ADANI COAL INVESTORS EXPOSED

Banks and investors are supporting Adani coal

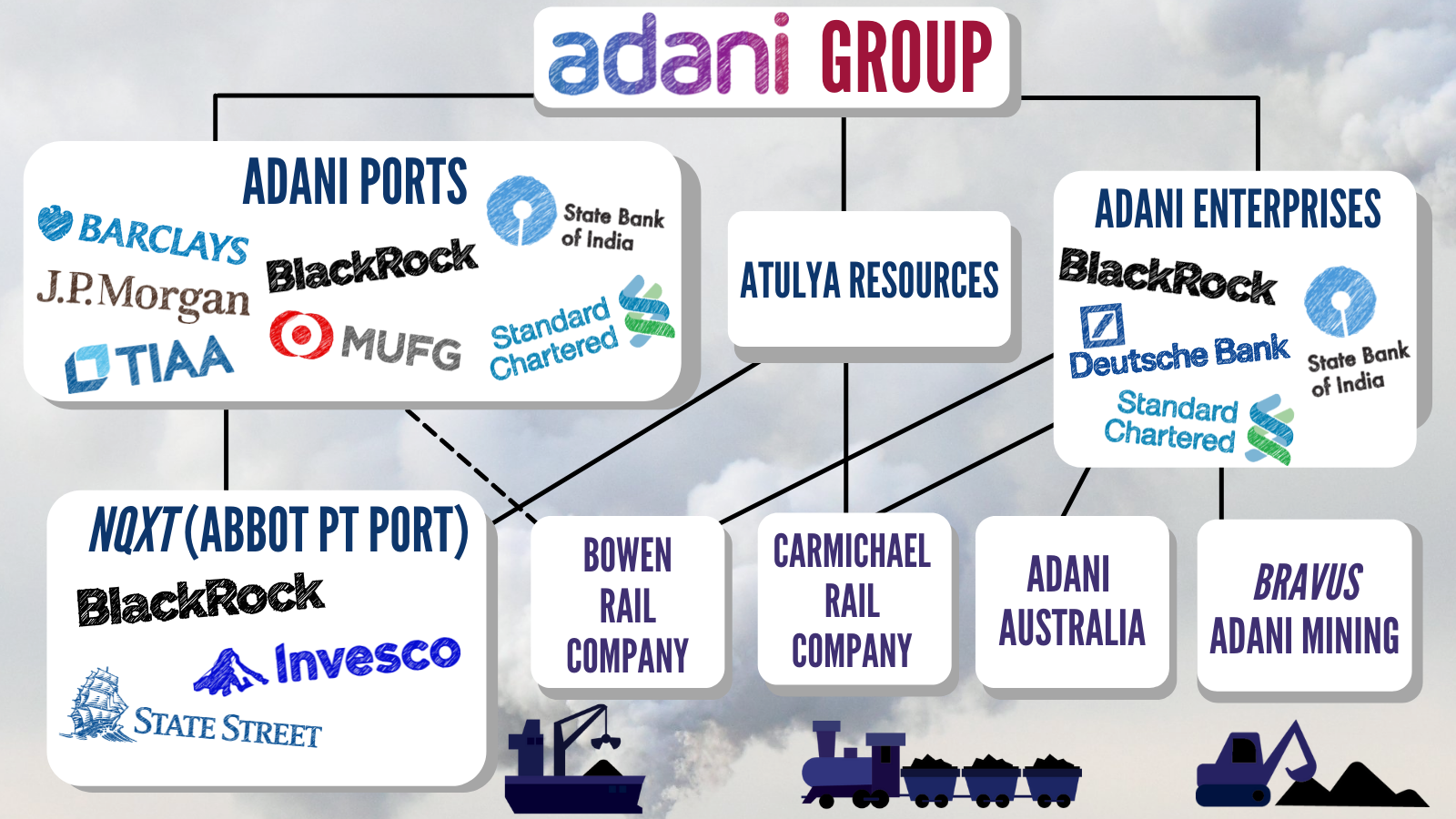

The Adani Group’s Australian coal operations, including the controversial Carmichael thermal coal project, are owned by a complex structure of companies. This complexity, combined with varied entity titles and major rebrandings in 2020 which removed the word “Adani” from entity names means that financiers are increasingly at risk of supporting the Carmichael coal project via indirect and inadvertent means.

