ARCHIVED CONTENT

This content is no longer being updated. Data on this page covers the period Jan 2008 – Dec 2019.

WHY BANKS MUST ABANDON AUSTRALIA’S LNG INDUSTRY

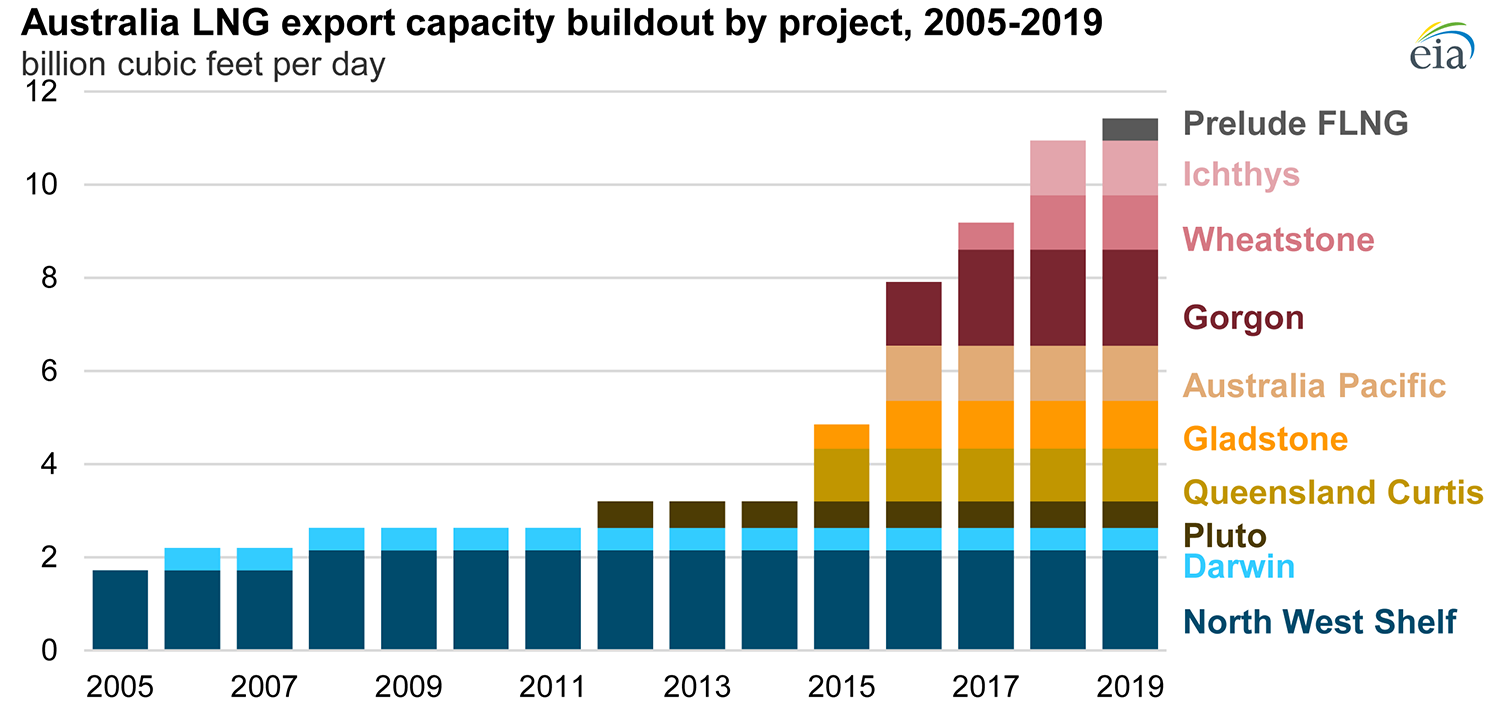

Over the last 10 years Australia ramped up its exports of LNG enormously, becoming the world’s largest exporter in calendar year 2019.

The 77.5 million tonnes of LNG exported from Australia in 2019 was enough to release 206 million tonnes of CO2 when combusted, equivalent to 39% of Australia’s annual greenhouse gas emissions (for the year to September 2019).

Behind this rapid expansion is a relatively small number of financial institutions that loaned more than $75 billion dollars to LNG projects and companies.

