20 November 2020

Horizon Oil was questioned over the company’s sustainability in the face a Paris-aligned energy transition at its annual general meeting today.

Horizon owns oil and gas exploration, development and production assets in China and New Zealand, having recently sold its beleaguered Papua New Guinea assets. The company is seeking to increase production in NZ and China, and is also on the lookout for “a significant growth asset”.

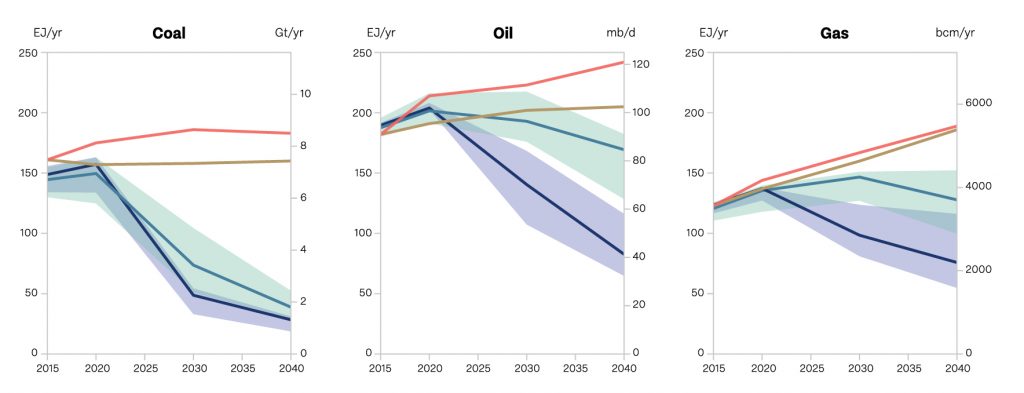

These plans are at odds with the Paris Agreement’s goal of limiting global warming to 1.5°C, which requires oil and gas production to rapidly decline from 2020 onwards.

Price assumptions out of line with Paris

At the end of the 2020 financial year, after revising its long term oil price assumption down to US$60/barrel, Horizon wrote down the value of its assets by US$67.3 million. This write-down amounted to 41% of the total FY2019 value of its oil and gas exploration and production assets.

The company was asked what scale of impairment could we expect if Horizon adopted the oil prices forecasted under the IEA’s Sustainable Development Scenario, which are US$57/barrel in 2025, falling to US$53 in 2040. That scenario gives just a 50% chance of limiting warming to 1.65°C, meaning prices consistent with a 1.5°C outcome would be even lower.

Horizon’s Chair Mike Harding said the company does not anticipate any write-downs under the IEA SDS, based on its FY20 scenario analysis. It’s worth noting the IEA SDS has been updated with long term price forecasts 8-10% lower than the previous version.

However, in response to another shareholder’s question, Harding claimed the company’s assets are resilient to oil prices as low as $35/barrel.

This begs the question: if Horizon’s assets are resilient to Paris-aligned price assumptions, why hasn’t the company adopted those assumptions in its financial statements? This is exactly what investors managing more than US$100 trillion in assets are calling for.

With the company hunting for a new growth project, a shareholder sought a commitment from the board that any potential investment in a significant growth asset would be assessed against a scenario consistent with holding global warming to 1.5°C before making the investment. Harding responded that ESG (environmental, social and governance) would be a key element in any decision-making process, but did not confirm a 1.5°C assessment would necessarily be undertaken.

Oil and gas production inherently unsustainable

While Horizon has put a lot of effort into improving its reporting and commentary on climate change and sustainability, one shareholder pointed out the elephant in the room:

“It is not logical that one would hope to have an impact in this area [climate change and sustainability] through their investment in oil and gas.”

While it seems the questioner had no interest in climate action, the point is entirely valid. Investment in any company that is completely reliant on pulling more dirty fossil fuels out of the ground undermines the goal of limiting global warming to 1.5°C in order to avoid the worst impact of climate change

This is why Market Forces is calling on big investors, including our super funds, to stop investing in fossil fuel companies undermining climate action, like Horizon Oil.

Find out if your super fund is invested in these companies and take action.