Campaign

The Climate Wreckers Index

The superannuation industry’s $140 billion bet on climate destruction

The vast majority of climate damage is being done by a relatively small number of companies around the world. This is who they are: the Climate Wreckers Index. Out of the tens of thousands of companies our superannuation funds could invest in, Market Forces has identified a global list of 190 companies doing most of the climate wrecking by expanding the coal, oil and gas industries.

Our analysis of the default or largest investment options of 30 of Australia’s largest super funds reveals the average option has over 9% of its members’ share investments in Climate Wreckers Index companies.

If this average were consistent across the $3.3 trillion superannuation industry, over $140 billion of Australians’ retirement savings – an average of more than $6,100 per member account – would be invested in this small but devastatingly dangerous group of companies driving us towards catastrophic climate change!

Our superannuation industry is making a $140 billion bet on climate destruction, on behalf of millions of members. We need member pressure to take that dirty bet off the table.

Take Action

Demand your super fund ditch climate wrecking companies.

Key findings

In 2022, super funds increased the proportion of their investments in these climate wreckers by nearly 50% on average.

The average super fund investment option has nearly 9.3% of its members’ share investments in Climate Wreckers Index companies, up from nearly 6.3% in 2022. Across the 30 super fund options analysed, this makes a total of $34.2 billion invested in the small group of companies posing the biggest threat to a safe climate future. If this average were consistent across the whole super industry, more than $140 billion of Australians’ retirement savings would be invested in the global companies with the biggest plans for expanding fossil fuels.

Australia’s biggest super fund has bought up big in Australia’s biggest climate wrecker, despite the fund’s climate commitments.

Although the overall exposure increase can be explained in part by Russia’s invasion of Ukraine driving up fossil fuel company share prices and BHP’s increased prominence on the ASX,* some super funds are still buying up big in climate wreckers. AustralianSuper’s Balanced investment option, for example, increased its shareholding in Woodside nearly 19 times throughout 2022! AustralianSuper’s massive buy up of Woodside shares has contributed to its Balanced option’s Climate Wreckers exposure more than doubling over the last year, taking the option from one of the least exposed to above average exposure.

Even discounting shares acquired through mergers,** we estimate AustralianSuper’s default option bought at least 30 million Woodside shares in 2022. This flies in the face of AustralianSuper’s commitment to achieving net zero emissions by 2050, particularly as the fund is failing to demonstrate effective active ownership of companies expanding fossil fuels.

Retail super funds are over-represented in the funds most exposed to the Climate Wreckers Index.

Out of the seven retail funds found in Australia’s biggest 30 super funds, four of their default or largest options – MLC MySuper Growth, Russell Investments Goal Tracker, AMP MySuper 1970s, and Colonial First State FirstChoice Wholesale Growth – appear in the top 10 most exposed to Climate Wreckers companies.

Long-term emissions reduction targets do little if anything to prevent investment in climate wrecking companies.

22 of the 30 funds in this study have set a net zero by 2050 (or sooner) emissions reduction target, yet almost all of the options included in both the 2022 and 2023 analyses significantly increased their investment exposure to the Climate Wreckers over the past year. This means that, despite their emissions targets, funds are often failing to take the immediate action required to facilitate a net zero emissions outcome or achievement of the Paris Agreement’s climate goals.

The one notable exception here is NGS Super, which set a carbon neutral by 2030 target and made the decision to divest from undiversified oil and gas producers in order to make progress towards that commitment. This demonstrates that long-term targets need short- and medium-term commitments and actions to back them up.

Fossil fuel restriction policies reduce Climate Wreckers exposure.

Unsurprisingly, funds that have implemented fossil fuel exclusion policies or taken fossil fuel divestment action were generally among those with the lowest overall exposures to the Climate Wreckers Index. NGS Super’s ‘Diversified MySuper’ option came in as the least exposed to the climate wreckers, resulting from the fund’s 2022 decision to divest from undiversified oil and gas producers including Santos and Woodside. Aware Super has an exclusion on thermal coal companies and applies ‘low carbon benchmarks’ to its listed equities portfolio, which should see a reduction in investment exposure to most of the other Climate Wreckers in its ‘High Growth’ option. Cbus applies a ‘stranded asset framework’ to its listed equities portfolio, which takes carbon intensity into account and likely explains why its ‘Growth’ option is less exposed than most.