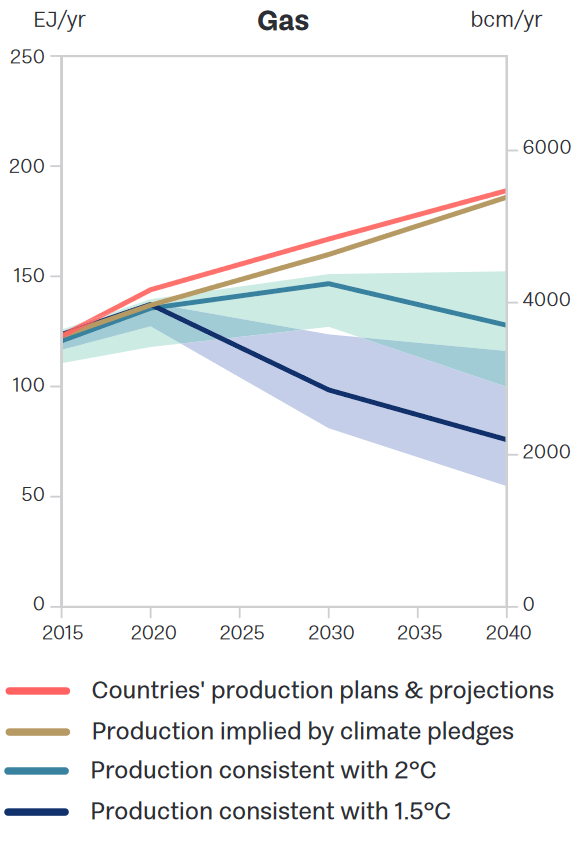

These projects and companies rely on the failure of the Paris Agreement, betting that the world’s gas consumption will continue to rise over coming decades when the role of gas must actually decline if we’re to avoid 1.5°C of warming.

Yet there are plans for another wave of Australian LNG, comprising new and expanded projects that would cost tens of billions of dollars more. None of this is compatible with a safe climate future.

But these plans are being put on hold by COVID-19 and the oil price crash. In March 2020, major Australian oil & gas producers Woodside and Santos delayed investment decisions for $60 billion of planned LNG expenditure.

This is our chance to leave LNG behind.

As governments, industry, investors and society all move to place a clean energy transition at the centre of economic recovery and stimulus plans in response to COVID-19, investors must position themselves to leave incompatible LNG projects, and the companies that have no interest in abandoning them, behind.

Use this form to tell Australia’s biggest LNG lenders to stop funding expansion of this climate-wrecking industry.

TAKE ACTION

Use this form to tell Australia’s biggest LNG lenders to stop funding expansion of LNG and to ensure that LNG projects and companies wind up their operations in line with the goals of the Paris Agreement.

Who are the biggest lenders to Australian LNG?

Market Forces has identified $75 billion in loans from January 2008 – December 2019 backing 11 Australian LNG projects (all amounts are displayed in Australian dollars unless otherwise specified). Here are the biggest lenders to this climate-wrecking industry:

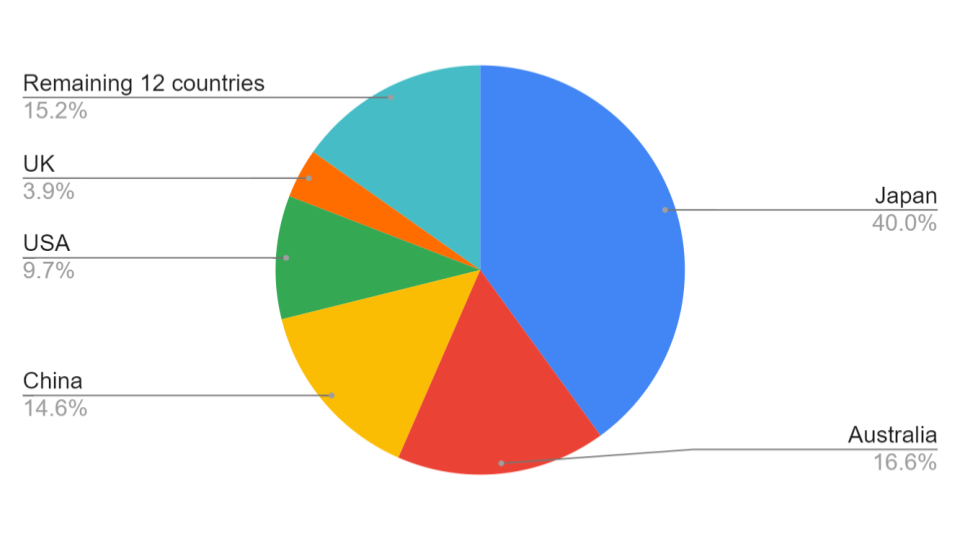

Japanese, Australian and Chinese lenders dominate lending to the Australian LNG sector.

