Australia’s ‘big four’ banks – ANZ, CommBank, NAB and Westpac – have all publicly championed the Paris Agreement. They have also committed to the global goal of net zero emissions by 2050, even though the current state of climate science means we should be aiming for net-zero emissions far sooner. But their actions are failing to satisfy either of these commitments, as they continue pouring billions of dollars into projects and companies expanding the scale of the fossil fuel industry.

Meanwhile, the International Energy Agency (IEA) has given us the best insight yet of the rapid energy transition required to achieve net-zero emissions by 2050, a goal supported by Australia’s major banks. The conclusion is clear: there is no room for new or expanded coal, oil and gas projects.

Yet there are plenty of dirty projects for the banks to choose from. According to data from the Office of the Chief Economist, companies are pursuing at least 116 new or expansionary fossil fuel projects in Australia that would cost at least $200 billion. These include coal mines, coal ports, gas fields, gas pipelines, LNG terminals and oil fields. Meanwhile, according to data from the Australian Energy Market Operator (AEMO), as of July 2021 there was at least 115 MW of upgraded or proposed coal-fired power on the horizon, along with 3.4 GW of gas-fired generation, across 23 projects. This brings the total number of proposed projects to 139.

The greenhouse gas footprint of these projects would be enormous. Just four of the projects listed by the Office of the Chief Economist would enable the release of 9.8 billion tonnes of CO2-e, enough to cancel out any gains made under Australia’s emissions reduction target (2021-2030) 109 times over. (These projects include Woodside’s Burrup Hub [Pluto expansion, Scarborough, Browse to North West Shelf] and Clive Palmer’s Galilee Coal and Rail Project.)

These are the projects we need to leave behind if we’re to bring emissions to zero by 2050, let alone limit warming to 1.5°C. The good news is you can help stop them by taking action as a customer, shareholder or citizen, telling the banks to reign in their splurging on climate-wrecking expansions of coal, oil and gas.

Emeritus Professor Will Steffen explains there is no room for new coal, oil or gas projects if we’re to limit global warming in line with the Paris Agreement

Take Action

Send a message to Australia’s big four banks, urging them to cease funding of expansionary fossil fuel projects:

What are the biggest threats to our climate and who is responsible for them?

By far the most significant threats were listed by data from the Office of the Chief Economist, which counted at least 116 new or expansionary fossil fuel projects in Australia that would cost at least $200 billion. Here are those projects:

Coal mines and ports, gas fields and pipelines, LNG terminals and oil fields (Office of the Chief Economist, November 2020)

| wdt_ID | Fossil Fuel Category: | Project | Company | State | Type | Status | Annual Estimated New Capacity | Capacity Unit | Resource | Cost Estimate A$m | Estimated Start Commercial Operation |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Gas | Barossa backfill to Darwin LNG | Santos / SK | NT | New project | Feasible | 9.00 | mmboe pa | Gas/LNG/Condensate | 5,000+ | 2025+ |

| 2 | Gas | Bowen Gas Project | Arrow Energy | QLD | New project | Publicly announced | Gas | 500+ | 2025+ | ||

| 3 | Gas | Browse to North West Shelf | Woodside/ BP / PetroChina / Shell / Japan Australia LNG | WA | New project | Feasible | 9.40 | mtpa | Gas/LNG/Condensate/LPG | 30000+ | 2028+ |

| 4 | Oil | Buffalo | Carnarvon Petroleum | WA | New project | Publicly announced | 31.00 | mmbls | Oil | 195+ | 2022+ |

| 5 | Gas | Cash Maple Development | PTTEP Australasia | WA | New project | Publicly announced | 2.50 | mtpa | LNG | 10000+ | 2027+ |

| 6 | Gas | Clio-Acme | Woodside / Chevron | WA | New project | Publicly announced | 600.00 | mmcfd | Gas | 2500–4999 | 2026+ |

| 7 | Gas | Crux LNG | Shell / SGH Energy / Osaka gas | WA | New project | Feasible | 2.90 | mtpa | LNG | 2500–4999 | 2025+ |

| 8 | Oil | Dorado | Santos / Carnarvon Petroleum | WA | New Project | Publicly announced | 85,000.00 | bbl/d | Oil | 1500–2499 | 2024+ |

| 9 | Gas | Equus | Western Gas | WA | New project | Publicly announced | Gas/LNG/Condensate | 6000 | 2025+ | ||

| 10 | Gas | Glenaras gas project | Galilee Energy Limited | QLD | New project | Publicly announced | Gas | 1500–2499 | 2025+ |

