28 April 2020

Woodside Energy is Australia’s largest gas producer, with a focus on liquefying and exporting gas, a fossil fuel the use of which cannot be expanded if we’re to limit global warming to 1.5°C. Woodside is headquartered in Western Australia, where most of its projects are located, including the Burrup Hub which according to Woodside “involves the proposed development of some 20 to 25 trillion cubic feet of gross dry gas resources”.

At its annual general meeting (AGM) last year, when asked if Woodside would align its strategy with limiting warming to 1.5°C above pre-industrial levels, the answer was a flat “no”.

With just days until 2020 AGM, Woodside faces a serious threat to its future due to COVID-19 and an oil price war. Since mid-February we’ve seen its share price collapse, the suspension or deferral of $2.7 billion of planned oil & gas investment and the company taking out more debt to strengthen its balance sheet.

UPDATE: Click here to read our summary of Woodside’s 2020 AGM.

Of course, aligning its operations with a 1.5°C economy would require Woodside and the broader oil & gas industry to immediately cease expanding production and instead reduce oil and gas output over time. This would result in many of the same outcomes we’re witnessing under COVID and the oil price crash. In this sense, the current conditions experienced by the oil & gas industry are a preview of a much larger, longer term crisis already underway.

As the current crisis unfolds, investors should be looking to the future and steering companies they own away from the larger, longer term risks posed by climate change. Yet it appears some investors have no interest in doing this, instead preferring to continue backing companies unwilling to help achieve a low carbon world. We expose these investors and ask why they’re helping sustain a company driving us towards climate breakdown.

ANZ and Westpac are major lenders to Woodside. If you’re a customer, click here to put them on notice.

The crisis facing Woodside

Woodside is facing an unprecedented crisis. Not only has demand for the company’s products dropped dramatically due to COVID-19 but it’s also competing with major global oil producers like Saudi Arabia and Russia which are engaged in a fierce price war. The result? Oil prices have fallen off a cliff, down to levels not seen since the early 2000s. For many oil and gas companies this could mean life or death, or in finance-speak; the very real threat of bankruptcy.

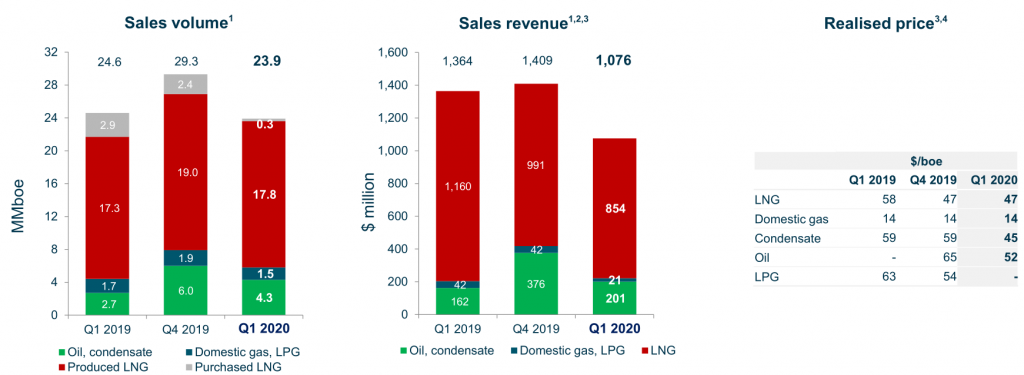

Early consequences can be partially observed in Woodside’s 2020-Q1 report. The company’s revenues decreased 23% compared to 2019-Q4 and 22% compared to 2019-Q1. Compared to 2019-Q4 the reduction is mainly associated with the oil segment, where sales volume and realised price decreased by 6% and 20%, respectively. For the first quarter of the year, realised LNG prices remained constant compared to the previous quarter.

Source: Woodside Q1 2020 Report

In response to the crisis, Woodside has suspended or deferred all non-committed activities. As a result, the total investment originally planned for 2020 was reduced from US$4.5 billion to around US$1.7 – US$1.9 billion. Production guidance, however, remains unchanged at 97 – 103 million barrels of oil equivalent (MMboe).

