16 October 2019

Origin Energy’s annual general meeting today was dominated by shareholder and community concerns over the climate, environmental and social impacts of the company’s dirty fossil fuel operations and plans.

That’s not surprising given Origin is one of Australia’s biggest greenhouse gas polluters and has plans to prolong coal-fired power and expand gas production that is totally inconsistent with the climate goals of the Paris Agreement.

Outside the meeting, hundreds of people gathered to support Traditional Owners who had travelled thousands of kilometres to tell Origin: don’t frack the Northern Territory.

Beetaloo fracking nightmare

Origin’s plans to open up the Northern Territory’s massive Beetaloo Basin for gas fracking face massive opposition by Aboriginal Traditional Owners and other community groups. It would also unlock greenhouse gas emissions equivalent to 50 new coal-fired power stations.

Traditional Owners from the Northern Territory travelled thousands of kilometres to attend the AGM and raise their concerns directly with the board.

Chairman Gordan Cairns tried to dodge their concerns but the message was clear: Traditional Owners don’t want fracking on their country.

“There is a track record of pollution both to the climate and to water resources that is caused by Origin’s reckless and invasive fracking activity.” Traditional Owner Lauren Mellor told shareholders & the board when they asserted that fracking wasn’t harmful.

“That is why people here today are standing up and will not let this activity move any further in terms of exploration and certainly not to production.”

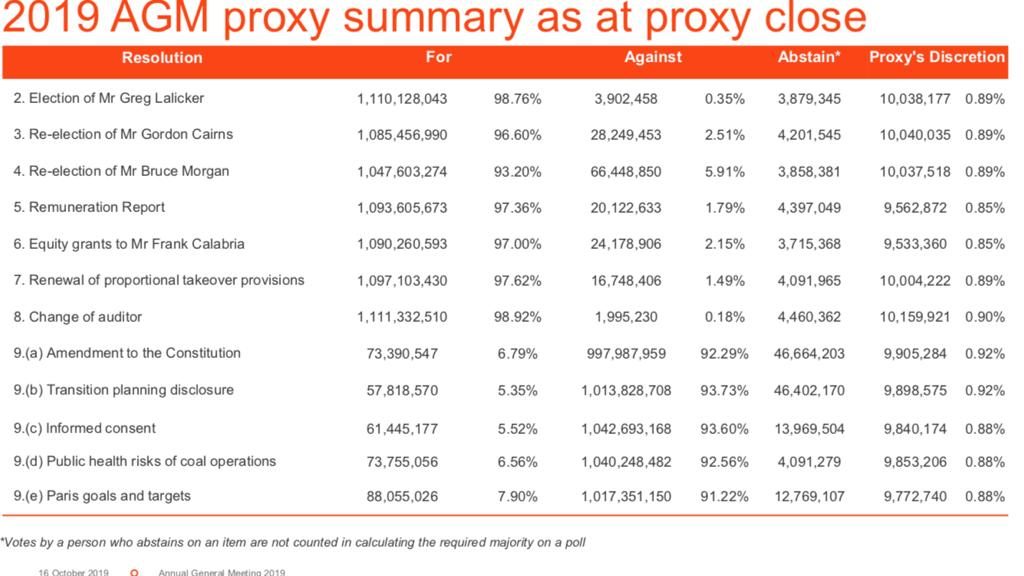

Yet, despite the impacts to Traditional Owners, to water, and to climate, over 93% of Origin’s investors – including Australia’s biggest super funds – have backed Origin’s dirty and destructive gas fracking plans. A shareholder resolution coordinated by the Australiasian Centre for Corporate Responsibility (ACCR), asking Origin to ensure the free, prior and informed consent of Aboriginal native title holders for the Beetaloo fracking project was properly established, received support from only 5.52% of Origin’s investors.

Another ACCR-led resolution was put to shareholders, calling on Origin to ensure future spending plans, such as the Beetaloo project, are consistent with the Paris climate goals and to set Paris-aligned greenhouse gas emission reduction targets. Despite the massive community push to get our political and business leaders to drive the low carbon transition required to meet Paris goals, it seems our super funds once again used our retirement savings to block real climate action, with just 7.9% of Origin’s investors supporting this shareholder resolution.

Dirty coal

Origin owns and operates Australia’s biggest coal-fired power station, Eraring. Despite the global commitment to reduce emissions set out in the 2015 Paris Agreement, Eraring’s emissions have risen every year since then. In FY2018, Eraring’s emissions were 20% higher than in FY2015. That number will rise again for FY2019 due to increased output at the power station.

Origin has a target to halve its operational emissions by 2032, coinciding with the proposed closure date of Eraring. But since the polluting plant accounts for around 75% of the company’s total emissions, it means Origin’s emission reduction plans actually allow it to continue increasing emissions, both at Eraring and other parts of the business, until 2032 – a situation that’s completely out of step with action required to meet the Paris climate goals.

These plans were challenged by a Market Forces-led shareholder resolution, which called on Origin to produce a plan to phase out coal power in line with the Paris climate goals. With 515 investors worth over US$35 trillion having signed a statement calling on governments to reduce emissions and phase out coal power in line with the Paris goals, one would expect this resolution to attracted plenty of support.

Unfortunately, it seems the majority of investors – including Australian super funds – are happy to make public calls for climate action but won’t make the same demands of companies they own shares in, refusing to use their power as a shareholder to influence real action. The resolution attracted only 5.35% of investor support, revealing the incredible hypocrisy of the investment community when it comes to climate change.

Will van de Pol, Market Forces asset management campaigner, spoke to the resolution at the meeting:

“Origin’s current coal power plans are out of step with current mainstream scientific projections of the decarbonisation required to meet the Paris climate goals. Failure to bridge this gap leaves our company exposed to significant climate change transition risks.”

“It seems many investors have hypocritically failed to take the opportunity provided by this resolution to ensure our company’s coal power plans are brought into line with current scientific projections of the low carbon transition required to meet the world’s climate commitments.”

Emission reduction targets

Origin’s emission reduction targets came under fire today by shareholders who thought it was “misleading to claim plans [to reduce emissions] are Paris-aligned until emission reduction targets are updated”.

Origin’s science-based targets for reducing emissions are based on a 50% chance of reducing emissions to a level where global warming would be limited to under 2 degrees. The Science-Based Targets Initiative will now only accept targets that are consistent with a 1.5 degree – or, at worst, a ‘well-below 2 degrees’ – warming scenario.

Cairns admitted that closing coal-fired power stations would decrease emissions, but felt Origin was doing enough to manage emissions.

“Closing Earring [Origin’s coal-fired power station] by 2032 is not good enough,” the shareholder responded.

Take action

Today, super funds failed to vote for a resolution to keep warming to below 1.5 degrees. They are using our retirement savings to bet on a dangerous future of climate catastrophe.