ARCHIVED CONTENT

This content is no longer being updated.

Don’t support

Vung Ang 2

Coal power station in Vietnam carries reputational and financial risk

The Korea Electric Power Corporation (KEPCO) and Samsung C&T have reportedly decided to build Vung Ang 2. The Japanese megabanks and the other companies linked to this project should not support a coal power plant on a site that is already known to have polluted air and water, will cause further impacts to livelihoods of local communities and carries stranded asset risk.

Vung Ang 2 is a planned ultra-supercritical 2 x 600MW coal-fired power station in Kỳ Lợi commune, Kỳ Anh district, Hà Tĩnh province in Central Vietnam.

Banks linked to this project are:

- Japan Bank for International Cooperation (JBIC)

- Mitsubishi UFJ Financial Group (MUFG)

- Sumitomo Mitsui Financial Group (SMFG)

- Mizuho Financial Group

- Sumitomo Mitsui Trust Bank (SMTB)

The sponsor of this $2.2 billion project is Mitsubishi Corporation subsidiary, Diamond Generating Asia. KEPCO (See NO COAL KEPCO webpage) has reportedly decided to become a sponsor, purchasing China Light and Power’s stake in the project. China Light and Power has withdrawn because of their climate policy.

General Electric and Energy China GPEC have reportedly decided to withdraw from the project with Samsung C&T becoming involved.

Delivery of collective letter urging JBIC not to fund Vung Ang 2

Take Action

Delivery of collective letter urging JBIC not to fund Vung Ang 2

About Vung Ang 2

Sponsors

- One Energy Ventures (Diamond Generating Asia (DGA), a subsidiary of Japan’s Mitsubishi Corporation)

- Chogoku Electric Power (Japan)

- SPV: Vung Ang 2 Thermal Power Joint Stock Company (VAPCO)

Advisors

- Legal: Linklaters

- Legal: Allens Arthur Robinson

- Technical (Lenders): Black & Veatch

- Tax: Pricewaterhouse Coopers

EPC

Samsung C&T, Doosan Heavy

Lenders

Banks

- Mitsubishi UFJ Financial Group

- Mizuho Bank

- SMBC

- Sumitomo Trust

Human Rights and Environmental Concerns

Cumulative health and livelihood impacts

Vung Ang 2 is proposed to be built on a site next to the Formosa Steel plant and the Vung Ang 1 coal plant, both of which have faced community protest.

The Formosa Steel Mill’s toxic chemical spill in 2016 is considered the most serious environmental disaster in Vietnam’s history. It devastated a hundred miles of ocean coastline, rendering these areas presently unfishable and depriving communities of both food and income. In June 2019, 7,875 Vietnamese fisherfolk and others whose livelihoods were destroyed filed a lawsuit seeking compensation from the Taiwanese firm responsible.

The Vung Ang 1 coal power plant is controversial given the close proximity of its coal ash heap to residential areas and farmland, and the air pollution the plant causes. This project was funded by JBIC, MUFG and SMBC in 2011.

Commune residents and health care centres in the area say they have seen an increase in “heart disease, stroke, lung disease, skin problems and cancers,” from the projects already on the site.

Photo credit: Le Quynh; Vung Ang 1 coal power station

Significant Problems with the Environmental Impact Assessment (EIA)

Independent analysis conducted by Environmental Law Alliance Worldwide (ELAW) found key aspects of the 2018 EIA did not meet internationally accepted standards for evaluating potential environmental impacts of the project. The experts found the EIA:

- fails to consider alternatives to coal power to minimize negative environmental impacts: In violation of the International Finance Corporation (IFC) Performance Standards, the international benchmark to manage environmental and social risk, as well as the Japan Bank for International Cooperation (JBIC) Guidelines for Confirmation of Environmental and Social Considerations, the 2018 EIA report does not include any assessment of alternatives for renewable energy generation. This is despite studies published proximate to the EIA report indicating that energy generated by new investments in renewables would be cheaper than energy generated by new investments in coal by 2020.