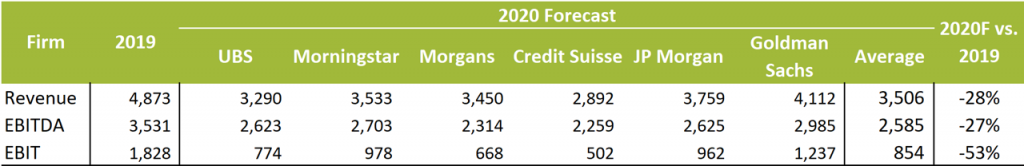

The outlook for the rest of the year isn’t much better. Analysts forecast a year-on-year decline in revenues of 28%, leading to a reduction in earnings (EBIT) of more than 50%.

Source: Refinitiv Eikon

EBITDA: Earnings before interests, taxes, depreciation and amortisation

EBIT: Earnings before interests and taxes

Woodside’s investors

Woodside needs a strong balance sheet to survive the crisis and that’s achieved through securing loans, bonds and equity from investors. Indeed investors, mainly banks, have shored up Woodside’s liquidity position (US$6.9 billion as at 31 Dec 2019) by providing and arranging bonds and loans for the company both before and during the crisis.

Before the crisis and as of December 2019, banks had made US$2.9 billion of loans available for Woodside to call upon and during 2019, Woodside issued US$1.7 billion of bonds and notes.

In January 2020, banks provided Woodside with a US$600m 7-year loan. Then in April 2020, banks extended and increased existing loans by another US$600m for what Refinitiv described as “Crisis Liquidity Financing; COVID-19. To deal with the fallout of the coronavirus pandemic”. Market Forces could not determine the lenders for the April 2020 loan.

“Crisis Liquidity Financing; COVID-19. To deal with the fallout of the coronavirus pandemic”

Refinitiv Eikon

So who are these investors? Market Forces examined company disclosures and information from financial data provider Refinitiv to find out.

Lenders

Market Forces identified the lenders to three of Woodside’s active (as at Apr 2020) loans totalling $1.8 billion. Two of these loans were finalised in October 2019 and another in January 2020, shortly before the crisis hit.

Lenders to Woodside’s syndicated facilities, closed Oct 2019 + Jan 2020 (US$m)

| Lender | Oct 2019 | Jan 2020 | Total |

| Sumitomo Mitsui Banking Corporation (SMBC) | 125 | 75 | 200 |

| Bank of China | 75 | 120 | 195 |

| Industrial & Commercial Bank of China (ICBC) | 55 | 70 | 125 |

| China Construction Bank | 75 | 45 | 120 |

| ING | 75 | 45 | 120 |

| Mizuho Bank | 120 | 120 | |

| Export Development Canada | 40 | 75 | 115 |

| ANZ | 100 | 100 | |

| BNP Paribas | 35 | 45 | 80 |

| DBS Bank | 55 | 25 | 80 |

| Scotiabank | 75 | 75 | |

| Westpac | 75 | 75 | |

| Agricultural Bank of China | 40 | 30 | 70 |

| Mega International Commercial Bank | 25 | 20 | 45 |

| Mitsubishi UFJ Financial Group (MUFG) | 20 | 25 | 45 |

| ABN AMRO Bank | 40 | 40 | |

| DNB Bank | 35 | 35 | |

| Hua Nan Commercial Bank | 25 | 10 | 35 |

| Sumitomo Mitsui Trust Bank | 35 | 35 | |

| Credit Industriel et Commercial | 30 | 30 | |

| Shinsei Bank | 15 | 15 | 30 |

| Credit Agricole | 20 | 20 | |

| Chiba Bank | 10 | 10 |

The biggest lender across these three loans is Japan’s Sumitomo Mitsui Banking Corporation (SMBC) which provided US$200m. SMBC is closely followed by state-sponsored Bank of China which provided US$195m to Woodside.

Among the lenders are Australian banks ANZ and Westpac, both of which have committed to support the Paris Agreement, though it appears these loans are entirely inconsistent with that commitment.