Contents

Coal mines

In May 2021, the International Energy Agency (IEA) released a landmark new report, outlining a roadmap to achieve net-zero emissions within the global energy sector by 2050. To achieve net-zero by 2050, the IEA warns against any new investment in coal mining projects (including expansions):

“No new coal mines or extensions of existing ones are needed in the NZE [Net Zero Emissions scenario] as coal demand declines precipitously.”

– IEA, 2021

This is consistent with scientific research showing that by 2050, 89% of global coal reserves – and 95% of Australia’s – must remain in the ground for a 50% chance of limiting global warming to 1.5ºC. Under this scenario, planned new coal developments would be unviable and existing production must rapidly decline.

Yet data from the Office of the Chief Economist lists 70 proposed new or expanded coal mines that would cost a combined $76 billion. As the IEA report makes clear, pursuing new and expanded coal mines is totally out of line with the goal of achieving net-zero emissions by 2050. Proposed mines such as New Hope’s New Acland Stage 3, Whitehaven’s Winchester South and Vickery mines, as well as Olive Downs and Valeria would all undermine the goals of the Paris Agreement and net-zero by 2050.

New Acland Stage 3 (New Hope Coal)

The New Acland Stage 3 coal mine in Queensland’s Darling Downs, proposed by publicly listed Australian coal mining company New Hope, would involve three new mine pits (named Manning Vale West, Manning Vale East and Willeroo) and is expected to produce 80.4 million ‘product tonnes’ of coal. If all this coal were combusted, it would release another 174 million tonnes of CO2 into our atmosphere, enabling the release of enough CO2 to cancel out the intended emissions reduction under Australia’s 2021-2030 greenhouse gas abatement target almost twice over.

In February 2021, the Oakey Coal Action Alliance (OCAA) – which represents 60 local landholders – won its High Court appeal against New Acland Stage 3. The High Court found original decisions recommending approval of the mine had been the subject of “apprehended bias”. The Court’s decision means a further assessment of New Acland Stage 3 will be conducted by the Land Court. The first Land Court hearing in 2016 took almost 100 sitting days, the longest trial in the Court’s 120 year history. As of September 2021, the existing New Acland mine remained under investigation by state government regulators after allegedly unlawfully mining $500 million of coal.

According to an article published via Bloomberg Professional on 15 Jan 2019, ANZ, CAT Finance, NAB, Macquarie and Mizuho provided New Hope with $600 million, which the coal miner stated “will be sufficient for the Company to also fund its medium term growth projects including New Acland Stage 3”. It’s unclear whether this debt provides all or only part of the funding requirements for New Acland Stage 3, though in any case these lenders should consider withdrawing their funding and rule out any further funding in future.

Winchester South (Whitehaven Coal)

Winchester South is being pursued by Whitehaven Coal, which (like New Hope) is one of the 23 biggest Australian companies dragging us in completely the wrong direction on climate change by expanding the scale of the fossil fuel sector and/or relying on scenarios consistent with the failure of the Paris Agreement to justify their future business prospects.

NAB and Westpac each loaned $110 million to Whitehaven in February 2020.

Winchester South would involve mining approximately 350 million tonnes of coal over a 30-year project lifespan. When emissions from digging up and burning the coal are added, the mine would unleash almost 550 million tonnes of carbon emissions in total, more than Australia’s annual emissions in 2020.

Despite Whitehaven publicly referring to Winchester South as a “metallurgical coal mine” (coal for steelmaking), the mine will in fact produce at least 40% thermal coal (coal for power generation). Whitehaven states Winchester South requires $1 billion in capital expenditure and could approach existing lenders like NAB to fund it.

