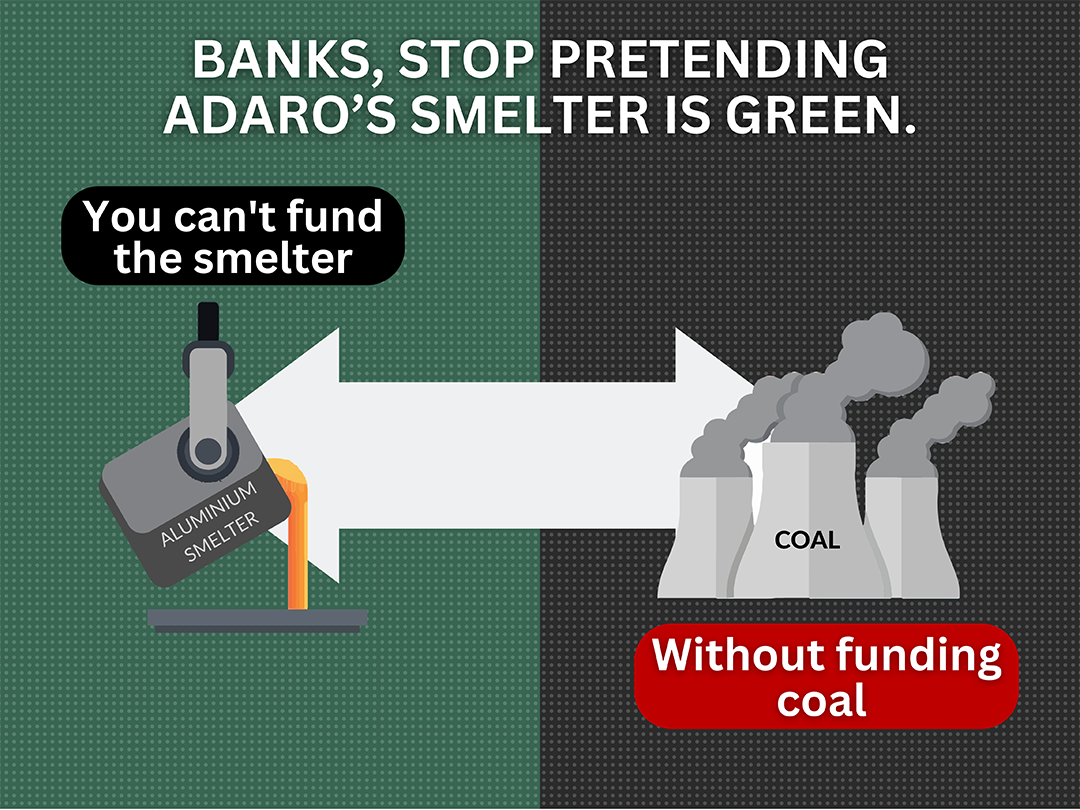

Banks can’t fund Adaro’s smelter without funding coal.

Adaro, the second largest coal miner in Indonesia, is trying to build an aluminium smelter which would be powered by new coal-fired power plants in North Kalimantan, a province of Indonesia on the island of Borneo. Companies and banks need to steer clear of this project to avoid violating their own coal restriction commitments.

Background on the project

Adaro plans to build an aluminium smelter powered by coal power and hydroelectric capacity. This smelter project will be developed in three phases with the first two phases including the construction of new coal power capacity. The first phase is estimated to be commercially operational by early 2025.

Adaro is betting on the failure of climate goals.

The International Energy Agency has made it clear that there can be no new coal-fired power plants if the world is to limit temperature increases to 1.5°C and align with net zero by 2050.

The scale of new coal power capacity required for the planned smelter is staggering. At full capacity, the smelter would produce 1.5 million tonnes of aluminium per annum and at least two-thirds of its power needs would be met by burning coal. This would require building the equivalent of two large-scale coal power plants.

Powered by a new coal power plant, the first phase of the aluminium smelter will emit 5.2 MtCO2-e per annum [1], while it is clear from the expert advice that we can’t afford to build any more CO2 emitting infrastructure if we want to have any hope of meeting the global goals of the Paris Agreement.