- uses the incorrect air pollution dispersion model (METI-LIS) which makes the air quality impact predictions meaningless: because the site of the proposed Vung Ang 2 coal power plant is on complex terrain for which the model should not be used. The true harm this project would cause to communities and their air quality therefore remains unassessed.

- permits wet handling of ash in violation of IFC Performance Standards: Wet disposal of coal ash poses significant environmental threats, including possible contamination of ground and surface water as well as significant risks to public health if the ash disposal fails or floods.

- allows for the discharge of thermal effluent in violation of IFC Performance Standards: The 2018 EIA report shows that the thermal discharges from Vung Ang 2 would be above the 3 degree Celsius limit, violating this international standard. The discharges of this heated water can have multiple negative effects on aquatic ecosystems affecting the livelihoods of communities and the local ecology.

- dismisses impacts on marine species without proper review: An annex to the EIA actually suggests the opposite; areas around the coast have a high biodiversity of plankton, and the area where the intake pipe is to be located have a large population of brackish and intertidal fish.

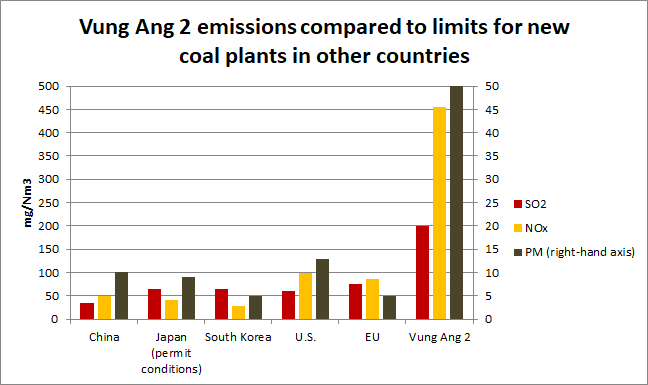

In addition, a separate expert analysis of Vung Ang 2 emissions by Centre for Research on Energy and Clean Air found that the ESIA applies weaker emission standards than those in Japan or Korea: The graph below shows Vung Ang 2 emissions of sulphur-dioxide (SO2), nitrogen-oxide (NOx) and fine particulate matter (PM) are much higher than limits for new coal plants in other countries.

Financial risks from coal power, considering the advance of renewables

Vung Ang 2 is being developed in an economy where renewables are fast becoming cheaper than coal. A recent report from financial think tank Carbon Tracker, states that it is already cheaper in Vietnam to invest in new solar PV than new coal, with new onshore wind generated power expected to become cheaper than coal power by 2021.

