Report

Stewards of Climate Disaster

How Australia’s biggest super funds are failing to deliver on climate claims through ‘active ownership’

Our new analysis reveals Australia’s five biggest super funds, which together manage a staggering $1 trillion of members’ retirement savings, are failing to live up to their climate claims.

All five funds in the study – AMP, Australian Retirement Trust, AustralianSuper, Aware Super and Commonwealth Super Corp – have claimed support for or alignment with the Paris climate goals and / or set net zero emissions by 2050 targets. The science is clear: meeting these goals means no new coal, oil or gas projects and a rapid decline in the use of these fossil fuels.

Despite claiming to pursue climate action by engaging* with companies they invest in, super funds have failed to comprehensively adopt effective engagement practices recommended by major responsible investor initiatives. So it is little wonder those funds’ efforts have been utterly inadequate to rein in the climate-wrecking fossil fuel expansion plans of companies like Santos and Woodside.

Lawyers have warned financial institutions without ‘reasonable grounds’ to believe they will achieve their climate goals could be engaging in misleading and deceptive conduct. This could have serious consequences for super funds failing to deliver on their climate commitments through active ownership of companies like Santos and Woodside.

Is your fund greenwashing? Demand answers today.

Take Action

Demand answers from your super fund: submit a legal request for information.

Key findings

1. Five key elements of an effective climate-related active ownership program are:

- Identifying and prioritising high climate risk-exposed companies for targeted engagement

- Setting time-bound engagement objectives for these priority companies

- Reporting to stakeholders on progress towards priority company objectives

- Outlining the consequences for companies failing to meet objectives through a publicly-disclosed escalation framework

- Identifying divestment as the ultimate escalation measure for companies failing to meet engagement objectives

2. Of Australia’s five biggest super funds, AMP, Australian Retirement Trust, AustralianSuper and Commonwealth Super Corp have almost completely failed to demonstrate any of the five identified climate-related effective active ownership criteria. Aware Super has made some progress, but still falls far short of comprehensively meeting the key elements of effective engagement.

3. Despite being the two largest undiversified fossil fuel producers on the ASX, not a single super fund in this study has publicly identified Santos and Woodside for targeted engagement, nor disclosed what is expected of these companies. Members are therefore left in the dark as to whether their fund is actually living up to its climate claims and attempting to influence these companies through active ownership, or simply allowing them to continue expanding fossil fuels.

4. Most super funds acknowledge climate risk and/or have set climate targets.

All five funds in this study acknowledge climate risk and the need for climate risk management, as well as having either:

- Set a 2050 net zero portfolio emissions target, and/or

- Set interim emissions reduction targets, and/or

- Voiced support for (or claimed alignment with) the climate goals of the Paris Agreement

Looking beyond the biggest five funds, a previous Market Forces study found most of Australia’s biggest 32 super funds have set targets to achieve net zero emissions by 2050 (or sooner).

5. Funds relying on active ownership to meet their stated climate targets and / or manage climate risk may be greenwashing and exposing themselves to legal risk. Super fund trustees have a legal duty to manage climate risk, and a landmark 2021 legal opinion concluded financial institutions that make net zero commitments must have ‘reasonable grounds’ to believe they will achieve these commitments, at the time they are made. According to the legal opinion, it is foreseeable that super funds (and their directors) failing to do this could be found to be engaging in misleading and deceptive conduct. This could have serious consequences for super funds that claim active ownership of companies like Santos and Woodside will contribute to achieving the fund’s climate commitments, given how inadequate investor stewardship efforts and their results have been to date.

Australia’s biggest super funds letting members down

Australian super funds have had many years to demonstrate responsible stewardship of the companies they own, but when it comes to the most climate-damaging companies in their portfolios, there has been an abject failure across the industry to drive change at the scale and pace necessary for a safe climate future. The five largest funds manage the retirement savings of millions of members, accounting for more than $1 trillion in assets under management. This is almost half of all assets managed by APRA-regulated funds (those which aren’t government-regulated funds or self-managed super funds).

