdings information as at 31 December 2022.

Methodology and sources

Methodology

The scope of our analysis covers the default (or largest) investment option of Australia’s largest 30 super funds by assets under management (AUM), according to APRA’s June 2022 fund-level superannuation statistics. Further to these APRA-regulated funds, our analysis includes any state-regulated funds with AUM large enough to be included in the top 30 list.

Where mergers between super funds have occurred since June 2022, the single merged entity is listed on the table and occupies only one position on the table, unless the merged funds were found to have clearly separate default options with different investments.

The final analysis pertains to 30 funds. HUB24, Netwealth and Macquarie were excluded as they do not appear to have default investment options comparable to the rest of those captured in the study.

Portfolio holdings disclosures were collected for the final 30 superannuation fund options (see sources below). These holdings were filtered for Australian listed equities, and each option’s investments in Woodside were identified. The investment exposure to Woodside was then calculated as a percentage of total Australian listed equities in each option, using portfolio holdings disclosures effective as at and 31 December 2022.

Sources

Portfolio holdings disclosures for all funds are effective as at 31 December 2022, and were sourced from each fund’s website:

|

Fund |

Investment option profiled |

Fund |

Investment option profiled |

|

Active Super |

Hostplus |

||

|

AMP |

Insignia Financial |

||

|

Australian Retirement Trust |

Mercer |

||

|

AustralianSuper |

Mine Super |

||

|

Aware Super |

MLC |

||

|

Brighter Super |

NGS Super |

||

|

CareSuper |

OnePath |

||

|

CBUS |

Rest |

||

|

Colonial First State |

Russell Investments |

||

|

CommBank Group Super |

Spirit Super |

||

|

Commonwealth Super Corp |

State Super |

||

|

Equipsuper |

Super SA |

||

|

ESSSuper |

TelstraSuper |

||

|

GESB |

UniSuper |

||

|

HESTA |

Vision Super |

Since 2018, a number of domestic and international banks—including ANZ and Westpac—have either loaned to, or arranged finance for, Woodside and its climate-wrecking projects and plans. ANZ and Westpac claim to support the goals of net zero emissions by 2050 and the Paris Agreement. However, both of these banks have loaned money to Woodside, enabling the company to pursue oil and gas production projects consistent with the failure of these global climate goals.

Has your bank loaned to, or arranged finance for, Woodside since 2018? Check out the list below and take action!

Banks that have loaned to, or arranged finance for, Woodside since 2018

- ABN AMRO

- Agricultural Bank of China

- ANZ

- Bank of China

- BNP Paribas

- Chiba Bank

- China Construction Bank

- Citigroup Global Markets

- Credit Agricole

- Credit Industriel et Commercial

- DBS Bank

- DnB ASA

- Export Development Canada

- Hua Nan Commercial Bank

- Industrial & Commercial Bank of China (ICBC)

- ING

- Mega International Commercial Bank

- Merrill

- MUFG Bank

- Mizuho Bank

- Morgan Stanley Australia

- Scotiabank

- Shinsei Bank

- Sumitomo Mitsui Trust Holdings

- Sumitomo Mitsui Banking Corporation (SMBC)

- UBS

- Westpac

Please note: This list was last updated on 11 March 2022

TAKE ACTION!

Send a message to the banks financing Woodside and tell them to stop funding climate failure

Your email will be sent to ABN AMRO, Australia & New Zealand Banking Group (ANZ), Bank of China, BNP Paribas, Chiba Bank, China Construction Bank, Citigroup, Crédit Agricole, Credit Industriel et Commercial, DBS Bank, Export Development Canada, Industrial & Commercial Bank of China (ICBC), ING, MUFG Bank, Mizuho Bank, Morgan Stanley Australia, Scotiabank, Shinsei Bank, Sumitomo Mitsui Trust Holdings, Sumitomo Mitsui Banking Corporation (SMBC), UBS, and Westpac.

