Market Forces is working with shareholders to put climate change on the agenda of Australia's biggest companies, and getting some great results.

Below are some highlights from annual general meetings held in the second half of 2017.

Get involved

DONATE TO SUPPORT OUR SHAREHOLDER ACTIVISM WORKJump to:

Check out the highlights (and lowlights) from a massive season of shareholder action!

ANZ doesn’t intend to increase coal exposure

19 December 2017

- ANZ reiterated last year's comments that the bank's exposure to coal is trending down and will continue that trend into the future.

- While ANZ and auditors confirmed climate change is a material risk, the bank was questioned over its loans to Cooper Energy, Boral Limited and Beach Energy, which don’t classify climate as a material business risk.

- Shareholders also pointed out further inconsistencies between ANZ's climate statements and continued support for fossil fuels, including lending to India’s Rural Electrification Corporation, whose main business activity is disbursing loans to coal-fired power projects, most of which breach ANZ’s own carbon emissions limit.

NAB confirms thermal coal ban

15 December 2017

- Chairman Dr Ken Henry confirmed that the bank would no longer lend to new thermal coal projects at the AGM.

- Dr Henry said NAB's exposure to thermal coal will continue to decline, indicating a phase out from the sector!

- External auditors, Ernst & Young, confirmed they considered climate change as a material business risk when reviewing NAB's 2017 financial statements.

Westpac rules out finance for Adani's Abbot Point coal terminal

8 December 2017

- When asked about potentially refinancing the Abbot point coal terminal, Chairman Lindsey Maxwell said he couldn’t comment on individual customers but that the bank’s lending is in line with its climate position. Westpac’s position takes into account the whole supply chain which would incorporate any infrastructure such as the terminal.

- The board was forced to defend the bank's lending to Whitehaven Coal, Cooper Energy, Senex and Oil Search, whose actions and climate risk disclosures are out of line with Westpac's own commitment to operate in line with 2 degrees.

8 companies in 8 days fail to recognise climate risk as material

28 November 2017

- According to the International Energy Agency and the Investor Group on Climate Change (amongst others), oil and gas assets are exposed to climate-related financial risks, while the Task Force on Climate-related Financial Disclosures (TCFD) suggests Energy and Finance as two of the sectors with the “highest likelihood of climate-related financial implications.”

- But in response to shareholder questions at AGMs over the past week or so, 8 companies operating in these sectors failed to recognise climate change as a material business risk: Armour Energy, AWE, Beach Energy, Carnarvon Petroleum, Horizon Oil, IOOF, LNG Ltd, and Seven Group Holdings.

- Just a few days later another oil and gas explorer, Central Petroleum, said it did not know what the TCFD is, and that the company was too small assess their future activities. Hardly convincing for shareholders concerned about Central's ability to survive the transition to a low carbon economy.

Commbank getting out of coal

15 November 2017

- Chair Catherine Livingstone indicated the bank intends to get out of the coal industry: the bank's coal funding has been 'trending down for some time. We expect that trend to continue over time as we help finance the transition to a low carbon economy.'

- Also confirmed that while they ‘don’t normally comment on individual clients….we will not provide funding to the Adani Carmichael mine.’

Medibank to divest for health

13 November 2017

- Australia's biggest health insurer today announced it will divest from fossil fuels due to the negative health impacts of climate change.

- Medibank committed to reduce exposure to fossil fuels by firstly moving their international share portfolio to a low carbon index within the next 12 months, and looking to do the same in Australia soon after.

Karoon Gas think setting GHG reduction targets would be meaningless

9 November 2017

- Chairman David Klingner expressed the company's belief that setting targets in terms of Karoon’s greenhouse gas emissions would be meaningless.

- In defending the company's decision to remunerate executives on the basis of expanding reserves, Klingner said "That's what we do.We are an oil and gas explorer." Clearly the company has no plans of shifting its business model to align with the Pars climate goals.

Boral: "Climate risk not material"

2 November 2017

- As one of Australia's biggest building materials companies, Boral is a major energy user and greenhouse gas emitter. The company is exposed to climate change transition risks, like potential carbon pricing, and physical risks, as evidenced by big losses due to hurricanes in the US.

- But despite this massive exposure, Boral admitted at their AGM that they didn't consider climate change as a material business risk in its FY2017 financial reporting.

- The company also failed to rule out helping Adani deliver on its Carmichael mega coal mine plans.

Whitehaven’s expansion plans contradict Paris aims

25 October 2017

- Whitehaven Coal talked up its expansion plans, which are based on coal power predictions that are completely out of line with the Paris climate change agreement

- The company also plans to challenge the EPA's decision to raise the Maules Creek coal mine to the highest environmental risk category

- Despite Whitehaven's atrocious environmental record and reckless expansion plans, the company still enjoys the financial support of Australia's big banks and most super funds

IAG: Federal Government is deaf to climate change concerns

20 October 2017

- IAG admitted they haven't been able to get their message through to the federal government to bring about sane climate mitigation and adaptation policy

- The company acknowledged the increasing cost of natural disasters, particularly Tropical Cyclone Debbie, and the need for spending on climate change adaptation. That probably not a bad idea seeing as IAG have paid out more on natural disasters than provisioned in ten of the last eleven years

Shareholder support for climate risk disclosure at Origin

18 October 2017

- 14% of shareholder votes, representing about $1.8 billion worth of stock, supported a shareholder resolution coordinated by Market Forces, calling on Origin to improve its climate risk disclosure

- Two other resolutions, also coordinated by Market Forces, requesting the company produce a transition plan and measure fugitive methane emissions, received 3.42% and 4.83% support respectively

- When asked why Origin pays more to attend political functions than its peers, chair Gordon Cairns said the sate of Australia's energy policy was largely to Origin's influence. He thinks helping bring about the that the train wreck that is our national energy policy was "money well spent"

AGL shareholders back Liddell closure

27 September 2017

- 126 AGL shareholders, representing $5.4 million worth of shares delivered a statement, supporting the board’s decision to close its Liddell coal power station in 2022

- Shareholders also called on the bank to “get out of coal” much sooner than the middle of the century

- Board stated that building new coal power stations would be uneconomical given the rapidly falling price of renewables

Suncorp to divest from fossil fuels?

21 September 2017

- Company Chair said he suspects Suncorp’s investments in fossil fuels ‘may be completely immaterial’ in two years time

- Suncorp say they support the Taskforce on Climate-related Financial Disclosures, but the company is still studying the framework, and will decide whether to implement it in the next several months

- Suncorp is clearly lagging many other major financial institutions on this issue

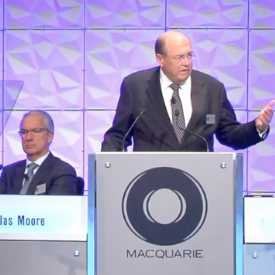

Macquarie “not aware” of climate risk recommendations

27 July 2017

- Macquarie Group Chairman Peter Warne made the startling admission that he “was not familiar” with the recommendations of the Taskforce on Climate-related Disclosures (TCFD)

- While the TCFD may not be well known in the community, its recommendations should be well understood by those in the finance world, whose businesses face massive risks due to climate change

- Macquarie still refused to pledge its support for the 2°C limit, which its major Australian banking peers have done