18 October 2022

The latest round of mandatory super fund disclosures reveal that most of Australia’s biggest super funds are selling shares in climate wrecking oil and gas companies Santos and Woodside. Some funds, however, have significantly increased their stake in these companies, which are both pursuing new oil and gas projects that are incompatible with limiting global warming to 1.5°C.

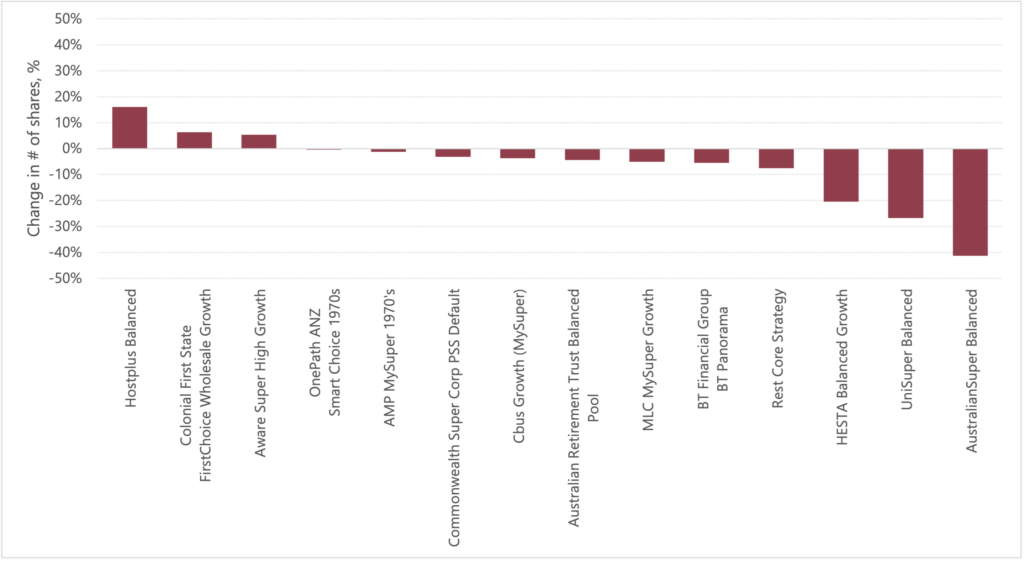

For the first time since super fund investment disclosures became mandatory, we can compare how many shares funds have either sold or bought in their default investment options. Our analysis shows that 11 out of the 14 super fund default investment options captured in our study owned less shares in Santos at 30 June 2022 than at 31 December 2021 (see Figure 1). AustralianSuper, UniSuper and HESTA have sold down a significant number of Santos shares in their default options, selling down their stakes by 41.3%, 26.8% and 20.5%, respectively.

Hostplus’ Balanced option, on the other hand, is the only one in our study to have significantly increased its stake in Santos, with a 16.1% jump in shares. Why is Hostplus using members’ retirement savings to buy up so many shares in this climate wrecker? Supporting Santos’ oil and gas expansion plans wildly contradicts the net zero by 2050 portfolio emissions reduction target Hostplus set earlier this year.

Take action

Tell your super fund to stop investing in Santos and Woodside and their climate-wrecking expansion plans.

