15 September 2015

An article written by Clancy Yeates in yesterday’s Sydney Morning Herald highlighted the significant financial and reputational risks that fossil fuel assets pose to banks, and questioned whether NAB and CommBank’s recent moves to distance themselves from Adani’s Carmichael mine project indicate a growing wariness of these risks.

Unfortunately, there doesn’t seem to be a whole lot of evidence to suggest any great shift in the big banks’ policies regarding coal or fossil fuels in general, although NAB’s commitment to increase lending to renewable energy projects is somewhat heartening.

The environmental and climate destruction that is being caused by the banks’ continued support for fossil fuels should be reason enough for them to get out of the sector. However, this position is repeatedly met with the age-old argument that financial institutions’ sole responsibility is to maximise profits, regardless of moral implications.

The environmental and climate destruction that is being caused by the banks’ continued support for fossil fuels should be reason enough for them to get out of the sector. However, this position is repeatedly met with the age-old argument that financial institutions’ sole responsibility is to maximise profits, regardless of moral implications.

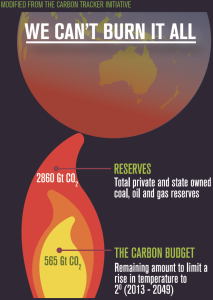

But the use of this argument can increasingly be flipped on its head as the value of fossil fuel assets continues to plummet and more is understood about the danger posed by a looming ‘carbon bubble’, which threatens to leave trillions of dollars worth of fossil fuel assets stranded as the world moves to limit global warming.

Latest studies have found that 80 per cent of global coal reserves can’t be dug up and burned if the world is to keep warming below the internationally agreed limit of 2°C. It’s dire fossil fuel predictions like these that have caused global financial concern, triggering a number of inquiries into the potential impact of stranded fossil fuel assets on international markets, which are being conducted by the likes of Goldman Sachs, the Bank of England and even the Financial Stability Board (at the request of the G20 nations!).

So if the financial world can see that global efforts to curb carbon emissions are going to drastically reduce the lifespan – and therefore profitability – of fossil fuel projects, then surely institutions have a financial responsibility to get out of these projects? And surely they must not increase their risk by investing in new projects?

As a matter of both social and financial responsibility, Australia’s banks need to show some leadership at their upcoming annual general meetings by announcing clear policies that will guide fast and drastic reductions in their exposure to fossil fuels.

Whilst limiting potential damage to their balance sheets and chaos in the wider market, fossil fuel divestment would also free up capital that could be used to finance Australia’s transition to renewable energies. Increased support for the renewables sector would allow us to take advantage of our wealth of wind and solar resources and become a world leader in the sector. It would also drive technology developments that will increase efficiency and lower costs of renewable energy.

Divesting from fossil fuels would also give a bank a massive reputational boost and avoid millions of dollars worth of savings being removed by its customers who are sick of their money being used to prop up the dirty fossil fuel industry.

Do you bank with one of the big four? Take this chance to put your bank on notice over their lending to coal and gas. You can add your savings to the hundreds of millions worth of business that the banks stand to lose unless they choose to ditch fossil fuels.