19 November 2020

At its annual general meeting today, Australian gas producer Senex Energy reiterated its plans for a five-fold increase in production over the next 5 years.

These plans are in stark contrast to the declines in gas use required to avoid the worst impacts of climate change, and recent analysis from the Grattan Institute, which found:

“Rather than indulging in wishful thinking or living in denial, the Federal Government and the gas industry – and its customers – should start planning now for a future without natural gas, or at least with a dramatically reduced role for natural gas.”

Tony Wood and Guy Dundas, Grattan Institute

Shareholders today raised this issue with the company, asking Senex’s board for its view on where demand for the company’s increasing gas production would come from.

In response, CEO Ian Davies disputed the Grattan Institute’s finding that “the increasing economic and environmental cost of gas means that [its]

role must shrink rather than expand”.

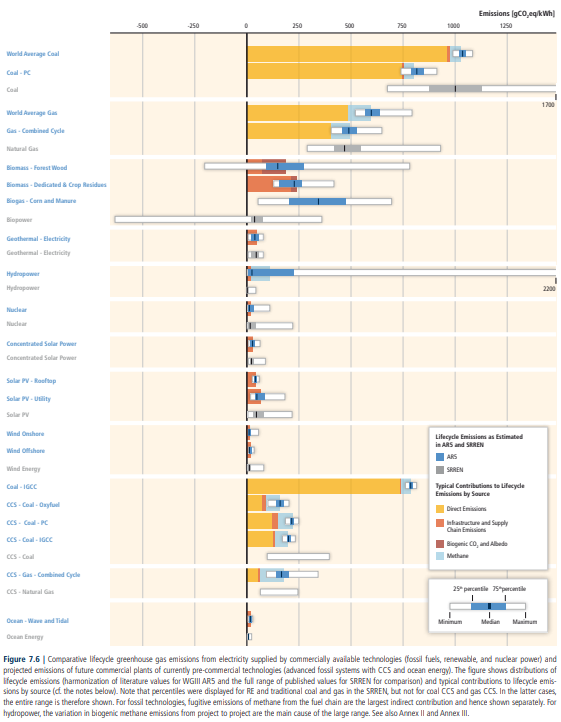

Mr Davies went on to misleadingly label gas a “low emissions technology.” However, as shown by the IPCC, gas is one of the most emissions intensive sources of energy, with a lifecycle emissions profile closer to that of coal than it is renewable energy sources.

In Australia, Fact Check has “estimated that open-cycle (peaking) gas turbines produce 28 per cent less emissions per kilowatt hour of electricity than conventional (subcritical) black coal plants, 20 per cent less than high-efficiency (supercritical) black coal plants, and 45 per cent less than brown coal plants.” These are marginal improvements compared to the near zero emissions renewable energy sources available, and could hardly warrant gas being labelled a “low emission technology”.

Further, research has shown that the fugitive emissions in gas production are likely underestimated, and may mean cancel out any emissions benefits of gas over coal as an energy source.

Oil price forecasts out of line with climate goals

Senex was also challenged over the oil price forecasts it uses to value it oil and gas assets, which are around 10% higher than those forecasts under the International Energy Agency’s Sustainable Development Scenario. That scenario gives just a 50% chance of holding warming to 1.65°C, so prices aligned with the Paris Agreement’s 1.5°C goal would be even lower.

Carbon Tracker has analysed IEA scenarios, and found “SDS levels of demand can be satisfied by oil projects that deliver a 15% internal rate of return (IRR) at an oil price in the high-$40s, and B2DS at an oil price in the high-$30s.” These prices are clearly well below Senex’s long-term oil forecast of US$62.50.

In response to shareholder questioning on the inconsistency between the price forecasts used and Senex’s claimed support for the Paris Agreement, company Chain Trevor Bourne said price forecasts were drawn from many sources, which “include the expected impact of climate change and potential policy responses”.

Despite taking questions on exactly which climate scenarios were considered, what assumptions were made about climate change impacts, and how those impacts were reflected in the company’s oil and gas price forecasts, Mr Bourne provided no specific details in response.

The company’s auditor stated that the audit process included comparing Senex’s price forecasts to “broker forecasts, analyst reports, and other market data,” which he said would include those individuals’ expectations of climate scenarios, but did not suggest the audit had specifically tested Senex’s price assumptions against a Paris-aligned scenario.

This appears to amount to Senex just following what others say, and not testing its assumptions against the Paris-aligned outcome it claims to support.

That approach will do little to appease the investors managing over $100 trillion that are calling for companies to use assumptions consistent with the Paris Agreement in financial statements.