On the other end of the spectrum, Commonwealth Super Corp (CSC) has an exclusion on thermal coal mining companies, yet no further policy commitments in place to reduce investments in other kinds of climate wreckers. The next highest-exposed funds – MLC and Russell Investments – have no public policies in place to prevent or restrict investments in any fossil fuel companies.

The funds with the default investment options most exposed to the Climate Wreckers Index (as a proportion of share investments):

- Commonwealth Super Corp – PSS Default (11.5%)

- MLC – MySuper Growth (11.4%)

- Russell Investments – Goal Tracker (11.0%)

The funds with the default investment options least exposed to the Climate Wreckers Index (as a proportion of share investments):

- NGS Super – Diversified MySuper (6.4%)

- Super SA – Triple S Balanced (6.8%)

- Cbus – Growth (7.2%)

* BHP delisted from the London stock exchange and consolidated into its Australian Securities Exchange (ASX) listed entity in 2022, increasing the company’s proportion of the total ASX market and therefore explaining some increase in super fund options’ exposure.

** Woodside took over BHP’s petroleum business on 1 June 2022. The deal saw eligible BHP shareholders – including almost all Australian super funds – issued one Woodside share for every 5.534 BHP shares they held on 26 May 2022. AustralianSuper also merged with LUCRF in June 2022, which will have contributed to a small increase of approximately 2 million in AustralianSuper’s Balanced option’s total Woodside shares, based on LUCRF’s 31 December 2021 Balanced option’s holdings disclosure. For scale, AustralianSuper’s Balanced option held over 51 million Woodside shares in December 2022.

The companies doing the most climate damage…

The Climate Wreckers Index is made up of the 190 publicly-listed companies from all over the world with the biggest plans to expand the scale of the fossil fuel industry.

Specifically, the list includes:

- The top 60 oil and gas producers by expansion plans

- The top 60 coal miners by expansion plans and coal reserves

- The top 30 companies by new gas power plant development plans

- The top 30 companies by new coal power plant development plans

- The top 10 companies by liquefied natural gas (LNG) import and export terminal development plans

Together, these companies are planning new coal, oil and gas projects that could add the equivalent of 230 years of Australia’s national annual emissions!

These companies are pursuing their rampant expansion plans despite the fact that achieving the Paris Agreement’s 1.5°C warming limit leaves no room for new coal, oil or gas development, which has been confirmed by the IPCC and IEA, among others.

“Investing in new fossil fuels infrastructure is moral and economic madness. Such investments will soon be stranded assets – a blot on the landscape, and a blight on investment portfolios.” – UN Secretary General Antonio Guterres

The Climate Wreckers Index is not an exhaustive list of companies involved in coal, oil and gas expansion, just the worst of the worst climate wreckers that our super funds can invest in.

Check out the full list below and see our case studies for examples of some of the dirty companies that make up the Climate Wreckers Index.

…backed by our retirement savings!

We’ve cross-checked the default (or largest) investment option of 30 of Australia’s largest super funds by assets under management, and found the average of these options has nearly 9.3% of its members’ publicly-traded company shares (listed equities) investments in Climate Wreckers Index companies. This is an average increase of nearly 50% from last year, totalling $34.2 billion of members’ retirement savings!

At a whole of fund level, the super funds profiled in the table below account for nearly 60% of all superannuation assets under management.

If the 9.3% average were consistent across the entire superannuation industry, more than

$6,100

per member account

would be invested in the Climate Wreckers Index companies.

Super funds’ investments in the Climate Wreckers Index

| wdt_ID | Fund | Investment option | Exposure to Climate Wreckers Index (% of listed equities)* | Total value of investments in Climate Wreckers Index |

|---|---|---|---|---|

| 57 | Active Super | High Growth | 8.8 | 151,483,777 |

| 58 | AMP | MySuper 1970s | 10.7 | 413,638,360 |

| 59 | Australian Retirement Trust | Lifecycle Balanced Pool | 10.5 | 2,370,912,693 |

| 60 | AustralianSuper | Balanced | 10.3 | 8,792,249,748 |

| 61 | Aware Super | High Growth | 7.4 | 2,722,268,010 |

| 62 | Brighter Super | MySuper | 10.8 | 630,492,858 |

| 63 | CareSuper | Balanced MySuper | 10.7 | 640,111,144 |

| 64 | CBUS | Growth | 7.2 | 2,021,548,383 |

| 65 | Colonial First State | FirstChoice Wholesale Growth | 10.2 | 139,757,321 |

