Adaro Energy Indonesia

A coal miner threatening global climate goals

Adaro Energy Indonesia (Adaro) is a coal mining company with no credible plans to diversify and transition away from coal.

Adaro’s “green” transition pathway does not mention a cap or reduction of overall coal production. The recently released “Decarbonization” pathway of Adaro involves building an aluminium smelter in North Kalimantan, which enables a new 1.1 GW coal-fired power plant and expanding its metallurgical (coking) coal production. At the same time, Adaro continues ramping up its overall coal production.

The new coal-fired coal plant controversy has led to financial institutions propping up Adaro exiting the company, with recent examples Singaporean banks DBS and OCBC and UK’s Standard Chartered Bank both advising that they would no longer be funding Adaro.

The remaining financial institutions must commit to providing no further financial support to Adaro unless Adaro produces plans to transition away from coal in a manner consistent with the Paris Agreement goals and net zero by 2050.

Adaro’s business plan bets on catastrophic climate change

Adaro increased its coal production by 19%, from 52.7 million tonnes in 2021 to 62.8 million tonnes in 2022, and ramped up its 2023 coal production target to 62-64 million tonnes. Adaro derived 98% of its 2022 revenue from coal. Despite the statement from the International Energy Agency (IEA) that no new coal mines or coal mine extensions are necessary, Adaro has three new (greenfield) metallurgical coal mining areas yet to operate and produce coal.

Adaro’s mining destroys local communities

The Wonorejo village, which was once occupied by transmigrants from Java, has now become part of Adaro’s mining complex. Since 2006, Adaro has systematically bought up the land to support its mining area expansion. Some villagers willingly sold their land, there were others who resisted and finally relented after they were intimidated into selling their land to Adaro. These villagers were eventually evicted to accommodate Adaro’s mining area expansion.

Image: A woman holds an umbrella as she waits with her family to be evacuated by the rescue team on a bamboo raft in front of her flooded house in South Kalimantan, Indonesia. The flooding has been linked to massive land clearing for palm oil plantations and coal mining activities in South Kalimantan. © Putra / Greenpeace.

Adaro’s mining activities are linked with deadly flooding in Kalimantan. In January 2021, South Kalimantan region of Indonesia was hit by a massive flood that killed 21 people, displaced 63,000 people from their homes and affected at least 340,000 people. Apart from extreme rainfall, the floods have been linked with degraded land due to coal mining in the water catchment area.

Adaro operates the largest single-site coal mine in South Kalimantan and is one of the mining companies that has caused the degradation of the Barito river’s water catchment areas. There are nine flooded areas around Adaro’s concession.

In the North Kalimantan region, Adaro’s new coal plant could contribute to threatening the livelihood of local fishermen

The site for Adaro’s new aluminium smelter and new coal-fired power plant in North Kalimantan is projected to contribute to a host of environmental impacts. The project is located inside the North Kalimantan Industrial Park in the province of North Kalimantan.

Activities from the industrial park, could result in the effects of hot water waste contamination, coal-fired power plant fly ash, rising air temperatures, project smoke, noise, sea dredging, and spilt coal/fuel spills will cause the sea to become murky, which will cause tourism (industry) to decrease and the quality and quantity of (fish) catches to significantly decrease.

How Adaro is driving climate change

Adaro increased its coal production by 19%, from 52.7 million tonnes in 2021 to 62.8 million tonnes in 2022. It ramped up its coal production target to 62 – 64 million tonnes in 2023.

Adaro has 1 billion of coal reserves. Burning all of the thermal and metallurgical coal would result in 2.2Gt CO2-eq, almost equivalent to India’s annual emission.1

Adaro is building a new 1.1 GW coal-fired power plant, even though the International Energy Agency has made clear that there can be no new coal-fired power plants approved if we want to achieve net zero emissions by 2050.

Company details

Despite Adaro’s Decarbonization statement, it has no time-bound plans and targets to reduce its thermal coal business. Adaro plans to achieve its 50% revenue target from non-thermal coal business by expanding downstreaming of mineral products – which partly reliant on coal energy, and growing its metallurgical coal business.

A credible transition plan must include how Adaro, a pure-play coal mining, plans to shift away from the coal business. This must include a clear timeline for when it will stop all coal production in a manner consistent with the Paris Agreement goals and net zero by 2050.

Adaro has greenfield coal mining areas covering around 34,000 hectares with estimated coal resources of 3.3 billion tonnes, “making it one of the largest undeveloped deposits of low calorific value coal” according to its 2022 Annual Report

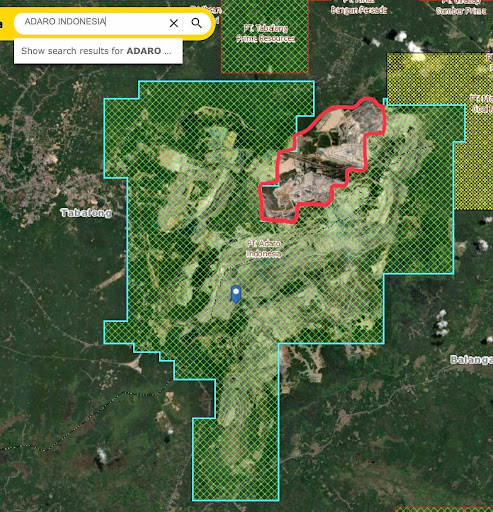

The map below is a screenshot taken from the Indonesian Ministry of Environment and Mineral Resources official concession map. The area outlined in red shows where Adaro’s mine exceeds its official licence area.