Topping the list of LNG lenders is the Japan Bank for International Cooperation (JBIC) with $11 billion. JBIC is Japan’s export credit agency (ECA), a government-owned bank that supports domestic companies’ export operations.

Japanese lenders including JBIC, MUFG, Mizuho and SMBC have loaned a combined $30 billion for 10 LNG projects, accounting for 40% of overall lending. Over half of this ($18 billion) was to finance the Ichthys LNG project, which part-owner INPEX states “is expected to supply approximately 10 percent of Japan’s LNG imports”.

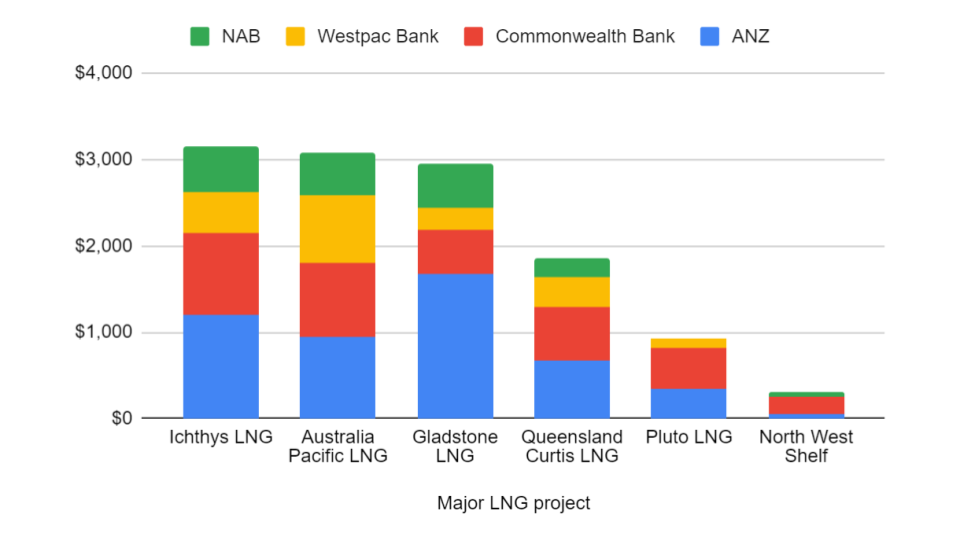

Australia’s big four banks — ANZ, Commonwealth Bank, NAB and Westpac — also play a critical role, having provided a combined $12.3 billion (16%) of loans backing 7 LNG projects, including Ichthys LNG, APLNG and Gladstone LNG. ANZ loaned the most of the big four, providing $4.9 billion.

Chinese banks loaned $11 billion (15%) and include China’s ECA the Export-Import Bank of China, China Development Bank, as well as the world’s four largest banks (by total assets); Industrial and Commercial Bank of China (ICBC), China Construction Bank, Agricultural Bank of China and Bank of China.

The vast majority of this lending ($8.7 billion) was for the Australia Pacific LNG (APLNG) and Queensland Curtis LNG (QCLNG) projects. According to May 2020 media reports, these two projects are the largest sources of Chinese LNG imports.

Other major lenders include those from the US, including the Export-Import Bank of the United States, which provided two huge loans for Queensland’s APLNG and QCLNG projects, as well as multinational investment bank Citi.

Lenders from the UK were also prominent and included Asia-focused multinational investment bank HSBC, providing loans across 4 different projects.