The below table plots the publicly-disclosed active ownership practices of these five largest super funds (by assets under management) against the five key themes of effective active ownership commonly outlined by major responsible investment initiatives in their published resources. All of the funds in this analysis are either members of, signatories to and / or associated with (through partner investor networks) at least two of the institutions which published these resources, meaning these super funds should be well aware of them (see more information section for further details).

Active ownership practices of Australia’s five largest super funds

| wdt_ID | Fund | Has the fund identified and prioritised high climate risk-exposed companies (e.g. Santos and Woodside) for targeted engagement? | Has the fund set time-bound engagement objectives for priority companies? | Does the fund report on the progress towards priority company objectives? | Does the fund have an escalation framework in place which identifies consequences for companies failing to meet objectives? | Does the fund identify divestment as the ultimate escalation measure for companies failing to meet objectives? |

|---|---|---|---|---|---|---|

| 1 | AustralianSuper |

Partially. The fund refers to the 'largest contributors to portfolio emissions' for scope 1 & 2 emissions only: "As part of this, we’ve identified the largest contributors to portfolio emissions based on the proportion of emissions we own of each company (apportioned emissions; which is calculated based on our ownership level and the company’s scope 1 and 2 emissions). We believe a focus on apportioned emissions is an effective way of measuring our progress towards Net Zero 2050 and impact on real-world outcomes, as it enables us to focus our stewardship actions on the highest contributors to portfolio emissions." (2022 Annual Report, pg. 40). These largest 20 companies are identified in the 2021 Climate Change report (pg. 35). |

Not found, but the fund mentions a few escalation actions: "If engagement doesn’t lead to a successful outcome on a material issue, we may escalate our actions and use our voting rights to vote against company resolutions. We may also vote in favour of shareholder resolutions if we believe they will lead to better outcomes for members." (Stewardship Statement, pg. 2) |

|||

| 2 | Commonwealth Super Corp |

|||||

| 3 | Australian Retirement Trust |

|||||

| 4 | Aware Super |

Prioritised, but not publicly identified: "Within our active ownership program, we prioritise engagement with the top 20 emitters (Scope 1 and 2 emissions) in our Australian-listed equities portfolio as well as industries with material Scope 3 emissions." (2022 RI Report, pg. 27). |

Yes, but the specific objectives for each company are not disclosed, only generic engagement ‘milestones.’ (Hermes EOS Report, pg. 6, 15) |

Only a summary of the objectives and milestones is reported, not the progress against specific objectives for high climate risk-exposed companies. (2022 Responsible Investment Report, pages 8-9; Hermes EOS Report, pg. 6) |

Yes, but the framework itself is not disclosed, only a few potential escalation actions. (Responsible Investment & ESG Policy, pg. 12) |

See Responsible Investment & ESG Policy, pg. 12 |

| 5 | AMP |

Source: Various. See more information section below. Each fund in the above table was contacted ahead of publication and given the opportunity to provide any further disclosures or commentary not captured by our research.

Key:

– Not found – Satisfies criteria

Necessary elements of effective net zero active ownership

The table below sets out the sources and details of the five key elements of effective active ownership practices commonly outlined by major responsible investment initiatives. Australian super funds should be meeting all of these criteria if they are seeking to meet their climate commitments through active ownership of climate-wrecking companies.

Five key elements of effective net zero active ownership

Investors identify and prioritise high climate risk-exposed companies or sectors for targeted engagement

| wdt_ID | Resource | Detail |

|---|---|---|

| 1 | “The first step in the net zero stewardship strategy process is to carry out portfolio analysis to identify which companies account for the majority share of financed emission [sic]. This enables investors to determine which companies can be classified as aligned to achieving net zero (or not), and which should therefore be subject to engagement.” (pg. 6) | |

| 2 | UNPRI - A Practical Guide to Active Ownership in Listed Equity |

"As institutional investors would usually hold thousands of companies in their portfolios and only be able to meaningfully engage with a small number of investees, setting up criteria for prioritisation is required. Prioritisation defines how company due diligence resources are targeted and recognises that not all ESG risks and opportunities can be identified and addressed.” |

