10 September 2020

BHP, one of the 20 largest historical contributors to global greenhouse gas emissions, this afternoon announced targets to reduce its operational emissions by 30% by 2030.

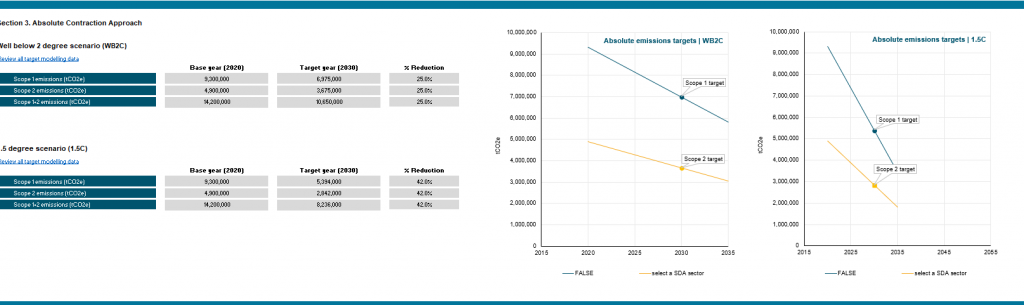

This falls short of the ~42% reduction that would be required to align with a 1.5°C pathway from 2020 to 2030, according to the Science Based Targets Initiative’s target setting tool (absolute contraction method).

Put simply, BHP has deliberately chosen not to meet the Paris Agreement’s ultimate aim of holding warming to 1.5 degrees Celsius.

While BHP’s target is less than perfect, it doubles the ambition of Rio Tinto’s paltry commitment to reduce its operational (scope 1 & 2) emissions to 15% below 2018 levels by 2030.

The decision to set targets consistent with more than 1.5°C of warming seems to amount to BHP shooting itself – and its investors – in the foot, as the company’s own modelling shows it would fare much better in a 1.5°C scenario (see below).

A carbon footprint bigger than Australia

By far BHP’s biggest contribution to climate change is its behemoth scope 3 emissions footprint. These are the emissions across the company’s entire value chain, beyond those of its own operations.

At a staggering 579 Mt CO2-e (million tonnes of carbon dioxide equivalent), BHP’s 2020 scope 3 emissions dwarf its 16 Mt CO2-e operational emissions, and are even larger than Australia’s total emissions each year.

| FY2018 | FY2019 | FY2020 | 2030 Target | ||

| BHP | Total | 611 | 581 | 579 | |

| Scope 1 | 8.9 | 9.3 | 9.5 | -30% (scope 1 & 2 – FY2020 baseline) | |

| Scope 2 | 5.9 | 4.9 | 6.3 | Total reduction 4.73 Mt CO2-e | |

| Scope 3 | 596 | 567 | 563 | -30% – emissions intensity of steelmaking customers -40% emissions intensity of shipping | |

| 2018 | 2019 | ||||

| Rio Tinto | Total | 565 | 521 | ||

| Scope 1 | 17.8 | 17.1 | -15% (scope 1 & 2 – 2018 baseline) | ||

| Scope 2 | 10.9 | 9.7 | Total reduction of 4.3 Mt CO2-e | ||

| Scope 3 | 536 | 494 | NONE | ||

| Australia | Total | 538 | 533 | -26-28% (2005 baseline) |

Action on scope 3

Any legitimate plan to address the risk climate change poses to BHP’s business (not to mention the planet) must ensure action to bring down scope 3 emissions in line with a 1.5 degrees Celsius warming outcome.BHP’s new climate plan makes some progress in this area, but again falls short of the scale of ambition required, and leaves many questions for the company to answer.

BHP will work to reduce the emissions intensity of its steelmaking customers by 30% by 2030. Given steelmaking accounts for over 70% of BHP’s massive scope 3 emissions profile (through the use of BHP’s iron ore and metallurgical coal), the scale of potential emissions reductions from this commitment is significant.

