Key Points:

- LNG dependence exposes Japan and other countries to high price volatility and financial risk.

- Switching to LNG will not lead to decarbonisation.

- The Japanese companies’ LNG buildout in Asia threatens Japan’s reputation by derailing the global goals of the Paris Agreement to mitigate the climate crisis.

- Building renewables and moving away from LNG will help Japan achieve energy self-sufficiency.

Facts about the gas (LNG) business

1. LNG dependence exposes Japan and other countries to high price volatility and financial risk

Increasing dependence on LNG makes our energy system vulnerable. LNG is a fossil fuel subject to geopolitics and therefore volatile price fluctuations. At the same time, it increases the financial risk for Mitsubishi, JERA, and for Japan which imports the majority of its energy.

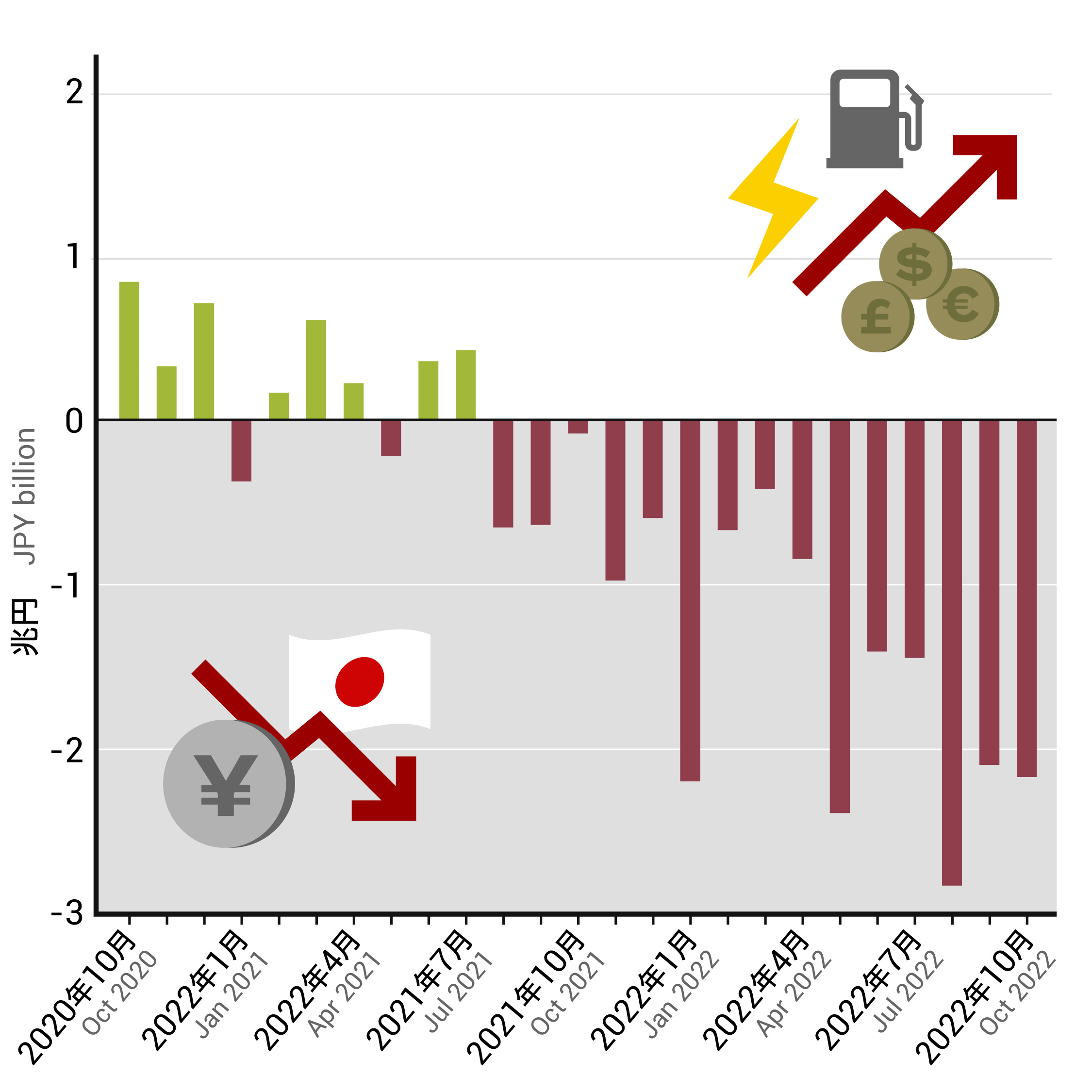

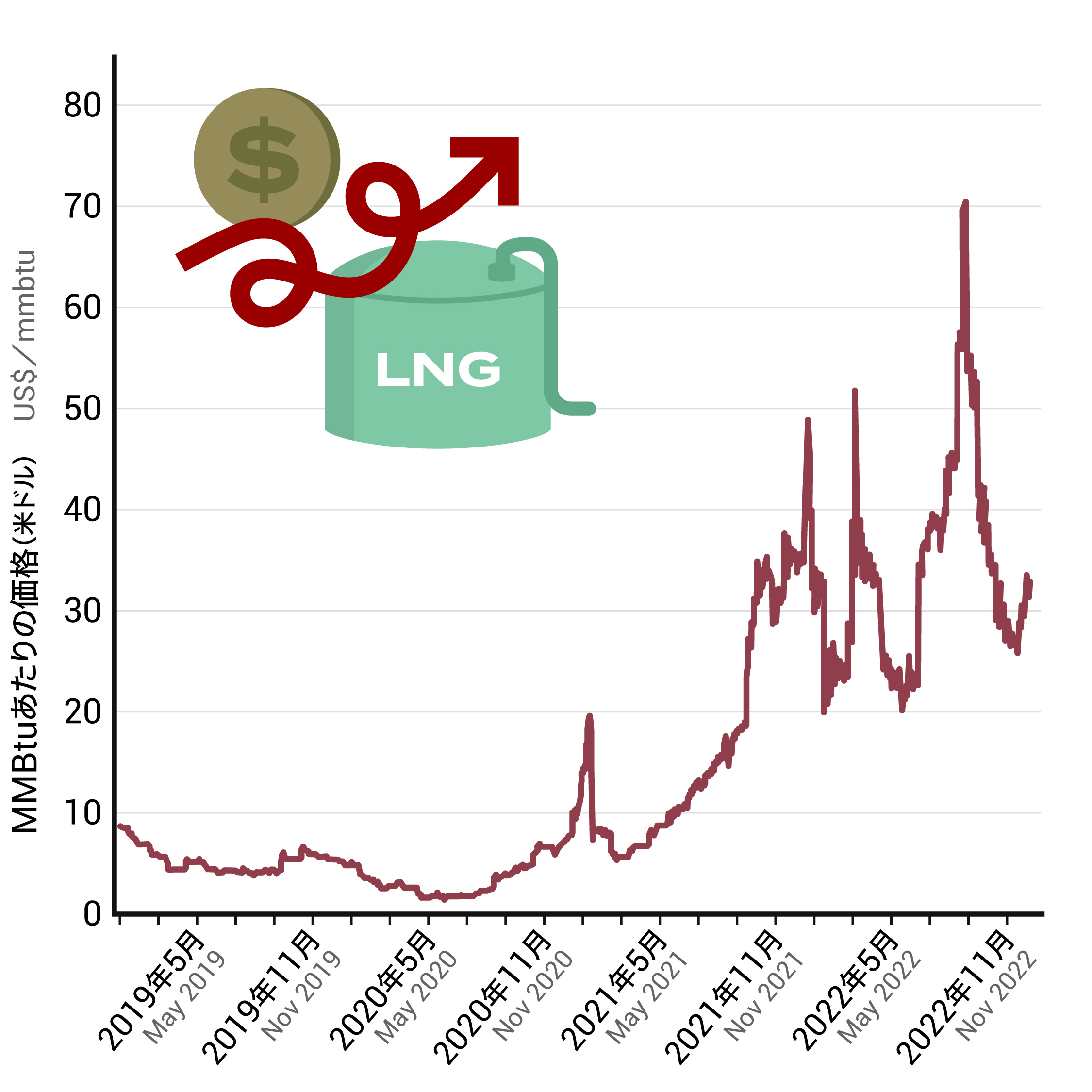

Japan’s average LNG import price has soared from $7.78/MMBtu in 2020 to a recent $20/MMBtu, while uncontracted LNG prices reached $70/MMbtu. We can see from this example that it is very difficult to create a reliable mid to long term price forecast for LNG. [graph1]