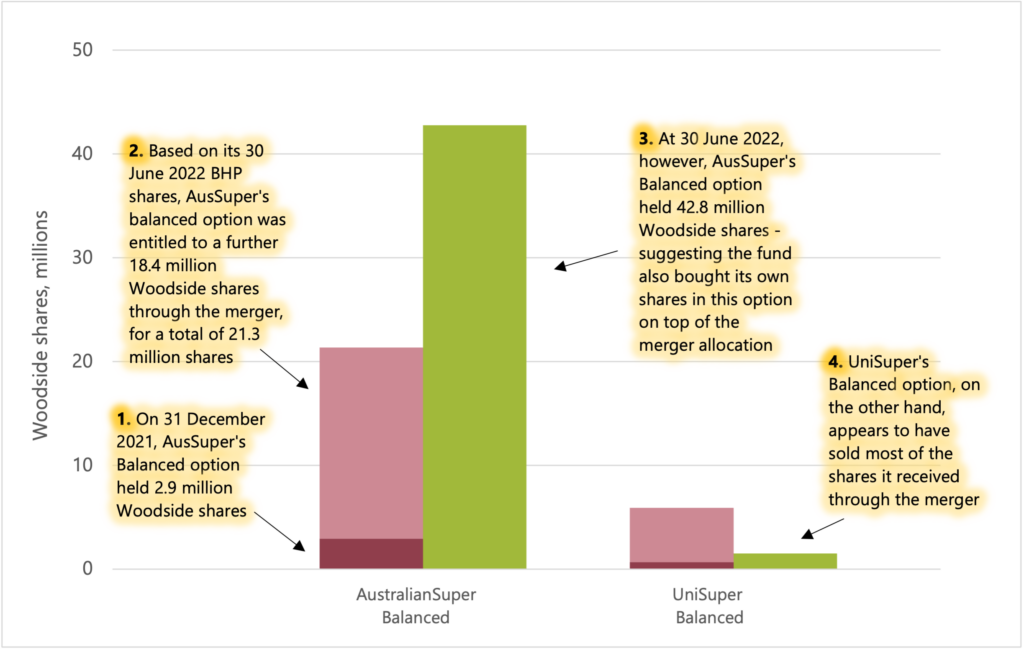

Eight out of 14 funds also appear to have sold shares in Woodside in their default options over the period from 31 December 2021 to 30 June 2022, after taking into account the shares these funds (as BHP shareholders) would have received through Woodside’s merger with BHP’s petroleum business at the start of June.

Although entitled to a large number of Woodside shares as a BHP shareholder, UniSuper’s Balanced option only saw a slight increase in Woodside share ownership over the six month period. As such, we estimate this option sold down its Woodside position by nearly three-quarters, post-merger. HESTA’s Balanced Growth option appears to have sold more than one-fifth of its Woodside shares, while Cbus’ Growth (MySuper) option reduced its position by one-sixth.

Though there is still work to be done, this progress is great news for the more than 15,000 UniSuper members who have been demanding the fund divest from companies expanding the fossil fuel industry, including Santos and Woodside. HESTA members have been demanding their fund do the same thing, yet have mostly been met with staunch opposition from HESTA, which claims engagement with (rather than divestment from) these companies will bring them into line with the Paris climate goals. Yet engagement with the likes of Santos and Woodside has clearly failed to do this. Has HESTA finally realised this and started escalating its action at these companies? Is it quietly selling down shares in response to members’ concerns? Or is the fund failing to listen to members and simply playing the market with these share sales?

AustralianSuper’s Balanced option, however, has increased its share ownership in Woodside by a massive 14 times – a jump that can only partly be explained by AustralianSuper’s existing shareholding in BHP (see Figure 2). This is despite being one of the few funds to have previously sold down a big stake in Woodside. Why has AustralianSuper changed its tune on Woodside and suddenly bought up so many shares in this climate pariah? This move flies in the face of AustralianSuper’s net zero by 2050 commitment and support for the Paris climate goals.

Climate scientists have been telling us for years there is no room for new oil and gas fields to be developed if we are to limit global warming to 1.5°C, while independent analysis of Santos and Woodside’s new and planned projects has confirmed they are incompatible with that goal. Yet both companies are still recklessly pursuing oil and gas expansion plans that would doom the Paris climate goals to failure.

Santos’ Barossa project, for example, has been labelled by energy experts “…a CO2 emissions factory with an LNG by-product,” yet the company has recently sanctioned another new climate-wrecking oil field incompatible with the Paris climate goals. Independent analysis of Woodside’s Scarborough-Pluto combined project has also concluded the project “…represents a bet against the world implementing the Paris Agreement,” but Woodside has recently confirmed its intention to continue pursuing the monstrous Browse offshore gas basin.

Has your super fund bought or sold shares in Santos and Woodside since December 2021? Check out our tables below to find out and take action.

Santos share ownership changes in the default investment options of Australia’s biggest super funds (by assets under management), December 2021 to June 2022

| wdt_ID | Fund | Investment option | # Santos shares 31 December 2021 | # Santos shares 30 June 2022 | Relative difference | formula_1 |

|---|---|---|---|---|---|---|

| 1 | AustralianSuper | Balanced | 11,393,382 | 6,687,859 | -41.3 | 41.30 |

| 2 | Commonwealth Super Corp | PSS Default | 7,845,919 | 7,595,870 | -3.2 | 3.19 |

| 3 | Australian Retirement Trust (formed after the merger between QSuper and Sunsuper) | Balanced Pool | 18,203,035 | 17,409,763 | -4.4 | 4.36 |

| 4 | Aware Super | High Growth | 24,724,863 | 26,053,271 | 5.4 | -5.37 |

| 5 | AMP | MySuper 1970's | 2,945,243 | 2,909,068 | -1.2 | 1.23 |

Woodside share ownership changes in the default investment options of Australia’s biggest super funds (by assets under management), December 2021 to June 2022

| wdt_ID | Fund | Investment option | # Woodside shares 31 December 2021 | Estimated Woodside share entitlement based on 30 June 2022 BHP holding | Implied Woodside shareholding post-BHP merger | # Woodside shares 30 June 2022 | Estimated Woodside shares bought or sold | % change 30 June 2022 shareholding vs implied holding post-BHP merger |

|---|---|---|---|---|---|---|---|---|

| 1 | AustralianSuper | Balanced | 2,920,141 | 18,444,402 | 21,364,543 | 42,769,762 | 21,405,219 | 100.2 |

| 2 | Commonwealth Super Corp | PSS Default | 2,217,451 | 2,398,074 | 4,615,525 | 4,620,991 | 5,466 | 0.1 |

| 3 | Australian Retirement Trust (formed after the merger between QSuper and Sunsuper) | Balanced Pool | 5,893,538 | 5,080,760 | 10,974,298 | 11,418,291 | 443,993 | 4.0 |

| 4 | Aware Super | High Growth | 4,405,219 | 4,766,192 | 9,171,411 | 8,865,685 | -305,726 | -3.3 |

| 5 | AMP | MySuper 1970's | 890,179 | 558,879 | 1,449,058 | 1,241,115 | -207,943 | -14.4 |

For more information on super funds’ investments in climate-wrecking oil and gas companies, check out our Santos and Woodside web pages.

