22 October 2020

Today’s AGM saw Australia’s biggest gas pipeline company quizzed about its plans to expand gas infrastructure. Plans that are inconsistent with the climate goals of the Paris Agreement.

Just two months ago, 25 leading scientists at Australian universities wrote that, if we’re to achieve the climate goals of the Paris Agreement, “the time has passed for any new fossil fuel infrastructure, including the proposed expansion of the gas industry in Australia”.

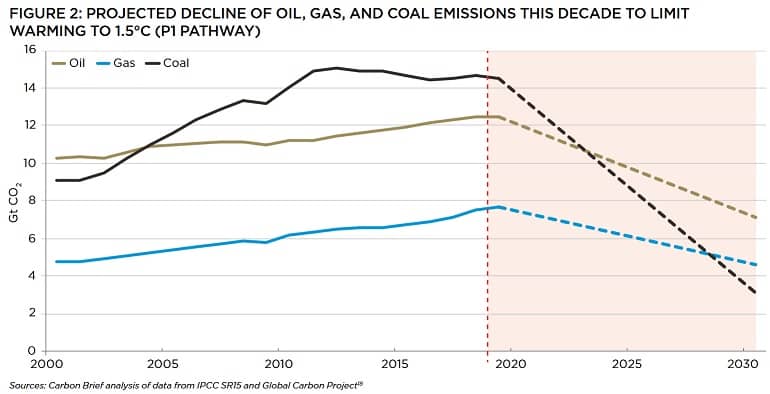

Far from playing a more prominent role in our global energy mix, the world’s top authority on climate change (the IPCC) sees gas use for primary energy falling 25% by 2030 under a 1.5°C warming scenario.

So shareholders attending APA’s annual general meeting online today were rightly concerned about the company’s plans to expand the gas industry in Australia, and about its capacity to manage transitional climate change risks.

This year, APA published a climate change position statement and a ‘climate change resilience report’, the latter of which disclosed scenario analysis purporting to show the potential impacts of climate change on APA’s business under different warming scenarios.

These documents seem to provide more questions than answers, with shareholders asking for seemingly basic information that could reasonably be expected of any company facing substantial climate change transition risks.

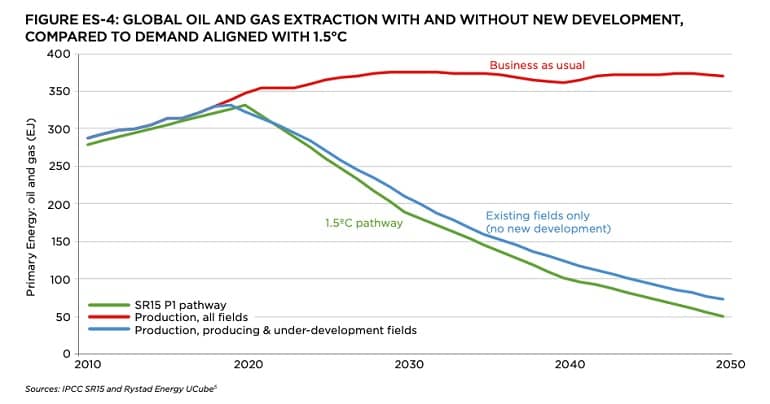

New gas projects out of line with Paris

APA’s recent ‘resilience report’ found that a 1.5°C scenario would see reduced revenues compared to other scenarios, yet provides only a shallow indication of what the revenue impacts would be (consisting of “positive impact”, “immaterial impact”, “5-15%” and “15%+”). One shareholder asked for the reduced revenue figures to be provided, and what steps APA is taking to ensure future spending isn’t wasted on projects that have no place in a 1.5°C world.

Chairman Michael Fraser sidestepped the revenue question, failing to provide the declines in revenue expected under 1.5°C and instead simply reiterating that “it would result in some reduced revenues”.