In addition, Japan spent 3 trillion yen on importing LNG in 2020, exacerbating Japan’s trade deficit.[1] According to trade statistics released by the Ministry of Finance, the trade deficit was 2.8 trillion yen in August 2022, the largest ever recorded for a single month, due to higher energy prices and a depreciation of the yen. [graph2]

Graph 1: Asia uncontracted LNG price

Source: Bloomberg Note: Front-month Japan-Korea Marker.

According to the Institute for Energy Economics and Financial Analysis, unaffordability of LNG and fuel supply insecurity “may cause new import terminals to go unused, potentially costing billions of dollars in stranded assets.”

According to the International Energy Agency’s World Energy Outlook 2022, in their Net Zero Emissions by 2050 (NZE2050) scenario, “there is no further need for additional [LNG] capacity beyond what exists or is under construction.” In NZE2050, LNG trade halves by the mid-2030s, and declines further to 2050.

Demand for LNG needs to fall in order to achieve the goal of the Paris Agreement. As the global transition away from fossil fuels accelerates, LNG assets will no longer be needed. Japanese companies, including Mitsubishi and JERA, could be left with stranded assets, affecting their long-term profitability.

Moreover, continued investment in LNG is problematic especially given the opportunity cost: this investment could instead be used for the rollout of renewable technology.

2. Switching to LNG will not lead to decarbonisation

Companies claiming that “LNG is better for the environmentally friendly” underestimate the environmental impact of LNG throughout its full life-cycle emissions.

Imported LNG emits a large amount of greenhouse gas when emissions from extraction, processing, storage, and transportation in addition to combustion are taken into account. Switching from coal to LNG undermines efforts to achieve net zero emissions when considering greenhouse gas emissions over the entire lifecycle.

