OUT OF LINE, OUT OF TIME

23 of Australia’s 300 biggest companies are pursuing plans consistent with the failure of the Paris Agreement.

If these companies get their way, they will enable emissions equivalent to almost 150 times Australia’s annual total.

And millions of Australians are invested in these climate wrecking companies through their super!

We can and must leave their polluting plans behind, but it will take pressure from all of us to demand our super funds divest from companies that are out of line with the Paris climate goals, and out of time to act.

TAKE ACTION

Tell your super fund to ditch climate-wrecking companies!

The 23 Out of Line companies

These 23 companies are undermining climate action by:

- Expanding the scale of the fossil fuel sector; and/or

- Relying on scenarios consistent with the failure of the Paris Agreement to justify their future business prospects.

| wdt_ID | Company | Sector | Market capitalisation | Expanding fossil fuels | Relying on >2°C scenarios | Emissions from fossil fuel resources or plans |

|---|---|---|---|---|---|---|

| 1 | BHP Group Ltd | Materials | $204.20 billion | Yes | Yes | 37.88 GtCO2e |

| 2 | Woodside Petroleum Ltd | Energy | $22.32 billion | Yes | Yes | 2.36 GtCO2e |

| 3 | Santos Ltd | Energy | $13.47 billion | Yes | Yes | 917.3 MtCO2e |

| 4 | South32 Ltd | Materials | $12.08 billion | Yes | Yes | 17.26 GtCO2e |

| 5 | APA Group | Utilities | $11.60 billion | Yes | Yes | 144.3 MtCO2e (per year) |

| 6 | AGL Energy Ltd | Utilities | $7.59 billion | Yes | Yes | 761.7 MtCO2e |

| 7 | Aurizon Holdings Ltd | Industrials | $7.32 billion | Yes | Yes | 288.5 MtCO2e (per year) |

| 8 | Origin Energy Ltd | Energy | $8.55 billion | Yes | Yes | 769.2 MtCO2e |

| 9 | Seven Group Holdings Ltd | Industrials | $8.16 billion | Yes | Yes | |

| 10 | Oil Search Ltd | Energy | $7.88 billion | Yes | Yes | 585.4 MtCO2e |

| 11 | Washington H Soul Pattinson and Company Ltd | Energy | $7.30 billion | Yes | Yes | |

| 12 | Mineral Resources Ltd | Materials | $7.29 billion | Yes | ||

| 13 | Ampol Ltd | Energy | $7.09 billion | Yes | ||

| 14 | Worley Ltd | Energy | $6.10 billion | Yes | ||

| 15 | Beach Energy Ltd | Energy | $4.24 billion | Yes | Yes | 173.2 MtCO2e |

| 16 | Viva Energy Group Ltd | Energy | $3.05 billion | Yes | ||

| 17 | Whitehaven Coal Ltd | Energy | $1.72 billion | Yes | Yes | 10.24 GtCO2e |

| 18 | New Hope Corporation Ltd | Energy | $1.19 billion | Yes | Yes | 6.31 GtCO2e |

| 19 | Cooper Energy Ltd | Energy | $648 million | Yes | Yes | 24.7 MtCO2e |

| 20 | Karoon Energy Ltd | Energy | $590 million | Yes | 34.2 MtCO2e | |

| 21 | Senex Energy Ltd | Energy | $464 million | Yes | Yes | 45.7 MtCO2e |

| 22 | Carnarvon Petroleum Ltd | Energy | $464 million | Yes | 42.1 MtCO2e | |

| 23 | FAR Ltd | Energy | $110 million | Yes | 1.2 MtCO2e |

Market capitalisation at 5 January 2021. Research completed 29 January 2021.