| 3 | Paris Aligned Investment Initiative - Net Zero Investment Framework |

Engagement and stewardship: “Prioritise engagement efforts based on relative exposure (weighted carbon intensity).” (pg. 18) |

| 4 | “Investors need to be willing to engage with different sectors of the economy to meaningfully manage their own portfolio alignment targets… This includes prioritizing the highest emitting sectors in their portfolios for analysis and engagement. A clear position should be developed on engaging high emitting investments (including adopting a formal fossil fuel policy), consistent with any climate pledges made.” (pg. 19) | |

| 5 | “FIs [financial institutions] should extend their investment policy to sectors and technologies that pose particular climate-related risks or offer particular opportunities. These are most notably… Sectors that are deemed to shrink and ultimately disappear with the energy transition (e.g., coal, oil, and gas).” (pg. 102) |

Investors set time-bound engagement objectives for priority companies

| wdt_ID | Resource | Detail |

|---|---|---|

| 1 | “Once the scope of assets targeted for engagement activities has been defined and priority companies identified, the next step in the net zero stewardship strategy process is to determine how the priority companies will be assessed and what they need to do in a specific timeframe to support delivery of portfolio goals and impact outcomes.” (pg. 9) | |

| 2 | UNPRI - A Practical Guide to Active Ownership in Listed Equity |

"Investors might find it useful to define milestones and timelines at the start of engagement, although these will need to be continuously reviewed to reflect internal and external developments during the multi-year dialogue with target companies." |

| 3 | Paris Aligned Investment Initiative - Net Zero Investment Framework |

Listed equity and corporate fixed income - implementation: “Set engagement strategy with clear milestones and escalation.” (pg. 16) |

| 4 | “Investors are encouraged to establish and publish an escalation strategy that explains the actions they will take if a company is not responsive to their engagement or to their net-zero alignment criteria /asks including clear timeframes for underweighting or divestment should engagement not be successful.” (pg. 31) |

|

| 5 | "FIs [financial institutions] should adopt an investment and/or lending policy that reflects and aligns with their climate-related investment principles. This can include... engagement objectives." (pg. 102) |

Investors report on the progress towards priority company objectives

| wdt_ID | Resource | Detail |

|---|---|---|

| 1 | “In addition… transparency and consistent reporting from asset owners and asset managers on their overall portfolio Net Zero alignment and engagement strategy, assessment, tracking and reporting.” (pg. 27) | |

| 2 | UNPRI - A Practical Guide to Active Ownership in Listed Equity |

"Transparency is a key component of active ownership and it forms part of many stewardship codes and principles… As much as investors are engaging with companies to access and encourage better ESG information and practices, they are responsible for reporting to their clients and beneficiaries on their engagement and voting activities and relevant outcomes. Such information should be easy to access and understand and provided on a regular basis (i.e. quarterly or annually).” |

| 3 | Paris Aligned Investment Initiative - Net Zero Investment Framework |

Recommended disclosures: “Metrics and targets • Performance against targets over time, and any updates or adjustments to targets that are relevant. Management • Engagement, stewardship and direct management actions… performance in relation to the engagement threshold, and key outcomes achieved. • Voting policy and voting record, including an explanation of any deviations from the policy. • Policy in relation to exclusions or phase out of fossil fuel investments.” (pg. 23) |

| 4 | "Publish organizational and portfolio objectives / targets on climate change and report on progress against these." "Publish an assessment of the outcomes and impacts achieved from corporate engagement." (pg. 53) “Disclose quantitative details of interim net-zero targets and report progress against them." (pg. 54) |

|

| 5 | "FIs [financial institutions] should publicly disclose their climate decisions and activities to increase impact.” “By signaling (i.e., making public) key climate-related decisions and activities, FIs will significantly amplify their impact. Given the climate urgency, the signaling effect is critical to raise the awareness of peer FIs, companies, service providers, policymakers, and other stakeholders.” “Signaling is particularly critical for a meaningful engagement strategy. FIs should disclose which companies they are engaging with, what their specific demands are, and publish at regular intervals an assessment of the engagement impact. This will increase pressure on corporations and drive deeper and faster changes." (pg. 107) |

