ARCHIVED CONTENT

This content is no longer being updated.

Analysis: Commonwealth Bank 2019 policy update

As part of its 2019 annual report release, Commonwealth Bank overhauled many of its policies relating to environment and society. The climate change and environment policies contained some major updates, including commitments that Commbank will:

- continue to reduce its exposure to thermal coal mining and power generation, with a view to exiting the sector by 2030, subject to Australia having a secure energy platform,

- only provide banking and financing activity to new oil, gas and metallurgical coal projects if supported by an assessment of the environmental, social and economic impacts of such activity and it is in line with the goals of the Paris Agreement.

- not provide project finance for the mining, exploration, or development of oil sands, or for oil and gas exploration and development in the Arctic

View the full CBA Environmental and Social Framework (external link)

Huge news! @Commbank joins the ranks of financial institutions in Australia committing to get thermal #coal off their books by 2030! Any new fossil fuel projects have to prove themselves aligned with the Paris Agreement https://t.co/KUVN4Y3fw7 #climatechange #ActOnClimate pic.twitter.com/ff31ZzAzKh

— Market Forces (@market_forces) August 7, 2019

Why we’re excited

Until now, Commonwealth Bank has had no policy restraining fossil fuel lending or exposure. Chairman Catherine Livingstone told shareholders at the bank’s 2017 annual general meeting that the bank’s exposure to coal is expected to fall over time, but only now has this made it into formal policy.

Commonwealth Bank is the first of the”big four” in Australia to publish an end date for their exposure to thermal coal. What’s more, it is consistent with the climate goals of the Paris Agreement. OECD countries such as Australia need to have phased out coal power by 2030 and this policy will send a signal to the owners of Australia’s current coal power plants: try to run them after 2030 and you won’t get any finance from Commbank.

2019 has also seen Australian general insurers Suncorp and QBE commit to getting out of thermal coal by 2025 and 2030 respectively. So the likes of AGL, Origin Energy and Energy Australia need to contend with not being able to get insurance from the two main Australian underwriters, and the country’s largest bank after 2030.

The bank’s commitment to only support new gas, oil or metallurgical coal projects if they are found to be in line with the goals of the Paris agreement is also a first among Australian banks.

Why we’re dubious

Commbank’s exit of thermal coal by 2030 is “subject to Australia having a secure energy platform”, clearly a line thrown in to placate the federal government. But frankly, this does as much to comfort the government as it does to challenge politicians to finally sort out Australia’s broken climate and energy policy. As much as Commbank didn’t need to add this provision, they didn’t need to put the 2030 time frame in print either, and the much stronger message from this policy is that Commbank wants out of thermal coal.

We can also look several ways at the bank’s approach to new fossil fuel projects. We’re well past the point where we can add any new coal, oil or gas projects and consider them compatible with the goals of the Paris Agreement, so you could argue this shouldn’t even be a necessary policy. The Intergovernmental Panel on Climate Change tells us to have the best chance of holding global warming to 1.5ºC, all fossil fuels need to decline, starting now. Even the head of the IEA has said there is no room to build new CO2 emitting infrastructure if we’re to hold global warming to the much weaker goal of 2ºC.

But this commitment goes far beyond what other banks have said in relation to new fossil fuel projects, and puts the onus on the company wanting a loan to prove how its project could be considered consistent with the Paris climate goals.

Why this matters

Commonwealth Bank’s policy reflects a dramatic turnaround from a bank that has lagged behind its peers on policy to restrict fossil fuel lending, and been one of the heaviest lenders to coal, oil and gas.

In the two years following the Paris Agreement being signed, Commonwealth Bank loaned at least $7.2 billion to coal, oil and gas companies and projects. Many of these projects were new or expansionary, and would add another 2.9 billion tonnes of CO2 to the atmosphere over their lifetimes, enough to cancel out the gains made by Australia’s carbon reduction commitments three times over.

More recently, Commonwealth Bank has issued loans to Australia’s three big coal power station operators Energy Australia, AGL and Origin, all of which intend to keep running coal power plants beyond 2030 and the latter having plans to massively expand gas extraction.

How Commbank now compares

Comparing banks’ environment and climate policies is an increasingly complicated task, as each institution takes different approaches and deals with its lending and exposure in different ways.

Here are the highlights “or lowlights” of other major bank policies.

ANZ

ANZ is the only one of Australia’s big banks to rule have a policy that excludes lending to any sector of the fossil fuel industry. The bank has ruled out providing finance to any coal fired power plant that would emit more than 0.8 tonnes of carbon dioxide for every Megawatt of energy produced.

While this is a far from an ideal emissions threshold, and we would advocate for a complete ban on funding any new fossil fuel based power stations, the policy has caused ANZ to withdraw from financing a project in Vietnam.

In 2018, ANZ committed to excluding new-to-bank lending to customers whose thermal coal assets exceed 50% of revenue, installed capacity or

generation. However, Market Forces has been unable to identify any likely customers that would be captured by this policy, rendering it meaningless.

NAB

In December 2017, NAB became the first of Australia’s big four banks to rule out lending to all new thermal coal mines or extensions. The bank’s updated risk appetite statement on coal mining states: “NAB will no longer finance new thermal coal mining projects.”