Fossil fuels tanking

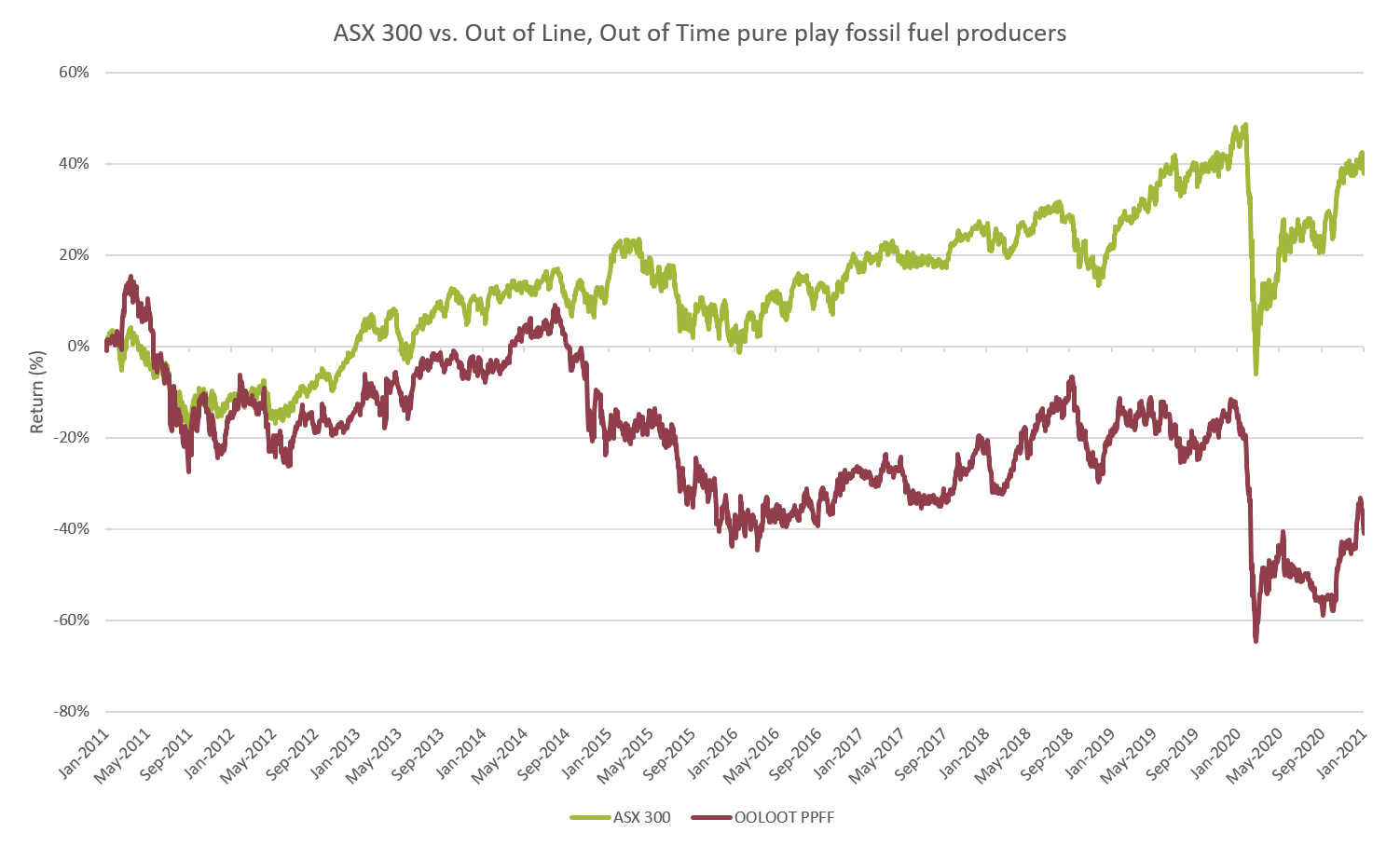

At the start of 2021, these Out of Line companies represented 14% of the ASX 300 by market capitalisation, down from 16% of the ASX 300 in January 2020.

This drop in total market share can largely be attributed to the poor performance of fossil fuel-related companies throughout the market turmoil of 2020. However, last year merely exacerbated a decade-long trend of fossil fuel companies underperforming compared to the rest of the Australian sharemarket.

An update to Market Forces’ May 2020 analysis shows an index tracking the market price of 11 ASX 300 companies whose sole business is producing coal, oil or gas has fallen 41% in the 10 years to 1 February 2021, while the ASX 300 had risen 38% over that time.

Australia’s biggest carbon bomb threats

For the first time, Market Forces has quantified the emissions that would be enabled as a result of fossil fuel companies recovering the coal, oil and gas resources they believe they have at least ‘reasonable prospects’ of extracting (coal) or that are at least ‘potentially recoverable’ (oil and gas), and following their current fossil fuel power generation plans.

There are differences in the way companies report coal reserves and resources, compared to oil and gas, outlined as follows.

For the coal companies, we’ve differentiated between the emissions that would be generated from:

- Proved and probable (marketable) reserves – The ‘economically mineable’ part of a coal resource. This extraction may require further infrastructure and investment.

- Additional resources – The amount of coal that has been measured, indicated, or inferred from geological information, and that the company believes there are ‘reasonable prospects’ of extraction. This extraction will almost certainly require further infrastructure and investment.

When it comes to oil and gas, we’ve differentiated between:

- Developed reserves (2P) – The ‘best estimate’ of the amount of oil and gas the company anticipates is commercially recoverable from existing wells and facilities.

- Undeveloped oil & gas reserves (2P) and resources (2C) – The ‘best estimate’ of the amount of oil and gas the company anticipates is commercially recoverable (2P) and potentially recoverable (2C) through future significant investments.

AGL and Origin both disclose the annual emissions of each of their power stations, as well as their planned closure dates, making it more straightforward to calculate the future emissions of each company’s plans.

You can read the full methodology and definitions at the bottom of this page.

Emissions from disclosed coal reserves and resources

Emissions from disclosed oil and gas reserves and resources

Emissions from power stations

Coal mining

Four companies in the Out of Line list mine coal: BHP, South32, Whitehaven Coal and New Hope Group.

There are two different types of coal: thermal coal, used for energy generation, and coking coal for steelmaking. Climate Analytics shows coal power must be phased out globally by 2040 in order to meet the Paris climate goals, while the International Energy Agency’s Sustainable Development Scenario, which provides just a 50% chance of limiting warming to 1.65°C, shows global coking coal use must fall by 20% in the next 5 years, 34% by 2030, and 53% by 2040.

