Japan’s fossil fuel footprint is immense, as the fifth-largest carbon emitter and is the largest provider of development finance to fossil fuels globally. As a result, Japanese energy companies stopping investment in coal and fossil gas and ramping up clean energy is key to avoiding a climate catastrophe.

Yet for all the talk of achieving a “net zero society” and a “sustainable energy cycle”, companies like Mitsubishi Corporation, JERA, Mitsubishi Heavy Industries, Sumitomo Corporation and Mitsui & Co, to name a few, are betting on technologies such as “blue” hydrogen or ammonia that extend the life of coal and gas assets but are as or more emission intensive and costly than renewable energy.

In order to manage their own climate risk, investors in Mitsubishi Corporation, JERA, Mitsubishi Heavy Industries, Sumitomo Corporation and Mitsui & Co. must engage with these companies and voice opposition to the use of blue hydrogen/ammonia-based technologies in companies’ transition plans.

Companies that fail to avoid these pitfalls may end up saddled with large stranded assets, destroying shareholder value and falling behind their competitors.

Key points:

- Greenhouse gas emissions from the production of “blue” hydrogen or ammonia can completely eliminate climate benefits when compared to burning fossil fuels.

- Green hydrogen, on the other hand, generates negligible lifecycle emissions

- Hydrogen and ammonia are far more costly than solar or wind energy for providing electricity, particularly in emerging economies such as Vietnam or Bangladesh.

Blue hydrogen does not reduce global emissions

Blue hydrogen is typically made from fossil gas, and its manufacture results in significant CO2 emissions, which companies propose to address using carbon capture and storage (CCS) – a technology with a track record of failure. Furthermore, methane, the main component of fossil gas, is also highly prone to leakage and is 86 times more potent as a greenhouse gas than CO2 on a 20-year timescale. Market Forces recently explored these issues in our online resource, Hydrogen from fossil fuels: an expensive way to increase emissions.

These limitations of blue hydrogen technology mean that producing and burning blue hydrogen is no cleaner than simply burning fossil fuels. For these very reasons, the ESG arm of Institutional Shareholder Services (ISS), a prominent proxy advisor, has warned of a “significant risk” that investments in blue hydrogen will become expensive failures.

Lifecycle emissions intensity of hydrogen and conventional fossil fuels

Source: Blue hydrogen, fossil gas, coal: Howarth & Jacobson – “How green is blue hydrogen?”, Energy Science & Engineering (2021); Green hydrogen: Hydrogen Council

Notes: Blue hydrogen intensity includes flue-gas CO2 capture. For green hydrogen, we have included capex-related emissions (for instance, from solar panel manufacture) as well, but note that operating CO2 emissions would be zero. The capex-related emissions are not included for blue hydrogen, fossil gas and coal.

Hydrogen does not have to be made from fossil fuels. It can also be produced using renewable energy and water – so called “green hydrogen” – which does not generate any greenhouse gas emissions. Historically, the barrier to this technology has been higher production costs than fossil-based hydrogen. However, today’s sky-high fossil gas prices have significantly lessened that gap, as Shell’s CEO Ben van Beurden has pointed out. Moreover, the cost of producing green hydrogen is widely expected to decline sharply in the coming years.

All told, blue hydrogen is a dirty technology with limited potential that primarily serves to extend the life of fossil gas assets. Despite these issues, Japanese companies are launching several initiatives into blue hydrogen technology. These include:

Company

Initiative

Mitsubishi Corporation

Partnering with US company Denbury to build a 1 million tonnes per year blue ammonia facility on the US Gulf Coast. The carbon captured in this facility will likely be used at least in part for enhanced oil recovery, i.e., to produce more fossil fuels and CO2 emissions.

Signed a Memorandum of Understanding with Shell to produce blue hydrogen in Canada. The new project would be co-located with Shell’s existing blue hydrogen facility, which Global Witness has found releases more CO2 than it captures.

Participating in a joint feasibility study with JOGMEC, PT Panca Amara Utama and Bandung Institute of Technology on blue ammonia production in Indonesia.

Mitsubishi Heavy Industries

Announced its plan to issue first transition bonds worth JPY 10 billion in early September 2022. The proceeds will be used in part for developing blue hydrogen and CCS.

JERA

Has put out a tender for 500,000 tonnes per year of either blue or green ammonia. According to media reports, JERA will only require that 60% of CO2 emissions are captured, and would allow captured carbon to be used for enhanced oil recovery, i.e., to produce more fossil fuels and CO2 emissions.

Promoting hydrogen and ammonia co-firing in Indonesia as part of the country’s power sector decarbonisation roadmap, which JERA has co-authored.

Sumitomo Corporation

Participating in a pilot project producing hydrogen from Australian coal. Coal-based hydrogen releases about 50% more greenhouse gases than gas-based hydrogen. The initiative is compensating for this using carbon offsets, with the intention to later add unreliable CCS technology.

