28 April 2023

Company directors under fire

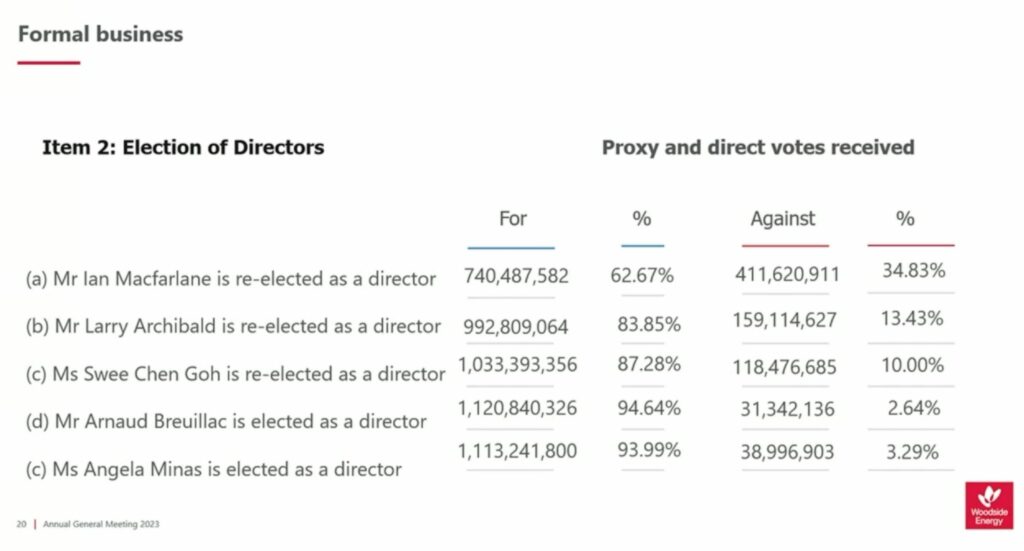

Nearly 35% of Woodside Energy’s shareholders voted against board member Ian Macfarlane’s re-election at the company’s annual general meeting (AGM) in Perth today. Investors also voted significantly against the re-election of directors Larry Archibald and Swee Chen Goh who received more than 13% and 10% of votes in opposition, respectively. With board-supported ASX directors typically receiving more than 95% support, today’s results demonstrate investors are dissatisfied with Woodside’s woeful climate strategy and made it clear that directors’ jobs are on the line because of this.

When Woodside received the highest ever recorded vote against its climate plan last year (49%), Chair Richard Goyder dismissed this investor protest by suggesting that strong support for directors meant investors were generally happy with the company’s strategy. Yet today when questioned by Market Forces Acting Executive Director Will van de Pol on what percentage of investors voting against a director it would take for the company to take serious climate action, Mr Goyder failed to respond directly, changing the subject to talk about shareholder votes for its acquisition of BHP’s petroleum business in 2022.

More than 15% of investors also supported a resolution requisitioned by Market Forces and Woodside shareholders calling on the company to demonstrate how it would align its future capital allocation with a net zero by 2050 pathway. This year’s increase in support for this resolution – after a similar resolution was filed last year – puts the onus on the company to ensure it acts on its investors’ demands for stronger climate action, as well as the broader community it claims to support.

Strategy incompatible with climate goals

Woodside is pursuing an emissions trajectory that clearly ignores all scientific evidence, and its board of directors is not only waving through these reckless fossil fuel expansion plans but actively incentivising them with big executive bonuses.

The company saw a strong vote against its remuneration report this year, after Market Forces worked with shareholders ahead of today’s AGM to lodge a statement against the company’s practice of paying bonuses for fossil fuel expansion.

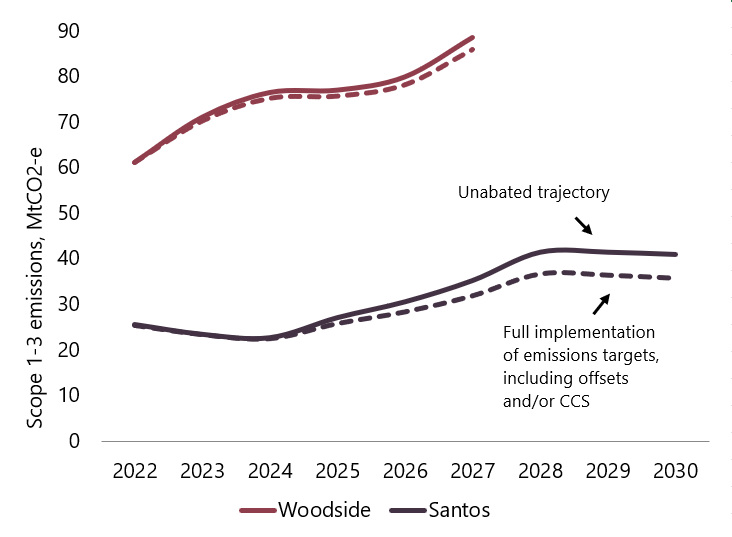

It was not only the company’s governance practices that came under scrutiny today. Many shareholders and proxy holders questioned the company’s climate transition plan and its heavy reliance on carbon offsets and unproven carbon capture and storage technology. Market Forces’ analysis demonstrates Woodside’s massive oil and gas expansion strategy puts the company on course to increase its overall emissions by 40% between 2022 and 2027. Worse still, the full implementation of Woodside’s utterly inadequate climate targets makes an almost imperceptible difference to the company’s projected emissions over that timeframe.

Woodside projected emissions, with climate targets impact

Investors voices inconsistent

It is clear from today’s AGM that Woodside directors and executives are facing ever-increasing scrutiny over its reckless business plans. But there are voices missing. With nearly half of the company’s investors having voted against its climate plans last year, it is clear some of those investors have failed to increase pressure on the company to deliver climate action.

Stewardship of a company can only be successful if it delivers results and doesn’t just rattle sabres in their scabbards. While protest votes are a clear step in the right direction and let directors and executives know they cannot get away with splashing investors’ cash on yesterday’s technologies, it’s time for that action to escalate. Investors need to step up and demand an end to Woodside’s fossil fuel expansion plans and sell their shares if the company refuses to listen.