BHP has discussed plans to divest its thermal coal and some of its coking coal mines. However, the company has no plans to wind up any coal mines it remains invested in, and by selling the others, BHP will allow other companies to continue operating them for years to come.

Market Forces calculates 4.4 GtCO2e would be generated by the use of BHP’s disclosed ‘proven and probable’ (2P) reserves, and a further 32.4 GtCO2e from BHP’s disclosed additional coal resources (measured + indicated + inferred), which are more prospective than reserves.

BHP uses two scenarios as inputs for its planning cases: Central Energy View, which is consistent with 3°C of warming by 2100, and Lower Carbon View (2.5°C of warming by 2100). BHP is also a major oil and gas producer, see below for the emissions analysis of the company’s oil and gas reserves.

South32 recently sold of its South African Energy Coal business, but continues to mine coking coal. The company is planning significant expansions and extensions to its coking coal mining operations.

Market Forces calculates 1.5 GtCO2e would be generated by the use of South32’s disclosed ‘proven and probable’ (2P) reserves, and a further 15.7 GtCO2e from the company’s disclosed additional coal resources (Measured + Indicated + Inferred).

South32 uses a scenario consistent with 3°C of warming as its base case to value its assets.

Whitehaven Coal is the largest undiversified (pure play) coal mining company on the ASX, and despite the need to rapidly wind down production of the dirtiest form of energy, Whitehaven actually plans to almost double production by 2030. To justify these plans, Whitehaven regularly refers to coal demand projections consistent with up to 4°C of global warming.

Market Forces calculates 1.7 GtCO2e would be generated by the use of Whitehaven’s disclosed ‘proven and probable’ (2P) reserves, and a further 8.5 GtCO2e from the company’s disclosed additional coal resources (Measured + Indicated + Inferred).

New Hope Group is another pure play coal miner with plans to expand the industry through its New Acland Stage 3 project and Elimatta proposal. New Hope’s plans would see it mining thermal coal well beyond 2040, the point at which the Paris Agreement requires coal fired power to be phased out worldwide. In discussing New Hope’s future prospects, the company’s 2020 annual report referred to the International Energy Agency’s 2019 Current Policies Scenario (projected to generate 6°C of warming), and Stated Policies Scenario (4°C).

Market Forces calculates 1.4 GtCO2e would be generated by the use of New Hope’s disclosed ‘proven and probable’ (2P) reserves, and a further 4.9 GtCO2e from the company’s disclosed additional coal resources (Measured + Indicated + Inferred). New Hope also has small undeveloped oil reserves, which would add a further 5 MtCO2e.

Oil & gas production

Analysis of the carbon budget required to limit warming in line with the Paris Agreement’s 1.5°C target shows oil production must fall by 4% annually from 2020 to 2030. Over the same time gas production needs to fall 3% per year. Yet Australia’s oil and gas producers are planning to massively increase production with new projects that would doom the Paris Agreement to failure.

Woodside Petroleum is Australia’s largest gas producer, and plans to increase production by more than 70% from 2019 levels by 2028. These plans include what would be Australia’s most polluting project ever – the massive Burrup Hub project in Western Australia. Woodside’s share of this project’s gas resources would generate over 1.6 GtCO2e alone.

Market Forces calculates 222 MtCO2e would be generated by the use of Woodside’s disclosed developed reserves (2P), and a further 2.1 GtCO2e from the company’s disclosed undeveloped reserves and contingent resources (2C).

Woodside’s latest investor presentation forecasts LNG demand to grow by over 4% each year to 2035, which is even higher than forecast under the International Energy Agency’s 2020 Stated Policy Scenario (STEPS ~3°C warming).

Santos plans to double its oil and gas production from 2018 to 2025, including through its proposed Narrabri coal seam gas project, which faces widespread opposition from local Gomeroi Traditional Owners and farmers, as well as climate scientists, who have confirmed the project is inconsistent with the Paris climate goals.

Market Forces calculates 169 MtCO2e would be generated by the use of Santos’ disclosed developed reserves (2P), and a further 748 MtCO2e from the company’s disclosed undeveloped reserves and contingent resources (2C).

To justify its increasing production plans, Santos cites global oil and domestic gas demand growth forecasts consistent with the IEA’s STEPS, and a global LNG forecast that doubles the STEPS demand growth projection from 2018-2035.

Origin Energy’s proposed Beetaloo gas project in the Northern Territory could add an extra 22% to Australia’s total annual emissions, when we know emissions need to fall by around half by 2030.

Market Forces calculates 128 MtCO2e would be generated by the use of Origin Energy disclosed developed reserves (2P), and a further 432 MtCO2e from the company’s disclosed undeveloped reserves and contingent resources (2C). Origin also operates fossil fuel power plants – see below.

Oil Search plans to increase production by more than 80% from 2020 levels by 2030, justifying these plans by referring to a scenario that forecasts LNG demand growth 15% higher than that projected under IEA’s STEPS (2020 to 2035).

Market Forces calculates 103 MtCO2e would be generated by the use of Oil Search’s disclosed developed reserves (2P), and a further 482 MtCO2e from the company’s disclosed undeveloped reserves and contingent resources (2C).