| 66 | Commonwealth Bank Group Super | Balanced | 7.8 | 165,136,845 |

| 67 | Commonwealth Super Corp | PSS Default | 11.5 | 1,089,137,513 |

| 68 | Equipsuper | Equip MySuper | 10.4 | 362,786,577 |

| 69 | ESSSuper | Growth | 7.5 | 98,369,472 |

| 70 | GESB | My West State Super | 9.1 | 519,391,327 |

| 71 | HESTA | Balanced Growth | 9.5 | 2,390,865,311 |

| 72 | Hostplus | Balanced | 7.9 | 1,739,300,343 |

| 73 | Insignia Financial | IOOF Balanced Investor Trust | 7.9 | 131,284,278 |

| 74 | Mercer | SmarthPath 1969-1973 | 9.5 | 155,594,584 |

| 75 | Mine Super | High Growth | 9.8 | 456,735,991 |

| 76 | MLC | MySuper Growth | 11.4 | 1,530,338,340 |

| 77 | NGS Super | Diversified (MySuper) | 6.4 | 267,091,301 |

| 78 | OnePath | ANZ Smart Choice 1970s | 10.5 | 352,746,389 |

| 79 | Rest | Core Strategy | 9.5 | 2,718,515,642 |

| 80 | Russell Investments | Goal Tracker | 11.0 | 277,663,159 |

| 81 | Spirit Super | Balanced (MySuper) | 8.8 | 912,772,444 |

| 82 | State Super | Balanced | 8.2 | 42,392,634 |

| 83 | Super SA | Triple S Balanced | 6.8 | 592,021,015 |

| 84 | Telstra | MySuper Balanced | 9.7 | 379,307,998 |

| 85 | UniSuper | Balanced | 10.9 | 1,946,167,695 |

| 86 | Vision Super | Balanced Growth | 7.4 | 210,752,679 |

*In order to compare funds with different allocations to publicly-traded company shares (listed equities), we calculated each fund’s investment exposure to the Climate Wreckers Index as a proportion of its total allocation to listed equities, minus any investments in pooled or managed investment fund products, such as Exchange Traded Funds (ETFs). This allows us to properly compare funds’ direct investments in Climate Wreckers Index company shares. You can read the full methodology below.

Each fund in the above table was contacted ahead of publication and given the opportunity to provide any further disclosures not captured by our research and raise any concerns relating to our analysis.

In 2022, several events changed the nature of the share market. For example, Russia’s invasion of Ukraine caused a shock to the global energy system, resulting in higher prices for fossil fuels. After a decade of declining fossil fuel share prices, the value of oil and gas companies increased in 2022 as a result of their war profiteering. BHP delisted from the London stock exchange and consolidated into its Australian Securities Exchange (ASX) listed entity in 2022, increasing the company’s proportion of the total ASX market and therefore explaining some increase in super fund options’ exposure.

Although this can explain in part why the average super fund’s exposure to the Climate Wreckers Index has increased over the past year, our analysis has also identified some super funds buying up big in the worst of the worst companies. See the case studies section for further details on which fund options have the highest investment exposures to some of the worst of the worst Climate Wreckers.

The Climate Wreckers Index companies

The table below shows the full list of the 190 companies that make up the Climate Wreckers Index.

This is not an exhaustive list of companies involved in coal, oil and gas expansion, just the worst of the worst climate wreckers that our super funds can invest in.

For the first time, we’ve included 10 companies involved in developing LNG import and export terminals to reflect the significant role these companies play in enabling new gas fields. We have also removed Russian companies from the list, due to sanctions placed on these companies by Australian and US authorities in 2022 in response to Russia’s invasion of Ukraine.

Why is BHP included?

BHP is included in the Climate Wreckers Index because of its massive coal reserves, and plans to expand coal projects. Our analysis of Global Energy Monitor (GEM) data finds that BHP has the 12th-highest coal reserves in operating mines of any listed company globally, at nearly 2 billion tonnes. At their current production capacity, BHP’s operating mines have a combined coal reserves life of 40 years.

For BHP to drop off the Climate Wreckers Index, the company must commit to managing down its existing coal mining assets in a manner consistent with the climate goals of the Paris Agreement. Far from this, BHP has applied to extend its Peak Downs mine to produce coal into the next century, and is planning to build the greenfield Blackwater South coal project with a life of 90 years!

