21 November 2018

Super funds invest our retirement nest eggs in major infrastructure projects and assets, not just companies.

This means you are likely to own a piece of some of the biggest, dirtiest fossil fuels projects on the planet.

Market Forces has found widespread investment in fossil fuel infrastructure among Australia’s 50 largest super funds from just a quick look at a handful of projects. Equally worrying, we found most funds aren’t even disclosing to their members which of these dirty projects they own.

The International Energy Agency now warns that the world has "no room to build anything that emits CO2 emissions” if we are to meet the upper 2°C limit of the Paris climate accord. It’s likely too that existing fossil fuel infrastructure will have to be shut down earlier than expected.

The IPCC tells us that limiting warming to 1.5°C rather than 2°C is crucial to avoid a wipe out of the Great Barrier Reef. Keeping to 1.5°C will also halve the number of people exposed to water stress globally, and stop an extra 40,000 people in small island countries from losing their homes to sea level rise by 2150. A 1.5°C warming limit means an even more rapid shift away from fossil fuels.

So the big question is why are our super funds investing billions of dollars of our retirement money in projects that fuel dangerous global warming and which also may end up as stranded, worthless assets?

And how many more of these kinds of investments are they hiding from us?

Use the form below to contact your super fund about its fossil fuel infrastructure investments.

Is this your fossil fuel project?

Freeport LNG

Freeport is a US$13 billion liquefied natural gas (LNG) export terminal being built in Texas, with plans to process millions of tonnes of fracked shale gas every year. Construction was severely disrupted by Hurricane Harvey in 2017 so its dirty operations will now start in late 2019. Climate scientists say Harvey was likely supercharged by climate change.

LNG will be the biggest driver of emissions growth in the oil and gas sector out to 2025. The LNG process - including production, processing, exporting and eventual burning of natural gas - is extremely emissions intensive. Methane, the main component of natural gas, is also a much more potent greenhouse gas than carbon dioxide. Depending on the amount of methane emissions that escape during production and processing, LNG may be as bad for our climate as coal.

In November 2018, Japanese industrial giant Toshiba paid US$800 million to offload its interest in Freeport. One reason put forward for this expensive change of heart is the falling cost of renewable power, which reduces demand for gas.

Ironically, Freeport LNG is among the group of companies lobbying the US Government to fork out billions of dollars to build a wall to protect fossil fuel infrastructure from sea level rise, which is being driven by climate change. The very projects driving dangerous global warming are seeking handouts to deal with the damage they are helping to cause. All so they can produce and process more climate-wrecking fossil fuels!

Liquified Natural Gas (LNG) will be the biggest driver of emissions growth in the oil and gas sector to 2025.

Freeport terminal

Which super funds invest in Freeport LNG?

YES

- AustralianSuper

- Catholic Super

- Cbus

- Energy Super

- HESTA

- HOSTPLUS

- Media Super

LIKELY*

- ESSSuper

- Local Government Super

- LUCRF

- Mercer

- NGS Super

- Sunsuper

- Tasplan

- TWU

- VicSuper

- Vision Super

NO

UNKNOWN: AMP, APSS, BT, Colonial First State Commonwealth Bank Group Super, Commonwealth Superannuation Corp, EISS, equipsuper, First State, Super, GESB, IOOF, LGIAsuper, Macquarie, Maritime Super, Mine Super, MLC Super Fund, MTAA Super, Netwealth, OnePath, Perpetual, Qantas Super, QSuper, REST, Russell Investments, StatePlus, Statewide, Suncorp Super SA, Telstra Super, Unisuper, Westpac Mastertrust

*Super funds are listed as 'Likely' because they use IFM as an investment manager. IFM holds Freeport in its international infrastructure portfolio, but also offers an Australian infrastructure investment option, so we can’t be 100% confident that these super funds are invested in Freeport.

Port of Newcastle

The IPCC says we need to phase out coal power globally by 2050 in order to hold global warming to 1.5°C

Coal reclaimer at Port of Newcastle Credit: Max Phillips (Jeremy Buckingham MLC)

Newcastle is home to the world’s biggest coal export terminal, sending out around 160 million tonnes of coal every year.