The diagram below offers a summary of the corporate structure of Adani’s Australian coal operations – and some of its major financiers. The refusal of banks to fund the Carmichael project meant that Adani was forced to “self-fund” the mine and rail line. However, the parent companies Adani Ports and Special Economic Zone (Adani Ports) and Adani Enterprises, as well as Adani’s coal port NQXT (North Queensland Export Terminal, owned by the Adani family via Cayman Islands-based Atulya Resources and formerly known as Adani Abbot Point Terminal) continue to attract investment from some of the world’s biggest financiers and banks.

Many of the investors and bankers identified have ruled out supporting the Carmichael project or made commitments/statements on climate change (see table below). Their exposure to Adani Ports, Adani Enterprises and/or NQXT, while the Adani Group continues to operate the Carmichael carbon-bomb, means that these financiers are supporting the Carmichael coal project and thereby probably breaching their commitments.

These financiers have been made aware of their exposure to the Carmichael mine, yet so far have refused to cut ties with the Adani Group subsidiaries that are supporting the expansion of Adani’s toxic coal project. It’s time these bankers and investors use their power to help stop the destructive and globally controversial project, by telling Adani Group’s executives to shut down the climate-wrecking mine. If Adani does not stop Carmichael, then these financiers must turn their backs on the Adani Group.

Contact the financiers now.

TAKE ACTION

Let the exposed investors and financiers know that their support for Adani supports Carmichael coal

For a more complete list of investors in the Adani Group subsidiaries directly linked to the Carmichael coal project click on the tab below the main table. Bondholder and shareholder data from publicly available sources accessed January 2022.

Simplified structure of Adani subsidiaries directly linked to coal in Australia

Key Adani company investors and bond arrangers

| Financier | Connection to Adani | Company statements undermined by exposure to Adani |

|---|---|---|

| Barclays | Bond arranger for Adani Ports since 2017, co-arranging at least six deals worth over US$3.5 billion. Bond arranger and lender to Adani Enterprises. | "Barclays has no plans to participate in financing the Abbot Point development or its associated mine/rail infrastructure" |

| BlackRock | Bondholder and shareholder in Adani Ports. Bondholder in NQXT (Abbot Point coal port). Shareholder in Adani Enterprises. | CEO Condemned Siemens for its willingness to work on Adani’s Carmichael mine saying “it is clear that it [Siemens] requires a more thorough review of the potential risks, including ESG risks, presented by future projects.” BlackRock was also reported to have raised concerns about the State Bank of India’s potential loan to Adani. January 2020: “we are in the process of removing from our discretionary active investment portfolios the public securities (both debt and equity) of companies that generate more than 25% of their revenues from thermal coal production” |

| Citi Group | Bond arranger for Adani Ports | "Citi is not involved and does not plan to be involved in any financing for the Abbot Point expansion" July 2020: “Citi will not provide project-related financial services for… New thermal coal mines or significant expansion of existing mines” |

| Deutsche Bank | Previously a bond arranger for Adani Ports, but backed out of the January 2021 bond issue reportedly due to environmental concerns. Has not been involved in subsequent Adani Ports bond issues. However, it is still a bondholder and shareholder in Adani Ports. Lender and bond arranger for Adani Enterprises, also a shareholder. | “We are currently not involved with this project [Abbot Point port] and will also not be involved with it in the future” July 2020: “We will not provide any financing for greenfield thermal coal mining; We will not finance new greenfield coal-related infrastructure, regardless if related to new or existing mines” August 2020: “we pledged ourselves to end our global business activities in coal mining by 2025” “Port-related environmental concerns which are in conflict with sustainability goals of the bank” was reported (paywalled) as Deutsche Bank’s reason for withdrawing from Adani Ports’ bond issue in January 2021. |

