9 May 2019

The vast majority of Rio Tinto’s investors – which includes just about every super fund in Australia – today failed to ensure the company acts to manage down its exposure to climate change risk.

A Market Forces-coordinated shareholder resolution was put to Rio Tinto’s annual general meeting in Perth today, calling on Rio Tinto to develop a strategy to align its operations with a climate scenario where warming is limited to 1.5°C, by setting targets to reduce its greenhouse gas emissions.

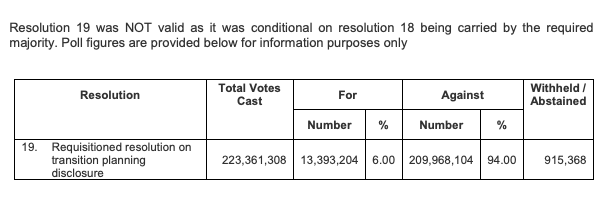

The resolution received just 6% of the shareholders vote, demonstrating a collapse in investor support for climate risk management.

Clearly, our super funds are prepared to ‘wait and see’, rather than proactively ensure members’ retirement savings are protected against foreseeable financial impacts of climate change. Those in charge of our retirement savings have failed to live up to their claims of active ownership and commitment to climate action.

Does your super fund vote for climate action? Find out and take action!

In recommending a vote against the resolution, Rio Tinto Chairman Simon Thompson repeated the company’s disingenuous claim that the resolution sought to have Rio police the emissions of its customers. But the company has itself admitted its iron ore business will be ‘materially affected’ by climate action. As stated at the meeting by Market Forces Executive Director Julien Vincent, the resolution simply sought to ensure Rio Tinto manages down its exposure to climate risk going forward.

Shareholders attending the meeting were also concerned about Rio Tinto’s plans to reduce greenhouse gas emissions and manage climate change risks.

Rio Tinto has committed to setting new targets to reduce its direct (scope 1 and 2) emissions, but Chairman Simon Thompson was unable to confirm integral details about those targets. Rio Tinto could not commit to producing absolute emission reduction targets, leaving the door open to setting intensity targets instead.

Emissions intensity targets are insufficient to ensure alignment with the Paris climate goals, as they can mask overall emissions increases with increasing levels of production or revenue. Absolute emission reduction targets are necessary to ensure Rio’s overall emissions fall.

Rio Tinto also refused to provide information regarding the dates attached to emission reduction targets nor the baseline year for those targets. Worst of all, the company appears destined to set targets tied to a 2°C warming scenario, rather than the 1.5°C limit required to avoid some of the most devastating impacts of climate change.

While Rio’s direct emissions are of course important, the emissions caused by customers processing Rio’s iron ore to make steel are the company’s biggest contribution to climate change. These ‘scope 3’ emissions are of an equal scale to Australia’s entire emissions each year!

Given the rapid decarbonisation required to meet the climate goals of the Paris Agreement, Rio Tinto’s exposure to the emissions intensive steel industry poses a significant risk to the company.

A shareholder put this to the meeting, asking how the company plans to manage this risk, if not by setting scope 3 emission reduction targets to guide its strategy. Thompson could provide no alternative metrics and targets, only offering a commitment to disclose scenario analysis of how decarbonisation of the steel industry might take place.

Scenario analysis involves stress testing a company’s plans and prospects against different climate change policies and outcomes, and is an important tool in understanding how climate change risks could materialise for a company.

However this analysis alone does not guarantee Rio Tinto’s strategy and capex decisions will be consistent with the goals of the Paris Agreement. Concrete targets are required to reassure shareholders that Rio will effectively manage climate risk.

With many super funds and other investors today baulking at their chance to demand these targets from Rio Tinto, it remains to be seen if the company will act to align its strategy with the goals of the Paris Agreement, thereby managing down its exposure to transitional climate risk.