Investors identify consequences or escalation measures for companies failing to meet objectives

| wdt_ID | Resource | Detail |

|---|---|---|

| 1 | "Develop an engagement strategy for priority companies: The establishment and implementation of strategies to increase alignment of priority companies, with clear escalation actions to be used where time bound objectives are not met." (pg. 5) | |

| 2 | UNPRI - A Practical Guide to Active Ownership in Listed Equity |

"Best practice disclosure on engagement activities include… detail on eventual escalation strategies taken after the initial dialogue has been unsuccessful (i.e. filing resolutions, issuing a statement, voting against, divestment etc.)." |

| 3 | Paris Aligned Investment Initiative - Net Zero Investment Framework |

Listed equity and corporate fixed income - implementation: “Set an engagement strategy with clear milestones and an escalation process with a feedback loop to investment, weighting, and divestment decisions.” For listed equity specifically: “• Implement an escalation approach, using the full range of routine AGM routes • Where a company is not on track to achieve its transition plan or targets set for two years or more, vote against the board, remuneration policy, annual report and accounts. • Vote against M&A unless the post M&A company meets or can be expected to meet the criteria within a reasonable period. • Co-file and/or support shareholder resolutions in line with the criteria.” (pg. 16) |

| 4 | "Establish a clear escalation strategy for companies or other entities that have not responded appropriately to engagement." (pg. 49) "Support, file or co-file climate resolutions at companies who have not responded appropriately to engagement, and vote against directors on climate grounds." "Pre-declare voting intentions on ESG defining resolutions and at company laggards." (pg. 50) |

|

| 5 | “Given the urgency to tackle climate change, FIs should have an escalation process in place for when engagement does not lead to significant results within set time frames (6, 12, 24, 36 months), where a range of options are available to FIs: open letters, filing/supporting shareholder resolutions, and voting at annual general meetings (AGMs), end support to companies’ efforts to raise capital (notably through corporate bonds), and ultimately divestment." (pg. 104) |

Investors identify divestment as the ultimate escalation measure for companies failing to meet objectives

| wdt_ID | Resource | Detail |

|---|---|---|

| 1 | "It is noted that the Net Zero Investment Framework identifies that stewardship should be the main tool by which to achieve change at companies in line with investor expectations and that divestment should only be used as a last resort (in the case it can be used at all) where escalation has been exhausted or change is otherwise seen as infeasible." (pg. 25) | |

| 2 | UNPRI - A Practical Guide to Active Ownership in Listed Equity |

"If dialogue does not bring the desired outcomes after a certain period of time, investors can consider different escalation strategies to trigger corporate reaction. Depending on the jurisdiction they belong to, these strategies might follow different orders. Possible next steps after an unsuccessful engagement include… threatening to reduce exposure or divest." |

| 3 | Paris Aligned Investment Initiative - Net Zero Investment Framework |

Selective divestment: “However, investors should consider divestment or exclusion: • As a consequence of climate financial risk assessment. • As a consequence of escalation following engagement. • For companies whose primary activity is no longer considered permissible within a credible pathway towards global net zero emissions, identify exclusions over relevant timeframes.” (pg. 19) |

| 4 | "Establish a formal investment policy on fossil fuels and other high impact activities, such as deforestation and biodiversity loss, that: • aligns with a net-zero target • includes an explicit commitment to phase out exposure to fossil fuels (either through engagement or divestment) in line with science-based net-zero pathways” (pg. 47) |

|

| 5 | "Public disclosure of climate actions should cover... divestment decisions if engagement is not deemed relevant or does not deliver within set time frames." "FIs should also indicate the names of companies from which they have divested or decided not to invest in, following the example of financial institutions in countries like Denmark and Norway… Therefore, public signaling is critical for amplification." (pg. 107-108) |