By contrast, South32 – another diversified miner currently producing coal – is not included in the Climate Wreckers Index as it has no coal expansion plans, nor does it have coal reserves anywhere near as large as BHP. The company has shelved several coal projects in recent years, including the Dendrobium extension project, which would have added 5.2 million tonnes of production capacity per year to South32’s books, a total of 78 million tonnes of coal until 2041.

| wdt_ID | Company name | Primary fossil fuel activity | Other identified fossil fuel activity |

|---|---|---|---|

| 1001 | ACWA Power | Gas power plant developer | |

| 1002 | Adani Group | Coal miner | Coal power plant developer |

| 1003 | Adaro Energy | Coal miner | |

| 1004 | AES Corporation | Gas power plant developer | |

| 1005 | Aker BP | Oil and gas producer | |

| 1006 | ALLETE | Coal miner | |

| 1007 | Alliance Resource Partners | Coal miner | |

| 1008 | Anglo American | Coal miner | |

| 1009 | Antero Resources | Oil and gas producer | |

| 1010 | APA Corporation | Oil and gas producer |

Climate wrecker case studies

Woodside

Woodside is pursuing massive new oil and gas projects consistent with the failure of the Paris Agreement, including the monstrous Scarborough gas field off the coast of Western Australia (WA), and the associated Pluto Train 2 liquified natural gas (LNG) processing plant. The Scarborough-Pluto 2 project could result in the emissions equivalent of running 15 coal-fired power stations every year, threatens to accelerate degradation of the Murujuga rock art (proposed for World Heritage listing) due to industrial emissions, and would also cause significant impacts to the local marine environment. Independent analysis has concluded the Scarborough-Pluto combined project “…represents a bet against the world implementing the Paris Agreement”. Woodside also intends to exploit the monstrous Browse offshore gas basin, a project even bigger and more polluting than the already out-of-line Scarborough project.

Gas flaring at Woodside’s Pluto LNG processing facility. Image courtesy of the Conservation Council of Western Australia (CCWA).

Despite the urgent need for fossil fuel production to begin declining in line with global climate goals, Woodside plans to significantly increase oil and gas production over the next five years. Beyond clearly contravening the IEA’s key conclusion that there is no room for new oil and gas production projects in the pathway to net zero emissions by 2050, a number of independent analyses of new oil and gas production projects being pursued by Woodside reveals how significantly out of line they are with global climate goals. Carbon Tracker, for example, has found that Woodside’s proposed Pluto Train 2 facility is not even financially competitive in a catastrophic 2.7°C global warming scenario, let alone in a world where we achieve the 1.5°C goal of the Paris Agreement.

AustralianSuper’s Balanced option has the highest exposure to Woodside as a proportion of listed equities (2.25%), followed by Equipsuper’s Equip MySuper option (1.99%) and ESSSuper’s Growth option (1.90%). NGS Super fully divested from Woodside in 2022.

Santos

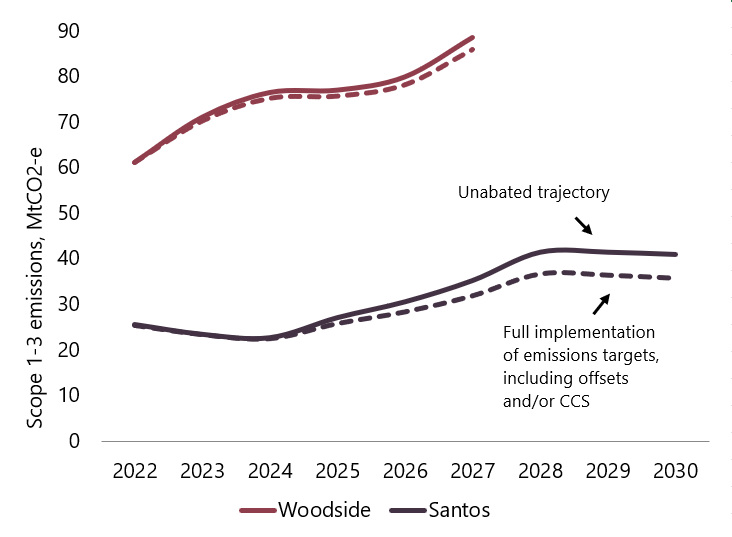

Santos is pursuing massive new oil and gas projects consistent with the failure of the Paris Agreement, including the dangerous and destructive Narrabri gas project in the Pilliga Forest, New South Wales (NSW). Santos merged with Oil Search in late 2021 to make the combined business one of the 20 largest companies on the Australian Securities Exchange (ASX). This new fossil fuel giant has one main aim: produce more oil and gas. In fact, Santos is pursuing major new projects that would increase its emissions by 40% from 2022 to 2030, despite the urgent need for fossil fuel production to begin declining in line with global climate goals