Olive Downs (Pembroke Resources)

Pembroke Resources bills itself as ‘an Australian-based company’ focused on developing ‘the Olive Downs Coking Coal Complex’. Pembroke states “Fully developed, the Olive Downs Coking Coal Project will be among the largest metallurgical coal mines in the world, producing up to 15 million tonnes of metallurgical coal per annum for almost 80 years”. Meanwhile, according to the IEA, no new coal mines are needed in a net-zero emissions by 2050 scenario, as “existing sources of production are sufficient to cover demand through to 2050”.

In May 2019, ABC News reported that Olive Downs ‘may impact koala habitat the size of Sydney Harbour’.

“A new Queensland coal mine, about the same size as Adani’s controversial project, did not draw opposition from environmentalists during the approval process, despite the possibility an expansive koala habitat the size of Sydney Harbour may be cleared. About 55 square kilometres of koala habitat will be cleared, with the coordinator-general recommending a significant offset to protect the vulnerable species. The mine site, considered one of Australia’s biggest, also includes 11 highly significant wetlands.”

ABC News, 15 May 2019

The Olive Downs mine obtained its final state and federal regulatory approvals in May 2020. If built, Olive Downs will be the third largest coal mine in Queensland, impacting almost 4,000 hectares of floodplains. Documents released to the ABC reveal that environmental regulators held serious concerns about Pembroke’s plans to leave three massive mine voids on the floodplains of the Isaac River.

Despite these concerns, the mine was approved, and in July 2021 received a $175 million federal government loan. A further $275 million is required for the mine’s first stage, which is expected to be financed through commercial banks. The big four Australian banks almost have or will be approached to provide additional funds for the mine and must turn it away.

Galilee Coal and Rail Project (Waratah Coal / Clive Palmer)

This project has gone by a few names over the years, having been known as the ‘Alpha North Coal Project’, ‘China First’ and the ‘Galilee Coal Project’. Whatever you want to call it, it’s Clive Palmer’s giant $6.4 billion proposal to mine up to 1.4 billion tonnes of thermal coal at a rate of up to 56 million tonnes per year. As of December, Waratah Coal (owned by Clive Palmer) reportedly planned to haul the coal to Adani’s Abbot Point coal port, where it would be shipped to China. According to Queensland’s Environmental Defenders Office (EDO), the combustion of the coal would generate around 2.9 billion tonnes of greenhouse gas emissions over the mine’s 30-35 year lifespan, equivalent to ~5.5 times Australia’s greenhouse gas emissions in the calendar year 2019. This is a carbon cost we simply can’t afford.

In May 2020, EDO announced it was heading to court on behalf of young Queenslanders and landholders, bringing a human rights challenge against the mine.

“EDO lawyers on behalf of Youth Verdict and The Bimblebox Alliance will for the first time argue that the climate change this mine will help fuel breaches the human rights of young people because their lives in the future will be at increased risk from bushfires, disease, floods, heatwaves and cyclones – impacting their right to life.”

Environmental Defenders Office

The case is still working its way through the courts, but in a small early victory for the EDO and its clients, the Land Court rejected an application by Waratah Coal to ‘strike out’ the human rights challenge. Instead, the Land Court affirmed it is required to consider the human rights arguments.

Vickery (Whitehaven Coal)

Whitehaven’s proposed $600 million Vickery coal mine involves mining approximately 168 million tonnes of coal from the Gunnedah Basin, in New South Wales. When emissions from digging up and burning the coal are included, the mine would unleash around 370 million tonnes of CO2 over its 26-year lifespan, the equivalent of about 70% of Australia’s greenhouse gas emissions in 2020.

In 2020, a class action challenging the Vickery coal mine expansion was brought by a group of eight young people from across Australia, represented by Equity Generation Lawyers and assisted by their 86 year-old litigation guardian, Sister Brigid Arthur. The case sought to prevent the federal environment minister from approving the proposed expansion.

In a world-first ruling in May 2021, Justice Bromberg of the Federal Court held that the environment minister has a duty of care to protect young people from the harms caused by climate change. The Court found that the impacts of global warming on young people “might fairly be described as the greatest intergenerational injustice ever inflicted by one generation of humans upon the next”.

