Take Action: Write to IAG and ask it to follow-through on the commitments made at its 2019 annual general meeting.

IAG AGM report: 25 October 2019

At its annual general meeting (AGM) in Sydney today, IAG faced calls from investors to fully disclose its fossil fuel investment exposure and set targets to reduce that exposure in line with limiting global warming to 1.5 degrees. IAG’s chair said getting fossil fuel exposure down to zero is “where we’re looking to go”, but there is currently no mechanism for IAG to achieve that.

Despite the extreme weather fueled by the climate crisis hitting insurers’ profits, the industry continues to support fossil fuel expansion through both providing insurance (underwriting) and investments.

IAG is slightly ahead of the pack due to its commitment to phase out all coal, oil and gas underwriting by 2023. However, it is still invested in fossil fuels, with investors unable to assess the extent of IAG’s climate risk exposure and no policy in place to ensure those investments are phased out.

Lack of transparency on fossil fuel investments

One shareholder asked IAG to provide more transparency on its fossil fuel investments, namely how it defined them and how it was going to manage them into the future.

Chair Elizabeth Bryan, claimed there are policies, definitions and targets internally used to manage these investments, and stated it was IAG’s intention to divest from fossil fuel companies.

However, with no policies available to shareholders, nothing is stopping IAG from continuing to invest in the coal, oil and gas companies that fuel the climate crisis. To remedy this, IAG committed to releasing its definitions. This needs to happen as soon as possible.

Another shareholder at the meeting was represented by Ken Thompson, former Deputy Commissioner with Fire and Rescue NSW. He called out IAG for remaining invested in companies that are expanding the fossil fuel sector and asked if IAG’s climate credibility would improve if it stops supporting the companies fueling the problem.

“Does IAG own any shares in a company that is working to expand the thermal coal industry? Or tar sands? Or unconventional gas? Or any company that is undermining the Paris Agreement by expanding fossil fuel production and/or use?” asked Thompson.

“We don’t own any stocks in those companies,” responded Bryan.

If this is true, IAG should not be invested in any of the 21 companies listed in Market Forces’ “Out of line, out of time” report that are ignoring the Paris goal of limiting global warming to 1.5 degrees. These companies include major fossil fuel players like Woodside, Santos, Origin Energy, AGL, Whitehaven Coal, Oil Search and New Hope Coal.

If IAG has divested from such companies, it sets a great precedent which all of our super funds must follow immediately. Tell your super fund to ditch companies undermining the Paris climate goals today.

Uninsurable properties

With the highly-publicised release this week of comprehensive research showing a progressive increase in the number of uninsurable properties across Australia, another shareholder took a big picture view and asked IAG whether the insurance industry as it currently stands has a future.

IAG was asked how it is dealing with worsening floods, bushfires, storms and droughts increasing claims combined with uninsurable areas growing and shrinking its market.

“We could be looking at a death spiral for our company”, the shareholder commented. “How does IAG intend to keep its head above water in its insurance business?”

CEO Peter Harmer admitted, “we have been seeing a continuing increase in the percentage of claims for natural peril events.”

Shareholder resolution

Finally, Market Forces brought all these issues together in its statement in support of a shareholder resolution.

“The biggest drivers of global warming are the coal, oil and gas industries. The science is clear that these industries need to be phased out as soon as possible, and IAG’s investment policies must reflect this.”

“There is not enough information being provided for investors to truly understand IAG’s fossil fuel exposure, and therefore how it is managing its own exposure to transitional climate risk.”

“Setting clear targets for reducing fossil fuel exposure in its investments would afford our company increased credibility among its peers and in the public domain when calling for action to be taken on the climate crisis, and send an important signal to markets that an urgent transition to a low-carbon economy is necessary. “

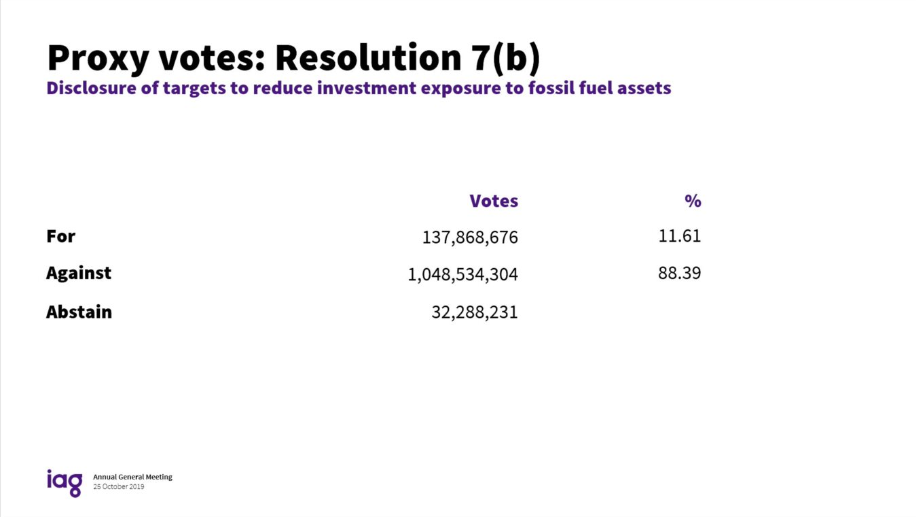

The shareholder resolution received 11.61% in favour, signalling investors worth about $2 billion in the company want more transparency on IAG’s plans to reduce fossil fuel exposure to zero.

As a first step to achieving this, IAG needs to follow through with the commitments made today at its AGM – publish its definitions of “high risk” companies, set a date for getting its fossil fuel exposure to zero, and confirm it is no longer invested in companies undermining the Paris agreement.