ADANI’S MASSIVE FOSSIL FUEL EXPANSION PLANS

Despite the need to urgently reduce carbon emissions and accelerate the transition to clean energy to limit global warming, the Adani Group conglomerate is pursuing and supporting massive new fossil fuel projects that endanger key climate goals.

It’s abundantly clear there’s no room for expansion of the fossil fuel industry if we’re to achieve the climate goals of the Paris Agreement[1]Market Forces, ‘Keeping global warming to 1.5 degrees’ (ND) online: https://www.marketforces.org.au/info/key-issues/keeping-global-warming-to-1-5-c/ . Similarly, the International Energy Agency (IEA) has found that achieving net zero emissions by 2050 means no new or expanded coal mines.[2]International Energy Agency, ‘Net Zero by 2050, A Roadmap for the Global Energy Sector’ (May 2021), p21

Adani Group’s pursuit of new climate-wrecking fossil fuel projects contradicts not only these findings, but also its own disingenuous attempts to present itself as concerned[3]Gautam Adani, [@gautam_adani], 5 June 2021, Tweet, Twitter about the climate crisis and a participant in the transition to clean energy.

“…there can be no new investments in oil, gas and coal, from now – from this year.” – Fatih Birol, Executive Director IEA, May 2021.

This non-exhaustive list of new or expanded coal, oil and gas projects presented below, collated mainly from Adani Group’s own reporting, websites and media releases, show the Adani Group is not transitioning away from fossil fuels, but in fact is continuing to bet billions of dollars on the failure of that transition.

Adani Group’s fossil fuel expansion plans include:

- Nearly doubling its coal-fired power capacity from 14 gigawatts (GW) to 26 GW, giving it more coal power capacity than all of Australia.

- Owning, developing or operating 155 million tonnes per annum (mtpa) of new thermal coal mining capacity, including the massive 60 mtpa Carmichael project in Australia, which could pave the way for more massive coal mines in the Galilee Basin. This does not include three recently purchased coal blocks for which the peak capacity estimates are unavailable.

- The extractable reserves of thermal coal that Adani is now developing as a MDO (miner, developer, operator) or as a commercial miner totals 6 billion tonnes. This figure does not include three new coal blocks for which extractable reserve estimates are unavailable. If all the coal from these mines is extracted and burned, these projects will yield an estimated 10 billion tonnes of CO2 emissions over the course of their lifetimes. For reference, this is 28% of global energy-related carbon emissions in 2021.

- New coal, oil and LNG terminals at Adani Ports and Special Economic Zone’s ports.

- An obscure and highly polluting facility that would convert coal, including imported thermal coal, into plastics.

For details on the specific projects see the sections below.

TAKE ACTION!

Tell the investors and bankers linked to Adani’s coal expansions to pull their support for Adani Group (email action goes to Barclays, State Bank of India, Deutsche Bank, Citi, JP Morgan, DBS, HSBC, BlackRock, Standard Chartered, MUFG, Credit Suisse).

An Adani power plant as seen from the Tragadi fishing community settlement in India. Credit: Stop Adani

Coal power

“Phasing out coal from the electricity sector is the single most important step to get in line with the 1.5-degree goal.” – António Guterres, UN Secretary-General, March 2021

As of June 2022, Adani Group has 12 GW of new coal-burning electricity generation capacity either under construction, planned or proposed, including the fiercely opposed Godda project. According to Adani Group, its existing[4]Adani Power, ‘About Us’ (2022) online: https://www.adanipower.com/about-us coal generation capacity of 14 GW[5]Adani Power, ‘Upcoming Power Plants’ (2022) online: https://www.adanipower.com/upcoming-power-plants and Adani Electricity, ‘Adani Dahanu Thermal Power Station‘ (2022) online: … Continue reading (including a 1,200 MW power station it purchased in 2022[6]Adani Power Ltd, ‘Audited Consolidated Financial Results For The Quarter And Year Ended 31st March, 2022’ (5 May 2022), p27 ) already makes it India’s largest private thermal power producer[7]Adani Power, ‘About Us’ (2022) online: https://www.adanipower.com/about-us. If all new projects are built, Adani Group would have a bigger coal-burning power generation capacity than all of Australia (26 GW vs 22 GW[8]Australian Energy Regulator, Australian Government, ‘Registered capacity by fuel source – regions’ (ND) online: … Continue reading).