Hyundai shouldn’t be buying dirty aluminium

Hyundai Motor Company signed an MoU to purchase aluminium from Adaro at an early production stage, claiming that the aluminium would be classified as low-carbon aluminium because it is powered using hydroelectric power generation.

However, Hyundai’s MoU fails to mention that hydroelectric power will only meet the smelter’s power needs at a later stage, with the early stage reliant on burning coal. Adaro confirmed publicly that the early stage of the smelter will be powered using coal capacity.

Buying dirty Aluminium to produce supposedly “green” electric vehicles is not a good look for Hyundai. The new coal power capacity needed for the smelter will create massive pollution that would contravene with Hyundai’s Carbon Neutrality Principles.

Banks and EV producers should steer clear of the project

Any company that supports this project will be enabling the construction of new coal-fired power plants. Companies that are serious about their Paris-alignment and Net Zero commitments must not support Adaro as long as the smelter is powered using a coal fired power plant.

The Financial Times and The Strait Times have reported that Standard Chartered, and DBS, which have previously lent to the Adaro group and OCBC, will not be participating in this smelter project.

On 12 May 2023, the deal reached financial closing. A group of five Indonesian domestic banks – Mandiri Bank, Bank Negara Indonesia (BNI), Bank Central Asia (BCA), Bank Rakyat Indonesia (BRI), Permata Bank – provided a total of IDR2.5 trillion and US$1.5 billion loans to Adaro’s smelter and coal power plant subsidiaries, Kalimantan Aluminium Industry (KAI), and Kaltara Power Indonesia (KPI).

Project details

| Phase 1 | |

| Project specification | Aluminium capacity of 500,000 tonnes per year, coal fired power plant |

| Sponsors | Smelter (Kalimantan Aluminium Industry) |

| Adaro Minerals Indonesia (65%), Aumay Mining (22.5%), Cita Mining Investindo (12.5%) | |

| Power Plant (Kaltara Power Indonesia) | |

| Adaro Power, Cita Mining Investindo | |

| Timeline | COD Q1 2025 |

| Project cost | US$ 2 billion (estimate) [1] |

| Financing scheme | Equity and bank loan |

| Financing status | Loan reached financial closure on 12 May 2023 |

| Loan [2] | Kaltara Aluminium Industry:US$981.4 million (tranche 1), IDR 1.547 trillion (tranche 2). Maturity 12 May 2031, tenor 8 years |

| Kaltara Power Indonesia: US$603.6 million (tranche 1), IDR 952.1 billion (tranche 2). Maturity, 12 May 2033, tenor 10 years | |

| Lenders [3] | Bank Mandiri (US$585M), BNI (US$350M), BRI (US$450M), BCA (US$270), Permata Bank (US$100M)[4] |

| Phase 2 | |

| Project specification | Aluminium capacity of 500,000 tonnes per year, coal fired power plant |

| Sponsors | Smelter (Kalimantan Aluminium Industry) |

| Adaro Minerals Indonesia (65%), Aumay Mining (22.5%), Cita Mining Investindo (12.5%) | |

| Power Plant (Kaltara Power Indonesia) | |

| Adaro Power, Cita Mining Investindo | |

| Timeline | COD Q4 2026 |

| Project cost | US$ 2 billion (estimate) |

| Financing scheme | Equity and bank loan |

| Financing status | Financing. Seeking equity and bank loans (may seek up to US$1.1 billion) |

| Lenders | N/A |

| Phase 3 | |

| Project specification | Aluminium capacity of 500,000 tonnes per year, hydroelectric power generation |

| Sponsors | N/A |

| Timeline | COD Q4 2029 |

| Project cost | N/A |

| Financing scheme | Equity and bank loan |

| Financing status | Planned |

| Lenders | N/A |

Endorsed by

Disclaimer

This webpage is intended to convey factual information about Adaro Energy Indonesia group.

Information comes from the companies’ available annual reports and websites, Refinitiv Eikon, Bloomberg and various news reports.

Occasionally where information is incomplete, assumptions must be made about data and these were made in a consistent manner and in good faith. Whilst we have endeavoured to gather and include all relevant deals, we cannot guarantee the completeness of the information presented.