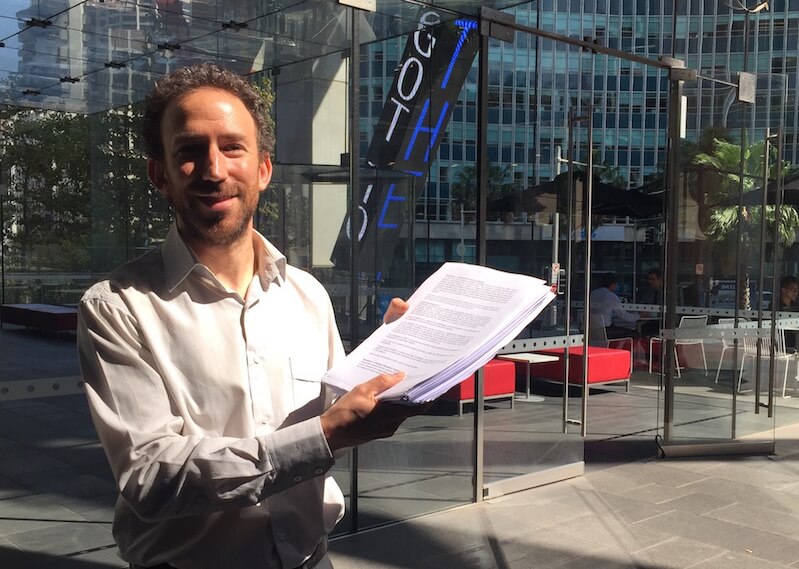

Today, shareholders coordinated by Market Forces together with the $2.85 billion investment manager Australian Ethical, lodged a resolution calling on QBE Insurance to set targets that reduce its investment in and underwriting of coal, oil and gas companies, in line with keeping global warming below 1.5C.

This move comes off the back of QBE once again missing an opportunity to end its support for climate-wrecking fossil fuels, with the release last month of an updated but woefully inadequate Climate Change “Action” Plan.

QBE provides insurance for some of the world’s most polluting coal mines and power stations, tar sands production, oil rigs and gas pipelines. Without its backing, these destructive industries would find it much harder to operate and expand. QBE’s latest Climate Change “Action” Plan does nothing to end this support and is a slap in the face for global efforts to tackle global warming.

Additionally, the losses incurred by QBE on catastrophes, which are exacerbated by global warming (fueled by the fossil fuel companies it underwrites), are a direct hit to the shareholder capital invested in QBE, and present major risks to the insurance industry’s ability to operate. According to Tom Herbstein of Cambridge University’s ClimateWise insurance project, “climate change fundamentally challenges the existing insurance business model because it is rendering actuary analysis in many places obsolete.”

In 2018 both IAG and the NZ Reserve Bank warned the effects of climate change will render huge swathes of the globe uninsurable. The same warning was made for Townsville after its record-breaking floods in February 2019. According to Munich Re, Australian weather-related insurance losses rose fourfold over the three decades to 2012. The trend is clear. Without drastic action in both climate change mitigation and adaptation, QBE faces shrinking markets and more unpredictable natural catastrophe claims.

Without drastic action in both climate change mitigation and adaptation, QBE faces shrinking markets and more unpredictable natural catastrophe claims.

Last year, a shareholder resolution pushed QBE to finally get started on disclosing to investors the risk it faces from climate change. However, disclosure is not enough, QBE also needs to actually do something to reduce its climate risks.

The latest shareholder resolution will be voted on at QBE’s annual general meeting on 9 May 2019. By voting in its favour, superannuation funds and other major investors will have an opportunity to prove their commitment to tackling climate change risk and “engaging” with irresponsible companies (rather than divestment) goes beyond mere words.

See the full QBE resolution and statement of support ( pdf download – scroll to Resolution 2)