19 May 2022

Responding to the shareholder vote on the Market Forces-coordinated shareholder resolution at Woodside’s AGM in Perth today, Market Forces Asset Management Campaigner Will van de Pol said:

“Today 49% of Woodside’s shareholders rejected the company’s utterly inadequate approach to climate change, the largest vote against any Say on Climate proposal in the world so far.“

“In fact 14.5% went so far as to demand the company to start winding up its oil and gas production in line with a credible pathway to net zero emissions by 2050. That’s well over $4 billion worth of capital invested in this company not only rejecting its reckless fossil fuel expansion plans, but instead telling Woodside to manage down production.“

“These votes deliver a staggering rebuke to Woodside’s moves to double down on its bet against the Paris Agreement’s climate goals by taking on BHP’s entire petroleum business, and pushing ahead with billions of dollars’ worth of new oil and gas projects that are incompatible with a 1.5°C warming limit.“

“The climate science is clear: there is no room for new oil and gas projects. And if we don’t rely on speculative and unproven carbon capture and storage technology, even existing projects will need to shut down early if we are to meet the Paris Agreement’s climate goals, which Woodside claims to support.“

“Any investor that claims to support Paris but continues to greenlight Woodside’s oil and gas expansion plans, including many of our super funds, is at best incompetent and at worst deliberately misleading when it comes to climate stewardship. Either way, these investors are complicit in climate destruction.“

Shareholders, Traditional Custodians, and civil society all delivered Woodside a considerable smackdown over its climate- and culture-wrecking plans at the company's AGM today.

— Market Forces (@market_forces) May 19, 2022

Read Market Forces’ investor briefing in support of today’s resolution

Doubling down on climate risk

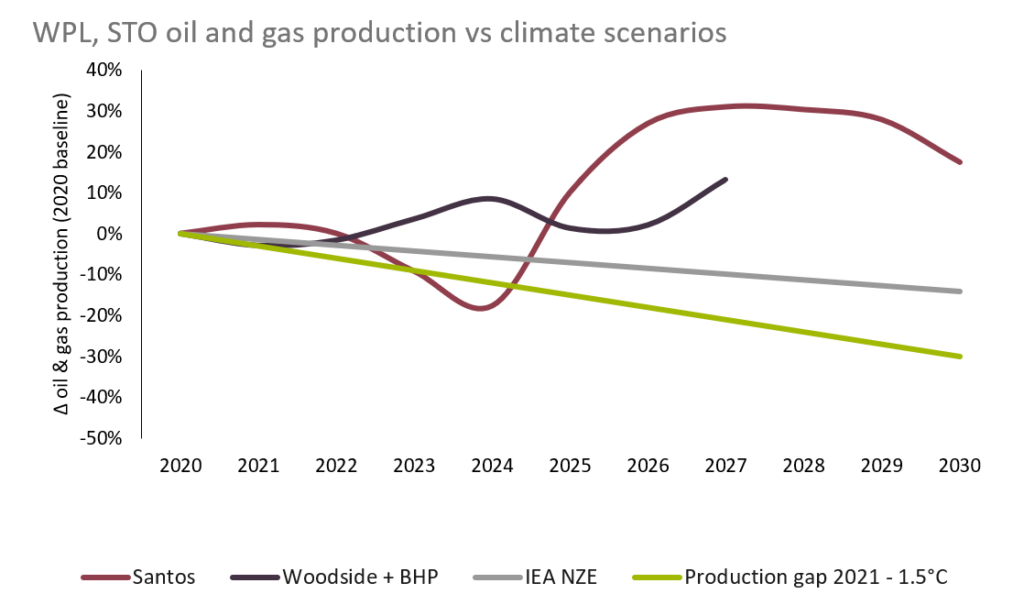

In 2020, 50% of Woodside’s shareholders demanded the company adopt emissions reduction targets (including scope 3) and capital expenditure plans aligned with the Paris climate goals. Last year 19% of shareholders demanded Woodside wind up oil and gas production in line with the Paris goals. And today, a record 49% of shareholders voted against the company’s own climate report. Yet Woodside continues to ignore investor concerns and double-down on its approach to climate risk. When asked what it was going to take for Woodside to actually bring its strategy and plans into line with global climate goals, Chair of the Board Richard Goyder said Woodside thinks its climate-wrecking business plans already are consistent with global climate goals. As shown in the chart below, this is patently false, a fact which many investors have clearly cottoned on to.

Despite the oil and gas demand declines projected under the IEA’s Net Zero Emissions (NZE) and the IPCC’s 1.5°C scenarios, however, Woodside is still planning to significantly increase its overall emissions by ramping up production. This planned production increase is in direct contradiction to the declines required to align with the NZE and Paris climate goals (see chart), despite what Goyder told investors today.

It is clear that Woodside is either deliberately misleading investors, or in complete denial that oil and gas production must begin declining immediately and steeply in order to meet the global climate goals it claims to be aligned with.

Traditional Custodians demand apology for the destruction of cultural heritage: Woodside refuses

Traditional Custodians from the Murujuga region—also known as the Burrup Peninsula, where Woodside plans to construct its Pluto Train 2 LNG processing facility—attended the meeting today and called out Woodside over its lack of consultation. Raelene Cooper asked the company if it would pause any further investment decisions relating to the Scarborough project until it had obtained the free, prior and informed consent of all Murujuga Traditional Custodians, which the company does not have.

This was followed closely by Josie Alec, who asked the company to apologise for the destruction of more than 4,000 pieces of rock art during the construction of the Karratha gas plant. Goyder claimed he was “not aware” of the destruction of this rock art, and CEO Meg O’Neill followed up with “we regret the damage that was caused at that time,” both directors clearly failing to apologise for the destruction.

“Moral and economic madness”: A chorus of climate reality

Many key voices in the movement for climate action were represented at today’s AGM, and all were united in their calls for Woodside to halt its climate-wrecking oil and gas expansion plans. Among these voices was Greenpeace Australia Pacific CEO David Ritter, who, in quoting UN Secretary General António Guterres on the development of new fossil fuel infrastructure and production, asked the board whether it considered its fossil fuel expansion plans to be “morally mad, economically mad, or both.” Goyder responded with the usual Woodside spin, ignoring David’s question and instead trotting out old lines from the coal industry playbook around energy security and standards of living. After David tried to respond to Goyder, he was rudely shut down and refused the right to reply.

Flight of capital

Shareholders at today’s meeting also approved Woodside’s takeover of BHP’s petroleum business. Woodside announced this plan in August 2021, which will roughly double the company’s fossil fuel production capacity. In payment, Woodside will issue new shares amounting to 48% of the combined company’s total to BHP shareholders.

With both companies pursuing significant oil and gas expansion plans that are incompatible with the Paris climate goals, the deal will see Woodside double down on its bet against the world achieving its climate commitments.

A number of significant investors have very little or no exposure to Woodside. For example, two of the biggest super funds in the country—AustralianSuper and UniSuper—have only minimal, passive exposure to Woodside, but significant investments in BHP. Other large investors have exclusion policies on pure play oil and gas investments. These investors who have either ruled out or actively decided against investing in Woodside are almost certain to sell the shares they receive through the BHP merger.

Concerns about the potential impact of climate-concerned shareholders selling down the Woodside shares they receive through the merger were also raised in today’s AGM. Given the company’s refusal to meet shareholders’ demands for climate plans and action, perhaps the company should be more concerned about losing investors who give up on their hopes of trying to bring the company into line.