To keep global warming under control, immediate and rapid reductions in greenhouse gas emissions are needed. Luckily, we already know how to get started: Stop expanding the fossil fuel industry, and “electrify everything” with renewable energy.

Still, experts agree that renewables might not take us all the way to zero emissions. Long-distance shipping, fast-response power generation and other applications may require additional options. This is where hydrogen comes in. When it’s used, it only produces heat and water. Hydrogen can also be used to produce ammonia, which is used in fertiliser and can itself be used as a fuel source.

When it comes to emissions, and whether hydrogen is truly a “clean” source of energy or not, it boils down to how the hydrogen is produced. Hydrogen can be made from renewable energy, but more often than not, it’s made from coal and fossil gas. Fossil fuel companies want you to think both renewable and fossil-based hydrogen and ammonia are good alternatives to dirty coal, oil and gas, but they’re not. To help cut through the greenwash, we’ve reviewed some of the key issues in the hydrogen supply chain. The table below summarises our findings.

Key points:

- Fossil fuel companies want to use hydrogen to justify burning more fossil fuels. Don’t assume that all hydrogen is “low-carbon” – it depends how it is produced.

- Fossil hydrogen and ammonia (includes ‘grey’ and ‘blue’ hydrogen / ammonia) is polluting, relies on unproven technologies, and should be avoided.

- Renewable hydrogen (‘green’ hydrogen) is the only type that has true potential as a sustainable energy solution.

Hydrogen technology scorecard

Technology

Decarbonisation potential

Market Forces view

Grey hydrogen / ammonia

Greenwash at its worst – grey/brown/black hydrogen may look “clean” when consumed, but this hides an extremely dirty journey before that stage. Should be avoided at all costs.

Blue hydrogen / ammonia

Even if companies can drastically reduce fossil gas leaks, blue hydrogen is unlikely to ever become a zero carbon solution, partly because CCS already has a poor track record and questionable potential. Worse, blue hydrogen risks being used as an excuse to sanction new oil and gas projects, which the IEA’s Net Zero by 2050 scenario clearly rules out.

LNG to hydrogen

Mitsubishi’s concept is a pipe dream. Blue hydrogen combines the substantial pitfalls of CCS with the emissions intensity of the LNG supply chain. It’s also likely to be expensive and financially volatile.

Green hydrogen

Green hydrogen is the only type that can be produced with little to no emissions, giving it immense potential for companies looking to diversify away from fossil fuels. As the cost of producing green hydrogen falls, it should be a no-brainer for businesses and governments of all persuasions.

Grey hydrogen / ammonia

Decarbonsation potential:

Comments:

Greenwash at its worst – grey/brown/black hydrogen may look “clean” when consumed, but this hides an extremely dirty journey before that stage. Should be avoided at all costs.

Blue hydrogen / ammonia

Decarbonsation potential:

Comments:

Even if companies can drastically reduce fossil gas leaks, blue hydrogen is unlikely to ever become a zero carbon solution., partly because CCS already has a poor track record and questionable potential. Worse, blue hydrogen risks being used as an excuse to sanction new oil and gas projects, which the IEA’s Net Zero by 2050 scenario clearly rules out.

LNG to hydrogen

Decarbonsation potential:

Comments:

Mitsubishi’s concept is a pipe dream. Blue hydrogen combines the substantial pitfalls of CCS with the emissions intensity of the LNG supply chain. It’s also likely to be expensive and financially volatile.

Green hydrogen

Decarbonsation potential:

Comments:

Green hydrogen is the only type that can be produced with little to no emissions, giving it immense potential for companies looking to diversify away from fossil fuels. As the cost of producing green hydrogen falls, it should be a no-brainer for businesses and governments of all persuasions.

Hydrogen can be produced in a number of different ways. This is normally described as the different ‘colours’ of hydrogen production – grey, brown/black, blue and green.

Other hydrogen colours – turquoise (methane pyrolysis), pink (using nuclear energy) and yellow (using grid electricity) – are not discussed as they are much less common.