| HSBC | Shareholder in Adani Ports and Adani Enterprises. Bond arranger for the State Bank of India which has failed to rule out a AU$1 billion loan to the Carmichael mine. | "[HSBC] is extraordinarily unlikely to go anywhere near [Abbot Point]" "HSBC will no longer support new thermal coal mines" “Global Businesses must not provide financial services for: New thermal coal mines or new customers dependent on thermal coal mining.” |

| Invesco | Bondholder in NQXT. Bondholder and shareholder in Adani Ports. Shareholder in Adani Enterprises. | According to Invesco’s climate change report, climate should be “top of the agenda for us as a society”. |

| JP Morgan | Bond co-arranger for at least five Adani Ports deals worth over US$2.5 billion. Bondholder in Adani Ports. Lender and bond arranger for Adani Enterprises. | "We will not finance... a new greenfield coal mine or a new coal-fired power plant in a high income OECD country" "We do not finance natural resource projects within UNESCO World Heritage Sites unless... such operations will not adversely affect the Outstanding Universal Value of the site” |

| Mizuho Bank | Shareholder in and bond arranger for Adani Ports. Bond arranger for Adani Enterprises | “We do not provide financing or investment which will be used for new thermal coal mining projects.” "Mizuho supports the Paris Agreement’s objective to ‘strengthen the global response to the threat of climate change’." |

| MUFG | Bond arranger for at least six Adani Ports deals worth over US$3.5 billion. Shareholder in Adani Ports. Bond arranger for Adani Enterprises. | “MUFG recognizes climate change as a critical issue for the global environment and believes that climate change issues must be addressed to achieve a sustainable society and support the continued operation of each group company and our clients." |

| Standard Chartered | Bond arranger for Adani Ports since 2017, co-arranging at least six deals worth over US$3.5 billion. Lender and bond arranger for Adani Enterprises. | "Both parties [Standard Chartered and Adani] have agreed to end the bank's role in the Carmichael project" "We will not provide project finance or project finance advisory services to new standalone, non captive thermal coal mining projects" |

| The State Bank of India | Shareholder in Adani Ports and Adani Enterprises. Currently considering lending AU $1billion to Adani's coal project despite Adani saying it doesn't need it | SBI recently formed part of a 100 million Euro climate initiative fund. “Human actions, including deforestation, encroachment on wildlife habitats, intensified agriculture, and acceleration of climate change, have pushed nature beyond its limit. It's time for a change!” |

| State Street Global | Bondholder in NQXT and Adani Ports. Shareholder in Adani Enterprises and Adani Ports. | State Street has set exclusions against investing in Adani Ports via ESG labelled indices. |

| Sumitomo Mitsui Financial Group | Shareholder in and bond arranger for Adani Ports. Shareholder in and bond arranger for Adani Enterprises. | “In October 2020, the Japanese Government announced a net-zero emissions goal for 2050, committing to achieving a transition toward a decarbonized society... we endorse the Government's policy, and strive to achieve greenhouse gas ("GHG") emissions reductions in line with the goals of the Paris Agreement.” |

| TIAA | Bondholder and shareholder in Adani Ports. Shareholder in Adani Enterprises. | “climate change has arisen as a leading health and economic challenge of our time.” |

Major global financiers and investors of Adani Group subsidiaries directly involved in the Carmichael coal project

| wdt_ID | Investor/Financier | North Queensland Export Terminal | Adani Ports & Special Economic Zones | Adani Enterprises |

|---|---|---|---|---|

| 1 | AIG Asset Management | Bondholder | ||

| 2 | Alliance Bernstein | Bondholder | ||

| 3 | Ameriprise Financial Group | Bondholder | ||

| 4 | Anthem Inc | Bondholder | ||

| 5 | Apollo Global Management | Bondholder | Lender | |

| 6 | Aviva | Shareholder | ||

| 7 | Axis Bank | Bond arranger | ||

| 8 | Barclays | Bond arranger | Lender, Bond arranger | |

| 9 | BlackRock Inc | Bondholder | Bondholder, Shareholder | Shareholder |

| 10 | Carlyle Investment Management | Bondholder | ||

| 11 | Charles Schwab Corp | Shareholder | Shareholder | |

| 12 | Citi Group | Bond arranger | ||

| 13 | Cohen & Steers Inc | Shareholder | ||

| 14 | Concise Investments | Bondholder | ||

| 15 | CREDIINVEST SICAV | Bondholder | ||

| 16 | Credit Agricole Group | Shareholder | Shareholder | |

| 17 | Credit Suisse Group | Bond arranger | Shareholder | |

| 18 | DBS Bank | Bond arranger | ||

| 19 | Deutsche Bank | Bondholder, Shareholder | Lender, Shareholder, Bond arranger | |