Total lending by bank country

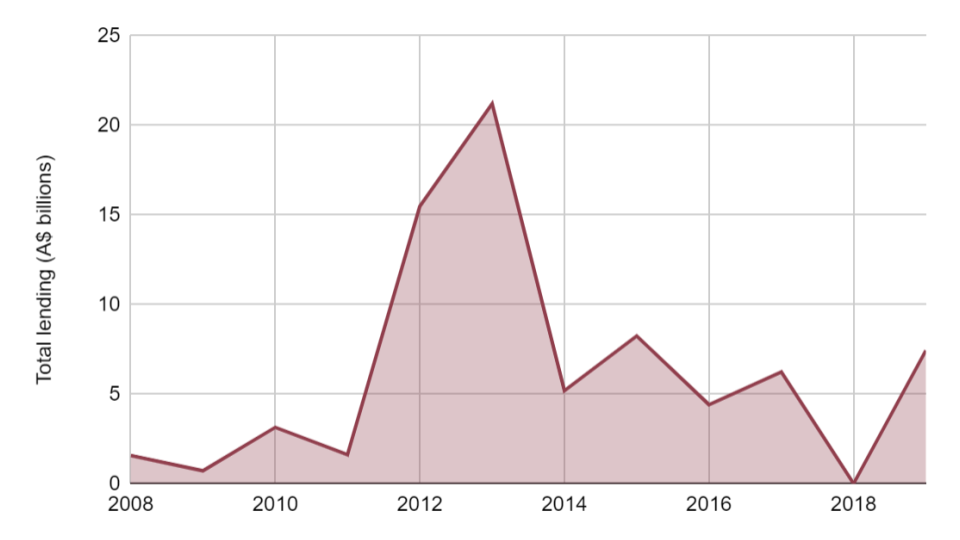

Total lending over time

LNG finance boomed in 2012 and 2013, drawing over $15 billion and $21 billion respectively. This includes one of Australia’s largest ever project financings; $20 billion for the Ichthys LNG in January 2013, a project with components in both the Northern Territory and Western Australia.

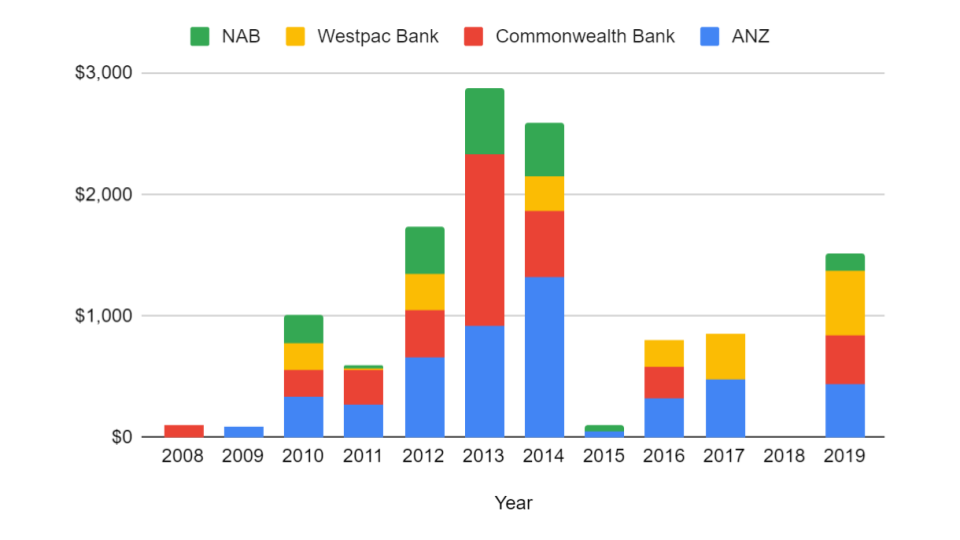

Australia’s big four banks

Australia’s major banks have been instrumental in the development of Australia’s LNG industry, lending at least $12.3 billion to Australian LNG projects since 2008. Adding insult to injury, they’ve continued to support some of the largest LNG developers in the country, with ANZ and Westpac lending US$100 million and US$75 million (respectively) to Australia’s biggest oil & gas company Woodside in October 2019.

Yet despite their continued support companies whose viability depends on the failure of the Paris Agreement, Australia’s major banks are now among those “urging a radical rethink in how to steer the economy out of the pandemic-induced economic crisis, calling for stimulus measures that are consistent with the Paris Agreement climate targets.”