Net zero by 2050 means no new fossil fuels, but super funds are failing to act on oil and gas expansion

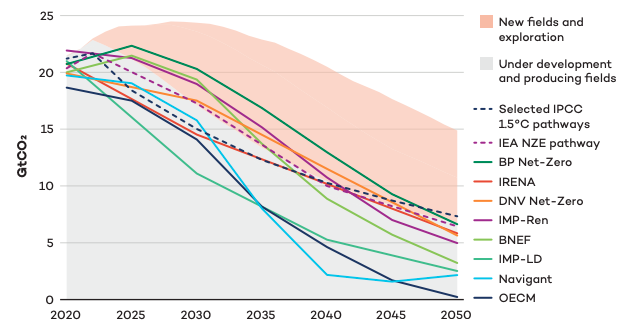

The International Energy Agency (IEA) concluded in 2021 that reaching net zero emissions by 2050 means no new oil and gas fields can be approved. The United Nations Environment Programme (UNEP) also confirmed that limiting global warming to 1.5°C in line with the Paris Agreement means “global fossil fuel production must start declining immediately and steeply.” More recently, the International Institute for Sustainable Development (IISD) determined that across a wide range of scenarios, “…developing any new oil and gas fields is incompatible with keeping [global] warming to 1.5°C,” as shown in the chart below.

The science is clear: avoiding the worst impacts of climate change means no new oil and gas projects should proceed.

Selected emissions reduction pathways vs. new oil and gas production

Source: Navigating Energy Transitions: Mapping the road to 1.5°C (IISD, 2022).

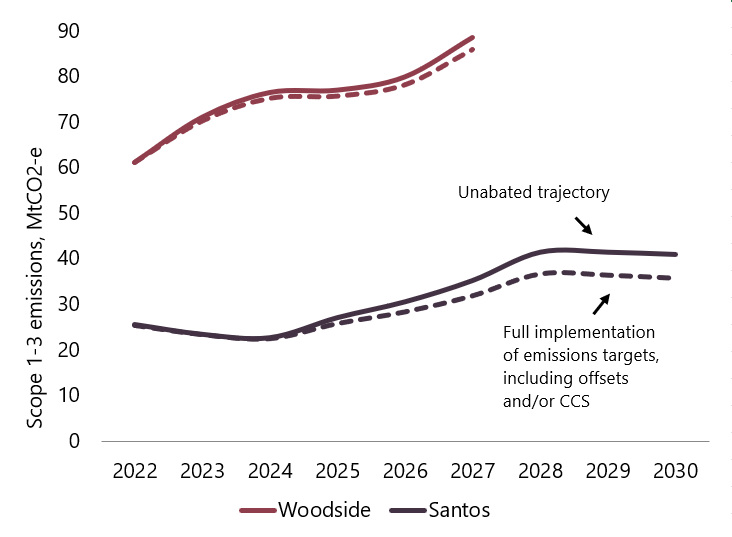

Despite the IEA and others’ clear warnings, Australia’s two largest oil and gas companies – Woodside and Santos – continue to pursue new projects and plan to significantly increase production. Even assuming full implementation of Santos and Woodside’s utterly inadequate emissions reduction targets, these companies’ increasing production plans are projected to see:

- Santos’ annual emissions increase by 40% from 2022 to 2030

- Woodside’s annual emissions increase by 40% from 2022 to 2027

The chart below outlines Market Forces’ analysis of Santos and Woodside’s projected emissions increase against the impact of the companies’ stated emissions reduction targets.

Santos, Woodside projected emissions, with climate targets impact

More than seven years after the Paris Agreement was signed, and with many super funds’ climate commitments having been in place for much of that time, ineffective ‘active ownership’ efforts with respect to companies like Santos and Woodside have been going on for too long.