The colours of hydrogen

Grey / brown / black hydrogen

Key points: The majority of today’s hydrogen and ammonia production is “grey”, meaning it’s based on fossil gas. Producing it is so emissions-intensive that it’s worse for the climate than simply burning fossil fuels.

Market Forces view: Greenwash at its worst – grey/brown/black hydrogen may look “clean” when consumed, but this hides an extremely dirty journey before that stage. Should be avoided at all costs.

Detail

The majority (59%) of all hydrogen produced today is done so by refining fossil gas in a process called steam methane reforming, which uses high temperature steam and high pressure to split methane into hydrogen and carbon monoxide. This process generates significant CO2 emissions – on a per-unit-of-energy basis, more than simply mining and burning coal. The resulting product is referred to as ‘grey’ hydrogen.

Lifecycle emissions intensity of grey hydrogen and conventional fossil fuels

Source: Grey hydrogen, fossil gas, coal: Howarth & Jacobson – “How green is blue hydrogen?”, Energy Science & Engineering (2021). Black/brown hydrogen: European Commission Well-to-Tank report (KOCH1 pathway, including combustion)

Coal can also be turned into hydrogen through coal gasification, which uses a stream of highly heated steam and oxygen to create a gaseous mix of carbon dioxide, carbon monoxide, water and hydrogen – this is known as ‘brown’ or ‘black’ hydrogen, and accounts for one-fifth of production today. This method, which emits 50% more greenhouse gases than grey hydrogen, is most widely used in China, although is now gaining traction in Indonesia as well.

Hydrogen is also a byproduct of oil refining, accounting for a further one-fifth of today’s global hydrogen supply. It’s typically re-used in other parts of the refining process.

2020 hydrogen production by source

Source: IEA Global Hydrogen Review 2021

Blue hydrogen

Key points: Blue hydrogen adds unproven and highly problematic carbon capture and storage (CCS) technology to the grey hydrogen process in an attempt to reduce CO2 emissions. However, fossil gas leaks at all stages of the supply chain and the significant limitations of CCS severely hampers the climate benefit. All told, blue hydrogen may be no better than burning coal.

Market Forces view: Even if companies can drastically reduce fossil gas leaks, blue hydrogen is unlikely to ever become a zero carbon solution. CCS already has a poor track record and questionable potential. Worse, blue hydrogen risks being used as an excuse to sanction new oil and gas projects, which the IEA’s Net Zero by 2050 scenario clearly rules out.

Detail

Blue hydrogen is attractive to fossil fuel companies, who see the possibility of their fossil gas resources being relevant in a net-zero emission economy. Oil and gas companies also like to point out that the IEA, in its Net Zero by 2050 (NZE 2050) scenario, expects blue hydrogen to account for 38% of total hydrogen supply in 2050 (grey/brown hydrogen falls to near zero). But this projection relies entirely on the success of carbon capture technology, which has a consistent track record of failure.

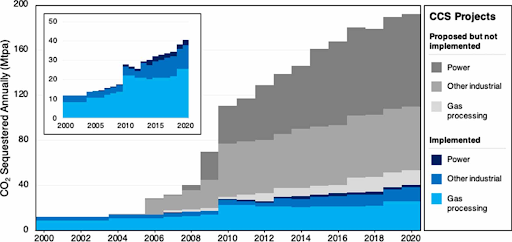

According to academic research, by 2020, three-quarters of CCS capacity in the US originally planned to be operational had been terminated or placed on indefinite hold, often because costs were too high or the technology wasn’t mature enough. The majority of today’s operating CCS projects focus on separating CO2 from fossil gas, with the resulting carbon often injected into the ground to increase fossil fuel production (so called “enhanced oil recovery”).

Global proposed vs. implemented annual CO2 sequestration

Should carbon capture fail to match the IEA expectation in NZE 2050, more rapid declines in coal, oil and gas consumption will be required to offset this failure.