| 20 | Dimensional Fund Advisors | Shareholder | Shareholder | |

| 21 | Emirates NBD Capital | Bond arranger | ||

| 22 | Fidelity | Shareholder | Shareholder | |

| 23 | FlexShares Trust | Shareholder | ||

| 24 | Fuchs & Associes Finance | Bondholder | ||

| 25 | GAM Holding AG | Bondholder | Bondholder | |

| 26 | Geode Capital Management | Shareholder | ||

| 27 | Goldman Sachs | Bondholder | ||

| 28 | Government Pension Investment Fund | Shareholder | ||

| 29 | Hartford Financial Services Group | Shareholder | ||

| 30 | HSBC | Shareholder | Shareholder | |

| 31 | IMI-Intesa Sanpaolo | Bond arranger | ||

| 32 | Invesco | Bondholder | Bondholder, Shareholder | Shareholder |

| 33 | JP Morgan | Bondholder, Bond arranger | Lender, Bond arranger | |

| 34 | Legal & General Group PLC | Shareholder | ||

| 35 | Loomis Sayles & Co | Bondholder | ||

| 36 | Lord Abbett & Co | Bondholder | ||

| 37 | Lyxor Asset Management | Shareholder | Shareholder | |

| 38 | Manulife Financial Corp | Bondholder | ||

| 39 | Massachusets Financial Services | Bondholder | ||

| 40 | Mercer Global Investments Management | Shareholder | ||

| 41 | Metlife Investment Management | Bondholder | ||

| 42 | Mirae Asset Global Investments Co | Shareholder | ||

| 43 | Mizuho Bank | Shareholder, Bond arranger | Bond arranger | |

| 44 | MUFG | Shareholder, Bond arranger | Shareholder, Bond arranger | |

| 45 | Nomura Holdings Inc | Shareholder | ||

| 46 | Norges | Shareholder | ||

| 47 | Northern Trust Corp | Shareholder | Shareholder | |

| 48 | Pan-American Life Insurance Group | Bondholder | ||

| 49 | Pictet Group | Bondholder | Shareholder | |

| 50 | Principal Financial Group | Bondholder | ||

| 51 | Royal Bank of Canada | Bondholder | ||

| 52 | Sagicor Life Insurance Co | Bondholder | ||

| 53 | SBI | Shareholder | Shareholder | |

| 54 | Service Life & Casualty Insurance | Bondholder | ||

| 55 | Societe Generale | Bond arranger | ||

| 56 | Southern Farm Bureau Life Insuranc | Bondholder | ||

| 57 | Standard Chartered | Bond arranger | Lender, Bond arranger | |

| 58 | Standard Insurance Co | Bondholder | ||

| 59 | State Street Corp | Bondholder | Bondholder, Shareholder | Shareholder |

| 60 | Sumitomo Mitsui Financial Group | Shareholder, Bond arranger | Shareholder, Bond arranger | |

| 61 | T. Rowe Price | Bondholder | ||

| 62 | Thompson Investment Management Inc | Bondholder | ||

| 63 | TIAA/Nuveen | Bondholder, Shareholder | Shareholder | |

| 64 | UBS AG | Bondholder, Shareholder | Shareholder | |

| 65 | Universal Investment | Bondholder | ||

| 66 | Vanguard | Shareholder | Shareholder | |

| 67 | VP Bank AG | Bondholder | ||

| 68 | WisdomTree Investments | Shareholder | ||

| 69 | Zuercher Kantonalbank | Shareholder |

Source: Bloomberg Finance L.P. Data collected January and February 2022.

Take action! Let the exposed investors and financiers know that their support for Adani supports Carmichael coal.