Big four lending by year

Big four lending by year

Despite having loaned billions to the industry over the past decade, some of Australia’s major banks have taken significant steps towards ruling out lending to new LNG projects moving forward. In August 2019 Commonwealth Bank announced it will:

“only provide Banking and Financing activity to New oil, gas or metallurgical coal projects if supported by an assessment of the environmental, social and economic impacts of such activity, and if in line with the goals of the Paris Agreement.”

Given our research finds Commonwealth Bank is the 8th largest backer of Australian LNG projects over the last decade, and that its latest reporting showed it had $2.8 billion on loan to LNG in June 2019, this isn’t good news for companies pursuing new LNG developments. Given that the latest science shows building new or expanded LNG infrastructure is inconsistent with the goals of the Paris Agreement, Commonwealth Bank’s policy should prohibit it from funding the expansion of LNG anywhere in the world moving forward.

Westpac made a similar pledge in May 2020, indicating that any financing of the sector from this point on will need to be in line with Westpac’s commitment to the Paris Agreement.

ANZ and NAB have been left behind by the competition, as neither has made any form of commitment to stop funding expansion of the oil & gas industry.

Top lenders to each project

Gladstone port development, QLD. © Greenpeace / Tom Jefferson

LNG has no place in a decarbonising world

Climate wrecking

The science is clear; there is absolutely no room for expansion of the LNG industry if we’re to limit global warming to 1.5°C consistent with the Paris Agreement’s climate goals.

“We have no room to build anything that emits CO2 emissions.” – Fatih Birol, Executive Director, International Energy Agency (13 Nov 2018)

In fact, the LNG industry needs to shrink. According to modelling from the Intergovernmental Panel on Climate Change (IPCC), a 1.5°C scenario (P1: no or limited overshoot) would see primary energy from gas decrease by 25% by 2030 and by 74% by 2050 (from a 2010 baseline).

“With average lifetimes of 20 years or longer for pipelines, terminals, wells, and platforms, the time to begin planning for a wind-down of gas production is, as with other fossil fuels, already upon us.” – SEI, IISD, ODI, Climate Analytics, CICERO, and UNEP (2019).

In Australia, the gas industry is counteracting efforts to cut greenhouse gas emissions. Australia’s 2019 emissions report showed that while emissions dropped for the electricity, agriculture and transport sectors, increases in emissions from the LNG-dominated gas sector wiped out these gains.

Among the emissions released by the LNG industry are fugitive emissions due to flaring and the venting and leakage of methane and carbon dioxide. LNG operations routinely release or flare gas to manage pipeline pressures but gas leaks are also a significant and often hidden source of emissions. So LNG is undermining Australia’s own progress to meet the Paris Agreement’s goals.

Credit: The Production Gap: 2019 Report (Figure ES.2), https://productiongap.org

Gas impeding the transition to renewables

There are concerns that Australia’s exported LNG could displace the use of renewable energy elsewhere and therefore increase emissions overseas. According to Frank Jotzo and Salim Mazouz of the Australian National University (ANU):

“For the most part, exported gas probably displaces natural gas that would otherwise be produced elsewhere, leaving overall emissions roughly the same. Some smaller share may displace coal. But it could just as easily displace renewable or nuclear energy, in which case Australian gas exports would increase global emissions, not reduce them.”

This has been acknowledged by gas industry-funded research. According to a July 2019 study of the greenhouse gas emissions associated with an LNG project in Queensland conducted by the Gas Industry Social and Environmental Research Alliance (GISERA):

‘Where natural gas displaces renewable forms of electricity generation rather than coal, such as where market conditions prioritise natural gas over solar, wind or nuclear energy sources, potential climate benefits are reduced and possibly reversed.’

Instead, Jotzo and Mazouz identify that clean renewable energy is the way forward:

“Thankfully, there actually is a way for Australia to help the world cut emissions, and in a big way. That is by producing large amounts of renewable energy for export, in the form of hydrogen, ammonia, and other fuels produced using wind and solar power and shipped to other countries that are less blessed with abundant renewable energy resources.”

Financial risk

According to analysis by independent financial think tank Carbon Tracker, as the world moves to replace fossil fuels with clean renewable energy, high cost sectors such as LNG and Arctic oil are among the most vulnerable to becoming stranded assets. Being stranded means these assets would no longer be able to generate an economic return for their investors.