Woodside is pursuing massive new oil and gas projects consistent with the failure of the Paris Agreement, including the monstrous Scarborough gas field off the coast of Western Australia (WA), and the associated Pluto Train 2 liquified natural gas (LNG) processing plant. In late 2021, the company also agreed to take over BHP’s entire petroleum business, which would roughly double Woodside’s oil and gas production capacity and make it a global top ten independent oil and gas company. This takeover will be voted on at the company’s 2021 annual general meeting (AGM), and, if it goes ahead, this means Woodside could be spending around $26 billion on expansionary oil and gas projects by 2030 that are incompatible with the Paris climate goals.

Despite the urgent need for fossil fuel production to begin declining in line with global climate goals, Woodside plans to significantly increase the combined total of Woodside and BHP’s oil and gas production over the next five years. Beyond clearly contravening the IEA’s key conclusion that there is no room for new oil and gas production projects in the pathway to net zero emissions by 2050, a number of independent analyses of new oil and gas production projects being pursued by Woodside reveals how significantly out of line they are with global climate goals. Carbon tracker, for example, has found that Woodside’s proposed Pluto Train 2 facility is not even financially competitive in a catastrophic 2.7°C global warming scenario, let alone in a world where we achieve the 1.5°C goal of the Paris Agreement.

Woodside plans to develop one of the most polluting projects Australia has ever seen: the massive Scarborough gas field off the coast of WA and its associated LNG processing facility, Pluto Train 2.

Woodside’s proposed Scarborough gas and Pluto LNG project could result in the emissions equivalent of 15 coal-fired power stations running for 30 years, threaten to accelerate degradation of the Murujuga rock art (proposed for World Heritage listing) due to industrial emissions, and would also cause significant impacts to the local marine environment. Independent analysis has concluded the Scarborough-Pluto combined project “…represents a bet against the world implementing the Paris Agreement”.

Gas flaring at Woodside’s Pluto LNG processing facility. Image courtesy of the Conservation Council of Western Australia (CCWA).

Sangomar is a new oil field proposed for development off the coast of Senegal. In 2021, Woodside acquired FAR Ltd’s interest in the project, increasing the company’s stake in Sangomar to 82%. Woodside is hoping for production to start in 2023, with the first phase aiming to produce 230 million barrels of climate-wrecking oil.

Carbon Tracker identified the $4.6bn Sangomar project as incompatible with the International Energy Agency’s (IEA) Sustainable Development Scenario (SDS)—a pathway that only aims to achieve net zero emissions by 2070—let alone a net zero by 2050 scenario. The Sangomar project is yet another example of Woodside’s reckless pursuit of fossil fuel projects that undermine global climate goals.

In 2021, Woodside, agreed to take over BHP’s entire petroleum business. Aside from roughly doubling Woodside’s oil and gas production capacity, this proposed takeover would place Woodside amongst the biggest oil and gas producers in the world. Some of these proposed projects Woodside may take on include:

- BHP’s share in Scarborough-Pluto

- The Trion oil field, located in the Gulf of Mexico. If this project goes ahead, it would add production capacity equal to an extra 11% on top of Woodside and BHP’s combined 2020 production levels

- The Browse basin, located off the coast of WA. This gas field could add further capacity equal to 14% above Woodside and BHP’s combined 2020 production if it goes ahead

Woodside has a track record of causing environmental damage and dodging accountability for it. In 2017, it was revealed that Woodside was responsible for an oil spill the previous year, which leaked 10,500 litres of oil into the ocean off the coast of WA over a period of two months. This spill was kept secret by the offshore oil and gas regulator, NOPSEMA (National Offshore Petroleum Safety and Environmental Management Authority).