Santos, Woodside projected emissions, with climate targets impact

Santos plans to drill 850 gas wells throughout the Pilliga Forest and surrounding farmland near Narrabri, NSW. The company is still desperately pursuing this toxic project, despite years of opposition from local Gomeroi Traditional Owners and farmers, as well as former Chief Scientist Penny Sackett, who has confirmed the project is inconsistent with the Paris Agreement and net zero by 2050.

Santos is also pushing ahead with its Barossa gas project, a massive new proposed gas field 300km North of Darwin, Northern Territory (NT). If the project goes ahead, Santos will transport gas from the Barossa field to an existing LNG processing facility in Darwin. The extremely high carbon dioxide (CO2) content of Barossa gas has led energy experts to state that the Barossa to Darwin LNG project looks like it’s shaping up to become “…a CO2 emissions factory with an LNG by-product.”

Santos’ oil and gas projects are not just damaging to a safe climate future. Tiwi Islands Traditional Owners successfully challenged Santos over its Barossa project in the Federal Court in 2022 for failing to adequately consult with them, subsequently winning the follow-up appeal from Santos.

Equipsuper’s Equip MySuper option has the highest exposure to Santos as a proportion of listed equities (1.48%), followed by Hostplus’ Balanced option (1.30%) and Russell Investments’ Goal Tracker option (1.07%). NGS Super fully divested from Santos in 2022.

Whitehaven

Whitehaven Coal is the biggest undiversified coal mining company on the Australian share market. Whitehaven’s plans to massively expand the coal industry are completely at odds with the Paris Agreement goal of limiting global warming to 1.5ºC.

Whitehaven is planning to spend around $2 billion on three new coal mines and expansions: Vickery, Narrabri Stage 3 and Winchester South. These mines have marketable coal reserves of over 500 million tonnes. When emissions from digging up and burning the coal are added, over their lifetimes these three mines would unleash 1.1 billion tonnes of carbon emissions, the equivalent of more than twice Australia’s annual emissions.

Whitehaven’s existing Maules Creek coal mine is one of Australia’s most controversial mining projects and was strongly opposed by local farmers and Gomeroi traditional owners. Despite a massive community campaign that included a two year blockade, Whitehaven bulldozed hundreds of hectares of critically endangered forest that provide important habitat for rare and endangered species like the Superb Parrot, Regent Honeyeater and Squirrel Glider.

Lock the Gate Alliance has compiled a comprehensive list of Whitehaven’s law-breaking over the last 10 years. This compilation shows the company and its subsidiaries have been found guilty or investigated 35 times and incurred almost $1.5 million in total penalties.

ESSSuper’s Growth option has the highest exposure to Whitehaven as a proportion of listed equities (0.78%), followed by State Super’s Balanced option (0.23%) and Brighter Super’s MySuper option (0.20%). Commonwealth Super Corp and Rest appear to have removed Whitehaven from their default options in 2022.

New Hope

New Hope is an Australian-based undiversified coal mining company deriving more than 95% of revenue from the sale of thermal coal. Despite there being no room for new or expanded coal mines if we’re to achieve the climate goals of the Paris Agreement or net zero emissions by 2050, New Hope is developing a major expansion of its New Acland coal mine on some of Queensland’s best farming land.

New Hope plans to spend around $900 million on its New Acland Stage 3 coal expansion, one of the most contested coal mining projects in Australian history. New Hope has determined there’s a further 200 million tonnes of coal reserves at New Acland, and Stage 3 would increase the mine’s production capacity to 7.5 million tonnes per year and extend its production life by 12 years.

Aside from the physical destruction of this prime farming land, there is deep community concern about the impact of the mine on local groundwater aquifers. According to the Oakey Coal Action Alliance, around 20,000 hectares of cropping land surrounding the mine is at risk of permanent groundwater impacts. Despite several rounds of water modelling revisions, expert scientists remained unconvinced by New Hope’s final water management plans. New Hope also operates the Bengalla coal mine, which is licensed to extract up to 15 million tonnes of coal per year until 2039.