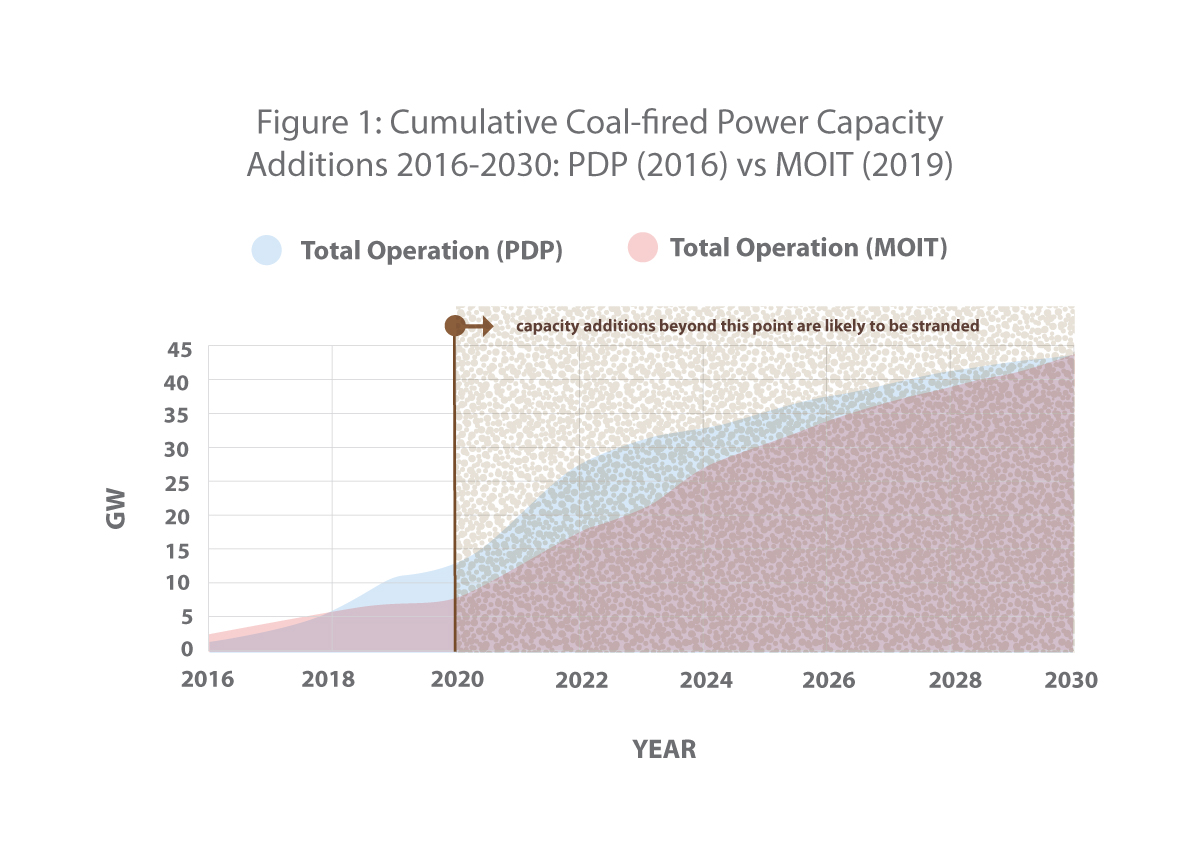

According to a recent 2019 report of the Ministry of Investment and Trade (MOIT) in Vietnam, extra coal power capacity currently in Vietnam’s pipeline – an estimated 35.7GW – has been significantly delayed. These costly delays have coincided with decreasing costs of renewables, to the point where any new coal capacity commissioned after 2020, including Vung Ang 2, would be more expensive than renewables. As such, Vung Ang 2 would be at risk of becoming a stranded asset.

Why the banks should be out of this project

The financial and reputational risks presented above are reasons enough for the banks to not fund Vung Ang 2.

In September 2019, MUFG, SMFG, Mizuho, and SMTB all signed up to the UN Principles for Responsible Banking, which commit signatory banks to “align their business strategy with the SDGs and the Paris Climate Agreement.” No new coal fired power plants can be built if we are to achieve the Paris Agreement’s climate goals of limiting global warming to 1.5°C or even 2°C. Research by Climate Analytics shows that coal needs to phased out globally by 2040. Funding this plant would violate these banks’ commitments.

References

- Alexandra Dockreay, IJGlobal, (4 May 2020), “Additional lenders considering Vung Ang 2.’

- Minerva Lau, Project Finance International, (11 September 2019), ‘ Banks restart talks on Vapco 2’

- Minerva Lau, Project Finance International, (29 March 2019), ‘Vung Ang 2 CFPP to go ultrasupercritical’

- Minerva Lau, Project Finance International, (15 August 2018), ‘OneEnergy appoints Vapco adviser’

- Mia Tahara-Stubbs, IJGlobal (23 January 2017), ‘Banks mandated on Vietnam Vung Ang 2 coal-fired’

- Global Data Point (20 January 2017), ‘Vietnam’s MOIT Investment Agreement signed BOT project in Vung Ang Thermal Power Plant 2’

- Vietnam Plus (17 January 2017), ‘Vung Ang II thermal power plant BOT project agreement clinched’

- Climate Policy Initiative (2016), ‘Slowing Down the Growth of Coal Power outside of China’

- BMI Research (2016), ‘Vietnam Power Report – 2016 Q4’

Information updated: 5 October 2020

In addition to the references noted above, Market Forces also considers information from financial journals, companies’ public disclosures, and news reports.