Beach Energy, Senex Energy, Carnarvon Petroleum, Karoon Energy, Cooper Energy, FAR – The emissions that would be generated by the use of the disclosed developed and undeveloped reserves of the 6 other oil and gas producers in the ASX 300 total 321 MtCO2e.

Power generation

Climate Analytics has confirmed Australia needs to be coal power-free by 2030 in order to meet the Paris climate goals, yet AGL and Origin plan to continue operating their coal power stations well beyond that date.

AGL operates three coal power stations, and plans to run Bayswater until 2035, and Loy Yang A until 2048. AGL’s own scenario analysis shows these plans are not consistent with a 1.5°C warming scenario. The company also plans to expand the fossil fuel sector by building a gas import terminal in Victoria.

Market Forces calculates AGL’s existing power stations will produce 737 MtCO2e if operated in line with the company’s current plans, while new gas-fired power stations AGL has announced to be built would add 24 MtCO2e.

Origin Energy operates Australia’s largest coal power plant, Eraring, which the company plans to run until 2032. The company’s own analysis shows Eraring would be virtually worthless by 2025 in a 1.5°C warming scenario, but that hasn’t changed the company’s plans at all. Market Forces calculates Origin’s existing power stations will produce 209 MtCO2e if operated in line with the company’s current plans. Origin is also a major oil and gas producer – see above.

Fossil fuel transport

Aurizon is a rail haulage company with a major focus on coal. The company hauled 214 Mt of coal in FY2020. When burnt, this coal would release approximately 543 MtCO2e.

Despite the company’s own analysis showing Australian coal exports need to decrease under the IEA’s Sustainable Development Scenario (50% chance of holding warming to 1.65°C), Aurizon’s 2020 investor presentation forecast coal exports to grow 1-2% per year over the next decade. This growth rate is consistent with Aurizon’s 2019 forecasts, based on scenarios consistent with 4-6°C of global warming.

APA’s network of gas pipelines carries approximately 2800 PJ of gas each year. When burnt, this gas would release approximately 144 MtCO2e. Far from shrinking its massive gas network, APA is planning new projects, including its Western Slopes Pipeline proposal that would unlock Santos’ destructive Narrabri Gas Project.

APA’s investor information refers to the Australian Energy Market Operator’s gas demand forecasts, which are based on assumptions from the IEA’s 2018 Stated Policies Scenario (projected to generate 4°C of warming).

Other fossil fuel players

Viva is an oil refiner, and has plans to expand the scale of the fossil fuel sector by building a liquefied natural gas (LNG) import terminal at Geelong.

Ampol (formerly Caltex) is also an oil refiner and petroleum distributor, and uses demand forecasts that are incompatible with the Paris climate goals when discussing future prospects in its 2020 Investor Presentation.

Worley is not a fossil fuel producer like many on this list, but facilitates the expansion of the fossil fuel sector by providing advisory, engineering, and construction services to new fossil fuel projects. Worley continues to announce agreements to provide services for major new oil and gas projects, including Corpus Christi LNG, which is estimated to enable emissions equivalent to 1.5 times Australia’s national emissions over its lifetime.

Take action: Use the form on this page to tell your super fund to ditch climate-wrecking companies!

BHP falls short of Paris-alignment

In last year’s study, BHP was identified as meeting the criteria for inclusion on the Out of Line, Out of Time list. However, the company had promised to announce a new climate action plan during 2020, including targets for its own operational emissions (scope 1 and 2), and those generated when BHP’s products were used by customers (Scope 3 emissions). BHP’s Scope 3 emissions are 35 times greater than its scope 1 and 2 combined, and even greater than Australia’s annual national emissions.

Sadly, the climate targets announced by BHP in September 2020 failed to live up to the company’s big promises.

BHP committed to reduce scope 1 and 2 emissions by 30% by 2030, falling short of the ~42% reduction that would be required to align with a 1.5°C pathway from 2020 to 2030, according to the Science Based Targets Initiative’s target setting tool (absolute contraction method).

On scope 3, BHP said it would work to reduce the emissions intensity of its steelmaking customers by 30% by 2030, and work with the maritime industry to support an emissions intensity reduction of 40% in BHP-chartered shipping by 2030. Unfortunately, these commitments lack detail and accountability, and fall short of the ~50% emissions reduction (2020-2030) required to align with the Paris 1.5°C limit.

The company has discussed divesting some of its fossil fuel production assets, but at the same time is pursuing massive oil and gas expansion projects, and will hold onto some coking coal mines with approvals to operate until 2058. Rather than committing to manage down coal production in line with the Paris goals, BHP is looking to sell its thermal coal assets, and its lower quality coking coal assets for other companies to continue operating for years to come.

Having failed to take its opportunity to demonstrate Paris-alignment, BHP is clearly recognised as Out of Line and Out of Time in this year’s report.

Super funds starting to shift

Throughout 2020, five major super funds, managing over $460 billion of members’ retirement savings, moved to divest from some Out of Line companies.

Nine of the 40 largest super funds have now announced divestment from a handful companies on the Out of Line list. This brings the total value of Australia’s super funds that have started divesting from fossil fuel companies to over $500 billion, almost a quarter of all superannuation assets under management (excluding funds with less than five members).