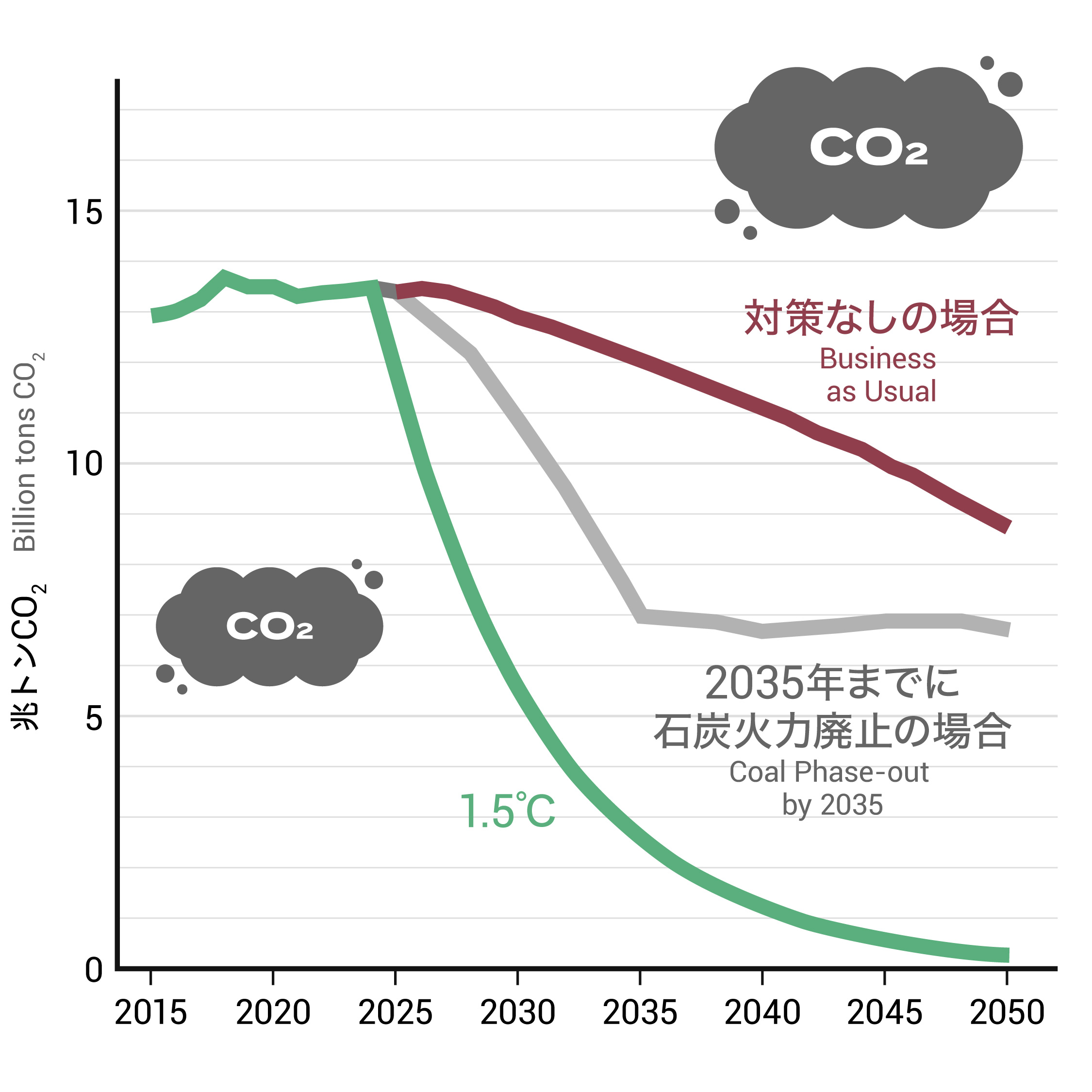

Recent analysis shows that switching from coal to gas will not decarbonise the power system and will not help us meet the climate goals of the Paris Agreement. [graph3]

In order to limit the temperature increase to 1.5 degrees Celsius, necessary to avoid even more frequent and severe extreme weather events caused by the climate crisis, gas generation would need to decrease by 90% over the next 20 years.

Therefore, switching from coal to LNG is not appropriate for achieving net zero emissions.

Graph 3: Global Power Sector Emissions in Bloomberg New Energy Finance (BNEF) Scenarios

Source: Oil Change International using data from Bloomberg New Energy Finance「New Energy Outlook 2019」

Problems with Japanese polluting companies

The Japanese companies’ LNG buildout in Asia threatens Japan’s reputation by derailing the global goals of the Paris Agreement to mitigate the climate crisis

A new study looking across Bangladesh, Thailand and Vietnam, the sites of the three largest gas power project expansions (outside China), identifies the Japanese companies most actively pursuing a liquefied natural gas (LNG) buildout in Asia, putting the climate goals of the Paris Agreement in peril.

Japanese companies are collectively attempting to back 15 proposed LNG power projects that would add 33.2 GW of thermal power capacity. Beyond these power projects, 7 LNG import terminals and Floating Storage and Regasification Units (FSRUs) are also proposed involving Japanese companies. JERA (a joint venture of TEPCO and Chubu Electric), Mitsubishi Corporation and SMBC Group, are among the offenders. [graph4]

Emissions from the planned LNG-to-power capacity in Bangladesh, if built, would cancel out any gains made under Japan’s 2030 emissions reduction target more than two times over.

