ARCHIVED CONTENT

This content is no longer being updated.

Harum Energy

Harum Energy conducts commercial coal mining operations as well as coal haulage, stockpiling and crushing and barging. Its mining activities are primarily conducted in East Kalimantan, Indonesia.

It is a publicly traded company listed on the Indonesian Stock Exchange and is majority-owned by PT Karunia Bara Perkasa.

Harum Energy Shareholders

| Investor | Ownership (%) | Filing Date |

|---|---|---|

| 1. PT Karunia Bara Perkasa | 74.05 | 31 Mar 2019 |

| 2. Dimensional Fund Advisors, L.P. | 1.22 | 31 May 2019 |

| 3. Cornèr Banca S.A. | 0.22 | 31 Dec 2018 |

| 4. APG Asset Management | 0.22 | 31 Dec 2018 |

| 5. Florida State Board of Administration | 0.12 | 31 Mar 2018 |

| 6. RAM Active Investments S.A. | 0.10 | 31 Dec 2018 |

| 7. PT Bara Sejahtera Abadi | 0.09 | 31 Mar 2019 |

| 8. Dimensional Fund Advisors | 0.07 | 31 May 2019 |

| 9. Artico Partners | 0.05 | 31 Dec 2018 |

| 10. Fidelity Management and Research | 0.03 | 31 May 2019 |

Loans

Lending from 2010

| Institution | Total Aggregate Debt (US$ millions) | Number of Deals | Latest Year of Deal |

|---|---|---|---|

| DBS Bank | 127 | 3 | 2017 |

| Mitsubishi UFJ Financial Group | 127 | 3 | 2017 |

| ANZ Banking Group | 94 | 2 | 2011 |

| OCBC Bank | 87 | 2 | 2017 |

| United Overseas Bank | 87 | 2 | 2017 |

| BNP Paribas | 40 | 1 | 2010 |

| Natixis | 40 | 1 | 2010 |

| Sumitomo Mitsui Banking Corporation | 33 | 1 | 2017 |

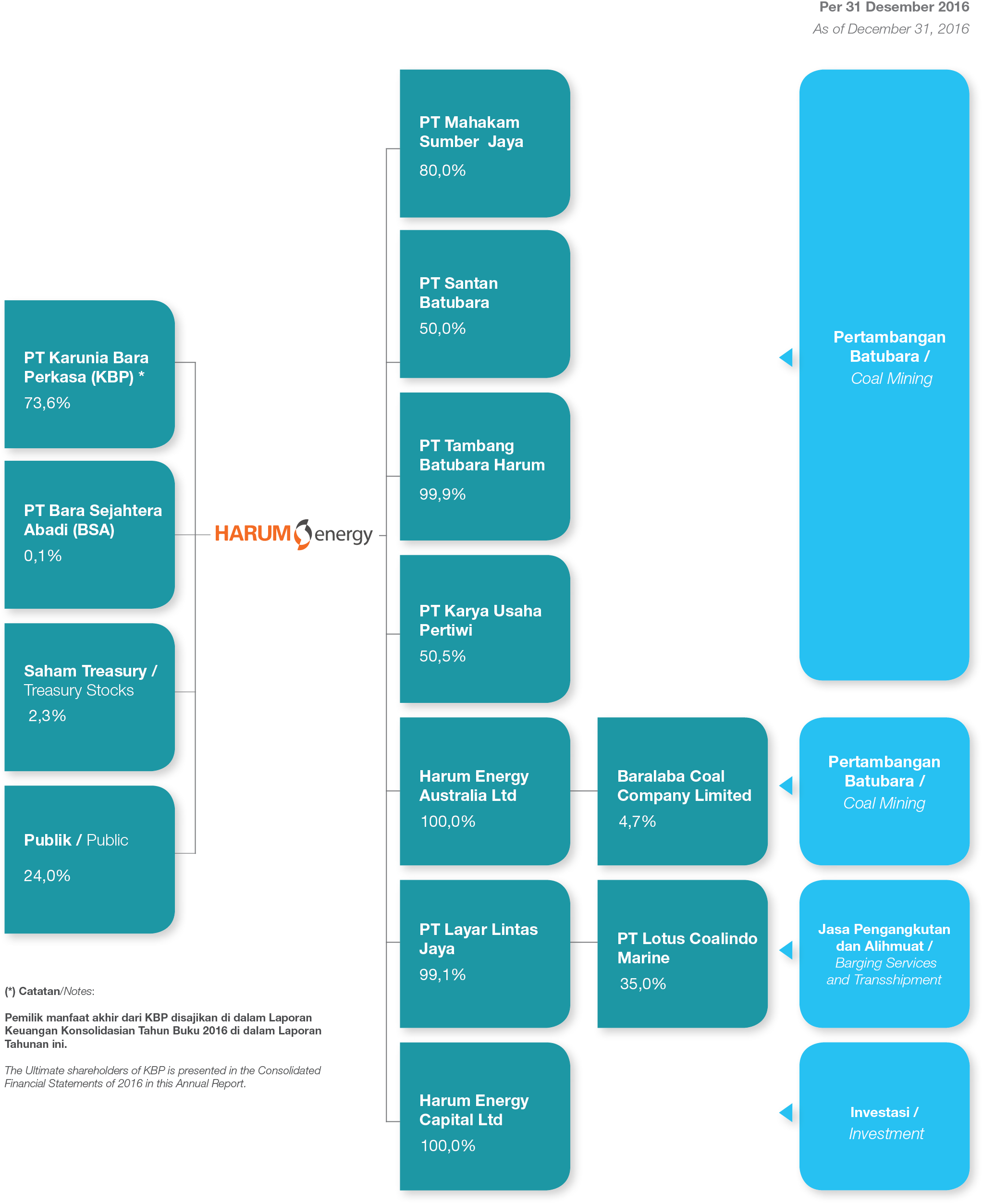

Structure of Harum Energy

Disclaimer

PLEASE NOTE: Information comes from the companies’ annual or financial reports (2010 to 2018) and websites, as well as other public and subscription-based information sources.

Occasionally, where information is incomplete, assumptions must be made about data and these were made in a consistent manner and in good faith. While we endeavoured to gather and include all relevant deals, we cannot guarantee the completeness of the information presented.