Update: 20 October 2022

Market Forces’ analysis found Hostplus’ Balanced investment option had increased its shareholding in Santos by 16.1% between 31 December 2021 and 30 June 2022. Hostplus has responded to the analysis, claiming its ‘increased stake in SANTOS came about due to the merger between HOSTPLUS and Statewide Super.’

Statewide Super did not disclose its full 31 December 2021 portfolio holdings prior to its merger with Hostplus, so Market Forces does not have the publicly-available data to scrutinise Hostplus’ claim. We have conducted our analysis based on super funds’ own published holdings disclosures. Information on Statewide Super’s website indicated the fund invested in Santos, which may explain some increase in Santos shares held by Hostplus post-merger.

Our analysis also found Hostplus’ Balanced option’s investment exposure to Santos (as a proportion of Australian listed equities) increased from 2.21% to 2.96% across the period 31 December 2021 to 30 June 2022.

Further to this, our April 2022 analysis found Hostplus’ balanced option had the second highest exposure to Santos at 31 December 2021 of the options in the study.

If Hostplus is ‘fully committed’ to transitioning its investment portfolio to net zero emissions by 2050 through engagement with portfolio companies, why did the fund vote against shareholder resolutions put to Woodside and Santos this year, which sought to bring their business plans into line with the goal of net zero by 2050?

Hostplus is still investing members’ retirement savings in thermal coal miners Whitehaven and New Hope, when many big super funds are already divesting. The fossil fuel expansion plans of these companies are completely out of line with the goal of net zero by 2050.

More information

Woodside and BHP Petroleum merger

Woodside took over BHP’s petroleum business on 1 June 2022. The deal saw eligible BHP shareholders—including almost all Australian super funds—issued one Woodside share for every 5.534 BHP shares they held on 26 May 2022.

Methodology

The scope of our analysis covers the default (or largest) investment options of Australia’s largest 15 super funds by assets under management (AUM), according to APRA’s June 2021 fund-level superannuation statistics, Table 1 and Table 2. Where mergers between super funds have occurred since June 2021, the single merged entity is listed on the table (noting the previous fund name/s) and occupies only one position on the table, unless the merged funds remain as standalone brands with standalone policies. The information in the above tables pertains to 14 funds, because QSuper and Sunsuper merged in February 2022 to form Australian Retirement Trust.

We identified the total number of shares each option had invested in Santos at 31 December 2021 and 30 June 2022, using the difference to calculate the relative change in share ownership.

We identified the total number of shares each option had invested in Woodside at 31 December 2021 and 30 June 2022, as well as the total number of shares each option had invested in BHP at the same dates. Using the BHP shareholding figure for each option at 30 June 2022, we calculated the number of shares each fund would have been entitled to if they held that same number of shares on 26 May 2022, that being one Woodside share for every 5.534 BHP shares. On this assumption, we were then able to calculate the theoretical share ownership had the fund only held onto its newly distributed shares, and compare that with the actual Woodside shareholding at 30 June 2022. This allows for an estimate of whether a fund has sold down newly distributed shares or increased its position in its own right.

BT Financial Group’s BT Panorama investment option has ‘Woodside Energy Group Ltd’ categorised under its ‘listed infrastructure’ asset class in its 30 June 2022 portfolio holdings disclosure. We have assumed this is in fact a listed equity asset as it is in the other funds analysed here.

Sources

Portfolio holdings disclosures for funds as at 30 June 2022 were sourced from each fund’s website (see below). The 31 December 2021 portfolio holdings disclosures were also sourced from each fund’s website, between March and April this year.

Portfolio holdings disclosures

- AMP

- Australian Retirement Trust

- AustralianSuper

- Aware Super

- BT Financial Group

- Cbus

- Colonial First State

- Commonwealth Super Corp

- HESTA

- Hostplus

- MLC

- OnePath

- Rest

- UniSuper

Disclaimer

The information provided by Market Forces does not constitute financial advice. The information is presented in order to inform people motivated by environmental concerns and take actions based on those concerns. Market Forces is organising data for environmental ends.

The information and actions provided by Market Forces do not account for any individual’s personal objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

Market Forces recommends all users obtain their own independent professional advice before making any decision relating to their particular requirements or circumstances. Switching super funds may have unintended financial consequences.

For more information about Market Forces, please visit the about page of the site.