Insignia Financial’s IOOF Balanced Investor Trust option has the highest exposure to New Hope as a proportion of listed equities (0.24%), followed by Colonial First State’s FirstChoice Wholesale Growth option (0.20%) and Mercer’s SmartPath 1969-1973 option (0.09%). Commbank Group Super, Commonwealth Super Corp and Rest appear to have removed New Hope from their default options in 2022.

Adani

Adani really needs no introduction. The company is responsible for the most controversial coal mine in Australia’s history: Carmichael.

Despite immense community resistance helping to significantly reduce the scale of the first phase of the Carmichael mine, Adani could still dig the biggest coal mine in Australia.

Adani Group’s other fossil fuel expansion plans include:

- Nearly doubling its coal-fired power capacity by 12 gigawatts (GW) to 26 GW, giving it more coal power capacity than all of Australia.

- Owning, developing or operating 155.6 million tonnes per annum (mtpa) of new thermal coal mining capacity, including the massive 60 mtpa Carmichael project in Australia, which would pave the way for more massive coal mines in the untapped Galilee Basin.

- New coal and LNG terminals at Adani Ports and Special Economic Zone’s ports.

- A highly polluting facility that would convert coal, including imported thermal coal, into plastics.

Brighter Super’s MySuper option has the highest exposure to Adani Group companies (excluding Adani Green) as a proportion of listed equities (0.05%), followed by Commbank Group Super’s Balanced option (0.04%) and OnePath’s ANZ Smart Choice 1970s option (0.04%). GESB and HESTA appear to have removed these companies from their default options in 2022.

Adaro

Adaro Energy Indonesia (Adaro) is a pure play coal mining company with plans to expand. Adaro produced 62.8 million tonnes of coal in 2022 alone – an increase of almost 20% from 2021 – and has coal reserves of 1.1 billion tonnes. Burning all of these reserves would release 2.2 billion tonnes of CO2-e, almost the equivalent of India’s total annual emissions. Adaro has stated plans to ramp up coal production to 64 million tonnes in 2023. To justify its business plans, Adaro presents global coal demand forecasts that are even higher than the International Energy Agency’s 2.5°C-aligned STEPS scenario.

Adaro also plans to build an aluminium smelter through a subsidiary which would be powered by new coal-fired power plants in North Kalimantan, a province of Indonesia on the island of Borneo. At full capacity, the smelter would produce 1.5 million tonnes of aluminium per annum and at least two-thirds of its power needs would be met by burning coal. The first phase of the smelter project includes building a new 1.1GW coal power plant, meaning the smelter would emit 5.2 MtCO2-e per annum throughout the first phase.

State Super’s Balanced option has the highest exposure to Adaro as a proportion of listed equities (0.05%), followed by Mercer’s SmartPath 1969-1973 option (0.01%) and Colonial First State’s FirstChoice Wholesale Growth option (0.01%). GESB and Spirit Super appear to have removed Adaro from their default options in 2022.

TEPCO & Chubu Electric

TEPCO, Chubu and their joint venture JERA are betting against the climate goals of the Paris Agreement and undermining their own net zero emissions commitments by expanding the liquefied natural gas (LNG) and coal power sectors.

JERA is responsible for a whopping 169 MtCO2-e annually, or 15% of Japan’s annual emissions (2020). The company is currently constructing three additional coal-fired power plants – two in Japan and one in Indonesia.

JERA is also pursuing significant involvement in the LNG sector, including gas fields, LNG terminals and LNG to power projects in countries such as Australia, Bangladesh, and Vietnam. This includes a stake in the Barossa gas field, discussed in the Santos case study above.

Vision Super’s Balanced Growth option has the highest exposure to TEPCO as a proportion of listed equities (0.03%), followed by State Super’s Balanced option (0.02%) and AMP’s MySuper 1970s option (0.02%). CareSuper and Russell Investments appear to have removed TEPCO from their default options in 2022.

Vision Super’s Balanced Growth option has the highest exposure to Chubu Electric as a proportion of listed equities (0.07%), followed by GESB’s My West State Super option (0.03%) and State Super’s Balanced option (0.02%). CareSuper, Cbus, Russell Investments and Spirit Super appear to have removed Chubu Electric from their default options in 2022.

Mitsubishi Corp

Mitsubishi Corp turned up in our research as expanding fossil fuels in three separate areas: gas power plants, coal production, and oil and gas production.

Mitsubishi is expanding its gas business by building gas fields, LNG terminals and LNG to power projects, contrary to the International Energy Agency’s ‘Net Zero by 2050’ scenario, which makes clear that achieving this goal means no new fossil fuel supply and an extremely limited and narrowing role for fossil fuels in electricity generation. It also finds that “there is no further need for additional [LNG] capacity beyond what exists or is under construction”.