Coal makes up over 90% of the value of its exports, so it’s fair to say the fortunes of the port hinge on the world continuing to burn coal. But the IPCC’s latest report shows we need to phase out coal power worldwide by 2050 to keep global warming to 1.5°C. To have even a fifty-fifty chance of not busting the upper 2°C limit enshrined in the Paris Agreement, Australian coal export volumes would need to decline by 2-23% to 2030, depending on potential changes in Australia’s share of global exports.

Newcastle Port has also been identified as facing large potential costs because of the direct physical impacts of climate change: rising sea levels and increased storm intensity. Under two different global warming scenarios, impacts on the Port of Newcastle are predicted to cost between US$153 million and US$166 million between 2070 and 2100.

A coal-dependant Port of Newcastle has no future in a 1.5°C warming pathway. So why are these super funds investing our retirement savings in this massive dirty fossil fuel project?

Which super funds invest in the Port of Newcastle?

YES

- ACSRF

- Catholic Super

- EISS

- Energy Super

- Media Super

- NGS Super

LIKELY*

- Commonwealth Superannuation Corp

- TWU Super

- Suncorp

- Sunsuper

NO

- AustralianSuper

UNKNOWN: AMP, Australia Post Super Scheme, BT, Care Super, Colonial First State, Commonwealth Bank Group Super, Construction & Building Unions Superannuation, equipsuper, ESSSuper, First State Super, GESB, HESTA, Hostplus, IOOF, LGIAsuper, Local Government Super, LUCRF, Macquarie, Maritime, Mercer, Mine Super, MLC Super Fund, MTAA Super, Netwealth, OnePath, Perpetual, Qantas Super, QSuper, REST, Russell Investments, State Super, Statewide, Super SA, Tasplan, Telstra Super, Unisuper, VicSuper, Vision Super, Westpac

*These funds are listed as 'Likely' to be invested in the Port of Newcastle as they use investment managers Gardior and / or Infrastructure Capital Group, whose portfolios include the Port of Newcastle.

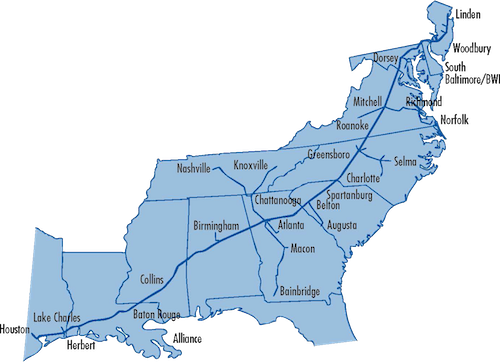

Colonial Pipeline Company

Colonial Pipeline transports refined petroleum products from refineries along the Gulf of Mexico coastline in southern USA to southern and eastern parts of the country. The pipeline is almost 9000 km long, the largest of its kind in the United States.

The IPCC’s latest report shows drastic action is needed to limit global warming to 1.5°C, and the devastating consequences of overshooting by even just half a degree. This 1.5°C limit requires a 45% reduction in global emissions by 2030, falling to net zero by 2050. That pathway imposes a swift move out of all fossil fuels, raising serious questions about the long-term sustainability of major infrastructure such as the Colonial Pipeline.

Already the pipeline has suffered several shut downs following Hurricanes Katrina and Rita in 2005, and Hurricane Harvey in 2017. Climate models project a 45-87% increase in the frequency of the most severe hurricanes in the US due to warming ocean temperatures and sea level rise.

Colonial Pipeline stretches from Houston, Texas to New Jersey

Which super funds invest in Colonial Pipeline?

YES

- Australian Super

- HESTA

- HOSTPLUS

LIKELY*

- Care Super

- Catholic Super

- Cbus

- ESSSuper

- Local Government Super

- LUCRF

- Media Super

- Mercer

- NGS Super

- Sunsuper

- Tasplan

- TWU Super

- VicSuper

- Vision Super

NO

- Energy Super

UNKNOWN: ACSRF, AMP, Australia Post Superannuation Scheme, BT, Colonial First State, Commonwealth Bank Group Super, Commonwealth Superannuation Corp, EISS, equipsuper, First State Super, GESB, IOOF, LGIAsuper, Macquarie Maritime, Mine Super, MLC Super Fund, MTAA Super, NAB Group Super, Netwealth, OnePath, Perpetual, Qantas Super, QSuper, REST, Russell Investments, StatePlus, Statewide, Suncorp, Super SA, Telstra Super, Unisuper, Westpac

*Super funds are listed as 'Likely' because they use IFM as an investment manager. IFM holds Colonial Pipeline in its international infrastructure portfolio, but also offers an Australian infrastructure investment option, so we can’t be 100% confident that these super funds are invested in Colonial.