As of August 2021, federal approval of the Vickery mine appeared to have stalled while the government appealed the Court’s decision.

Credit: ABC News (Brendan Esposito)

Valeria (Glencore)

Glencore is one of the biggest coal mining corporations in the world, with 17 operational mines across New South Wales and Queensland. In 2020, the mining multinational produced about 100 million tonnes of coal from these mines. ANZ, Commonwealth Bank and NAB all made loans to Glencore International in May 2020.

Glencore’s proposed $1.5 billion Valeria coal project, located in Central Queensland, would involve construction of a greenfield open-cut coal mine producing approximately 20 million tonnes of run-of-mine coal every year for 35 years. The company aims to begin constructing the climate-wrecking coal mine in 2024, well past the point when any new coal mines can be considered compatible with net-zero emissions by 2050.

In September 2020, superannuation fund UniSuper, which holds a 15% stake in the project, called on Glencore to abandon the mine, with chief investment officer John Pearce stating:

“We don’t believe the economics of that stack up. We think thermal coal is bound to be a stranded asset.”

John Pearce, UniSuper

Gas fields

The IEA is clear there can be no new gas fields in a net-zero emissions by 2050 scenario, with the IEA’s Executive Director remarking that further investment in oil and gas projects may be “junk investments” that could derail the achievement of climate goals.

Nevertheless, fossil fuel companies like Woodside and Santos continue pursuing huge new gas projects. Data from the Office of the Chief Economist lists 44 proposed new or expanded oil, gas and LNG projects that would cost around $125 billion.

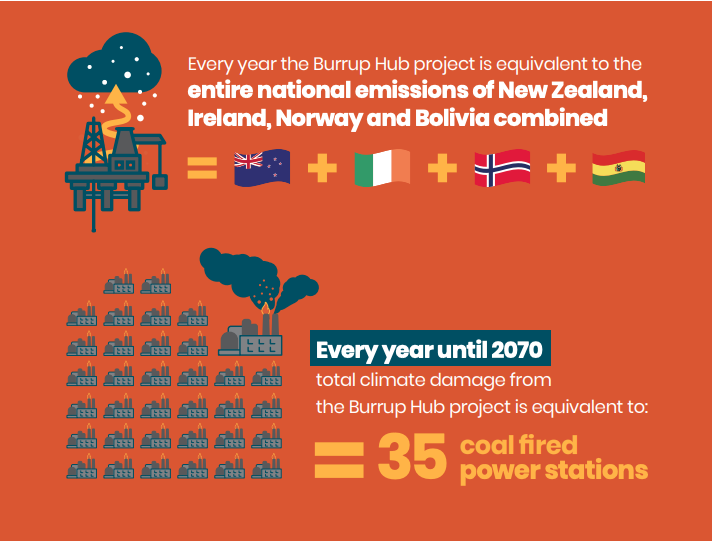

Burrup Hub (Woodside Energy)

Woodside Energy is Australia’s largest gas producer whose sights are set on extracting 20 to 25 trillion cubic feet of gas, primarily for export as LNG, through its Burrup Hub projects in north-west Western Australia. The Burrup Hub comprises multiple climate-wrecking gas projects, including ‘Browse to North West Shelf’, ‘North West Shelf project extension’ and the Scarborough gas fields. The Hub has been labelled one of the 12 global ‘carbon bombs’ jeopardising the goals of the Paris Agreement.

“The Burrup Hub would be the most polluting project ever to be developed in Australia, delivering some of the world’s dirtiest LNG for up to 50 years. With estimated total emissions of over 6 billion tonnes (gigatons) of carbon pollution across its lifetime, the proposal has profound implications for the global climate across generations.”

Piers Verstegen, Director, Conservation Council of Western Australia

According to Woodside’s own figures, Scope 1, 2 and 3 lifetime emissions from Burrup Hub projects would be up to 6.88 Gt CO2-e, nearly 14 times Australia’s total greenhouse gas emissions for the 2020 calendar year. This includes up to 1,615 Mt CO2 from the ‘Browse to North West Shelf’ project, 4,394 Mt CO2 from the ‘North West Shelf project extension’ and 878 Mt CO2 from the Scarborough gas fields.

