24 March 2014

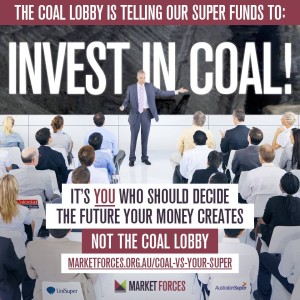

Well here’s a sign that the coal industry is in trouble. But its going to need a response.

The Australian newspaper ran a story that documented the coal industry’s plans to lobby fund managers – including Australian superannuation funds – to stay invested in coal. BHP, Glencore Xstrata, Rio Tinto, they’re all part of the lobbying campaign. The threat of divestment has got them scared, but if they succeed in convincing your super fund to stay invested in this dirty industry it’s a big problem. We’ve created an email action where super fund members can contact their fund and remind them that as a member, your views should override the coal industries and you want a fossil fuel free future. Just enter your details, select your fund and you can let your fund know that your voice matters more than big coal’s.

To be clear, this is the coal industry – the source of more carbon emissions in Australia and globally – telling the managers of your retirement savings what to do. We think that your super fund ought to hear from the people whose money they actually manage and hear what they – you – think. You can make edits to the email if you want but we’re trying to make three clear points here.

1. Coal IS set to decline. Financial analysts from firms such as Bernstein, HSBC and Deutsche Bank are all pointing to a peak in coal use in the near future, driven largely by Chinese efforts to control air pollution.

2. Even if a future of less coal was not being predicted by financial analysts, divesting from this industry is still the morally and environmentally right thing to do. Coal is the single biggest cause of greenhouse gas emissions globally and in Australia. Our exports of coal are capable of producing about a billion tonnes of carbon dioxide per year.

3. Divesting from coal is doable, without being a big risk to investment returns. A recent report by the Australia Institute, commissioned by Market Forces and The Australia Institute shows that removing fossil fuel companies from a portfolio based on the ASX 200 is doable and with minimal impact on investment returns.

We’re expect to see a lot of movement in the super fund sector this year. With research we commissioned last year showing that up to a quarter of a trillion dollars in the sector could be shifted, just on the basis of coal and gas concerns.

Engagement now from members of as many funds as possible will make all the difference as this sector reshapes itself to go fossil fuel free.