16 May 2020

The value of Australia’s fossil fuel producers has tanked over the last 10 years, a trend which has been exacerbated during the Covid-19 pandemic.

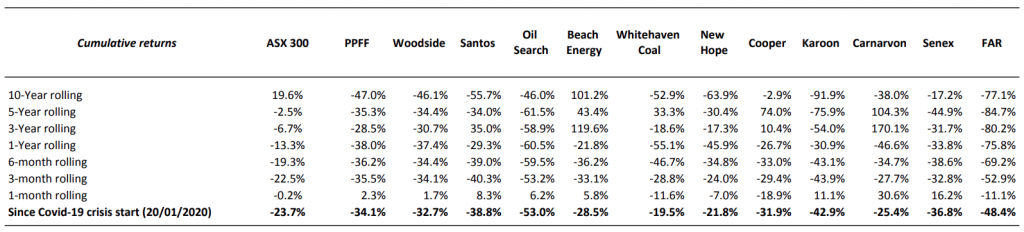

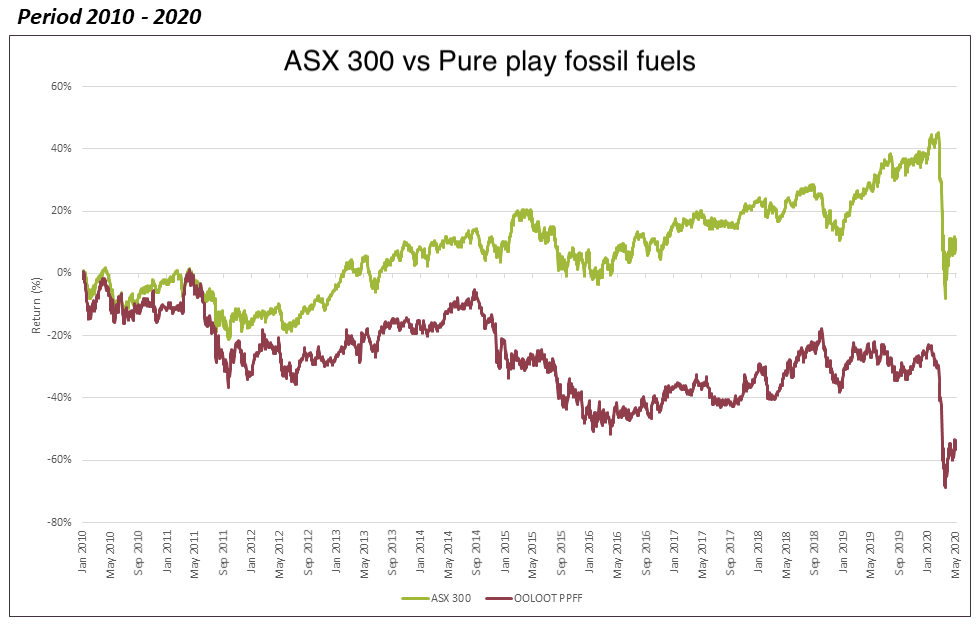

We identified 11 companies in the top 300 listed on the Australian share market (ASX 300) whose sole business is producing coal, oil or gas. An index tracking the sharemarket performance of these 11 ‘pure play’ fossil fuel companies has halved in value since January 2010, while the ASX 300 has risen 20% over that time.

Put simply, if someone had invested $100,000 in an index made up of Australia’s pure play fossil fuel producers in 2010, that investment would now be worth just $53,000.

Analysis as at close of ASX 11 May 2020

01/01/2010 – 11/05/2020

Take action

Ask your super fund how it can possibly justify climate-wrecking fossil fuel investments

Time to leave dirty fossil fuels behind

There is no justification for our super funds continuing to invest our retirement savings in companies that for the past 10 years have been massively losing value, all while pursuing their plans driving us towards runaway climate change and the social, economic and environmental destruction it would usher in.

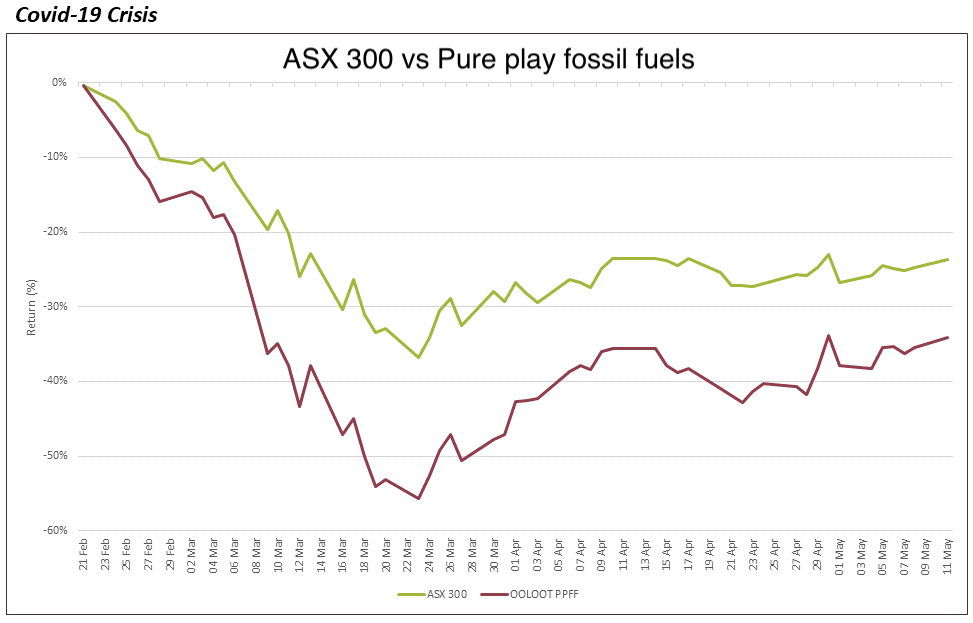

The performance gap between pure play fossil fuel producers and the rest of the market has been growing wider and wider over the last 10 years, and has been particularly severe since the Covid-19 pandemic began impacting the sharemarket. Since 20 February this year, the ASX 300 is down 24%, while the 11 pure play fossil fuel producers are down 34%.

According to the International Energy Agency, the future is looking bleak for fossil fuels. The IEA projects oil demand to fall by 9%, coal by 8% and gas by 5% through 2020, while solar is expected to grow by 15% and wind by 10%. Those IEA figures prompted industry observers Carbon Tracker Initiative to suggest 2019 was the peak of global fossil fuel demand.

It’s time for super funds to break free from dirty fossil fuel investments, and instead invest in companies that will drive the clean, sustainable economic recovery we need to see.

20/02/2020 – 11/05/2020