18 May 2016

Whether or not they realised it at the time, Australia’s major banks signed up to some radical changes at the end of 2015. They all came out in support of the goal to hold global warming to below two degrees, recognising the role they had to play in helping the world achieve that goal.

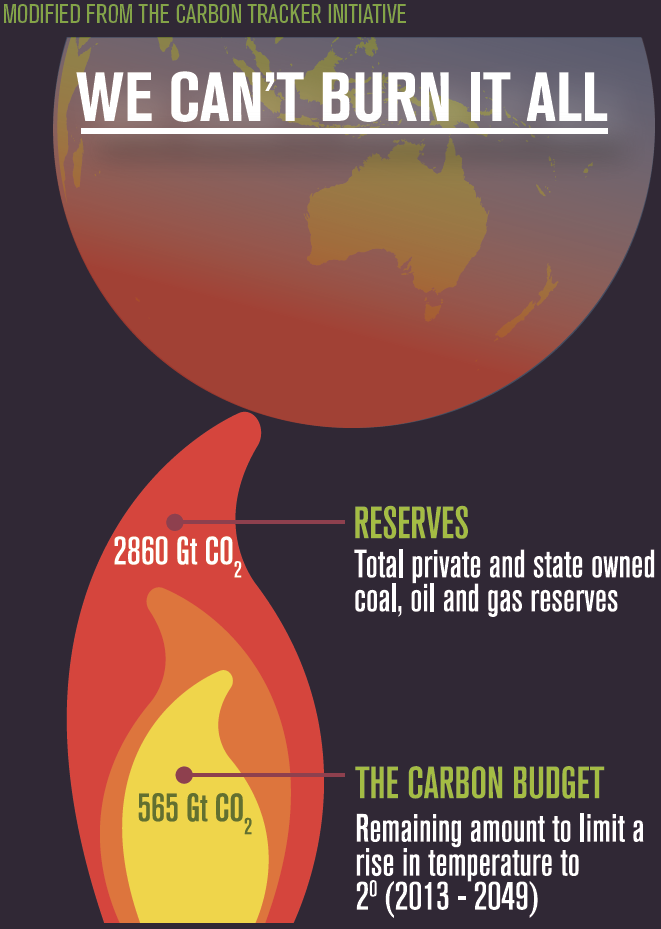

Keeping global warming below 2°C means operating within an extremely strict carbon budget – one where more than 80% of all owned fossil fuel reserves must be kept in the ground. If we can’t burn it, we can’t finance it either so for the banks being committed to the 2°C global warming limit means getting out of fossil fuels in a matter of years.

Can it be done? That’s not really a question any of us have the luxury of answering, given that if we blow the carbon budget we face runaway climate change. We simply have to. Market Forces is calling on Australia’s major banks to:

- end lending that enables the expansion of the fossil fuel industry,

- reduce exposure to coal within five years

- reduce exposure to all fossil fuels to zero by 2030

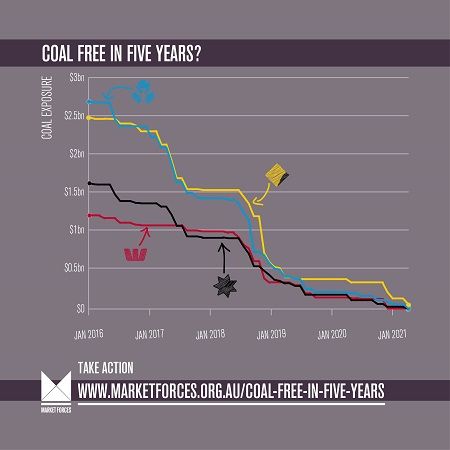

Getting to zero coal exposure in five years by doing nothing

As the most greenhouse-intensive fossil fuel it is likely – and logical – that coal is phased out fastest, closely followed by other fossil fuels. Australia’s big four banks have loaned over $20 billion to coal in Australia since 2008 but when we take a closer look at these deals, many of them mature after only a few years.

If the banks do nothing at all, simply allowing their current coal loans to mature without refinancing or making any new deals, all but CommBank would have zero debt exposure to the industry by early 2021. At that point, only CommBank’s long-term $59 million loan to Loy Yang B power station in Victoria would be outstanding, due to expire in 2026.

Of course, we’re not advocating the banks do nothing at all. Market Forces and our friends in the environment movement and civil society are urging the banks to actively manage down all exposures to fossil fuels, through debt, asset management and elsewhere, as quickly as possible. At the same time they need to massively increase support – both financial and though advocacy – for renewables and energy efficiency.

No room for current fossil fuels, let alone new coal and gas

Studies have shown that, even without any new construction, emissions from coal-fired power stations in 2030 would still be 150% higher than levels consistent with the less than 2°C target. Rather than facilitating the expansion and extension of the coal industry, we need to be actively shortening its lifespan. Even allowing current coal projects to run their course is inconsistent with our 2°C commitments.

And coal investments aren’t the only ones on the chopping block. The authors of a recent Oxford university report telling us: “If nations are serious about their Paris commitments, then all new investment in energy infrastructure would need to be zero emissions from 2018 onwards.” It can’t be put much more clearly than that – our banks simply cannot continue to invest in fossil fuels. Reducing their exposure to coal by the end of the decade would be a good start, but it needs to be quickly followed by a complete exit from gas and oil as well.

Community holds the power

Customers leaving their banks in protest over their fossil fuel investments. Click here to take action.

It was community pressure saw each of the big four publicly announce support for the 2°C warming limit in 2015. It will be the community who holds the banks accountable to their commitments to see the sorts of changes we need to avoid runaway climate change.

The big four banks have to understand that any decision to prolong their exposure to coal is inconsistent with their 2°C policy statements, and this sort of hypocrisy will not be tolerated. Any loan that expands, or prolongs the banks’ exposure to the fossil fuel industry from now on will be met with a strong public reaction, including customers around Australia publicly closing their accounts.

If you bank with one of the big four, you can add your voice to thousands of others who have pledged to hold their bank accountable. Put your bank on notice, telling them if they continue to choose fossil fuels, you’ll choose another bank. You can also check out our banks comparison table, which lists more than 120 financial institutions and their positions on fossil fuel lending, helping you find a bank that aligns more closely with your values.

There are a couple of important milestones along the road to the end of coal finance, with considerable reductions in exposure projected for mid-2017 and -2018 if the banks avoid new loans to the sector. These points mark the maturity of deals to several projects, including struggling major coal ports and dirty brown coal-fired power stations. For the banks, getting these deals off their loan books would not only help them meet their climate commitments, it would also be a prudent business decision.

With coal consumption in the world’s two largest economies – China and the US – dropping significantly, many financial analysts have concluded that the global thermal coal industry is in structural decline. As countries begin to implement strict emissions policies to meet their Paris Agreement obligations, the writing is on the wall for the future of the coal industry – or the lack thereof.

Banks’ exposure to fossil fuel projects is hurting the planet and potentially their bottom lines. There can be no justification for any of our banks being involved in any future refinancing deal in the coal sector, let alone facilitating a new project.

Abbot Point coal export terminal