28 October 2016

Yesterday Whitehaven Coal held their Annual General Meeting in Sydney. They obviously had a lot to hide. While most AGMs are filmed and broadcast, Whitehaven decided to record only the audio, and cut off recording completely before question time.

To bring you up to speed Whitehaven is the company that, despite years of strong community resistance, built the Maules Creek coal mine in the critically endangered Grassy White-box Woodland in the Leard State Forest. The mine began producing coal last year.

Maules Creek construction caused loss of the Gomeroi traditional owners heritage, loss of habitat of 396 different species including threatened species as well as contributing to global warming. There are many reasons why it’s a poor decision to build a mine in the middle of a state forest.

The decision was also disastrous from an economic point of view. Having committed to the expensive mine at the height of coal prices, Whitehaven took on huge amounts of debt, only to have prices drop to around half of their 2011 peak by the start of 2016. During this period, Whitehaven’s share prices fell from $7.20 in 2011 to bottom out at $0.37 in February 2016. The company reported a loss of $330.6 million for the year ending June 30, 2015.

Since early this year, both the coal price and Whitehaven’s share value have increased, but in the face of increased action to transition away from the world’s dirtiest energy, questions must be asked about the longevity of this apparent revival.

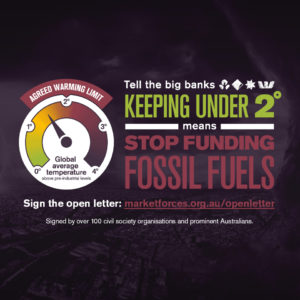

In case you were wondering which banks provided the massive debt to allow Whitehaven to build Maules Creek – each of Australia’s big four banks have loaned hundreds of millions, with ANZ the most heavily involved. If you bank with one of the big four, put them on notice over their support for dirty fossil fuels.

In case you were wondering which banks provided the massive debt to allow Whitehaven to build Maules Creek – each of Australia’s big four banks have loaned hundreds of millions, with ANZ the most heavily involved. If you bank with one of the big four, put them on notice over their support for dirty fossil fuels.

Whitehaven and sustainability

As part of its rehabilitation obligations, Whitehaven has allocated $32 million to rehabilitate 2,000 hectares of the Maules Creek mine site. However, the company is also obliged to restore a further 3,000 hectares of woodland with native vegetation. This includes grassland being restored to the woodland form of the Critically Endangered Grassy White-box Woodland as part of an offset program.

Whitehaven has not estimated these extra rehab costs, nor what they would mean to shareholders. Frustrated by the lack of foresight of the company, shareholders wanted to know when the cost of restoring the grassland to woodland would hit the Whitehaven Coal balance sheet. They asked how much it would cost to rehabilitate the site.

CEO Paul Flynn responded by saying Whitehaven has 40 years in which to rehabilitate these areas. But in fact, the company has only until 2018 at the latest in which to secure the relevant properties according to the Commonwealth approval conditions. The obligation to transform farm paddocks to Grassy White-Box woodland will be a huge undertaking and is likely to cost the company dearly. The apparent lack of understanding of environmental approval conditions and rehabilitation obligations is extremely worrying, especially given the widespread community opposition to the Maules Creek project.

Stranded asset?

Yesterday, CEO Paul Flynn informed the AGM that Whitehaven coal although currently selling only 16% of its output as coking coal (used to make steel), it has the potential to increase this to 80%. This would be important to the long-term viability of the company as the world moves away from thermal coal (for energy) in order to meet the Paris Agreement. However, coking coal production requires much more water than thermal.

The Namoi River catchment, which would provide the water, flows into the Darling River, and is critical for farming throughout the Namoi Valley and downstream. Its capacity to provide water for increased coking coal production as well as water for farming is limited. If Whitehaven is unable to secure the water required to produce coking coal, and the market for dirty thermal coal dries up due to emissions reduction policies, Whitehaven’s coal mines may end up stranded assets.

You can take action now and send a powerful message that you don’t want your money supporting companies like Whitehaven.

Do you bank with one of the big four?

All four banks loaned hundreds of millions of dollars to help Whitehaven buil Maules Creek. If you bank with ANZ, CommBank, NAB or Westpac, put them on notice over their dirty lending. Click the link or fill in the form below to tell your bank if they choose fossil fuels, you’ll choose a new bank.

You can also sign our open letter to let the banks know you don’t want them investing in fossil fuel projects like Maules Creek mine.

Is your super fund funding Whitehaven?

You can use Super Switch to find out if your super in invested in fossil fuel companies like Whitehaven, and tell your fund to divest.

Put your bank on notice