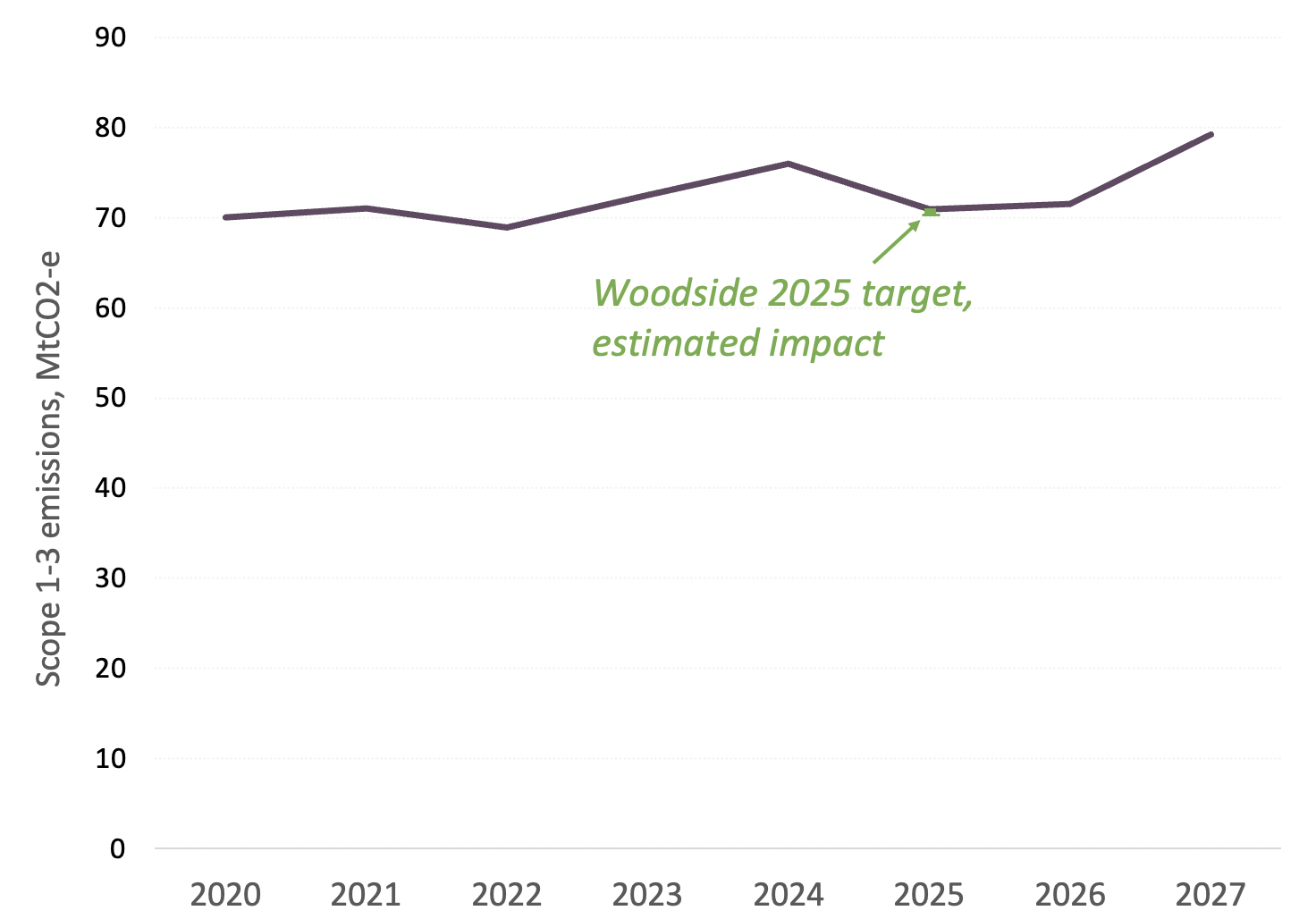

Looking forward, Woodside continues to shirk responsibility for the emissions from its climate-wrecking business activities. The company has committed to achieving net zero ‘scope 1 and 2’ (or ‘operational’) emissions by 2050, despite these emissions only accounting for approximately 10% of the company’s overall emissions profile. Much of the remaining 90% of Woodside’s emissions—its ‘scope 3’ emissions—come from customers burning its oil and gas for energy use. The chart (Figure 1) shows Woodside’s totally inadequate 2025 emissions reduction target (a 15% reduction in scope 1 and 2 emissions) has almost no impact on the company’s estimated emissions pathway, which is actually expected to increase due to its increasing production plans.