The project also risks accelerating degradation of the Murujuga rock art (proposed for World Heritage listing) due to industrial emissions, and significant impacts to the local marine environment.

In October 2019, ANZ and Westpac each loaned to Woodside, supporting development of Pluto LNG Train 2 (Pluto 2), which is part of the Burrup Hub and would enable Woodside to export an additional 5 million tonnes of LNG per annum from its Scarborough gas fields.

The Conservation Council of Western Australia, represented by the EDO, has since launched a court challenge against approvals for the Burrup Hub, arguing “the WA state government unlawfully approved these changes without a full assessment, leaving Australians in the dark about potentially devastating impacts on our climate, communities, coral reefs, and native species”.

Beetaloo Basin (Origin Energy)

Origin Energy plans to frack the Beetaloo Gas Field, approximately 180km south-east of Katherine in the Northern Territory. The project is opposed by Traditional Owner advocates such as SEED, Australia’s first Indigenous youth climate network. SEED views the Beetalo project and broader plans to frack gas in the Northern Territory as a threat to community self determination, Traditional Owner land rights and the climate.

According to Professor Ian Lowe of Griffith University, “approving the proposed development of shale gas from the Beetaloo Sub-Basin or McArthur Basin would add very significantly to Australia’s greenhouse gas emissions in the critical period before 2030, when we are required by the Paris agreement to achieve significant reductions”.

“Emissions from development of onshore shale gas in the Northern Territory may be difficult to offset and could impact on Australia’s progress in meeting Paris Agreement commitments”

Australian Department of the Environment and Energy, as reported by ABC News

ANZ, Commonwealth Bank and Westpac funded Origin in July 2020.

Narrabri Gas Project (Santos)

Santos is one of Australia’s largest gas producers and is focused on developing its $3.6 billion Narrabri Gas Project, based in northern New South Wales. Santos could extract up to 200 terajoules (TJ) of gas per day over 20 years through unconventional gas extraction known as fracking. If combusted, 200 TJ of gas would release 10,000 tonnes of CO2-e, equivalent to the annual emissions of between 3,300 – 6,600 cars.

Expert reviews of the project’s Environmental Impact Statement detail significant and unaddressed issues with the project. These range from impacts to groundwater and local bushland to Aboriginal cultural heritage and the project’s financial viability. The NSW Department of Planning and Environment received 23,000 submissions in response to the project’s Environmental Impact Statement, stating ”this is the most submissions the Department has ever received on a development application”. 98% of total and 64% of local submissions opposed the project.

“Total GHG emissions from the use of Narrabri gas would approach those of coal”

Dr Andrew Grogan, April 2020

Members of the Gomeroi Nation, the Traditional Owners of the Narrabri region, fear the project would destroy sacred sites including the Great Artesian Basin. These concerns, among others, have compelled Traditional Owners and supporters to gather in the hundreds across capital cities to protest the project.

“Our Artesian is not up for sale and neither are we.”

Gomeroi elder Polly Cutmore, November 2020

In May 2021 Market Forces supported the North West Alliance, an affiliation of 40 groups across north west NSW, to place a full page message in The Australian Financial Review drawing attention to these impacts and calling on NAB to cease funding companies like Santos.

Santos still needs to secure finance to develop this project. Given all four of Australia’s major banks loaned to Santos as recently as November 2020, they’re all clearly at risk of funding this community- and climate-wrecking project.

Barossa gas field (Santos)

In November 2020, ANZ, NAB, CommBank and Westpac loaned Santos a combined $244 million for the acquisition of oil and gas assets including the Barossa offshore gas field 300km north of Darwin. Just four months later, Santos made a ‘final investment decision’ to proceed with the Barossa gas project.

Given the IEA’s finding that net zero by 2050 means “no new oil and gas fields”, the major banks’ funding of projects like Barossa is clearly inconsistent with their support for net zero.

The Barossa gas project would produce 3.7 million tonnes of LNG each year for 25 years, during which time it would enable the release of 401 million tonnes of CO2, equivalent to 80% of Australia’s total greenhouse gas emissions in 2020.