Graph 4: Involvement of Japanese companies in proposed LNG to power projects

| Order | wdt_ID | Japanese Companies (all roles except feasibility study) | Number of Projects | Total capacity |

|---|---|---|---|---|

| 1 | 1 | JERA | 5 | 11,600 |

| 14 | 2 | Mitsubishi Corporation | 1 | 1,500 |

| 2 | 3 | Sumitomo Corporation | 2 | 6,200 |

| 3 | 4 | JBIC | 3 | 6,150 |

| 4 | 5 | ENEOS (formerly JXTG) | 1 | 6,000 |

| 5 | 6 | Tokyo Gas | 2 | 4,700 |

| 6 | 7 | SMBC Group | 3 | 4,400 |

| 7 | 8 | Mitsui & Co | 2 | 3,830 |

| 9 | 9 | Kyushu Electric | 3 | 3,100 |

| 11 | 10 | Sojitz | 3 | 3,100 |

| 8 | 11 | Osaka Gas | 1 | 3,200 |

| 12 | 12 | J-Power | 1 | 3,000 |

| 13 | 13 | Marubeni | 2 | 2,900 |

The lifecycle emissions from 15 proposed LNG power projects’ operating lifetime with all Japanese companies’ involvement (33.2 GW) is estimated to be 2.14 billion tonnes of CO2-e. This figure does not include projects where Japanese companies are involved at the environmental impact assessment and feasibility study stage. This is more than three times the equivalent of Japan’s 2030 absolute emission reduction target under its nationally determined contributions (NDCs) towards achieving the goals of the Paris Agreement [2].

Building renewables and moving away from LNG will help Japan achieve energy self-sufficiency

Globally, the trend is toward increasing renewable energy as part of the energy mix given its cost effectiveness and price stability in comparison with volatile fossil fuels.

According to IRENA, an intergovernmental organisation tasked with supporting renewable energy deployment, “the data suggest that since 2018, the trend is not only one of renewables competing with fossil fuels, but significantly undercutting them when new electricity generation capacity is required.” Carbon Tracker has found that new solar and onshore wind power developments in Japan, South Korea and Vietnam are either already cheaper, or will become cheaper overall investments than new gas units by 2025.

