30 July 2021

In mid-July Adani Electricity Mumbai issued US$300m worth of “sustainability-linked” bonds – a form of general corporate finance which carry no obligation to be directed towards sustainable projects and can be issued by any company willing to report on certain “sustainable” key performance indicators (KPIs). These KPIs are often cherry-picked by the issuer to align with easily-achievable targets. The penalty for missing these KPIs is small (in this case an additional 0.15% interest per annum), with no penalty being applicable until 2027 (so for only four years of the ten year bond at most). It’s safe to say we won’t be avoiding catastrophic global warming via the issuing of “sustainability-linked” bonds.

One of the companies which reviewed this bond issue was Moody’s-owned Vigeo Eiris (VE). VE provided an opinion that the company met the sustainability criteria required for these bonds – but had to issue a correction after it was revealed that it had forgotten to mention that Adani Electricity Mumbai operates a 500MW coal-burning power station.

This example is illustrative. If you want to get a clear picture of Adani Group’s actions rather than words, then you need to pull back the greenwash curtain, and when you do, you’ll see coal, and lots of it.

Earlier this month Market Forces released research which compiled a list of Adani Group’s under construction and planned coal, oil and gas projects. The picture is alarming and of global significance – particularly when it comes to Adani Group’s coal plans.

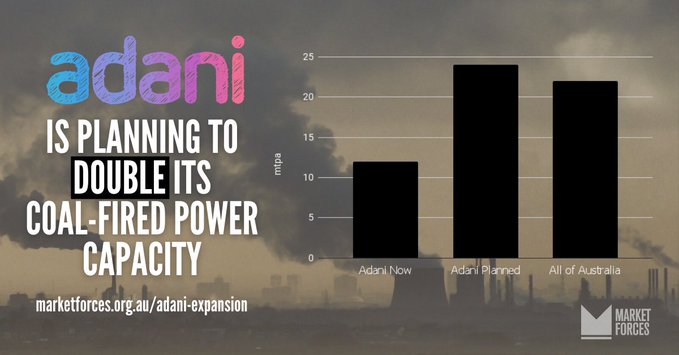

Adani Group is aiming to roughly double its coal fired power capacity to over 24GW (not including a 1.2GW coal plant Adani began the process of purchasing while the research was being conducted). It will do this through the construction of four new coal-burning power stations and the expansion of two existing power stations.

Its under construction Carmichael thermal coal project in Australia could end up as Australia’s biggest coal mine, with up to 60 mega-tonnes per annum (mtpa) capacity approved for the project. This is terrible for the climate in and of itself, and additionally, Carmichael would be the first coal mine in the Galilee Basin, making it easier for more mines to be developed. If all the proposed Galilee Basin mines went ahead, around 705 million tonnes of carbon dioxide pollution would be produced each year from the combustion of Galilee Basin coal, which is 1.3 times Australia’s total annual emissions. It has been estimated that burning all of the coal in the Galilee Basin would produce a total of 20-30 gigatonnes of CO2 emissions (GtCO2), which is 5-7% of the entire remaining carbon budget for the Paris Agreement’s 1.5 degree limit (420 GtCO2).

Adani Group is also planning to either own, develop or operate thermal coal mines of up to 72mtpa capacity in India. Beyond thermal coal mining and burning, subsidiary Adani Ports is aiming for a 12% compounded annual growth in coal handling for fiscal year (FY) 2021 and it operates what it calls the biggest coal import port at Mundra. This same subsidiary is proposing to build a new coal terminal of up to 71mtpa at Kattupalli port. Adani Group plans to increase capacity at its North Queensland Export Terminal (formerly Adani Abbot Point Terminal) in the Great Barrier Reef World Heritage Area by 20%, from 50 to 60mtpa.

These new coal projects, at a time when climate scientists, the UN and the International Energy Agency are all saying no new coal projects can be built and coal-fired power must be phased out by 2030 in developed countries and 2040 in developing countries, should send alarm bells ringing through any investor or bank linked to the Adani Group.

While many of the more ethical or forward-thinking financial institutions are cutting ties with the Adani Group, it is still succeeding in raising billions via international credit markets to fund its expansion. Adani Group’s bond arrangers and investors, including Barclays, Standard Chartered, MUFG, BlackRock, State Bank of India, HSBC, JP Morgan and Deutsche Bank are playing a critical role in helping, directly or indirectly, fund new thermal coal projects.

In meetings with Market Forces, some of these financiers point to Adani Group’s expansion into renewable energy as evidence the conglomerate is “transitioning to clean energy”. This is obviously ridiculous. Building new coal mining and coal burning infrastructure is the opposite of transitioning to clean energy. Investing in new thermal coal mines and power stations in 2021 locks in polluting infrastructure for decades to come. The size of Adani’s ambitions, if it proceeds, will undermine global efforts to limit global warming.

Adani Group’s investors and bond arrangers must look beyond the greenwash and judge Adani Group by its actions, not words. They have the power and the responsibility to convince Adani to drop the Carmichael and other new thermal coal projects. If they cannot do so then they must cut ties with Adani Group and stop supporting its climate-wrecking activities.

For more information see our research on Adani Group’s massive fossil fuel expansion plans.

Take action: write to Adani Group investors and bond arrangers, asking them to convince Adani to abandon its new thermal coal projects like Carmichael, or cut ties with the group.