17 November 2020

At its annual general meeting today, New Hope Corporation faced a shareholder resolution calling on the company to wind up its coal production in line with the climate goals of the Paris Agreement.

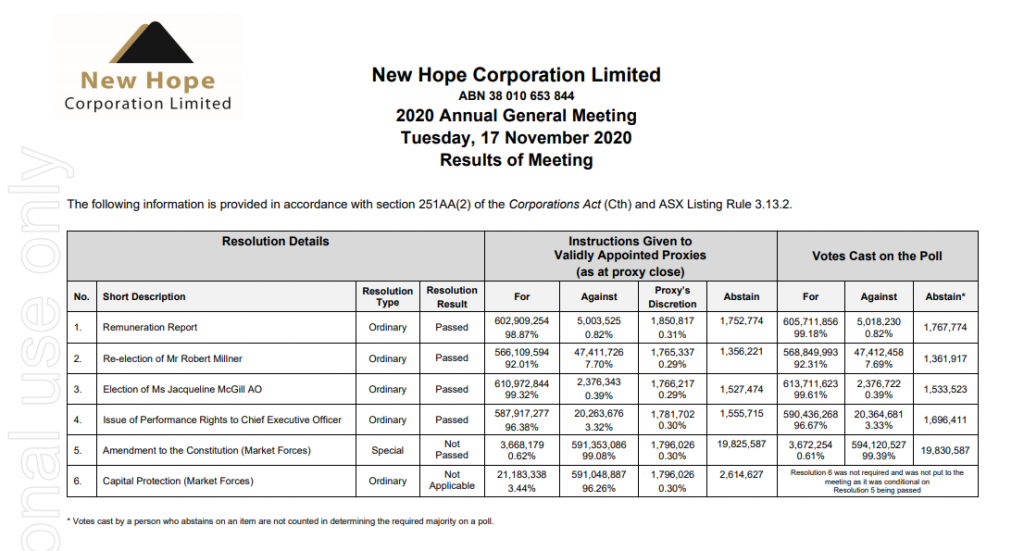

With the Board recommending shareholders vote against the resolution, and parent company Washington H Soul Pattinson controlling 50% of the company’s shares, 3.44% of New Hope’s investors ended up supporting the resolution.

The shareholder proposal sought to protect shareholders’ capital from being wasted on coal production that would have no market in an energy transition consistent with limiting global warming to 1.5°C, and asked the company to support workers to transition through a managed decline in production.

New Hope’s rejection of the resolution, and comments at the AGM demonstrated the company is becoming increasingly detached from the transition away from coal required to meet the Paris climate goals. Any large investors that haven’t already followed the smart money out of coal mining companies like New Hope should be concerned by the company’s refusal to recognise this rapid transition, which is already underway.

New Hope’s CEO Reinhold Schmidt said in September “Thermal coal is part of the long term energy mix, it will always be there,” and “there will always be a future for us.”

Since then a number of New Hope’s major export markets have announced significant climate policy updates, and the International Energy Agency has stated that they do not expect coal to ever recover to pre-Covid levels.

At today’s meeting, Mr Schmidt stated categorically that he stands by his earlier statements, but referred to coal demand scenarios consistent with catastrophic global warming of 4°C or more.

Failing to respond to policy shifts

Net-zero by 2050 is a particularly hot topic for New Hope, given two of its top five markets have recently signed up to achieve that goal (Japan: 41% of FY20 revenue, and Korea: 6%), another (China: 12%) aims to hit net zero by 2060, and opposition parties in the remaining two (Taiwan: 7% and Australia: 12%) have net-zero 2050 policies.

When asked if the board requested and / or reviewed modelling of potential impacts on demand due to these recent net-zero emissions commitments, and how these commitments being factored into New Hope’s strategic and capital expenditure planning, the response was simply: “We have not considered that yet.”

Silence on lower warming scenarios speaks volumes

In his opening address, company Chair Robert Millner referred to two of the International Energy Agency’s energy demand forecasts released in 2019 when explaining why the company “remain[s] positive about the future”.

However, Mr Millner conveniently failed to mention the IEA’s 2020 update, in which coal production forecasts were significantly revised downwards, or the other IEA forecast, the Sustainable Development Scenario, which is aimed at holding global warming to less than 2°C and shows coal demand declining sharply.

When asked about the company’s resilience under the IEA’s 2020 scenarios, Mr Schmidt said these updated scenarios would be considered in the company’s Sustainability Report to be released in 2021. Given the IEA’s new net zero 2050 scenario shows coal-fired power falling by 75% by 2030, it’s impossible to see how New Hope could “remain positive about the future” under these updated scenarios.