In addition to the above loans, as at 31 December 2019 Woodside still owed US$333 million to the Japan Bank for International Cooperation (JBIC) for a $1 billion loan received in 2008. Market Forces was unable to identify lenders for other active loans.

Bond managers and investors

Bond managers, usually major investment banks, are hired to sell bonds on behalf of clients (e.g. Woodside) to prospective bond investors, usually institutional investors such as asset management and insurance companies, who become ‘bondholders’ upon purchasing the bonds.

February 2019 bond

Woodside hasn’t issued bonds since the beginning of the crisis, however a recent strengthening of Woodside’s balance sheet came in Feb 2019, when major banking group companies Citigroup Global Markets (Citi), Merrill Lynch Pierce Fenner & Smith (Bank of America) and UBS Securities (UBS) helped Woodside issue US$1.5 billion of bonds.

Many of the identified investors in this bond are US-based investment managers, with the top 5 being PIMCO, Guggenheim Investment Management, PPM America, State Farm Insurance Companies and USAA Investment Management Company.

Bonds issued over the last decade

More broadly, Market Forces identified and aggregated the bond managers for 7 bonds with final maturity dates post-April 2020, issued by Woodside over the last 10 years (earliest Mar 2011, most recent Feb 2019).

| Bond managers (parent company) | Estimated manager allocation amount (US$m)* |

| Citi | 1,390 |

| UBS | 1,190 |

| Bank of America | 700 |

| JP Morgan | 400 |

| Credit Suisse | 225 |

| Morgan Stanley | 200 |

| Mitsubishi UFJ Securities International | 175 |

| Total | 4,279 |

* Where manager allocation amounts are not stated, it was assumed that principal amounts were split equally among the managers. All bond summary data was accessed in April 2020.

Market Forces also identified and aggregated the top 10 bondholders of 6 Woodside bonds issued since 2011:

| Bondholder | Value of bond holdings (US$m)* |

| PIMCO | 281 |

| State Farm Insurance Companies | 142 |

| T Rowe Price | 141 |

| Columbia Management Investment Advisers LLC | 141 |

| Liberty Mutual Insurance Group | 111 |

| John Hancock Financial Services, Inc | 97 |

| PPM America Inc | 85 |

| TIAA Global Asset Management | 83 |

| Great-West Life & Annuity Insurance Company of New York | 55 |

| Protective Life Insurance Co | 53 |

* values are current as of the most recent ‘reported date’ listed by Refinitiv. All bondholder data was accessed in April 2020.

Despite having launched a ‘Climate Bond Strategy’ in 2019, global investment management firm PIMCO holds the largest disclosed value of Woodside bonds at US$281m.

Numerous bond holders are US-based life insurance or pension companies. Customers and members of these companies may be disappointed to learn that the premiums they pay, or their retirement savings, are invested in polluting companies such as Woodside.

Shareholders

Despite financial pressures, shareholders have not been asked to participate in any capital raisings for Woodside in the last few months. Shareholders are however being asked to vote on a resolution pushing for Woodside to commit to emissions reduction targets, presenting an opportunity for investors to live up to their claimed support for climate action.

UPDATE: A record-breaking 50% of Woodside’s investors voted in favour of the resolution led by the Australasian Centre for Corporate Responsibility (ACCR).

According to data from Refinitiv, these are Woodside’s top 10 shareholders:

| Investor Name | % Outstanding | No. of shares held | Total value of shares (US$m) |

| BlackRock | 6.10% | 57,686,070 | 1,050 |

| Vanguard | 5.70% | 54,678,158 | 611 |

| Norges Bank Investment Management (NBIM) | 1.40% | 13,555,737 | 327 |

| UBS | 0.70% | 7,043,538 | 128 |

| Schroder Investment Management | 0.60% | 5,334,580 | 119 |

| Eastspring Investments | 0.50% | 4,897,319 | 118 |

| APG Asset Management | 0.40% | 4,019,220 | 99 |

| Orbis Investment Management | 0.40% | 3,525,993 | 78 |

| State Street Global Advisors | 0.70% | 6,320,937 | 72 |

| MLC Investment Group | 0.30% | 2,891,668 | 70 |