The company will also work with the maritime industry to support an emissions intensity reduction of 40% in BHP-chartered shipping by 2030.

The company has recently announced plans to divest thermal coal assets and its stake in Gippsland Basin oil and gas fields, as well as exit its coking coal joint venture with Mitsui. These moves will help bring down BHP scope 3 emissions, but essentially palm off responsibility for those emissions rather than actively bring them down.

BHP will remain a producer of metallurgical coal and oil and gas through a number of other projects in Australia and overseas.

Incentivising climate action

BHP today confirmed it will tie 10% of CEO Mike Henry’s short-term incentive remuneration to targets and goals associated with the company’s climate commitments. Similar incentives will be extended to other senior executives.

The 10% climate change component will include:

- Reductions in Scope 1 and Scope 2 operational GHG emissions

- Short and medium-term actions to reduce operational GHG emissions on the pathway to net-zero emissions

- Short and medium-term actions to address value chain (Scope 3) GHG emissions.

Carbon capture pipe dreams

BHP’s 1.5°C scenario analysis relies heavily on a massive uptake of carbon capture and storage (CCS) technology, which has failed to be proven viable. As a result the company’s model underestimates the declines in fossil fuel use that would be required to meet the Paris Agreement’s 1.5°C target.

BHP’s scenario shows fossil fuels’ share of primary energy falling by ~50% by 2050. However, the IPCC’s P1 scenario (which models a 1.5°C outcome without CCS), shows coal use for primary energy must fall by 97% by 2050, with oil and gas use down 87% and 74% over the same timeframe.

Similarly, the BHP scenario has energy-related emissions falling by just 3.8% every year to 2050, whereas UNEP tells us emissions need to fall by almost twice as much (-7.6%) each year for the next decade if we are to hold warming to 1.5°C.

One element of the 1.5°C scenario analysis that should ring alarm bells for BHP investors is its assumption of effective global carbon prices of $160/t in 2030 and $280 in 2050.

Based on BHP’s 2020 scope 3 emissions related to the steelmaking industry,* a US$160/t 2030 carbon price would impose a liability of US$27-48 billion** on BHP’s steelmaking clients. This indicates a staggering level of carbon risk exposure facing the steel sector that currently accounts for over half of BHP’s revenue.

*Processing of iron ore: 205.6-322.6 Mt CO2-e + Use of sold metallurgical coal: 33.7-108.2 Mt CO2-e.

**Assuming BHP’s target to reduce the emissions intensity of steelmaking clients by 30% by 2030 translates to a commensurate reduction in absolute emissions.

Comments

Market Forces Executive Director Julien Vincent said:

“BHP has set the bar for its diversified mining competitors, which have failed to set greenhouse gas reduction targets anywhere near what has just been announced. The fact that the targets are linked to remuneration helps keep management accountable to these commitments.

“By comparison it doubles the ambition of Rio Tinto’s paltry commitment to reduce its operational emissions to 15% below 2018 levels by 2030.

“However, setting the bar at 30% below 2020 levels by 2030 is clearly choosing to fall short of the Paris Agreement’s ultimate goal of holding global warming to less than 1.5ºC. This limit has been supported by investors worth over US$37 trillion, not to mention the global community concerned for a liveable climate.

“On Scope 3 emissions, BHP has been generous with hope, but stingy with delivery. The prospect of reducing emissions from steel production by 30% over the next decade is a tantalising start, but doesn’t count for much if all BHP is going to do is work with customers to find pathways for reducing emissions. These targets need to be set as a minimum standard, and backed with the sort of investment you’d expect from a company trying to preserve its customer base.

“Scope 3 emissions still represented 97% of BHP’s carbon liability in 2019. The bulk of effort and attention should be going into where BHP’s climate risk is largest and when you’ve got a scope 3 profile as large as Australia’s national emissions, it has to be tackled head on.

Whether motivated by protecting the climate or just avoiding a massive carbon liability sitting on its books, BHP has every reason to reduce its absolute scope 3 emissions with the same degree of effort as it puts into its operational emissions.