Despite this recent progress, the majority of Out of Line companies continue to enjoy the financial backing of the majority of our super funds.

While so many super funds continue to invest in fossil fuel producers, Market Forces is also supporting shareholders to call on coal, oil and gas producers to demonstrate how they will ‘wind up’ (bring about an end to) their fossil fuel operations, protecting money from being wasted on new projects, and supporting workers as the economy rapidly moves on from fossil fuels to meet the Paris Agreement.

| wdt_ID | Fund | Assets under management | Divested from | Announced |

|---|---|---|---|---|

| 1 | AustralianSuper | $191 billion | Thermal coal mining companies (active holdings): Whitehaven Coal | November 2020 |

| 2 | Aware Super | $126 billion | Thermal coal mining companies: Whitehaven Coal, New Hope Group, Washington H Soul Pattinson | July 2020 |

| 3 | UniSuper | $85 billion | Thermal coal mining companies: Whitehaven Coal, New Hope Group, Washington H Soul Pattinson | September 2020 |

| 4 | Hesta | $55 billion | Thermal coal mining companies: Whitehaven Coal, New Hope Group, Washington H Soul Pattinson | June 2020 |

| 5 | Vision Super | $13 billion | Thermal coal mining companies: Whitehaven Coal, New Hope Group, Washington H Soul Pattinson | 2018 |

| 6 | Local Government Super | $13 billion | Thermal coal mining and coal power companies: Whitehaven Coal, New Hope Group, Washington H Soul Pattinson, AGL, Origin |

2014 |

| 7 | NGS Super | $12 billion | Thermal coal mining and coal power companies: Whitehaven Coal, New Hope Group, Washington H Soul Pattinson, AGL, Origin |

2019 |

| 8 | Suncorp | $6 billion* | Thermal coal mining and coal power companies (by 2025): Whitehaven Coal, New Hope, BHP, AGL, Origin Oil and gas producers (over 3 phases: 10% by 2025, 50% by 2030, 100% by 2040): Woodisde, Santos, Oil Search, Beach, Cooper, Karoon, Carnarvon, Senex, FAR. |

August 2020 |

| 9 | Media Super | $6 billion | Thermal coal mining companies: Whitehaven Coal, New Hope Group, Washington H Soul Pattinson | 2019 |

*Superannuation fund assets only

Learn more

How super funds support climate destruction

Australia’s superannuation industry invests $3 trillion on behalf of the nation’s workers, with $2.2 trillion of that managed by super funds, rather than self-managed. Through those investments, super funds own 40% of the Australian Securities Exchange. That means super funds invest a huge chunk of our money in the companies driving us towards catastrophic climate change, including those whose plans pose the biggest carbon bomb threats like BHP, Woodside, Origin, AGL, Santos, Whitehaven Coal, and New Hope.

If your super fund owns a piece of these companies, so do you! Fortunately, this gives us and our super funds a lot of power. We need to harness that power to ensure only those companies that are willing and able to be part of a low carbon economy are supported with our hard-earned dollars.

The 23 ‘Out of Line, Out of Time’ companies identified in this study have had their chance to show they have a place in the clean energy transition. Not only have they failed to take that chance, they are actively undermining climate action.

Super funds must act now to get our retirement savings out of all Out of Line companies.

The shareholder push to wind up fossil fuel production

Super funds often say they prefer to engage with companies to encourage them to become more sustainable, rather than cutting ties by selling their shares. But after five years of attempted engagement, the Out of Line companies continue to pursue plans that are incompatible with the Paris climate goals.

These companies have no place in a decarbonised economy. Their business plans are based on digging up, transporting, selling and burning more dirty coal, oil and gas, when we know these industries must rapidly decline. They should not enjoy the support of any investor committed to avoiding catastrophic climate change.

Yet almost every super fund continues to hold shares in Out of Line companies. So Market Forces is supporting shareholders to propose resolutions, calling on coal, oil and gas producers to demonstrate how they will ‘wind up’ (bring about an end to) their fossil fuel operations, protecting investors’ money from being wasted on new projects, and supporting workers as the economy rapidly moves on from fossil fuels to meet the Paris Agreement.

While our super funds remain invested in these companies, the only meaningful demand they could make through engagement with the company is for a managed decline of fossil fuel production.

What about the rest?