These are the financial institutions propping up Adaro

Banks that have provided loans to Adaro

In April 2021, a group of 14 banks loaned a total US$400 million to Adaro’s largest subsidiary in thermal coal mining, Adaro Indonesia.

In July 2022, a group of 7 banks – CIMB, UOB, Mandiri, Permata, Bank of China, CTBC, and Qatar National Bank – continues to support Adaro and provided a US$350 million loan for a unit of Adaro Energy Indonesia, Saptaindra Sejati.

In May 2023, a group of five Indonesian domestic banks – Mandiri Bank, Bank Negara Indonesia (BNI), Bank Central Asia (BCA), Bank Rakyat Indonesia (BRI), Permata Bank – provided a total of IDR2.5 trillion and US$1.5 billion loans to Adaro’s smelter and coal power plant subsidiaries. Kalimantan Aluminium Industry (KAI), and Kaltara Power Indonesia (KPI).

These banks are enabling Adaro’s expansionary coal business, construction of a new coal-fired power plant, and backing a company whose plans undermine the 1.5°C goal of the Paris Agreement.

Adaro’s banks

| wdt_ID | Bank | Amount loaned since 2021 | Ruled out Adaro and smelter project? | Explanation |

|---|---|---|---|---|

| 1 | Bank Mandiri | US$781million | No | Able to finance Adaro under its current policy. |

| 2 | Bank Rakyat Indonesia | US$465million | No | Able to finance Adaro under its current policy. |

| 3 | Bank Negara Indonesia (BNI) | US$399million | No | Able to finance Adaro under its current policy. |

| 4 | Bank Central Asia (BCA) | US$270million | No | Able to finance Adaro under its current policy. |

| 5 | CIMB Bank | US$153million | No | CIMB has not made any commitment to stop providing support to Adaro. In December 2020, CIMB committed to phasing out coal from its portfolio by 2040 and will prohibit asset-level or general corporate financing for new thermal coal mines as well as expans |

| 6 | Bank Permata | US$133million | No | Able to finance Adaro under its current policy |

| 7 | United Overseas Bank | US$103million | No | UOB has not made any commitment to stop providing support to Adaro. UOB’s policy states that UOB will not knowingly provide financing to companies for the development of greenfield thermal coal mines or thermal coal mine expansion projects. The policy |

| 8 | Maybank | US$75million | No | Maybank has not made any commitment to stop providing support to Adaro. Maybank’s latest policy in September 2022 states that it is committed to not financing any new greenfield coal activity and no new borrowers engaged in thermal coal-related activitie |

| 9 | Standard Chartered Bank | US$33million | Yes | Standard Chartered Bank advised that they would no longer be funding Adaro. Standard Chartered also confirmed that it will not be involved in Adaro’s new smelter projects that would enable a new coal-fired power plant |

| 10 | Qatar National Bank | US$33million | No | Able to finance Adaro under its current policy |

| 11 | Sumitomo Mitsui Banking Corporation | US$20million | No | SMBC has not made any commitment to stop providing support to Adaro. SMBC’s policy states it will not provide support for new or expansion of existing thermal coal mining projects. |

| 12 | CTBC Bank | US$19.6million | No | Able to finance Adaro under its current policy |

| 13 | Bank of China | US$15million | No | Bank of China has not made any commitment to stop providing support to Adaro. In 2020, Bank of China stated it would no longer provide financing for new coal mining and coal power projects overseas. |

| 14 | HSBC | US$10million | Yes | Under HSBC’s latest thermal coal policy, HSBC is restricted from providing any financial support to new coal-fired power plants, including captive coal-fired power plants. In the policy, HSBC states that “For the avoidance of doubt, the Policy does apply |

| 15 | Citibank | US$8million | No | Citibank has not made any commitment to stop providing support to Adaro. Citibank will not provide project-related financial services for the new thermal coal mines or significant expansion of existing mines. |

| 16 | Bank Danamon | US$8million | No | Able to finance Adaro under its current policy |

Adaro’s international shareholders and bondholders

| wdt_ID | Asset Manager | Bondholder | Shareholder |

|---|---|---|---|

| 1 | AllianceBernstein L.P. | Yes | Yes |

| 2 | BlackRock | Yes | Yes |

| 3 | Credit Suisse | Yes | Yes |

| 4 | Dimensional Fund Advisors, L.P. | No | Yes |

| 5 | Fidelity International | Yes | Yes |

| 6 | Goldman Sachs Asset Management | No | Yes |

| 7 | HSBC Global Asset Management | Yes | Yes |

| 8 | Invesco | Yes | Yes |

| 9 | JP Morgan Asset Management | Yes | Yes |

| 10 | Manulife | Yes | Yes |

| 11 | Maybank Asset Management Singapore | Yes | No |

| 12 | Mitsubishi UFJ Kokusai Asset Management | No | Yes |

| 13 | UBS Asset Management | Yes | Yes |

| 14 | Vanguard | No | Yes |

Banks and institutional investors must commit to providing no further financial support to Adaro unless Adaro produces time-bound plans to transition away from coal, and halt the construction of the new coal-fired power plants, consistent with the climate goals of the Paris Agreement and IEA Net Zero 2050 pathway.

Disclaimer

Information comes from the companies’ available annual reports and websites, Refinitiv Eikon, Bloomberg and various news reports.

Occasionally where information is incomplete, assumptions must be made about data and these were made in a consistent manner and in good faith. Whilst we have endeavoured to gather and include all relevant deals, we cannot guarantee the completeness of the information presented.

Join us

Subscribe for email updates: be part of the movement taking action to protect our climate.