In 2018 the bank said it “will not finance oil and gas projects within or impacting the Arctic National Wildlife Refuge area and any similar Antarctic Refuge.” However, NAB had previously explained to Market Forces that it had no exposure to these sectors, rendering this policy immaterial.

Westpac

Westpac’s climate change policy update, released in April 2017, says “for new thermal coal proposals we will limit lending to any new thermal coal mines or projects (including those of existing customers) to only existing coal producing basins and where the calorific value for that mine ranks in at least the top 15% globally”.

The bank also committed to: reduce the emissions intensity of its power generation portfolio; only lending to new coal power stations that reduce the overall emissions intensity of the energy grid they will operate in; and not lend to existing coal power stations for the expansion or lifetime extension purposes, unless there is a reduction in emissions intensity.

Wesptac also set a target of limiting its power sector portfolio average emissions intensity to no more than 0.3 tonnes of CO2 per Megawatt-hour.

Tracking fossil fuel exposure

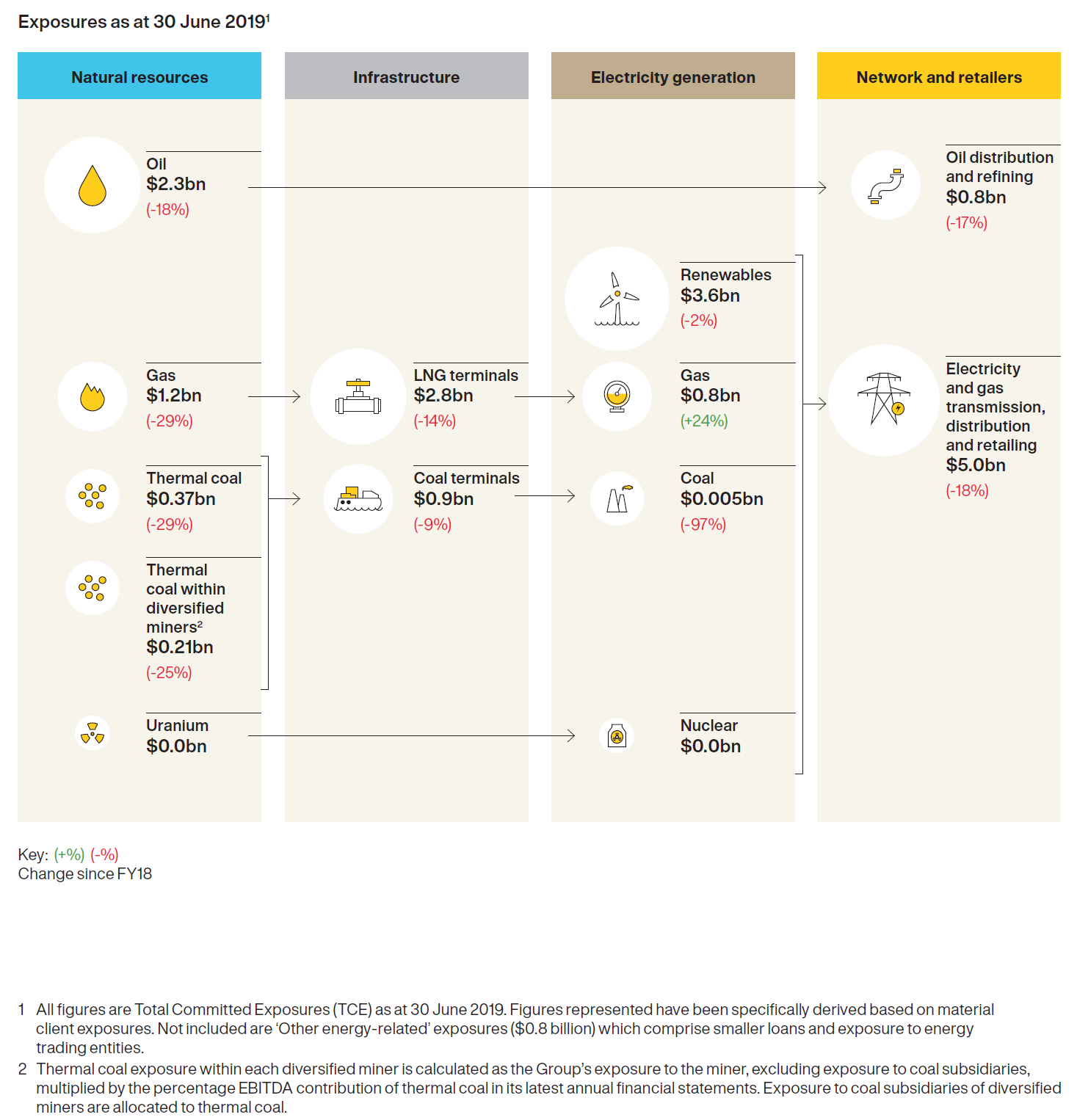

At the same time as Commbank announced its new Environmental and Social Framework, it reported on current exposures to coal, oil, gas and renewables.

Figures are reported slightly differently from the previous year, making a comparison challenging, but based on the numbers disclosed in Commbank’s 2019 Annual Report (reproduced below), overall exposures to the fossil fuel sector are down $1.8 billion from 2018, with all but one subsector (gas power) falling.

Disturbingly, renewable energy electricity generation also fell by 2%, but the highlight was a 97% drop in coal power generation.