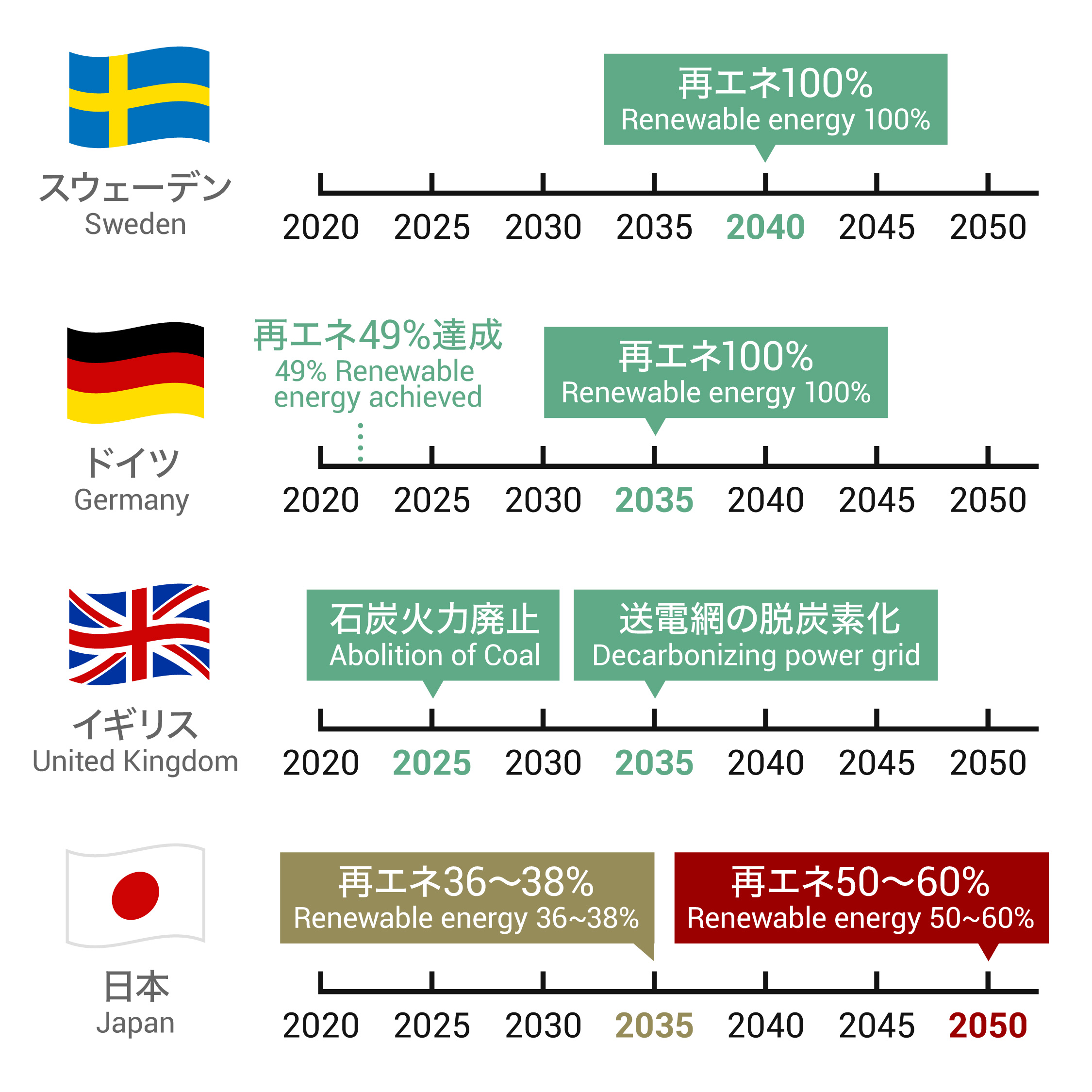

Japan’s renewable energy targets are 36-38% by 2030 and 50-60% by 2050. In contrast, countries that have set even more ambitious goals and increased their use of renewable energy include :

- Sweden increased its mix of hydro energy and bioenergy and is heading towards meeting its target of 100% renewable electricity production by 2040.

- Germany has set a target to use close to 100% renewable energy by 2035. Renewables provided 49% of Germany’s power in the first half of 2022.

- The UK has transitioned away from coal from 2008 when 80% of its electricity came from fossil fuels. Now the UK government’s targets to “phase out coal by 2025 and largely decarbonise the grid by 2030 could be met years ahead of schedule.”

Comparison of goals set by Japan with countries that have increased their use of renewable energy

Source: Climate Council, Carbon Brief, and METI

Japan has the ability to meet 100% of its energy needs from renewable energy, and can better harness its solar and wind energy potential. The same is true of the emerging economies, such as Vietnam, in which Japanese corporations are pushing expensive LNG.

Survey on LNG

Please feel free to contact us if you have any comments or questions. Email: [email protected]

References

[1] Estimated from “Natural Gas and LNG Data Hub 2022” by Japan Oil, Gas and Metals National Corporation

[2] Japan NDC absolute emission reduction target is -620 MtCO2-e compared to 2013 baseline. Source: Climate Watch

Disclaimer

This webpage is intended to convey factual information about the LNG project and Japanese companies.

Information comes from the companies’ available annual reports and websites, Refinitiv Eikon, Bloomberg and various news reports.

Occasionally where information is incomplete, assumptions must be made about data and these were made in a consistent manner and in good faith. Whilst we have endeavoured to gather and include all relevant deals, we cannot guarantee the completeness of the information presented.