Non-state actors cannot claim to be net zero while continuing to build or invest in new fossil fuel supply… Net zero is entirely incompatible with continued investment in fossil fuels.” – The UN High-Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities, Integrity Matters: Net Zero Commitments by Businesses, Financial Institutions, Cities and Regions

In spite of their own commitments to net zero by 2050 and support for the Paris climate goals, many funds (including several of those analysed in this report) have shown a pattern of voting against crucial climate-related shareholder resolutions at these two companies, with some funds even voting for Woodside and Santos’ utterly inadequate climate plans in 2022.

The table below outlines the voting decisions of the five super funds featured in this analysis on some of the climate-related items put to investors at Santos and Woodside’s 2021 and 2022 annual general meetings (AGMs), including ‘capital protection’ shareholder resolutions – which requested disclosure of business plans aligned with global climate goals – as well as each company’s climate report.

Super funds’ proxy voting at Santos and Woodside’s 2021 and 2022 AGMs

| 2021 | 2022 | |||

| Company | Fund | Capital protection resolution | Capital protection resolution | Approval of climate report |

| Woodside | AustralianSuper | Against | Against | Against |

| Commonwealth Super Corp | Not disclosed | Not disclosed | Not disclosed | |

| Australian Retirement Trust | Against | Against | Against | |

| Aware Super | Abstain | Combination* | Against | |

| AMP | For | Not disclosed | Not disclosed | |

| Santos | AustralianSuper | Against | Against | For |

| Commonwealth Super Corp | Not disclosed | Not disclosed | Not disclosed | |

| Australian Retirement Trust | Against | Against | For | |

| Aware Super | Abstain | Abstain | Against | |

| AMP | For | Not disclosed | Not disclosed | |

Source: Various. See more information section below.

* A ’Combination’ vote implies a fund’s asset managers have voted different ways on a particular resolution.

Legal requirements regarding climate commitments

In a landmark 2021 legal opinion, barristers Noel Hutley SC and Sebastian Hartford Davis highlighted the legal risks of greenwashing, particularly in relation to the forward-looking climate commitments of listed companies and financial institutions.

Hutley and Hartford Davis found companies that make net zero commitments need to have ‘reasonable grounds’ to believe they will achieve these commitments at the time they are made. Super funds (and their directors) failing to do this could be engaging in misleading and deceptive conduct.

Companies making net zero commitments require ‘reasonable grounds’ to support the express and implied representations contained within such commitments at the time those commitments are made.” – Noel Hutley SC and Sebastian Hartford Davis, Climate Change and Directors’ Duties

Given the current lack of action demonstrated by the biggest Australian super funds towards meaningfully engaging with companies like Santos and Woodside, it appears funds that have made climate commitments such as a net zero by 2050 (or claimed ‘alignment’ with the Paris Agreement) may not have a reasonable basis to believe they’ll achieve these commitments through active ownership as they are currently delivering it.

In order to avoid accusations of greenwashing and exposure to litigation risk, super funds must immediately and significantly ramp up their engagement efforts with these companies, demanding an end to fossil fuel expansion and divesting from companies that fail to comply. Super funds can no longer pretend their inadequate engagement with companies expanding fossil fuel production will bring them into line with their own climate commitments when these companies are actively undermining net zero by 2050 and a safe climate future.

Super fund members have a right to demand detailed information from their fund about its engagement with climate-wrecking companies, including:

- Which companies the fund has identified and prioritised for targeted engagement

- Any time-bound engagement objectives the fund has set with respect to these companies, particularly in relation to Santos and Woodside

- Any progress the fund has made towards these objectives since they were set

- Any consequences the fund has made clear to companies which fail to meet its objectives within a given timeframe, including an escalation framework or clear set of escalation steps

- Whether the fund has made clear to these companies that divestment is the ultimate escalation step

Use your power as a super fund member to make sure your fund cannot get away with greenwashing. Demand information about its active ownership of the climate-wrecking companies it invests your retirement savings in.