Hydrogen production by type in IEA’s Net Zero by 2050 scenario

Chart excludes “Refining CNR” and “Biomass”, which are both negligible. Source: IEA Net Zero by 2050

The biggest problem with blue hydrogen is the emissions created during its production. According to research by academics Robert Howarth and Mark Jacobson at Cornell and Stanford universities, blue hydrogen lifecycle emissions are barely any less than grey hydrogen, due to three factors:

- Methane leaks. Methane, the main ingredient in fossil gas, tends to leak out across all stages of the supply chain – including from gas wells, pipelines, and storage terminals. Methane is 86 times more powerful than CO2 as a greenhouse gas over a 20-year period, so these leaks make a big difference to the final emissions reductions of using blue hydrogen.

- CCS has limited capture rates. It’s important to understand that even in the rare cases where carbon capture works, it’s only partly effective. Today, the two hydrogen facilities that use CCS technology have capture rates of 53-90%, according to company reporting. A recent investigation by Global Witness showed that one of these plants, Shell’s Quest facility in Canada, emits more CO2 than it captures. The reason capture rates are low is partly because CCS facilities are sometimes down for maintenance (while hydrogen production continues) or turned off because of low profitability.

- CCS is energy intensive. Capturing carbon uses a lot of energy and today’s CCS facilities burn fossil gas to generate this energy. These emissions are not typically captured, further contributing to the poor overall emissions reductions of CCS.

These three factors combine into some very disappointing emissions results – in fact, blue hydrogen is no better than burning coal.

Lifecycle emissions intensity of hydrogen types and conventional fossil fuels

Source: Grey hydrogen, blue hydrogen, fossil gas, coal: Howarth & Jacobson – “How green is blue hydrogen?”, Energy Science & Engineering (2021). Black/brown hydrogen: European Commission Well-to-Tank report (KOCH1 pathway, including combustion). Green hydrogen: Hydrogen Council

Note: For green hydrogen, we have included capex-related emissions (for instance, from solar panel manufacture) as well, but note that operating CO2 emissions would be zero. These emissions are not included for other fuels in this chart.

The fossil fuel industry’s view of blue hydrogen emissions is much more optimistic. The Hydrogen Council, a global industry group with members including Shell and Saudi Aramco, some of the world’s largest oil and gas producers, forecasts that the emissions intensity of blue hydrogen production in 2030 will be 76-94% lower than the independent scientific estimates shown above. The Hydrogen Council discloses only a few of its assumptions however, making its analysis much less reliable. The IEA estimates a similar range of intensities, though again with little information on key assumptions like methane leak rates.

Shell’s blue hydrogen plant in Alberta, Canada, which Global Witness has found emits more CO2 than it captures. Source: Alberta Newsroom via Flickr

LNG to blue hydrogen

Key points: Liquefied natural gas (LNG) to blue hydrogen, a type of blue hydrogen production proposed by Mitsubishi Corporation, involves a complicated mix of fossil gas and carbon capture built around the continued use of Japan’s LNG and coal infrastructure.

Market Forces view: Mitsubishi’s concept is a pipe dream. Blue hydrogen combines the substantial pitfalls of CCS with the emissions intensity of the LNG supply chain. It’s also likely to be expensive and financially volatile.

Detail

Japanese conglomerate Mitsubishi is proposing a particularly unrealistic form of blue hydrogen based on liquefied natural gas (LNG). Fossil gas would be liquefied and shipped to Japan (as it already is today), where it would be turned into hydrogen using emissions-intensive refining processes. The CO2 captured in these hydrogen producing plants would then be put back on a ship to be sent overseas to carbon storage sites, for instance in Western Australia.

LNG carrier. Source: Wikimedia Commons

This idea has the same problems inherent in the blue hydrogen production process, particularly methane leaks in gas production. It would also have its own unique problems:

- LNG production is energy intensive. Nearly all LNG production plants burn fossil gas to power the process that turns fossil gas into a super-chilled liquid ready to be put on a ship. According to the UK Department for Business, Energy and Industrial Strategy, each tonne of LNG generates on average 0.88 tonnes of CO2-e before taking combustion into account. With 380 million tonnes (Mt) of LNG traded in 2021, this implies emissions of 334 Mt CO2-e just from production and transport – nearly equivalent to the annual emissions of France (363 Mt in 2018).