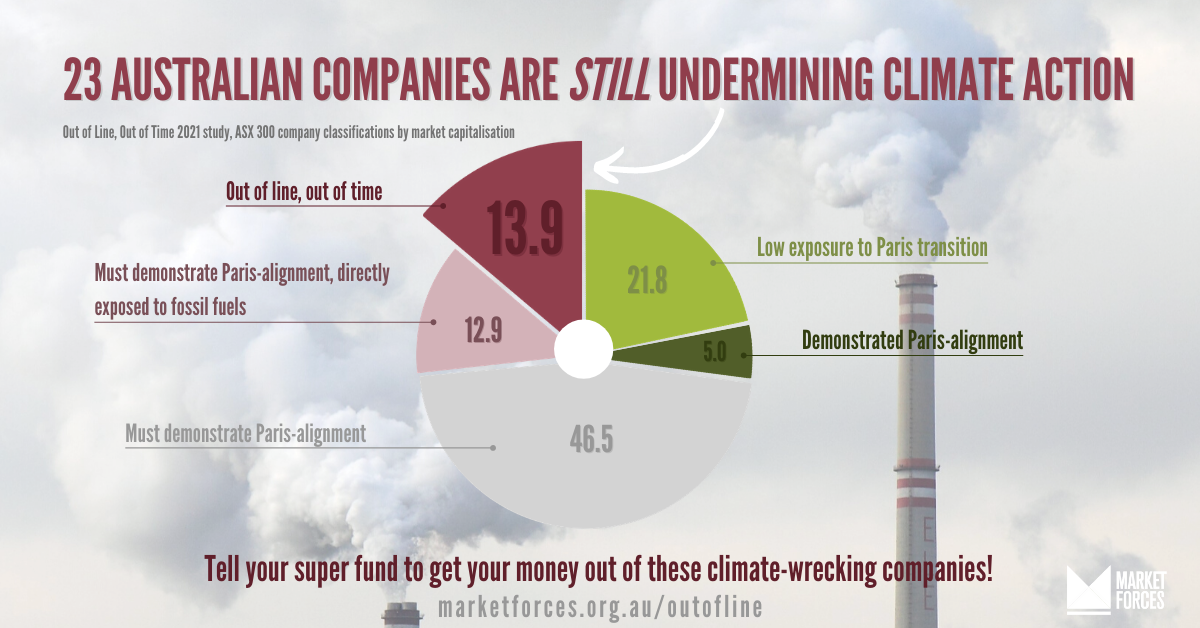

Market capitalisation at 5 January 2021. Research completed 29 January 2021.

Must demonstrate Paris-alignment

Almost half of the 300 largest publicly owned companies in Australia (120 companies representing 60% of market capitalisation) do not meet the Out of Line criteria, but still need to demonstrate how they will bring their business models into line with the goals of the Paris Agreement.

Investors must work with these companies to ensure they produce Paris-aligned plans and targets as part of their annual reporting.

Directly exposed to climate risk

Of these companies, 22 (13% of ASX 300 market cap) were found to be directly exposed to the transition away from fossil fuels required to meet the climate goals of the Paris Agreement. These companies either provide services to support the fossil fuel sector, such as mining services, or rely on fossil fuels to process their products, such as iron ore producers.

These companies must face strong, targeted investor engagement to ensure they manage down their significant exposure to climate change transition risks by shifting their business models away from their current reliance on fossil fuels. If they are unable or unwilling to transition, super funds must consider divestment.

| wdt_ID | Other companies directly exposed to fossil fuel-related transition risk | Sector | Market Cap |

|---|---|---|---|

| 1 | Rio Tinto Ltd | Materials | $171.03 billion |

| 2 | Fortescue Metals Group Ltd | Materials | $76.77 billion |

| 3 | BlueScope Steel Ltd | Materials | $8.91 billion |

| 4 | CIMIC Group Ltd | Industrials | $7.78 billion |

| 5 | AusNet Services Ltd | Utilities | $6.80 billion |

| 6 | Orica Ltd | Materials | $6.21 billion |

| 7 | Qube Holdings Ltd | Industrials | $5.72 billion |

| 8 | ALS Ltd | Industrials | $4.74 billion |

| 9 | Incitec Pivot Ltd | Materials | $4.45 billion |

| 10 | Downer EDI Ltd | Industrials | $3.84 billion |

Low exposure

151 companies (22% of market cap) are in the Consumer Discretionary, Consumer Staples, Health Care, Information Technology, Real Estate, and Telecommunications sectors, and emit less than 50 kilotonnes of carbon dioxide equivalent per year. With no direct involvement in the fossil fuel industry, and relatively low emissions, these companies are not actively holding back the transition to a Paris-aligned economy. They are therefore deemed to have relatively low exposure to the shift away from fossil fuels.

These companies should still face investor scrutiny to ensure they are acting to minimise emissions across their value chains.

Demonstrated alignment

Just 8 companies (5% of market cap) have clearly demonstrated strategic alignment with the goals of the Paris Agreement. While this has risen significantly from just 5 separate companies (2% of market cap) in 2020,* this list still remains far too short.

Real estate companies dominate the list of companies that have demonstrated alignment with the Paris climate goals, with Charter Hall Group, Dexus, GPT Group, LendLease Group and Mirvac all having disclosed targets to completely decarbonise their operations and value chains before 2050. Importantly these plans include Paris-aligned interim targets and detailed strategies for meeting those targets.

The other companies that have demonstrated Paris-alignment are Telstra and Transurban – which have each set SBI-approved, 1.5°C-aligned emission reduction targets, including value chain emissions – and ethical investment company Australian Ethical.

*In the 2020 Out of Line Study, four different classes of Charter Hall securities were included in the ASX 300 list used for the study, meaning 8 securities, but just 5 separate companies, were found to have demonstrated Paris-alignment.

Take action: Use the form on this page to tell your super fund to ditch climate-wrecking companies!