More information

Glossary

Investor stewardship / active ownership

This refers to the practice of investors exerting influence over the companies they invest in through tools such as “…engagement and voting [on items of business at annual general meetings] – two of the most widely used tools – resolutions/proposals, board roles, supplier monitoring/negotiation, contributing to research and public discourse, litigation.”

Engagement

This refers to the specific “…Interactions between an investor and current or potential investees/issuers, in order to: improve practice on an ESG issue, change a sustainability outcome in the real world or improve public disclosure.”

Engagement may be conducted with companies directly, or indirectly through collaborative investor networks / initiatives, in order to seek specific outcomes from those companies. Engagement is just one part of an investor’s stewardship / active ownership toolkit, which also includes things like filing shareholder resolutions, voting against company remuneration reports or directors, or divestment.

Scope

Super funds

The scope of our analysis covers the largest five super funds by assets under management according to APRA’s June 2022 fund-level superannuation statistics. This is a point-in-time comparison of super funds’ recent disclosures and policies, not a historical comparison indicating progress over time.

Methodology

We examined a variety of resources (listed below) regarding ‘effective practice’ climate-related active ownership from a number of responsible investment initiatives, including institutional investor groups, member organisations and intergovernmental bodies. We identified a trend of five key themes across five resources, enabling us to define what effective active ownership looks like when it comes to high climate risk-exposed companies. We then sought out any public disclosures from the five biggest Australian super funds (by assets under management) relating to the active ownership of high climate risk-exposed companies, paying particular attention to Santos and Woodside as the two biggest undiversified fossil fuel producers on the ASX. The five resources regarding climate-related active ownership were chosen on the grounds that they are published by notable responsible investment initiatives with significant industry membership, with all super funds featured in the study either being signatories to, members of, or associated with (through partner investor networks) at least two of the institutions which published the resources (see below section ‘Responsible investment initiatives’).

Sources

Super funds

All information was sourced from publicly-available policy documents, webpages, reports, blog posts, media releases and media reports. The five funds featured in this analysis were contacted ahead of publication and given the opportunity to provide any further public disclosures or commentary not captured by our research.

The disclosure documents relating to each super fund captured in this study are as follows:

AustralianSuper

- ESG and Stewardship Policy

- Stewardship Statement

- Share Voting Approach

- Share Voting Records

- 2021 Climate Change Report

Commonwealth Super Corp

- Stewardship Factsheet

- Proxy Voting and Engagement Principles

- Proxy voting reports (summaries only)

- Engagement examples

- Investment Quality and Sustainability page (where most of the above documents are linked)

Australian Retirement Trust

Linked from the Sustainable Investing page:

- 2021-22 Sustainable Investment Report

- Sustainable Investment Policy

- Climate Change Policy

Linked from the Governance and Reporting page:

- Proxy voting record history (from 3 October 2022)

- Various proxy voting disclosures

Aware Super

- Stewardship Statement

- Responsible Investment & ESG Policy

- 2022 Responsible Investment Report

- Voting disclosures on Proxy Voting page

- 2021 Stewardship Report

- 2021 Annual Review: Aware Super Engagement Highlights (Hermes EOS report)

- Destination Net Zero report

- Climate Change Portfolio Transition Plan

- Engagement and Advocacy page

AMP

- Stewardship statement

- Proxy voting policy (plus a second policy document found here)

- 2021 review: proxy voting, ESG and investment stewardship

- Responsible investment and ESG statement

- Climate change position and action plan

- Climate action plan: 2021 progress report supplement

- ESG and responsible investment philosophy

- Proxy voting disclosures linked from the Governance and active ownership page

| wdt_ID | Fund | Climate commitment or climate risk acknowledgement | Commitment to active ownership |

|---|---|---|---|

| 1 | AustralianSuper |

Target to achieve net zero emissions by 2050 and public support for the Paris climate goals. |

"We use our influence as a large asset owner to engage with internally held Australian ASX-listed companies and unlisted assets for a clear articulation of their net zero business strategies and actionable progress plans which track actual emissions reduction trajectories. For our core portfolio of internally held equities we have developed ownership plans to monitor and manage progress for climate exposed companies." (Net Zero 2050 Factsheet, pg. 4) |

| 2 | Commonwealth Super Corp |

Claims 'alignment' with the Paris Agreement, acknowledges climate risk and the need for climate risk management. |