Conducting a feasibility study on blue hydrogen production at the Bacton Gas Terminal in the UK.

Conducting a feasibility study on a blue hydrogen plant in Oman.

Mitsui & Co.

Partnering with CF Industries to build a >1 million tonnes per year blue ammonia plant on the US Gulf Coast, targeting a final investment decision in 2023.

Signed a Joint Study Agreement with ADNOC to build a blue hydrogen facility in the UAE with a target production of 200,000 tonnes per year.

Ammonia co-firing is costly when compared to renewable energy for power generation

Hydrogen can theoretically be used in a wide variety of applications, including power generation. However, because of questionable competitiveness against renewable energy and limited CO2 savings in the case of fossil-based hydrogen, its potential is likely to be more limited than Japanese companies claim.

In Japan, the most prominent use case has quickly become power generation using ammonia, a refined form of hydrogen. Companies claim this fuel can be mixed directly into existing coal-fired power plants without needing major retrofits and that this can lead to immediate reductions in CO2 emissions. In JERA’s case, this forms the main pillar of their transition strategy – a significant fact as JERA owns the greatest coal-fired power generation capacity in Japan, 10.3 gigawatts.

JERA’s Hekinan Power Station, which is being targeted for ammonia co-firing. Source: Wikimedia Commons

We see considerable risks with this approach. Firstly, emissions reductions would only be possible to the extent that the underlying ammonia production has little to no emissions. If blue hydrogen is used – which JERA has left the door open to – CO2 emissions would simply be moved from the power plant to the hydrogen supply chain. JERA’s weak emissions targets, which focus only on power plant emissions, do not incentivise the company to consider this problem.

Ammonia power also has highly questionable economic potential, particularly in emerging Asian economies where Japanese companies are directing many of their efforts. Indonesia’s recently published power sector decarbonisation roadmap, prepared by JICA, JERA, TEPCO and TEPSCO, finds that 20% ammonia co-firing in Indonesian coal plants would only generate positive financial returns if the carbon price is at least USD$200/tonne. For reference, Indonesia’s new carbon tax, planned to take effect by end-2022, is a mere USD$2/tonne.

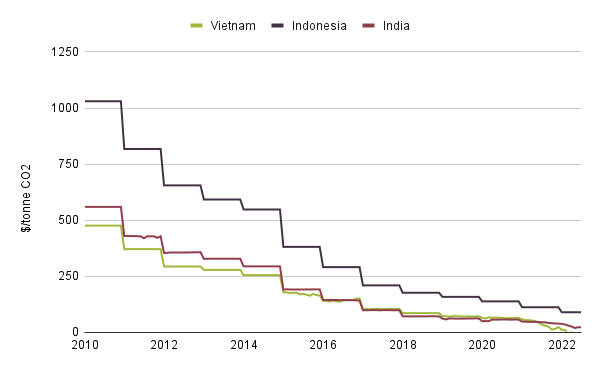

Meanwhile, financial think tank TransitionZero estimates that renewable energy with battery storage outcompetes coal in Indonesia at a carbon price of just USD$90/tonne; in India, at USD$22/tonne; and in Vietnam, renewables already beat coal without a carbon price. With continued declines in solar and wind power costs, their advantage over ammonia and hydrogen power will likely continue to grow.

Carbon price where renewables + battery storage is cheaper than coal

Investors will bear the cost of failure

Real-world examples of fossil hydrogen investments suggest that the cost of failure could be steep. Shell’s Quest Carbon Capture and Storage (CCS) facility in Canada, part of one of only two blue hydrogen plants in the world, had not turned a profit after almost six years of operation and despite CAD720 million of government subsidies. Without subsidies, the plant would have generated a cumulative loss of CAD830 million. Combined with its disappointing CO2 capture performance, it’s hard to see why Japanese companies are eager to follow suit.

Similarly, investors will need to beware of the “transition bonds” companies such as JERA and Mitsubishi Heavy Industries (MHI) have issued/are planning to issue. Co-firing plants, to which the proceeds from these bonds will be directed, have been critiqued by an influential green bonds certifier Climate Bonds Initiative for not aligning with a net-zero emissions future. The assessments of these “transition bonds” by METI and an independent assurer cover neither the technical viability of proposed use of the bonds’ proceeds nor the associated financial risks. Moreover, neither JERA nor MHI will report the greenhouse gas emissions from the use of proceeds, leaving investors uninformed about their financed emissions.

The conclusions for investors are clear. First, blue hydrogen will not lead to reliable emissions reductions. Investors with tough net zero targets therefore need to push companies towards more credible solutions like green hydrogen. Second, blue hydrogen and large-scale ammonia co-firing come with significant financial risks in the power sector. Barring major government bailouts, those risks will fall squarely on investors in the form of lower returns and stranded assets.