Methodologies and assumptions

Company classifications methodology

Scope

- Research comprises all ASX300 companies (as at 5 Jan 2021)

- S&P/ASX300 list from Thomson Reuters Eikon

Sources

- Annual reports

- Sustainability reports

- Company websites

- Investor Presentations

- NGERS reporting data (2018-19 and 2017-18)

Process

Sector group 1

Consumer Discretionary, Consumer Staples, Health Care, Information Technology, Real Estate, Communication Services

- Is the company required to report under NGERS or have combined scope 1 and scope 2 greenhouse gas emissions equal to or greater than 50 kilotonnes CO2-e

- NO – Company has low exposure to Paris transition

- YES / UNCLEAR – Does the company have Paris-aligned emission reduction targets covering its entire business, along with clear plans to achieve those targets?

- YES – Company has demonstrated Paris-alignment

- NO / PARTIAL – Company must demonstrate Paris-alignment

Sector group 2

Financials (GICS Industry: Insurance, Capital Markets, Consumer Finance, Diversified Financial Services, Banks, Thrifts & Mortgage Finance)

- Does the company have investments in coal, oil or gas companies or projects?

- NO – Has the company demonstrated how investment decisions (investment portfolio, loan book, or underwriting portfolio) will align the business’ operations with a Paris-aligned scenario?

- YES – Company has demonstrated Paris-alignment

- NO – Company has low exposure to Paris transition

- YES / Unclear – Has the company demonstrated how investment decisions (investment portfolio, loan book, or underwriting portfolio) will align the business’ operations with a Paris-aligned scenario?

- YES – Company has demonstrated Paris-alignment

- NO / PARTIAL – Company must demonstrate Paris-alignment

Sector group 3

Industrials, Materials, Utilities (GICS Industry: Airlines, Transportation Infrastructure, Road & Rail, Commercial Services & Supplies, Professional Services, Aerospace & Defense, Building Products, Construction & Engineering, Trading Companies & Distributors, Metals & Mining, Chemicals, Construction Materials, Containers & Packaging, Electric Utilities, Gas Utilities, Multi-Utilities, Independent Power and Renewable Electricity Producers)

- Does the company own or operate fossil fuel exploration, production, transport, energy generation or refining assets? [These would typically include GICS sub-industry: Gas Utilities, Multi-Utilities, Diversified Metals & Mining, Marine Ports & Services]

- YES – Apply ‘Sector group 4’ (Energy) methodology

- NO – Does the company: provide services to support fossil fuel energy generation, distribution, exploration, production, or transportation; or does the company produce iron ore? [These would typically include GICS sub-industry: Electric Utilities, Marine Ports & Services, Railroads, Diversified Support Services, Environmental & Facilities Services, Human Resource & Employment Services, Research & Consulting Services, Construction & Engineering, Commodity Chemicals]

- YES – Has the company demonstrated how its strategy (involving capex decisions, remuneration and emission reduction targets) is consistent with a Paris-aligned scenario?

- YES – Company has demonstrated Paris-alignment

- NO – Company must demonstrate Paris-alignment, and is noted as directly exposed to transitional climate risk

- NO – apply ‘Sector group 1’ methodology

Sector group 4

Energy

- Does the company rely on scenarios that overtly fail to meet the goals of the Paris Agreement when discussing future plans or prospects? [GICS sub-industry: Coal & Consumable Fuels, Integrated Oil & Gas, Oil & Gas Equipment & Services, Oil & Gas Exploration & Production, Oil & Gas Refining & Marketing]

- YES – Company is ‘out of line, out of time’

- NO/ UNCLEAR – Is the company attempting to expand the fossil fuel industry?

- YES – Company is ‘out of line, out of time’

- NO/ UNCLEAR – has the company demonstrated how its strategy (involving capex decisions, remuneration and emission reduction targets) is aligned to a Paris-aligned scenario?

- YES – Company has demonstrated Paris-alignment

- NO/ PARTIAL – Company must demonstrate Paris-alignment, and is noted as directly exposed to transitional climate risk

Potential emissions calculations methodology

Coal, oil and gas producers

Out of Line companies who produce coal, oil, and/or gas disclose their reserves and resources in annual reports, reserves and resource statements and other ASX announcements. From these sources, the following data is collected:

- Petroleum (oil & gas): 2P developed reserves, 2P undeveloped reserves, 2C resources

- Coal: Proved and Probable reserves, Measured, Indicated and Inferred resources for each project. It is also recorded whether coal is thermal or metallurgical.

It is assumed that all petroleum is combusted, with the amount of greenhouse gas released estimated using emissions factors contained in the National Greenhouse Accounts Factors 2020.

It is assumed that all thermal coal is combusted, and that all metallurgical coal is used in the steel industry. Greenhouse gas emissions from coal use are estimated using emissions factors in the National Inventory Report 2018 (Table 3.2).

