ARCHIVED CONTENT

This content is no longer being updated.

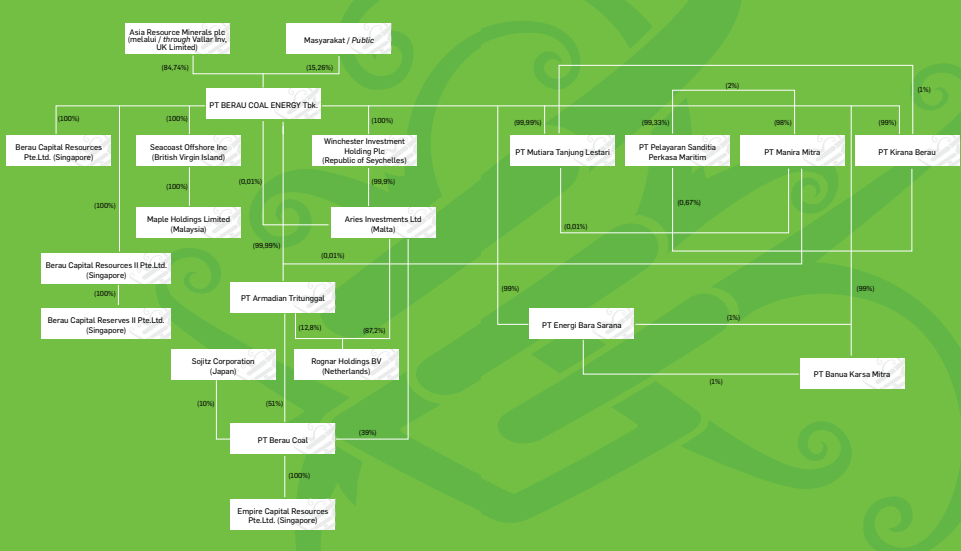

Berau Coal

Berau Coal Shareholders

| Investor | Ownership (%) | Filing Date |

|---|---|---|

| PT Sinarindo Ekamulya (Sinar Mas Group) | 84.74 | 22 Dec 2016 |

| Other Investors (unclear) | 15.26 |

Loans

Jul 2010: General Credit Facility: US$400M

- Financial Close: 23/07/2010

- Tranche 1 (US$300M: Due July 2014)

- Tranche 2 (US$100M: Due April 2015

- Lender: Credit Suisse

Apr 2011: Term Loan to Mutiara Tanjung Lestrai: US$3M

- Financial Close: 12/04/2011

- Lender: Bank Mega

Dec 2011: Term Loan to Mutiara Tanjung Lestrai: US$5M

- Financial Close: 30/12/2011

- Lender: Indonesia Eximbank

Jan 2012: Term Loan to Mutiara Tanjung Lestrai: US$3M

- Financial Close: 20/01/2012

- Lender: Bank Mega

May 2012: Term Loan to Pelayaran Sanditia Perkasa: US$5M

- Financial Close: 08/05/2012

- Lender: Indonesia Eximbank

Oct 2012: Term Loan to Pelayaran Sanditia Perkasa: US$3M

- Financial Close: 30/10/2012

- Lender: Bank Mandiri

Bonds

Jun 2010: US$350M

| Institution | Role |

|---|---|

| Deutsche Bank (US$70M) | Joint Book Runner |

| Credit Suisse (US$280M) | Joint Book Runner |

| Krung Thai Bank | Joint Book Runner |

| Siam Commercial Bank PLC | Joint Book Runner |

Jul 2010: US$100M

| Institution | Role |

|---|---|

| Credit Suisse (US$70M) | Joint Book Runner |

| Deutsche Bank Securities Corp. (US$30M) | Joint Book Runner |

Mar 2012: $US500M

No further information

DISCLAIMER

PLEASE NOTE: Information comes from the companies’ available annual reports (2010 to 2014) and websites, as well as other public and subscription-based information sources.

Occasionally, where information is incomplete, assumptions must be made about data and these were made in a consistent manner and in good faith. While we endeavoured to gather and include all relevant deals, we cannot guarantee the completeness of the information presented.

INFORMATION UPDATED: 19 AUGUST 2019