"The CSC investment team assesses and manages climate-related issues through the portfolio by... Engaging actively and constructively with investee companies on climate change issues." (Climate Risk Factsheet, pg. 5) |

| 3 | Australian Retirement Trust |

Target to achieve net zero emissions by 2050, plans to set interim targets. |

"Australian Retirement Trust undertakes active ownership activities (engagement, voting, and advocacy) in the belief that these actions act to improve long-term sustainable returns for members. Australian Retirement Trust believes that engaging on climate change will improve transparency, promote best practice, and lead to improved outcomes for members." (Climate Change Policy, pg. 4-5) |

| 4 | Aware Super |

Target to achieve net zero emissions by 2050 and a 45% reduction in portfolio emissions by 2030 (from a 2020 baseline). |

Aware Super's Destination Net Zero report (climate strategy) has three pillars, the third being 'Climate change and active ownership': "We have a responsibility to engage companies we invest in to transition to a low-carbon economy. Within our active ownership programme we prioritise engagement with the top 20 emitters (Scope 1 & 2) in our Australian listed equities portfolio." (pg. 9) |

| 5 | AMP |

Target to achieve net zero emissions by 2050 and public support for the Paris climate goals. |

"We will leverage our influence as a global investor to engage with companies, assets and other investors to advocate for an orderly transition." "We are committed to [e]ngaging companies, assets and external fund managers where we have greatest influence to seek reductions in greenhouse gas emissions, development of clear transition strategies, enhanced climate-related disclosures and resilience to physical climate risks." (Climate change position and action plan, pg. 3) |

Net zero active ownership

The five net zero active ownership resources referenced in this study are as follows:

- Institutional Investors Group on Climate Change – Net Zero Stewardship Toolkit

- Principles for Responsible Investment – A Practical Guide to Active Ownership in Listed Equity

- Paris Aligned Investment Initiative – Net Zero Investment Framework

- The Investor Agenda – Investor Climate Action Plans (ICAPs) Guidance on using the Expectations Ladder

- Science Based Targets initiative – Financial Sector Science-Based Targets Guidance

Responsible investment initiatives

The below table indicates whether the five super funds analysed in this report are members of, signatories to and / or associated with (through partner investor networks) the responsible investment initiatives which published the five resources examined. All five funds analysed in this study are also members of The Investor Group on Climate Change (IGCC).

| wdt_ID | Fund | IIGCC | UN PRI | PAII | The Investor Agenda | SBTi |

|---|---|---|---|---|---|---|

| 1 | AustralianSuper |

Yes | Yes | Yes* | Yes^ | No |

| 2 | Commonwealth Super Corp |

No | Yes | Yes* | Yes^ | No |

| 3 | Australian Retirement Trust |

No | Yes | Yes* | Yes^ | No |

| 4 | Aware Super |

No | Yes | Yes* | Yes^ | No |

| 5 | AMP |

No | No | Yes* | Yes^ | No |

* These funds are members of the IGCC, which is a partner investor network in the Paris Aligned Investment Initiative (PAII). No super fund captured in this study is a standalone signatory to this initiative.

^ The IGCC and the IIGCC are both founding partners of The Investor Agenda. No super fund in this study is a standalone partner of this initiative.

Disclaimer

The information provided by Market Forces does not constitute financial advice. The information is presented in order to inform people motivated by environmental concerns and take actions based on those concerns. Market Forces is organising data for environmental ends.

The information and actions provided by Market Forces do not account for any individual’s personal objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

Market Forces recommends all users obtain their own independent professional advice before making any decision relating to their particular requirements or circumstances. Switching super funds may have unintended financial consequences.

For more information about Market Forces, please visit the about page of the site.

Join us

Subscribe for email updates: be part of the movement taking action to protect our climate.