Explanation of reserve/resource categories

- 2P petroleum reserves represent the best estimate of reserves and are the sum of proved reserves and probable reserves. “Proved Reserves are those quantities of petroleum that, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be commercially recoverable, from a given date forward, from known reservoirs and under defined economic conditions, operating methods, and government regulations”. “Probable Reserves are those additional Reserves which analysis of geoscience and engineering data indicate are less likely to be recovered than Proved Reserves but more certain to be recovered than Possible Reserves.” (PRMS, 2018)

- 2P petroleum reserves are split into developed and undeveloped categories to indicate whether they can be accessed using existing wells and infrastructure.

- 2C petroleum resources represent the best estimate of contingent resources, which are those quantities of petroleum, as of a given date, that are potentially recoverable from known accumulations by application of development projects, but which are not currently considered to be commercially recoverable owing to one or more contingencies. (PRMS, 2018)

- Proved marketable coal reserves and Probable marketable coal reserves (proved and probable coal reserves): A proved coal reserve “is the economically mineable part of a Measured Mineral Resource [and] implies a high degree of confidence in the Modifying Factors”. A probable coal reserve “is the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable [Coal] Reserve is lower than that applying to a Proved [Coal] Reserve.” (JORC, 2012)

- Market Forces refers to ’additional coal resources’ as the sums of Measured, Indicated and Inferred coal resources, excluding the associated proved and probable coal reserves. Coal resources are those quantities of coal which the company believes have ‘reasonable prospects’ of eventual extraction (JORC, 2012). This extraction will almost certainly require further infrastructure and investment.

Sources: Petroleum Resource Management System, JORC 2012

Notes:

- The distinction between metallurgical coal and thermal coal is not always made clear in company reporting. While some effort has been made to distinguish between thermal and metallurgical coal for each project, there is an immaterial difference (approximately 0.5 percentage points) in the emissions resulting from the use of these products in the electricity generation and steel making industries (see National Inventory Report 2018, Table 3.2).

- Regarding petroleum reserves, there are several instances whereby companies do not disclose the development status of each petroleum type (e.g. what proportion of gas reserves are developed vs undeveloped) but do report the development status of all petroleum products combined (e.g. total developed petroleum reserves vs total undeveloped petroleum reserves). In this instance, it is assumed that the development status of each petroleum type is proportional to that of all petroleum products.

- In BHP’s 2020 Annual Report, only 1P reserves are disclosed (as of 30/06/2020), but the development status of each petroleum type is also disclosed. A 2019 BHP Petroleum briefing discloses total 1P and 2P reserves, and 2C resources, for each petroleum type (as of 30/06/2019). In order to estimate the development status of BHP’s 1P and 2P reserves, and 2C resources, it was assumed that the development status of BHP’s reserves (1P and 2P) and resources (2C) as disclosed in the earlier statement, were proportional to that of BHP’s 1P reserves as disclosed in the later statement.

Existing power generation facilities

In order to estimate the remaining lifetime greenhouse gas emissions from existing fossil fuel power generation facilities owned by Origin Energy and AGL Energy, the following data was collected:

- Scope 1 and 2 greenhouse gas emissions from each power generation facility in FY2019. Source: ‘Greenhouse and energy information for designated generation facilities 2018-19’, Clean Energy Regulator.

- Expected closure year of each generation unit. Source: ‘NEM Generation Information November 2020’, AEMO.

Assuming that every unit emits the same amount of greenhouse gas as it did in FY2019, from 2020 until its closure, the FY2019 emissions of each unit were multiplied by each unit’s expected remaining lifetime to estimate the total remaining lifetime emissions of each generation facility.

Proposed power generation facilities

Proposed power generation facilities owned by Origin Energy and AGL Energy were identified by consulting AEMO’s ‘NEM Generation Information November 2020’.

The lifetime greenhouse gas emissions of each proposed generation facility were estimated as follows:

- Newcastle Gas Peaker: According to the project’s EIS Greenhouse Gas Assessment, “Scope 1 emissions were estimated at between approximately 140 – 220 kilotonnes on a carbon dioxide equivalent basis (kt CO2-e) per annum”. The expected lifetime of the project is 25 years. Therefore, estimated lifetime emissions are the product of the mid-point of the annual emissions range (180 kt CO2-e) and the project lifetime (25 years).

A similar calculation was performed for each of the remaining projects:

- NSW Gas Peaker: The emissions intensity of this project is assumed to be the same as for the Newcastle Gas Peaker (mid-point: 0.587 t CO2-e/MWh), whilst capacity factor (25%) and lifetime (25 years) were taken from a hypothetical reciprocating engine project in AEMO’s 2019 Cost and Technical Parameters Review Report.

Torrone Gas Turbine: The expected lifetime was taken from a hypothetical reciprocating engine project in AEMO’s 2019 Cost and Technical Parameters Review Report and annual emissions from the midpoint of the range given in the Local Air and Greenhouse Gas Assessment for Torrone GT.

Disclaimer

The information provided by Market Forces does not constitute financial advice. The information is presented in order to inform people motivated by environmental concerns and take actions based on those concerns. Market Forces is organising data for environmental ends.

The information and actions provided by Market Forces do not account for any individual’s personal objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

Market Forces recommends all users obtain their own independent professional advice before making any decision relating to their particular requirements or circumstances. Switching super funds may have unintended financial consequences.

For more information about Market Forces, please visit the about page of the site. To see how we profile super funds go to the methodology page.