Adani’s Godda coal project. credit: Geoff Law/AdaniWatch

| wdt_ID | Project name | New or expansion | Project stage | Capacity |

|---|---|---|---|---|

| 1 | Pench Thermal Power Project | New | Planned | 1,320 MW |

| 2 | Adani Godda Power Station | New | Under development | 1,600 MW |

| 3 | Bhadreswar Thermal Power Project | New | Planned | 3,300 MW |

| 4 | Dahej Thermal Power Project | New | Planned | 2,640 MW |

| 5 | Udupi Power Station Expansion | Expansion of existing plant | Planned | 2,800 MW (1,600 MW of new capacity) |

| 6 | Kawai Thermal Power Project | Expansion of existing plant | Planned | 2,920 MW (1,600 MW of new capacity) |

Content collected July 2022

Table sources:

– Adani Power website

– Adani Power ESG report 2020-2021, p23

Using information collected from Global Energy Monitor’s Global Coal Plant Tracker (GCPT), we estimate the lifetime emissions from Adani Group’s coal power expansions to be 1.7 billion tonnes CO2[9]Global Energy Monitor (GEM), ‘Global Coal Plant Tracker – January 2022 dataset’ (not publicly available). This is three and a half times Australia’s 2021 emissions[10]Department of Industry, Science & Resources, Australian Government, ‘Australia’s greenhouse gas emissions: December 2021 quarterly update’ (27 June 2022). According to 2021 data from Bloomberg, new solar power in India is now cheaper than both new and, on average, existing coal-burning electricity[11]James Fernyhough, Renew Economy, ‘Building new solar now cheaper than keeping existing coal plants open: BNEF’ (24 June 2021).. Onshore wind energy is also cheaper than new coal plants in India.[12]Veronika Henze, BloombergNEF, ‘Scale-up of Solar and Wind Puts Existing Coal, Gas at Risk’ (28 April, 2020)

Coal transportation and coal washing

Adani Group companies are also pursuing new infrastructure projects that would provide essential services to the coal sector. The Group has received a letter of intent (LOI) to provide “washery services” for a proposed 10 mtpa coal washery for the Mahanadi Coalfields-owned Hingula mine in Odisha[13]Adani Enterprises Ltd, ‘Business – Mining – India,’ (accessed July 2022) online: … Continue reading, India. Additionally, Adani owns a proposed terminal at Kattupalli Port, Tamil Nadu, India, which would handle up to 71 mtpa[14]Marine Infrastructure Developer Private Limited, ‘Draft Comprehensive EIA/EMP Report Proposed Revised Master Plan of Kattupalli Port’ (December 2020), p 2-40 of coal. The proposed coal terminal (which also includes an expansion of oil and gas capacity discussed in the ‘oil and gas’ section below) is highly contested, with locals raising serious concerns regarding its environmental impacts and its approval process.[15]Nityanand Jayaraman, The Wire, ‘Illegal and Unnecessary – but Adani Port Proposal Makes it to Public Hearing Stage’ (16 January 2021)

Adani Group’s subsidiary Adani Ports and Special Economic Zone (Adani Ports) already runs what it claims is the “world’s largest coal import terminal”[16]Adani Ports and Special Economic Zone Limited, ‘Integrated Annual Report 2021-22 (July 2022), p8 at Mundra, India. From financial year 2021 to 2022, coal cargo volumes increased from 78 mt to 103 mt, and coal made up 33% of Adani Ports’ cargo mix by volume in FY2022[17]Adani Ports and Special Economic Zone Limited, ‘Integrated Annual Report 2021-22’ (July 2022), p12 . In February 2022, Adani Ports took control of a berth in the Haldia dock complex in West Bengal[18]Indrajit Kundu, Business Today India, ‘Adani makes debut in Bengal with Haldia Dock project, eyes Tajpur Port too’ (11 February 2022), a dry bulk terminal Adani plans to upgrade in order to handle an increased amount of dry bulk goods, which is reported to primarily be coal.[19]IP. Manoj, The Hindu Business Line ‘Adani Ports set for West Bengal entry with a cargo terminal at Haldia Dock’ (4 October 2021)

In Australia, Adani Ports established the Bowen Rail Company (BRC)[20]Josh Robertson, ABC News, ‘Adani launches own rail company to haul coal from Carmichael mine’ (15 September 2020) to transport thermal coal produced by the Carmichael coal project from mine to port, before transfering BRC to Adani Enterprises in July 2021 in what it openly admitted was an attempt to meet its climate neutrality goals[21]Adani Ports and Special Economic Zone Limited, ‘Integrated Annual Report 2020-21’ (2021), p 129. Adani Ports remains connected to Carmichael as co-owner and sole operator of the coal port, North Queensland Export Terminal (NQXT), through which all coal from the Carmichael project will be transported. Currently NQXT has government approvals in place to increase its capacity by 20% from 50 mtpa to 60 mtpa.[22]Sofie Wainwright, ABC News, ‘Adani granted 20 per cent boost to annual coal exports through Abbot Point terminal’ (11 October 2018)

Adani’s Abbot Point Coal Terminal in Australia. This photo was taken after a coal spill into the Caley Valley wetlands. Credit: Australian Conservation Foundation

Thermal coal mining

The Adani Group plans to own, develop or operate proposed, under-development and recently operating thermal coal mining projects in India and Australia with a combined capacity of 155.6 mtpa (which does not include capacity assessments for three of its newly acquired coal blocks). For context, Australia’s total thermal coal exports in 2020 was 199 mt[23]Office of the Chief Economist, Australian Government Department of Industry, Science, Energy and Resources, ‘Resources and Energy Quarterly’ (March 2021) .

| wdt_ID | Project name | New or expansion | Project stage | Capacity | Total Extractable Reserves | Adani Group’s role |

|---|---|---|---|---|---|---|

| 1 | Parsa coal mine | New mine | Under development | 5 mtpa | 184 mt | Mine developer and operator |

| 2 | Gidhmuri Paturia coal mine | New mine | Under development | 5.6 mtpa | 158 mt | Mine developer and operator |

| 3 | Kente Extension | New mine | Under development | 7 mtpa | 170 mt | Mine developer and operator |

| 4 | Gare Pelma I | New mine | Conditional letter of intent received | 15 mtpa | 427 mt | Mine developer and operator |

| 5 | Gare Pelma II | New mine linked to existing power station | Under development | 23 mtpa | 655 mt | Mine developer and operator |

| 6 | Khargaon coal block | New coal block | Under development | Not available (NA) | NA (250 mt geological reserves) | Mine owner, developer and operator (commercial miner) |

| 7 | Jhigador coal block | New coal block | Under development | NA | NA (250 mt geological reserves) | Mine owner, developer and operator (commercial miner) |

| 8 | Gondulpara | New coal block | Under development | 4 mtpa | 116.68 mt | Mine owner, developer and operator (commercial miner) |

| 9 | Suliyari coal mine | New mine | In production as of 2021 | 5 mtpa | 109 mt | Mine developer and operator |

| 10 | Dhirauli | New coal block | Under development | 5 mtpa | 313.79 mt | Mine owner, developer and operator (commercial miner) |

Content collected July 2022

Table sources:

– Adani Enterprises Ltd, ‘Annual Report 2021-2022’, page 113

– Adani Enterprises Website

– Mineable reserves information available on MSTC website (a Government of India company)

“No new coal mines or extensions of existing ones are needed in the [Net‐Zero Emissions by 2050 Scenario] as coal demand declines precipitously.” – ‘Net Zero by 2050’, International Energy Agency, May 2021

Adani Group owns 74 mtpa of proposed, under development and recently operating coal mining projects, including the massive Carmichael project in Australia (this figure doesn’t include three new coal blocks acquired in 2021 and 2022 for which annual mining capacity has not been assessed). Carmichael is particularly important as Adani’s work establishing infrastructure for this mine could enable several more new thermal coal mines of a similar size.[24]Jemima Burt, ABC News, ‘Adani could be ‘ice-breaker’ for six more proposed Galilee Basin mines, resources body says’ (12 June 2019)

In 2018, Lucas Dow, CEO of Adani Australia (then CEO of Adani Mining/Bravus) promised a scaled back version of the Carmichael project[25]Michael Slezak, ABC News, ‘Adani says a scaled-down version of its Carmichael coal mine will go ahead; environmentalists express scepticism’ (29 November 2018), but in 2020 Dow said Bravus was still pursuing the full extent of its planning permissions, 60 mtpa.[26]Josh Robertson, ABC News, ‘Adani executive Lucas Dow talks up bigger coal mine in leaked video at LNP fundraising event’ (19 March 2020) The mine became operational in early 2022 and in a recent earnings call, Adani Enterprises Director Vinay Prakash said of production at Carmichael, “We can definitely go beyond 15 and may touch 25 million tonnes to 30 million in the next 2-3 years’ times”.[27]Adani Enterprises Ltd, ‘Adani Enterprises Limited Q4 FY2022 Earnings Conference Call’ (May 4, 2022), p10

Aside from owning coal mines, Adani Group plans to develop and/or operate another 81.6 mtpa of new mines owned by several Indian state-owned companies. As a mine developer and operator, Adani produced 17.5 mt in financial year (FY) 2021 and 27.7 mt in FY2022.[28]Adani Enterprises Ltd, ‘Annual Report 2021-2022’, (July 2022), p105

Mining Production Increasing

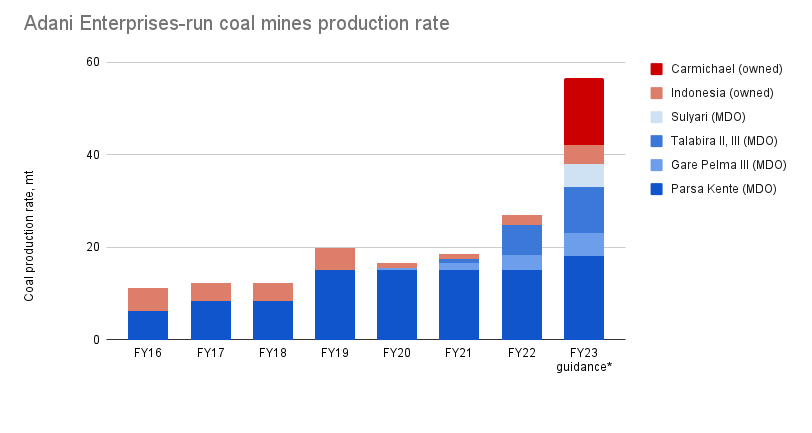

The chart below illustrates the steady increase in Adani’s coal production, as both MDO (miner, developer, operator) and owner (commercial mining), since the Paris Agreement was signed. Four out of nine of Adani’s coal mining projects as MDO are in production, and two out of eight of its commercial coal projects are operational. Adani plans to ramp up production to full capacity at its recently “operationalised” mines (as of 2021); the Talabira II & III coal mine (from 1 mtpa in FY2021 to 10 mtpa in FY2023, the full mine capacity being 20 mtpa), the Gare Palma III mine (from 1.5 in FY2021 mtpa to 5 mtpa FY2023), and Suliyari which is operational as of April 2022. The Adani Carmichael mine in Australia and Adani’s project in Indonesia account for the commercial coal volumes shown below. The capacity projections for the next financial year are based on Adani Enterprises Ltd public disclosures.

This information is relevant as of July 2022 using publicly available sources and market disclosures from Adani Enterprises Ltd. Coal production is in run-of-mine (ROM) terms. Carmichael figures are only disclosed as saleable coal; they have been adjusted to ROM using the average ratio of ROM to saleable coal at Parsa Kente.

The sum of the known extractable reserves of thermal coal that Adani is now developing as a MDO (miner, developer, operator) and as a commercial miner totals 6 billion tonnes, plus the Khargaon, Jhigador and Gondbahera Ujheni East coal blocks for which extractable reserve estimates are unavailable. Our initial research suggests these mines have another 750 million tonnes of coal resource (inferred) in place.

If all the coal from these mines is extracted and burned, these projects will yield an estimated 10130 mt of CO2 emissions over the course of their lifetimes.[29]Coal emissions were calculated using Global Energy Monitor’s Global Coal Mine Tracker ‘Adjusted CO2/Tonne of Coal’ guidelines As a comparison, this is 28% of global energy-related carbon emissions in 2021.[30]International Energy Agency, Press release ‘Global CO2 emissions rebounded to their highest level in history in 2021’ (8 March 2022)

Coal to plastics

In April 2021 Adani Group submitted an Environmental Clearance Report to the Indian Ministry of Environment, Forests and Climate Change for a proposed US$4 billion coal-to-polyvinyl chloride (PVC) plant at Mundra, Gujarat. This plant would use a total of 3.1 mtpa of imported coal, including 1 mtpa of thermal coal.[31]Kadam Environmental Consultants, ‘Form 1: Environmental Clearance for proposed Coal to PVC plant project near Village Vandh & Tunda, Taluka Mundra, District Kachchh, Gujarat’ (April 2021), p55

Coal-to-plastics plants use coal as the raw material for conversion to plastic products, unlike the conventional oil-to-plastics process. They are highly polluting, producing around eleven tonnes of carbon dioxide emissions for every tonne of product produced, more than triple the emissions from oil-to-plastics production.[32]Kelly Cui, Wood Mackenzie, ‘The opportunities and challenges of CTO/MTO development’ (7 November 2017) Assuming Adani’s coal-to-PVC plant were to have this same emissions intensity (as of July 2022, it’s unclear whether this is the case), this means it would emit up to 22 million tonnes of CO2 each year, roughly equivalent to the amount emitted by Adani’s 4,620 MW Mundra coal-burning power station.[33]Carbon Brief, ‘Global Coal Power’ (26 March 2020) online: https://www.carbonbrief.org/mapped-worlds-coal-power-plants

As of July 2022, it appears Adani still plans on building the project with the first phase to be commissioned by November 2024.[34]Adani Enterprises Ltd, ‘Annual Report 2021-22’ (July 2022), p130 Reports indicate Adani is working on finance for the coal-to-PVC plant, likely underwritten by the State Bank of India.[35]Shayan Ghosh, LiveMint, Why Adani wants ₹14,000 cr loan from SBI (21 July 2022)

Oil and gas

Despite there being no room for expansion of the oil and gas industry if we’re to limit global warming to 1.5°C,[36]Market Forces, ‘Keeping global warming to 1.5 degrees’ (ND) online: https://www.marketforces.org.au/info/key-issues/keeping-global-warming-to-1-5-c/ Adani Group continues pursuing a number of new and expanded oil and gas projects.

The Adani Group, in partnership with oil major Total of France, is currently working on a significant expansion of capacity to import and distribute liquefied natural gas (LNG). A 5 mtpa LNG terminal at Mundra started operations in 2020, of which Adani Group is a minority owner.[37]Adani Ports and Special Economic Zone Limited, ‘Integrated Annual Report 2019-20’ (2020), p45 Further port expansions are listed in the table below.

“Also not needed [in the Net‐Zero Emissions by 2050 Scenario] are many of the liquefied natural gas (LNG) liquefaction facilities currently under construction or at the planning stage.” – ‘Net Zero by 2050’, International Energy Agency, May 2021

Adani Gas, a joint venture company between Adani Group and Total, has signed a non-binding agreement with Italian gas company Snam to create a joint venture to develop a compressed natural gas (CNG) compressors manufacturing facility. In its media release Adani Gas states that this would help with “fostering the use of natural gas”.[38]Adani Gas, ‘Adani Group announces strategic collaboration with Snam, Europe’s leading gas infrastructure company on energy mix transition’ [Press Release], (6 November 2020)

Adani Gas successfully bid on contracts to develop city gas distribution across 14 new geographical areas totalling 56 districts in India. According to its own reporting, this now makes Adani Gas India’s largest gas distribution company.[39]Adani Gas, ‘Adani Total Gas Q3 FY22 Results’ (2 February 2022)

| wdt_ID | Project name | Project stage | Capacity | Adani Group’s role | Source |

|---|---|---|---|---|---|

| 1 | Dhamra LNG Terminal | New - currently under construction | 10 mtpa | Adani Group 12.6%, Total 87.4% ownership | |

| 2 | Kattupalli Port | Planned expansion of new fossil fuel capacity | 65 mtpa (LPG, LNG, POL, crude oil) | Owner | |

| 3 | Vizhinjam Port | Expansion - currently under construction | Unknown - oil handling | Owner | |

| 4 | CNG compressors manufacturing | New - proposed | Unknown | Joint venture between Adani Gas (Adani Group and Total) and Snam | |

| 5 | Mundra Port | Planned | 10 mmtpa crude oil capacity | In agreement with India Oil Corp Ltd |

Take action! Tell the investors and bankers linked to Adani’s coal expansions to pull their support for Adani Group.

References