19 April 2019

The decision by the Japan Bank for International Cooperation (JBIC) and a consortium of commercial banks to finance the proposed Van Phong 1 coal-fired power station in Vietnam has been branded as shameless and cowardly by clean energy advocates.

JBIC announced on its website that financing had been concluded, despite:

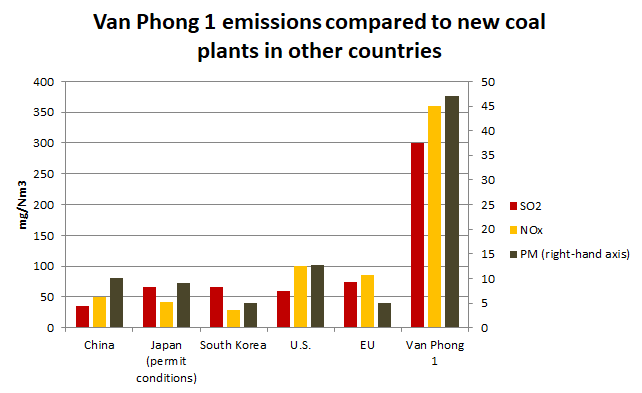

- Van Phong 1’s Environmental and Social Impact Assessment (ESIA) revealing air pollution rates would be up to nine times higher than those of the average Japanese coal power station,

- The community consultation process was handled by the local government instead of an independent entity, and no evidence that replacement livelihoods were offered to dozens of families relocated from the area,

- The fact that Van Phong 1 plans to use supercritical boiler technology, which is not allowed under the OECD sector understanding on coal power stations.

JBIC met with Market Forces earlier in the week, confirming the above points as correct and undertaking to receive and act on further information before proceeding to finance the project.

“JBIC has just proven itself a wholly untrustworthy and cowardly organisation”, said Market Forces Executive Director Julien Vincent.

“Having undertaken just days ago to receive and act on new information that indicates Van Phong 1 would breach the bank’s social and environmental guidelines, JBIC has instead rushed out a pre-holiday approval in an attempt to avert public scrutiny and accountability for the impacts this project would create for the environment and livelihoods.”

“It takes bad faith to another level with an institution can commit to respecting process and following up material concerns, then proceed to provide a US$1.2 billion subsidy to a polluting and disruptive project.

This week also saw DBS and OCBC, Singapore’s largest banks, introduce policies to stop funding new coal power lending. However, these policies made space for projects they were already in negotiation to finance to continue, and Van Phong 1 was among those projects.

“We hope DBS and OCBC enjoyed their 24-72 hours of feeling green this week”, said Mr Vincent. “They are as aware as any other bank of the impacts that Van Phong 1 would pose to people the environment and climate. Everything about this project points to why DBS and OCBC should move away from coal, yet they chose to undermine their own climate credibility just days after improving their policy”.

“It is shameful that JBIC decided to finance a new coal power in Vietnam when just one day earlier, international civil society called PM Abe to act on climate change”, said Ayumi Fukusaka, Friends of the Earth Japan Campaigner for Climate and Energy.

The statement can be seen below:

“Building new coal power plants accelerates climate change and everyone on the planet, including Japanese people, will suffer from its consequences.

“In Vietnam, people are already suffering from severe air pollution and the effects of climate change. It is unacceptable to finance coal, let alone an inefficient coal power. It worsens pollution and people’s lives.

“JBIC must immediately stop financing Van Phong 1.”

Shin Furuno, Senior Regional Campaigner, East Asia Finance, 350.org said “Japans big three commercial banks – MUFG Bank, Sumitomo Mitsui Banking Corporation (SMBC) and Mizuho Bank – have just demonstrated their wholly inadequate policies on coal financing and the urgent need to update their credit policies in line with the Paris Agreement.

“In particular, SMBC’s support for this project is disappointing given their recent endorsement of the UN Principles for Responsible Banking, which commits banks to align their business strategies with the goals of the Paris Agreement.”