Figure 1: The estimated impact of Woodside’s 2025 emissions reduction target vs. its estimated emissions profile

Woodside’s claim of support for the Paris climate goals appears misleading, in light of the fact that the company’s increased production plans are likely to see its emissions increase over the next five to ten years. Taking Woodside’s own production projections—applying conservative assumptions where required and assuming Woodside fully implements its emissions targets—our analysis shows that Woodside and BHP Petroleum’s combined annual emissions (from production, excluding Woodside’s traded LNG business) are likely to increase by at least 11% from 2020 to 2027.

Furthermore, despite repeated claims from Woodside (and the broader gas industry) that increasing LNG exports would reduce global emissions by displacing coal in Asia, a CSIRO study—commissioned and then withheld from the public by Woodside—contradicts this claim, finding increasing Australian gas supply could prolong coal, displace renewables and actually increase emissions in Asia.

One of the many pieces of rock art at Murujuga. Image courtesy of CCWA.

Woodside’s regard for Indigenous cultural heritage is no better than its consideration for the environment. In the 1980’s, the construction of the Karratha gas plant—a joint venture owned and operated by Woodside but co-owned with BHP, Shell, Chevron, BP, and Japan Australia LNG—saw the destruction of 5,000 pieces of Indigenous rock art.

Worse still, Woodside’s destructive activities at Murujuga (also known as the Burrup Peninsula) continue to this very day. Industrial emissions from its Pluto 2 LNG processing facility threaten to accelerate the degradation of the Murujuga rock art—a 40,000 year-old collection of rock art containing Indigenous cultural and spiritual knowledge—undermining efforts to achieve world heritage listing for the site. Woodside’s blatant disregard for Indigenous cultural heritage has been dubbed “Juukan Gorge in slow motion,” a reference to Rio Tinto’s destruction of the 46,000 year-old rock shelters in WA’s Pilbara region.

For more information on Woodside’s despicable track record on environmental, social and cultural heritage damage, check out the Woodside Come Clean web page.

Westpac takes two steps forward, one big step back

8 November 2023 This week Westpac announced a host of new project finance restrictions for new and expanded fossil fuel projects, but also walked back a key policy that restricts finance to the companies developing them. In a disappointing regression on its...

Super fund support for Woodside and Santos’ climate-wrecking expansion plans

12 September 2023 Our latest analysis shows members of Australia’s biggest super funds own a significant stake in some of Australia’s worst climate criminals, Woodside and Santos. For the first time, we’ve paired our investment analysis with share voting data to...

Woodside pushing ahead with Trion oil field, another project out of line with Paris climate goals

20 June 2023 Climate wrecking oil and gas company Woodside has today made the decision to proceed with a new offshore oil field, once again demonstrating a complete disregard for investor demands to align with global climate goals. Woodside today made the final...

HESTA’s sleight of hand distracting members from the fund’s most climate-damaging investments

14 June 2023 HESTA’s latest climate change report yet again fails to articulate the fund’s expectations of the most climate-damaging companies in its portfolio, including Santos and Woodside. For all its lofty claims of climate action, HESTA continues to invest in...

Super funds invest $34 billion in fossil fuel expansion

MEDIA RELEASE Sunday 7 May, 2023: A new report by Market Forces reveals Australia’s 30 biggest super funds increased their investment exposure to Australian and international companies most responsible for expanding fossil fuels in 2022 to a total of more than AU$34...

After record vote against climate report in 2022, Woodside now sees record protest vote against directors

28 April 2023 Company directors under fire Nearly 35% of Woodside Energy’s shareholders voted against board member Ian Macfarlane’s re-election at the company’s annual general meeting (AGM) in Perth today. Investors also voted significantly against the re-election of...

Page last updated March 2022. Unless otherwise specified, all currencies are in AUD.

Disclaimer

The information provided by Market Forces does not constitute financial advice. The information is presented in order to inform people motivated by environmental concerns and take actions based on those concerns. Market Forces is organising data for environmental ends.

The information and actions provided by Market Forces do not account for any individual’s personal objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

Market Forces recommends all users obtain their own independent professional advice before making any decision relating to their particular requirements or circumstances. Switching super funds may have unintended financial consequences.

Market Forces does not receive funding from any super funds or other financial institutions.

For more information about Market Forces, please visit the about page of the site. To see how we profile super funds go to the methodology page.