- Shipping the CO2 out of Japan wastes energy and risks leaks. The IPCC estimates that 3-4% of CO2 shipped overseas is emitted for every 1000km travelled from fuel consumption and CO2 leaks. The journey from Japan to Western Australia is about 5000km long, meaning that as much as one-fifth of the CO2 captured from blue hydrogen production would be lost.

- LNG is expensive. LNG is a much more expensive form of fossil gas than that sourced domestically via pipelines and its price is extremely volatile, as recent experience has shown. Since gas prices are the main factor in the cost of blue hydrogen, using LNG would make this a very expensive and financially unpredictable exercise for Mitsubishi, inviting questions as to who bears the cost of this endeavour.

Green hydrogen / ammonia

Key points: Green hydrogen uses renewable energy to turn water into hydrogen. It’s extremely low carbon compared to fossil-based hydrogen. Although it’s still more expensive, costs are likely to fall fast.

Market Forces view: Green hydrogen is the only type that can be produced with little to no emissions, giving it immense potential for companies looking to diversify away from fossil fuels. As the cost of producing green hydrogen falls, it should be a no-brainer for businesses and governments of all persuasions.

Detail

Green hydrogen is produced using electricity. A device called an electrolyser splits water into hydrogen and oxygen using an electric current, resulting in no carbon emissions so long as the underlying electricity production is renewable. It’s also important to avoid hydrogen leaks, since unburned hydrogen in the atmosphere contributes to climate change in part by preventing the breakdown of methane. This applies to fossil-based hydrogen as well.

Although commercial-scale water electrolysis is a technology more than a century old, it has very low deployment rates, making up just 0.03% of global hydrogen supply in 2020.

The biggest barrier to green hydrogen is its high production costs. Because electrolysis uses so much electricity, the electricity needs to be very cheap to make it economical. The IEA estimates that, for green hydrogen to fully outcompete fossil-based hydrogen it may require an electricity cost of less than US$20/MWh; the global average cost of solar PV in 2021 was $48/MWh, albeit with some significantly cheaper outliers. As renewables get even cheaper – globally, the cost of solar generation fell 88% between 2010 and 2021 – low-cost green hydrogen is increasingly within grasp. Most proposed green hydrogen projects are designed with dedicated onsite renewables, meaning day-to-day energy costs would be extremely low.

Electrolysers are also expensive because there are still very few of them. That’s set to change as more and larger ones are constructed; the IEA expects nearly 670MW of new capacity in 2022 alone, more than was added in the entire previous decade. The International Renewable Energy Agency (IRENA) estimates that electrolyser costs could fall by 40-55% by 2030 as the technology scales – mimicking the precipitous cost declines of renewable energy in recent years.