Meanwhile, Mitsubishi’s coal mining subsidiary is expanding its metallurgical coal mining operations in Australia.

GESB’s My West State Super option has the highest exposure to Mitsubishi Corp companies* as a proportion of listed equities (0.07%), followed by AMP’s MySuper 1970s option (0.06%) and HESTA’s Balanced Growth option (0.05%). Vision Super appears to have removed Mitsubishi Corp companies from its default option in 2022.

* Excluding non-fossil fuel-related subsidiaries (see methodology below)

General Electric

General Electric (GE) has historically been heavily involved in coal power generation, both in the United States and also as a developer of coal power plants internationally. While the company announced it is exiting new coal power builds, it is planning major expansions in the LNG and gas power sectors.

Market Forces’ research has found GE is involved in new LNG to power plants in Vietnam and Bangladesh with combined capacity of 24.6 GW.

Spirit Super’s Balanced (MySuper) option has the highest exposure to GE as a proportion of listed equities (0.32%), followed by Australian Retirement Trust’s Lifecycle Balanced Pool option (0.24%) and Commonwealth Super Corp’s PSS Default option (0.20%). CareSuper appears to have removed GE from its default option in 2022.

Further information

Methodology

Constructing the list of 190 companies (the Climate Wreckers Index)

Process

Data was pooled from several sources:

- Global Energy Monitor (GEM)’s ‘Global Coal Plant Tracker’, aggregating plants in development by MW capacity (‘coal plant developers’).

- GEM’s ‘Global Gas Plant Tracker’, aggregating plants in development by MW capacity (‘gas plant developers’).

- Urgewald’s Global Oil and Gas Exit List (GOGEL), ordered by short term expansion plans in million barrels of oil (MMBOE) equivalent (‘upstream oil and gas expanders’) and LNG terminals capacity under development in million tonnes per annum (mtpa) (‘LNG terminal developers’).

- GEM’s ‘Global Coal Mine Tracker’, by aggregating each mine by company and creating two lists: one ordered by ‘probable and proven’ reserves in currently operating coal mines in million tonnes, and one ordering by size of expansion plans in million tonnes per year.

The companies on the list were screened to only include publicly traded companies. The final list of 190 companies was composed of the top 30 public coal plant developers, the top 30 public gas plant developers, the top 60 public upstream oil and gas expanders, the top 10 public LNG terminal developers, and 60 companies from the coal mine tracker consisting of 35 companies based on reserves, and 25 companies based on expansion plans.

Details

- Public companies that appeared on multiple lists were kept on the list they appeared highest, removed from the other list(s) and replaced by the company with the next-highest value. If a company was in the same position on multiple lists, the priority was given to the coal plant list, then coal mine reserves, then coal mine expansion, then oil and gas expansion, then LNG terminals, then gas plants.

- Where multiple companies owned a coal mine/coal plant/gas plant, the relevant capacity (MW/Mt/Mtpa) was distributed pro rata based on ownership. Where this information was not provided in the primary source, it was assumed to be an equal split between owners.

- Companies from the primary sources were only included if they were publicly listed.

We compiled all publicly listed subsidiaries as identified by the Bloomberg RELS function, excluding those without a clear involvement in fossil fuels or where the purported parent’s ownership couldn’t be confirmed through further analysis. A table of subsidiaries excluded or included is in the appendix.

Emissions Calculations

LNG terminals were not included in the emissions calculations due to the risk of double counting emissions from upstream gas production.

Gas plant emissions were calculated based on the total megawatts (MW) in development. We assumed that new plants in development are combined cycle plants, which is the less emissions intensive technology. We used emissions factors from the IPCC, and a capacity factor of 57% based on the US CCGT fleet. Plants were assumed to have an economic life of 30 years.

Coal plant emissions were aggregated at the plant level from GEM emissions estimates.

Coal mine emissions were calculated by taking the total 2P (proven and probable) reserves in proposed new coal mines, including proposed mines owned by the 35 companies included for the size of their reserves in operating projects. We applied emissions factors from the Australian Government based on the type of coal: Lignite, anthracite, bituminous, subbituminous and metallurgical. If GEM indicated a mine contained a mix of metallurgical and thermal we assumed 100% thermal; this makes our estimates conservative, since metallurgical coal has a higher emissions factor than thermal coal. As with oil and gas, our estimates only account for product combustion.