However LNG has been a risky bet for some investors even despite the transition. According to Bruce Robertson, Energy Finance Analyst at IEEFA, since 2014 there have been significant write offs in the value of assets owned by major onshore coal-seam gas to LNG (CSG-to-LNG) producers Santos (nearly $7 billion), Origin Energy ($3 billion plus) and BG Group ($5 billion).

“Santos has taken a series of write-offs on its wealth-destroying investments in the coal seam gas to liquefied natural gas industry since its inception in 2014. All up, its investments in the CSG to LNG industry have been a financial failure.” – Bruce Robertson (Energy Finance Analyst Gas/LNG) and Tom Lawson (Research Assistant), IEEFA

Robertson adds that falling share prices over the past 10 years of such oil and gas companies are further evidence that “they’ve demonstrably destroyed wealth for their shareholders”. This accords with recent analysis from Market Forces which finds that 11 companies whose sole business is producing coal, oil or gas halved in value since January 2010, while the broader sharemarket rose 20% over that time.

“They’ve demonstrably destroyed wealth for their shareholders” – Bruce Robertson, Energy Finance Analyst Gas/LNG, IEEFA

What banks must do next

Despite the multitude of risks LNG poses to the climate and economy, companies are still pursuing tens of billions of dollars’ worth of projects in Western Australia, the Northern Territory and Queensland.

Below is a list of Australian LNG projects being pursued according to the Office of the Chief Economist’s ‘Resources and Energy Major Projects List’ published December 2019. As we recover from the COVID-19 crisis, these are the projects and companies banks must leave behind.

LNG projects being pursued in Australia - Office of the Chief Economist (click to expand)

There is no doubt that a significant proportion of this planned expenditure would require bank loans.

However in recent months and in response to COVID-19 and the oil price crash, a huge amount of this planned investment has been delayed. In March, Australia’s largest oil & gas producer Woodside announced the deferral of $53 billion of LNG growth projects in Western Australia, including the Scarborough, Pluto-2 and Browse projects. At the same time, Australian oil & gas major Santos said it was “hunkering down” as it delayed the $7 billion Barossa gas project that would supply the Darwin LNG plant.

New and expansionary LNG projects are completely inconsistent with the goals of the Paris Agreement and have no place in a decarbonising economy. As governments, industry, investors and society all move to place a clean energy transition at the centre of economic recovery and stimulus plans in response to COVID-19, investors must position themselves to leave incompatible fossil fuel projects, and the companies that have no interest in abandoning them, behind.

Clean energy transitions must be at the center of economic recovery and stimulus plans. – International Energy Agency

To achieve this, investors including banks should avoid providing direct funding (project finance) for these projects. However not all of the projects would be funded directly. Instead, companies can also fund projects indirectly by seeking corporate loans that can be used for a variety of purposes including financing LNG projects.

Institutions providing corporate credit for companies attempting to expand the scale of the fossil fuel industry, including the likes of Woodside and Santos, must do so only on the condition that these companies immediately stop wasteful spending on new fossil fuel projects and have concrete plans to manage down assets in a timeframe consistent with the Paris Agreement.

Regarding those project loans to existing LNG infrastructure that banks have already provided and that are due for expiry and refinancing over the coming years and decades, banks considering recommitment to these projects must ensure that the project’s output will decline in a manner consistent with the Paris Agreement, or else manage down credit exposure consistent with the same timeframe.

A closer look at some dirty LNG projects

Australian LNG projects have been funded by 47 separate loans since 2008. Loans range from $163 million for LNG transport vessels to $19 billion (excluding sponsor loans) for the Ichthys project, Australia’s largest ever project finance deal. Explore some of Australia’s major LNG projects, who is funding them and the problems they’ve created (click to expand):

Ichthys LNG’s liquefaction and export facilities are based in Darwin. Operations started in 2018 and can liquefy almost 9 million tonnes of LNG per annum. The gas is extracted from a rig, 220km from Western Australia coast. A 890km gas pipeline carries the gas to Darwin, the longest subsea pipeline in the southern hemisphere.

Market Forces estimates that over the lifetime of the Ichthys project, it would enable the release of 1.1 billion tonnes of CO2, double Australia’s annual greenhouse gas emissions.