Neerabup Power Station

Neerabup is a gas-fired power station on the northern outskirts of Perth. It came online in 2009 and has an expected lifetime of 30 years. Although the Paris climate goals do not require gas power to be phased out as rapidly as coal, meeting the 1.5°C target means a 45% reduction in global emissions by 2030.

Gas for the Neerabup plant is sourced mainly from North West Shelf offshore gas field, and delivered through the Dampier to Bunbury Natural Gas Pipeline.

Apart from the obvious climate impacts of burning fossil fuels, offshore oil and gas production creates serious spillage risks. Woodside's North West Shelf project has already caused a significant oil spill of over 10,000 litres in 2016.

The gas pipeline corridor impacts several areas of conservation value including national parks, nature reserves, conservation reserves, environmentally sensitive areas, and one threatened ecological community.

Neerabup Power Station in Western Australia relies on major fossil fuel infrastructure and resource projects and is exposed to physical climate hazards

Which super funds invest in Neerabup Power Station?

YES

- Catholic Super

- Media Super

LIKELY*

- ACSRF

- Commonwealth Superannuation Corp

- NGS Super

- TWU Super

NO

- AustralianSuper

- Energy Super

UNKNOWN: AMP, Australia Post Superannuation Scheme, BT, Care Super, Cbus, Colonial First State, Commonwealth Bank Group Super, EISS, equipsuper, ESSSuper, First State Super, GESB, HESTA, HOSTPLUS, IOOF, LGIAsuper, Local Government Super, LUCRF, Macquarie, Maritime, Mercer, Mine Super, MLC Super Fund, MTAA Super, Netwealth, OnePath, Perpetual, Qantas Super, REST, Russell Investments, StatePlus, Statewide, Suncorp, Sunsuper, Super SA, Tasplan, Telstra Super, Unisuper, VicSuper, Vision Super, VicSuper, Westpac Mastertrust

*These funds are listed as 'Likely' to be invested as they use Infrastructure Capital Group as an investment manager. Neerabup is part of two of ICG's three infrastructure investment options.

Esperance Energy Project

The Esperance Energy Project is a 336km gas pipeline and 39MW gas power station on the south coast of Western Australia.

Esperance has already seen something of a mini-scale energy revolution. After a number of rural properties were cut off from the electricity network by bushfire damage in 2015, five off-grid solar and battery storage systems were installed to replace supply. As renewable energy generation and storage technologies quickly become cheaper and more sophisticated, hopefully a larger scale clean energy revolution makes dirty fossil fuel energy infrastructure like Esperance obsolete.

Which super funds invest in Esperance Energy?

YES

- Catholic Super

- Media Super

LIKELY*

- ACSRF

- Commonwealth Superannuation Corp

- NGS Super

- TWU Super

NO

- AustralianSuper

- Energy Super

UNKNOWN: AMP, Australia Post Superannuation Scheme, BT, Care Super, Cbus, Colonial First State, Commonwealth Bank Group Super, EISS, equipsuper, ESSSuper, First State Super, GESB, HESTA, HOSTPLUS, IOOF, LGIAsuper, Local Government Super, LUCRF, Macquarie, Maritime, Mercer, Mine Super, MLC Super Fund, MTAA Super, Netwealth, OnePath, Perpetual, Qantas Super, QSuper, REST, Russell Investments, StatePlus, Statewide, Suncorp, Sunsuper, Super SA, Tasplan, Telstra Super, Unisuper, VicSuper, Vision Super, VicSuper, Westpac Mastertrust

*These funds are listed as 'Likely' to be invested as they use Infrastructure Capital Group as an investment manager. The Esperance Energy Project is included in two of ICG's three infrastructure investment options.