Overall, we found that the companies on the Climate Wreckers Index are pursuing:

- New or expanded oil and gas fields with combined expected production of 111 billion barrels of oil equivalent

– The estimated carbon dioxide emissions from combustion of this much oil and gas is more than 42 billion tonnes, equal to 91 times Australia’s annual emissions - New or expanded coal mines with combined reserves of 16 billion tonnes

– The estimated carbon dioxide equivalent (CO2-e) from combustion of this much coal is 27 billion tonnes, equivalent to 58 times Australia’s annual emissions - New coal plants with combined capacity of 179 GW

– Based on GEM emissions data, the total emissions from these coal plants is estimated to be 28 billion tonnes of CO2-e, equal to 60 times Australia’s annual emissions - New gas plants with combined capacity of 139 GW

– Assuming that of these plants will be modern combined cycle plants, the total emissions is estimated to be 10 billion tonnes of CO2-e, equal to 22 times Australia’s annual emissions

Super Fund Option Exposures

Scope

The scope of our analysis covers the default (or largest) investment option of Australia’s largest 30 super funds by assets under management, according to APRA’s June 2022 fund-level superannuation statistics [Table 1 and Table 2]. Further to these APRA-regulated funds, our analysis includes any state-regulated funds big enough to be included in the top 30 list.

Where mergers between super funds occurred between June 2022 and 31 March 2023, the single merged entity is listed on the table (noting the previous fund name/s) and occupies only one position on the table, unless the merged funds were found to have clearly separate default options with different investments.

The final analysis pertains to 30 funds. HUB24, Netwealth and Macquarie were excluded as they do not appear to have default investment options comparable to the rest of those captured in the study.

Process

Portfolio holdings disclosures were collected for the final 30 superannuation fund options (see sources in appendix 2 below). These holdings were filtered for listed equities, and we extracted all the investments whose security identifiers matched companies in the Climate Wreckers Index. We calculated and have presented the total investment exposure to Climate Wreckers Index companies as a percentage of total listed equities in the option, minus any allocation to pooled or managed investment fund products within the total listed equities allocation. Portfolio holdings disclosures are as at 31 December 2022.

Average Exposure Figures

To calculate the average exposure to Climate Wreckers Index companies, we took the average percentage of listed equity assets invested in Climate Wreckers Index companies for all fund options profiled, applied this average exposure to all superannuation listed equity assets (based on the industry average asset allocation), and divided by the number of accounts, per ASFA’s November 2022 Superannuation Statistics.

Appendices

1. Super Funds profiled (including sources)

| wdt_ID | Fund | Investment option profiled |

|---|---|---|

| 35 | Active Super | |

| 36 | AMP | |

| 37 | Australian Retirement Trust | |

| 38 | AustralianSuper | |

| 39 | Aware Super | |

| 41 | Brighter Super | |

| 42 | CareSuper | |

| 43 | CBUS | |

| 44 | Colonial First State | |

| 45 | CommBank Group Super |

2. Conglomerate Subsidiaries

| wdt_ID | Company | Included (1) | Excluded (2) |

|---|---|---|---|

| 1 | Adani Group | Adani Enterprises Ltd Adani Ports & Special Economic Zone Ltd Adani Power Adani Total Gas Ltd Adani Transmission Ltd |

Adani Green Energy Ltd |

| 2 | Adaro Energy | Adaro Minerals Indonesia Tbk PT | |

| 3 | Anglo American | Anglo American Platinum Ltd Kumba Iron Ore Ltd |

|

| 4 | BP | Castrol India Ltd | |

| 5 | Chevron | Star Petroleum Refining PCL | |

| 6 | Chubu Electric Power | Toenec Corp ES-Con Japan Ltd | |

| 7 | CITIC Ltd | Citic Pacific Special Steel Group Co Ltd China CITIC Bank Corp Ltd CITIC Telecom International Holdings Ltd |

|

| 8 | Diamondback Energy | Viper Energy Partners LP | |

| 9 | Ecopetrol | Interconexion Electrica SA ESP | |

| 10 | EDP - Energias de Portugal | EDP Renovaveis SA EDP - Energias do Brasil SA |

1 The parent company was always included.

2 Subsidiaries in neither the included nor excluded columns were not found in any of the super funds analysed

Join us

Subscribe for email updates: be part of the movement taking action to protect our climate.