Ichthys is owned by Japanese oil & gas company INPEX (66%). The remaining 33% of Ichthys is predominantly owned by French multinational oil & gas major Total and a number of Japanese gas and utility companies.

Market Forces identified multiple loans totalling $30 billion for Ichthys LNG during 2008 – 2019, with $19 billion of this provided in January 2013. Top lenders to Ichthys include the Japan Bank for International Cooperation ($5.5B), Mizuho Financial Group ($4.1B), SMBC ($3.9B), MUFG ($3.9B), ANZ ($1.2B) and Commonwealth Bank ($941m).

Aside from being environmentally destructive, Ichthys is also a very costly project. In 2018 the project saw an US$8 billion cost blowout, adding 17% to the original $45 billion estimate, and delays to production caused by a contractor walk out on a power plant for the Darwin LNG facilities. In the same year, Australian regulators took enforcement action against the operators of Ichthys facilities for electrical hazards that could have sparked a gas explosion.

APLNG’s liquefaction and export facilities are based near Gladstone, Queensland, alongside two other massive LNG facilities; Queensland Curtis LNG (QCLNG) and Gladstone LNG (GLNG).

All of these facilities sit on Curtis Island, within the Great Barrier Reef World Heritage Area. The shipping, coastal industrialisation and climate change caused by these plants have been and remain a significant threat to the Reef.

The owners of the facility include Origin (37.5%), ConocoPhillips (37.5%) and Sinopec (25%).

Market Forces has identified $11 billion in loans for APLNG, with the top lenders being Export-Import Bank of China ($3.4B), the Export-Import Bank of the United States ($2.9B), ANZ ($942m), Commonwealth Bank ($870m), Westpac ($769m) and SMBC ($649m).

Pluto LNG’s liquefaction and export facilities are based in the Pilbara, Western Australia. Pluto LNG’s operations started in 2012 and can produce almost 5 million tonnes of LNG per annum.

Pluto LNG is owned and operated by Woodside Energy. The facility is based next to Woodside’s North-West Shelf LNG and Karratha Gas Plant facilities. Woodside plans to expand Pluto and connect its LNG assets through its Barrup Hub vision.

Market Forces identified over $3.5B in finance for Pluto, with the top lenders being the Japan Bank for International Cooperation ($1B), MUFG ($432m), Commonwealth Bank ($281m), ANZ ($193m), Development Bank of Japan ($169m) and Bank of China ($132m).

Woodside demonstrates the fragility of the LNG industry in the wake of COVID-19 impacts and the oil price wars. With revenue dropping, Woodside has depended on bank loans for “crisis liquidity financing”

Gorgon LNG is based on Barrow Island, Western Australia. The facilities are based north of its sister Wheatstone Project. Gorgon’s operations started in 2016 and can produce over 15 million tonnes of LNG per annum.

Gorgon is one of the most expensive LNG projects in history. Originally costed at US$37 billion in 2009, this blew out to US$54 billion, making it “the biggest investment ever made in a single LNG project”.

Gorgon LNG features the world’s biggest carbon capture and storage (CCS) project which involves injecting carbon dioxide under the Barrow Island. CCS operations only commenced in mid-2019 after months of failures. During its failures, the CCS project is estimated to account for half of Australia’s increase in emissions in 2018. Gorgon LNG demonstrates how dirty LNG can be.

Gorgon is owned by Chevron Corporation (47.3%), ExxonMobil (25%) and Royal Dutch Shell (25%). The remaining stakes (less than 3%) are owned by Osaka Gas, Tokyo Gas and Chubu Electric Power.

Chevron displays some of Australia’s most egregious examples of corporate fossil fuel behaviour. According to ATO data, Chevron paid no tax in Australia in the 5 years to FY2018. Over the same timeframe, it donated $582,692 to Australia’s major political parties. Meanwhile, its troubled Gorgon LNG CCS scheme was backed by a $60 million federal government subsidy (via the Low Emissions Technology Demonstration Fund).

Market Forces identified almost $1B in loans for Gorgon, whose top lenders include the Japan Bank for International Cooperation ($483m), the Export-Import Bank of China ($297m), MUFG ($171m) and SMBC ($28m).