Fraser’s answer also failed to provide any significant actions APA is taking to prevent wasted capital expenditure under 1.5°C beyond what is already publicly disclosed, telling shareholders “we obviously look at what the supply and demand outlook is” and “we stress test those scenarios”.

Fraser also listed a number of basic steps APA would take when considering any investment, including the presence of long-term contracts and the creditworthiness of counterparties. These are not additional or special measures taken to ensure assets are compatible with a 1.5°C scenario, and would apply just as equally to assets operating in a 4°C scenario.

Importantly, Fraser implied that APA failed to investigate the viability of its prospective and ‘under construction’ projects as part of its 1.5°C scenario analysis, telling shareholders this analysis is conducted once new assets are added to the portfolio:

“As we do add new assets to the portfolio, when we do our resilience report for next year, those new assets will be stress tested under the 1.5-degree scenario”

Michael Fraser, APA Chairman

Emissions disclosure woeful

Surprisingly, APA has so far failed to disclose its scope 3 greenhouse gas emissions, those generated downstream of APA’s operations, as end users use the gas supplied by APA. The size of these emissions are an indicator of financial risk exposure, as market and regulatory responses to climate change are expected to impact gas demand.

Asked why it hasn’t disclosed scope 3 emissions, and whether APA’s large investors are demanding this disclosure, APA’s response was bewildering:

Fraser told shareholders APA “don’t actually have access to that data”, “there’s certainly no requirement upon us to report that or to get to that”, and finally “we can obviously have a guess at it”. In other words, there’s nothing preventing APA from disclosing its estimated scope 3 emissions.

It’s commonplace for energy companies to disclose their scope 3 emissions. For example, Australia’s largest gas producer Woodside Energy has publicly disclosed the estimated scope 3 emissions from its prospective Burrup Hub projects. This includes up to 1,615 Mt CO2 from the ‘Browse to North West Shelf’ project, 4,394 Mt CO2 from the ‘North West Shelf project extension’ and 878 Mt CO2 from the Scarborough gas fields.

Shareholders should take note that APA has decided not to publish estimated scope 3 emissions. Given that APA is planning to publish emissions reduction targets next year, how will it set such targets for its scope 3 emissions if it hasn’t disclosed them?

Fraser didn’t provide an answer to the question about whether APA’s substantial shareholders had requested the scope 3 disclosure.

Greenwash

APA reports to have invested $750 million in renewable energy generation since 2009, but over that period also spent $4 billion growing its business mainly consisting of gas.

Noting that for every dollar spent on developing renewable energy, APA has spent around $5 expanding the gas industry, APA was asked if it plans to continue allocating less than 20% of growth funding to renewables.

Despite its track record of gas investment, and the fact that it’s pursuing significant gas investments moving forward, APA told shareholders that “we actually don’t see ourselves in a strategic sense and looking forward as a gas company, we see ourselves as an energy infrastructure company”.

It also told shareholders that if 90% of viable growth opportunities were in renewables, “that’s where we would invest”. However, APA’s rhetoric on energy infrastructure suggests otherwise. In response to a separate question, Fraser told shareholders “if you were magically able to convert all the coal fired power stations around the world to gas overnight, you’d have a massive reduction in global greenhouse gas emissions”. What if they were replaced with renewable energy?

Fraser also told shareholders: “The problem we have at the moment with more renewables on the system, there are a number of problems in relation to the grid being able to support it, but also there’s the reliability factor”. However, according to leading economist and climate change expert Professor Ross Garnaut:

“I now have no doubt that intermittent renewables could meet 100 per cent of Australia’s electricity requirements by the 2030s, with high degrees of security and reliability, and at wholesale prices much lower than any experienced in Australia over the past decade”

Professor Ross Garnaut, Professorial Research Fellow in Economics, University of Melbourne

Perhaps APA isn’t as open to renewables as it says it is.

Take action

Is your bank or super fund invested in APA or another company undermining a safe climate? Take action: