24 November 2022

New Hope’s 2022 annual general meeting (AGM) descended to new lows this year, with very limited accessibility for shareholders. A site visit for shareholders to the company’s Bengalla mine scheduled before the AGM was also cancelled.

The company held its 2022 AGM in the regional New South Wales town of Muswellbrook as the state experiences record flooding, and it didn’t provide any way of observing or taking part in the AGM online. The chair, Robert Millner, allowed for less than 25 minutes of questions.

In this day and age, it is standard practice for ASX-200 companies to include an audio or video webcast for shareholders. New Hope provided digital access to its last two AGMs during the pandemic (even though the company’s tech issues last year affected shareholder participation).

New Hope’s 2021 annual general meeting was dubbed a farce, with over 10 percent of investors voting against remuneration arrangements and 27 per cent against the re-election of director Todd Barlow, suggesting strong dissatisfaction within the company’s shareholder base about its management.

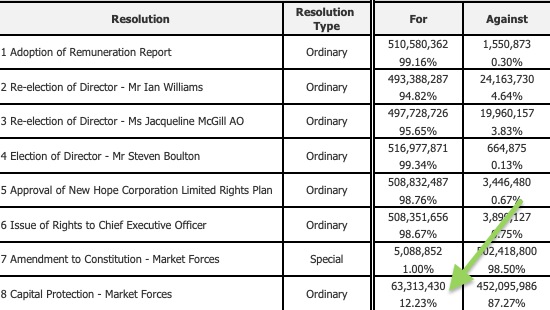

While this year shareholders supported the remuneration report and the re-election of all directors, shareholder support for a wind up resolution filed by over 100 shareholders and supported by Market Forces received a significant increase in support from 2021, reaching 12%.

Shareholder support for Market Forces coordinated resolution grows

Despite record coal prices and company profits, more than 12% of New Hope’s shareholders demanded the company stop expanding and start managing down coal mining in line with a net zero emissions by 2050 pathway.

This is the third year that New Hope faced a wind up resolution, with support increasing each year from 3.44% in 2020, to 8.98% in 2021 and 12.23% today. With parent company Washington H. Soul Pattinson controlling 37% of New Hope’s shares, this is 20% of New Hope’s remaining investors calling on the company to wind up coal mining operations.

As shown by today’s resolution vote, many investors don’t want to see New Hope spend its windfall on making the climate crisis worse, and instead want the company to return capital to shareholders while ensuring a just transition for workers and the community.

[We] have engaged constructively with the [NHC] board indicating our preference for existing mines over expansion, responsible site remediation and the return of all surplus cash-flows and franking credits to shareholders, rather than pursuing capital destructive growth projects and acquisitions.

Neil Margolis, Merlon Capital Partners

Investors with more than US$61 trillion in assets under management have committed to helping meet the goal of net zero greenhouse gas emissions by 2050 or sooner. Washington H Soul Pattinson, which owns just under 40 percent of New Hope Group, has made no such commitment.

New Hope’s pathetic scenario analysis and poor governance

In its Climate and Global Energy Transition Statement, New Hope outlines the importance of a net zero carbon economy by 2050 while outlining its plans to expand coal production, which will release high amounts of carbon emissions into the atmosphere for decades.

For years, minority shareholders have called on New Hope to assess the viability of its business against production scenarios aligned with a 1.5°C or net-zero by 2050 scenario. This year the company finally acquiesced, using Wood Mackenzie’s AET-1.5 scenario. But New Hope’s analysis (if it can even be called that) still falls woefully short of providing any use to shareholders.

New Hope claims both its Bengalla and New Acland mines have sufficiently low production costs relative to other thermal coal mines globally to remain resilient under Wood Mac’s AET-1.5 scenario. The company shows that under this scenario, by 2030, projects producing seaborne thermal coal at a cost below roughly US$90/tonne would remain competitive. However, New Hope hasn’t been resilient at these prices in the past – during FY10-FY16, the company ran a loss of $890 million despite Newcastle coal prices averaging over US$100/tonne.

In response to a question on this issue, New Hope CEO Rob Bishop said that the company feels it has adequately “stress tested” its assets, and that because of Australia’s “high quality, low emissions coal” that demand would remain resilient despite the global transition away from coal. However, this reputation for Australian coal is under threat, with allegations of some Australian coal exporters faking coal quality reports to increase their profits aired in Parliament this week.

Signs of financial trouble ahead?

Since just last year, the geopolitical and market conditions have changed significantly. Russia’s invasion of Ukraine has contributed to record breaking coal prices, enabling New Hope to pay back all of its outstanding debt to its lenders and cancel its revolving credit facility with banks NAB, ANZ, Mizuho, CAT Finance and Macquarie Bank.

CEO Rob Bishop admitted that the company may need to keep more cash on hand due to increased insurance costs and the diminishing availability of bank debt.

In response to a question from a shareholder on the company’s capital structure moving forward, Rob Bishop shared this response:

“It’s a fact that obtaining bank debt moving forward is increasingly challenging. Most of the Australian banks have moved away from fossil fuels, despite the fact that they’re still providing support from a hedging perspective, any project funding is off the table. Overseas banks- some of them are still interested. We found through the convertible bond there’s a lot of [investors] out there that are prepared to invest or believe in the New Hope story and coal moving forward- believe that coal has a bright future. The transition to renewables is going to take a lot longer than the world expects so there is plenty of funding out there for a company like New Hope.”

While coal companies are currently making record profits, many analysts predict today’s high coal prices will accelerate the transition to renewables.

It also appears that in addition to Whitehaven and Adani (now Bravus), New Hope is exploring a coal insurance mutual scheme in an attempt to mitigate the increasing costs of insurance:

New Hope breaks ground on highly controversial New Acland Stage 3 coal expansion, increasing stranded asset risk

Last week, after a 15 year battle, New Hope started work on New Acland Stage 3. Due to the AGM being in Muswellbrook, members of Oakey Coal Action Alliance (OCAA), the local community group which is fighting to stop New Acland Stage 3 were unable to attend the meeting. Despite these hurdles, a question was asked by a proxy-holder on behalf of OCAA secretary Paul King:

Will the water table around Acland Stage 3 be drawn down and take 300 years to recover, and if so could this fact be used by the mine’s opponents to appeal against the mine’s Associated Water Licence? If the water licence can still be lost on appeal, is it wise to expend capital to restart the mine before matters are finally determined?

With the mine being held up in the courts precisely because of groundwater impacts on the Darling Downs, a possible appeal of the Associated Water License may again halt the project.

Because of community resistance from OCAA and others, New Acland Stage 3 is now only going ahead 15 years after the project was first planned. A lot has changed over that time, with the energy transition well and truly underway and the vast majority of New Hope’s markets now committed to net zero by 2050.

Recent modelling by the Reserve Bank of Australia (RBA) highlights that under all scenarios except for the current policies (baseline) scenario, “Australian coal-related investments are at risk of becoming ‘stranded assets’ as lower export volumes and prices weigh on firm profitability.” The RBA report also notes that under its “Net Zero and Below 2ºC” scenarios, even existing coal mines are at risk of becoming stranded.

With such questionable scenario analysis provided to shareholders, investors should be concerned that New Acland Stage 3 is one such asset