Please note that only a small amount of funding (A$1B) was identified for Gorgon relative to its total project cost (US$54B). This is because Gorgon’s developers funded the project with their own equity, rather than via bank debt.

Direct lending is the tip of the iceberg

This study considered direct lending to LNG projects, also known as ‘project finance’, capturing 26 project finance deals involving $51 billion in loans. While project finance is the most common form of funding for LNG projects, this infrastructure can also be funded by various other pathways, with industry sources noting that neither Queensland Curtis LNG (QCLNG), Gladstone LNG (GLNG) nor Gorgon LNG used project finance loans to raise funding.

Corporate lending

Market Forces also captured a less direct form of lending in this study, corporate lending, identifying 21 corporate finance deals involving over $24 billion loaned to Australian LNG since 2008.

Corporate loans involve banks lending to a company rather than a project. Often these loans are used for ‘general corporate purposes’, which can be for a variety of uses including to refinance existing debt, helping cashflow or for project development. It is often difficult to discern exactly what the funding is used for and in many cases this must be estimated. However in the present study, Market Forces chose to only include those corporate deals with a clear link to specific LNG projects, where proceeds were primarily for funding the projects. This likely resulted in an under-estimate of corporate lending to the sector.

Bond arrangement and bondholding

While Market Forces only captured loans as part of this study, bonds are a noteworthy piece of the overall LNG finance picture.

For example, major Australian gas pipeline company APA Group issued $5 billion of bonds in March 2015 backing its acquisition of the Queensland Curtis LNG (QCLNG) pipeline from BG group. In that case, BNP Paribas, HSBC, NAB and Royal Bank of Scotland (RBS) helped APA sell €1,350 million to investors in the European bond market, as well as £600 million to investors in the UK bond market. Meanwhile, ANZ, JP Morgan, Morgan Stanley and Bank of Nova Scotia helped APA issue US$1.4 billion in the US bond market. Commonwealth Bank, DNB Markets, Mitsubishi UFJ Securities and Westpac also helped issue the European, British and US bonds (acting as ‘Co Managers’).

For a list of the biggest bond managers and bondholders in major Australian LNG producer Woodside, click here.

Over the last decade, major banks have funded a massive expansion of climate-wrecking #LNG and there are plans for a 2nd wave.

— Market Forces (@market_forces) May 22, 2020

The science is clear: avoiding 1.5°C of warming means no expansion of dirty gas.

As we recover, tell banks to leave LNG behind https://t.co/AhM0cI1FgE pic.twitter.com/k4ohO4ARYA

Methodology

Scope

- Assets: LNG projects in Australia

- Timeframe: 1 Jan 2008 – 31 Dec 2019

- Finance type: Project and corporate loans

- Transaction type: Primary, refinancing, acquisition

Market Forces obtained primary data from finance industry databases provided by IJGlobal and Refinitiv. Further primary data was sourced from company filings, reports and market disclosures. Figures were cross-referenced for consistency and verified against secondary material. This report presents a synthesis of this material.

The loans we have captured include refinancings, as (1) we consider each refinancing a conscious decision by a lender to continue supporting a project, and (2) the lending group can and often does change upon refinancing and we wanted to capture this.

Where corporate lending occurred, Market Forces chose to only include those deals with a clear link to specific LNG projects, where proceeds were primarily for funding the projects. This likely resulted in an under-estimate of corporate lending to the sector.

Dollar values represent the sum of committed loan amounts and are presented in Australian dollars unless otherwise specified. No adjustments have been made to reflect the net present value of facilities arranged before 1 Jan 2020.

We have tried to capture as much information as possible in this study but a lack of transparency about fossil fuel lending means it will only ever be a partial picture.

Take Action

Tell Australia’s biggest LNG lenders to stop funding expansion of this climate-wrecking industry.

DISCLAIMER

The information provided by Market Forces does not constitute financial advice. The information is presented in order to inform people motivated by environmental concerns and take actions based on those concerns. Market Forces is organising data for environmental ends.

The information and actions provided by Market Forces do not account for any individual’s personal objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

Market Forces recommends all users obtain their own independent professional advice before making any decision relating to their particular requirements or circumstances. Switching super funds may have unintended financial consequences.

For more information about Market Forces, please visit the about page of the site.