“The Barossa to Darwin LNG project looks more like a CO2 emissions factory with an LNG by-product”

John Robert, Process Engineer and Industrial Economist, March 2021

In August 2021, Santos was hit with a lawsuit filed by The Australasian Centre for Corporate Responsibility (ACCR) alleging the company’s statements about gas being “clean” and having a clear pathway to net zero by 2040 were deceptive.

Greater Sunrise gas field (Woodside, Osaka Gas)

The Greater Sunrise gas field is based in the Timor Sea, between Australia and Timor-Leste. The project sparked The Greater Sunrise gas field is based in the Timor Sea, between Australia and Timor-Leste. The project sparked diplomatic tensions as Australia and Timor-Leste tussled over claims to the 5 trillion cubic feet of gas reserves. After years of negotiation, the countries signed a treaty in 2018 to clarify resource sharing arrangements. At the time of writing, the project was owned by state company Timor GAP (57%), Woodside Energy (33%) and Japanese energy company, Osaka Gas (10%).

Coal and gas-fired power

According to data from the Australian Energy Market Operator (AEMO), as of July 2021 there was at least 140 MW of upgraded and proposed coal-fired power on the horizon, along with 3.4 GW of gas-fired generation, across a combined 23 projects. This is despite there being no room for new fossil fuel generation if we’re to meet the goals of the Paris Agreement, according to leading economists at Oxford University and the head of the International Energy Agency.

Coal and gas-fired power stations being pursued in NSW, QLD, SA, TAS and VIC (AEMO, July 2021)

| wdt_ID | Site Name | Owner | Fuel Type | Nameplate Capacity (MW) | Status |

|---|---|---|---|---|---|

| 1 | Bayswater | AGL Macquarie Pty Limited | Coal | 25 | Upgrade |

| 2 | Bayswater | AGL Macquarie Pty Limited | Coal | 25 | Upgrade |

| 3 | Bayswater | AGL Macquarie Pty Limited | Coal | 25 | Upgrade |

| 4 | Dalton | AGL Hydro Partnership | Gas - OCGT | 0 | Proposed |

| 5 | Goldwind Reciprocating Engine | Goldwind | Gas - Other | 72 | Proposed |

| 6 | Grosvenor 2 Waste Coal Mine Gas Power Station | EDL Projects Australia Pty Ltd | Gas - Other | 15 | Proposed |

| 7 | Kurri Kurri OCGT | Snowy Hydro Limited | Gas - OCGT | 750 | Committed |

| 8 | Loy Yang A Power Station | AGL Loy Yang Marketing Pty Ltd | Coal | 15 | Anticipated Upgrade |

| 9 | Marulan | EnergyAustralia Marulan Pty Ltd | Gas - Other | 250 | Proposed |

| 10 | Mortlake | Origin Energy Power Limited | Gas - OCGT | 50 | Proposed |

The emerging coal and gas-fired threats to our climate include:

- AGL’s proposed Tarrone Power Project, a 500-600 MW open cycle gas-fired power plant near Macarthur, Victoria. All big four banks made loans to AGL as recently as Sep 2019.

- Hunter Energy’s planned recommissioning of the 150 MW Redbank coal-fired power station in NSW that was shut down 5 years ago. Westpac and BankWest (a subsidiary of Commonwealth Bank) funded the plant back in 2004.

- The proposed 750 MW Kurri Kurri gas-fired power station, is to be owned and operated by the publicly owned Snowy Hydro Ltd. The federal government has committed $600 million to the project, which energy experts say will be an expensive white-elephant, operating on average only 1 hour per month.

Beyond the proposals listed above are other absurd fossil fuel pipe dreams including:

- Shine Energy’s proposal to build a 1,000 MW coal-fired power station in Queensland, for which it has still not received $4m in promised government funding for a feasibility study (as of Jun 2020) and doubts government support is genuine.

- Trevor St Baker’s dream of building coal power stations to replace Hazelwood and Vales Point A, which the Australian Financial Review noted banks are reluctant to fund.