27 November 2018

This week industry super fund Vision Super, whose membership is mainly made up of Victorian local government employees, announced that it will begin selling off its thermal coal and tar sands company shares.

This positive and responsible move means Vision Super members' money will no longer be used to fund the expansion of the two dirtiest fossil fuels.

Vision Super’s CEO Stephen Rowe, explained its divestment move by saying:

“...thermal coal and tar sands are two of the biggest contributors to climate change, and we don’t believe the risk of continuing to use them can be mitigated.”

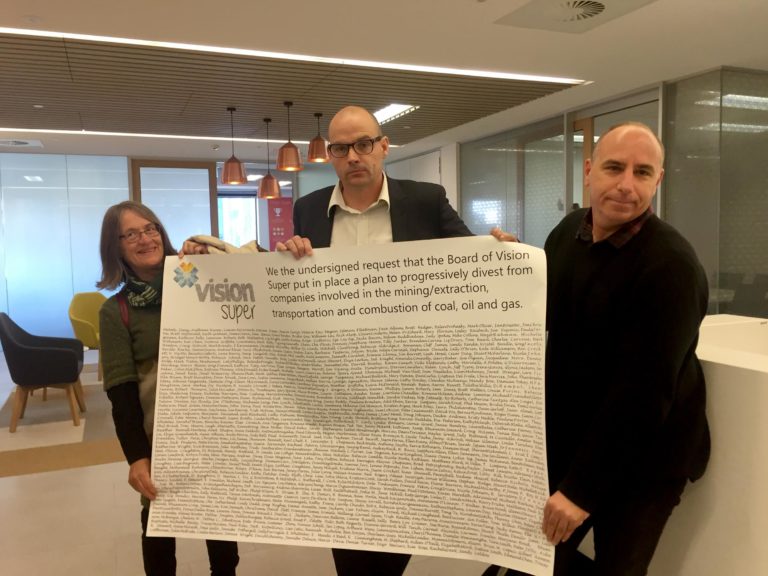

Back in 2016 almost 700 Vision Super members called on the fund to divest from fossil fuels. Vision Super told them that it preferred to “engage” with polluting companies rather than divest.

We are pleased to see that at least with coal and tar sands, Vision has realised that engagement is pointless when the entire business model of a company goes against the urgent need to reduce carbon emissions as fast as possible.

To keep global warming below 1.5 degrees no fossil fuel expansion of any sort can occur. Therefore, we call on Vision Super to finish the job by divesting from oil and gas companies too, and demand all other super funds follow suit.