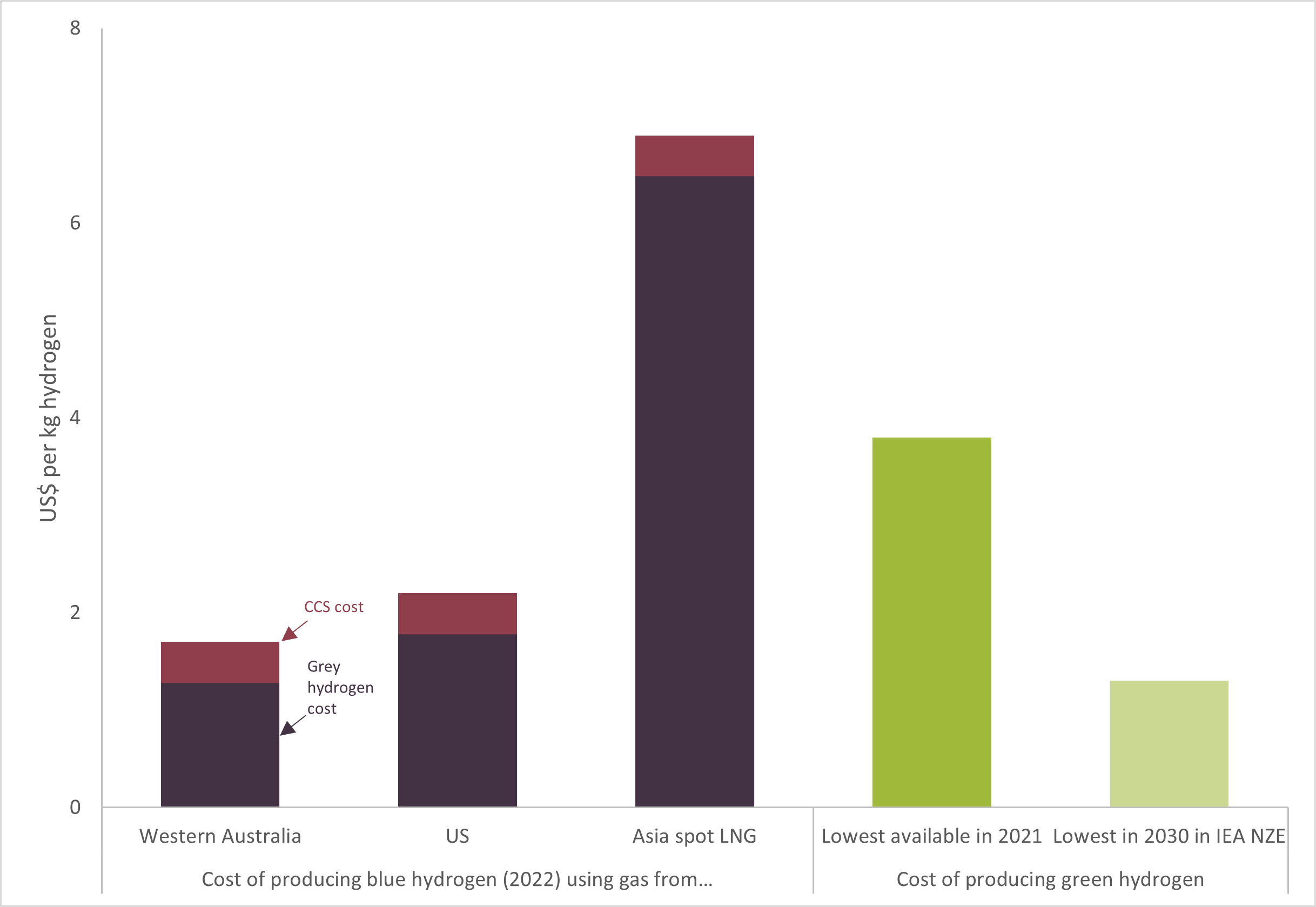

Skyrocketing gas prices since 2021 have also meant that the playing field between blue and green hydrogen is levelling. Below, we show estimated production costs for blue hydrogen using real-world gas prices from 2022, against current and projected best-case production costs for green hydrogen. Green hydrogen already outcompetes blue hydrogen from LNG, and by 2030 could also outcompete blue hydrogen from relatively cheaper sources of gas, for instance from the US and Western Australia.

These numbers clearly show how the volatile cost of gas means blue hydrogen is a financially unreliable venture. For a technology that doesn’t even help reduce emissions, it’s clear blue hydrogen is just a distraction.

Estimated hydrogen production costs

Note: Costs are on a levelised basis. Blue hydrogen based on average gas prices for January – October 2022; production costs ignore local factors such as subsidies and transport costs. Cheapest green hydrogen in 2021 is from onshore wind; in 2030 under NZE from solar PV.

Sources: IEA (Hydrogen production costs); gasTrading (WA, spot prices); Bloomberg (US, Henry Hub; Asia spot LNG, Japan Korea Marker)

A wind farm in Portland, Victoria. Credit: Jeremy Buckingham.