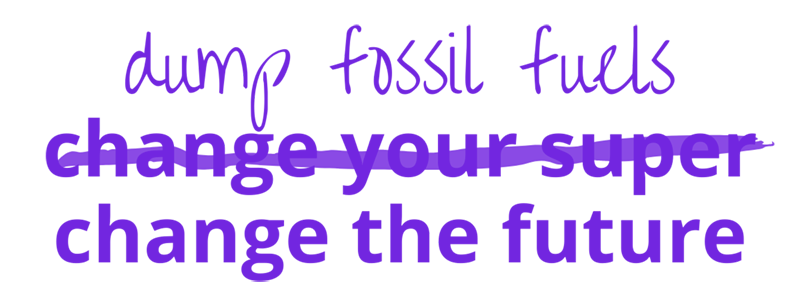

This webpage was created by Market Forces. On its own website, HESTA paints itself as ethical and sustainable but fails to mention investing over $2 billion in fossil fuels which are driving the climate crisis. So we decided to fix it for them, free of charge.

Join the movement calling on HESTA to stop investing in fossil fuel companies causing climate destruction and strain on the health system.

HESTA claims it is driving meaningful change for generations to come. Yet the fund currently invests in companies with fossil fuel expansion plans that undermine our chances of avoiding catastrophic climate change. A new report, endorsed by some of the country’s top medical colleges, warns the effects of climate change will place immense pressure on Australia’s hospitals in the next 10 years[1]The Royal Australasian College of Physicians, Climate Change and Australia’s Healthcare Systems – A Review of Literature, Policy and Practice … Continue reading.

Use the form on this page to join the movement calling on HESTA to stop investing in fossil fuel companies causing climate destruction and strain on the health system.

HESTA has over $2 billion invested in fossil fuels, including investments in Australia’s two biggest oil and gas companies Woodside and Santos[2]HESTA states “At 30 June 2021 oil and gas companies represent only 3.60% of our total portfolio exposure”. The fund’s total assets under management at that time were $67,002,788,000.. These companies are pursuing new fossil fuel projects, contributing to catastrophic climate change which is ‘the greatest global health threat facing the world in the 21st century’, according to The Lancet medical journal[3] The Lancet Countdown on Health and Climate Change https://www.thelancet.com/countdown-health-climate.

HESTA’s investments in Woodside

Woodside is an oil and gas company that is currently trying to develop the Scarborough offshore gas field, one of the dirtiest new fossil fuel projects planned in Australia. Expert analysis has found “Woodside’s proposed Scarborough to Pluto LNG project in Western Australia represents a bet against the world implementing the Paris Agreement”[4]Climate Analytics, Warming Western Australia: How Woodside’s Scarborough and Pluto Project undermines the Paris Agreement (2021) … Continue reading.

The project would result in the emissions equivalent of 15 coal power stations running for 30 years, threaten to accelerate the degradation of Murujuga Rock art (proposed for World Heritage listing), and would also cause significant impacts to the local marine environment[5]Conservation Council of Western Australia, Why the Scarborough LNG development cannot proceed (2021) … Continue reading.

Woodside’s Burrup hub. Photo credit CCWA.

HESTA’s investments in Santos

Just like Woodside, Santos plans to massively increase dirty gas production, taking us in completely the opposite direction to the clean, green future we need. Santos is planning to develop the highly controversial Narrabri coal seam gas project in northern New South Wales. When burnt, the gas produced from this project could add carbon emissions equivalent to between 3,300 – 6,600 cars every year! On top of this, experts have highlighted[6]https://www.csgfreenorthwest.org.au/eis_expert_reviews_2 the project’s significant potential impacts on Aboriginal cultural heritage, groundwater, and local bush and farmland.

Narrabri residents say no to Santos coal seam gas. Credit – Lock the Gate Alliance / Joseph McGrath

References

| ↑1 | The Royal Australasian College of Physicians, Climate Change and Australia’s Healthcare Systems – A Review of Literature, Policy and Practice https://www.racp.edu.au/advocacy/policy-and-advocacy-priorities/climate-change-and-health. |

|---|---|

| ↑2 | HESTA states “At 30 June 2021 oil and gas companies represent only 3.60% of our total portfolio exposure”. The fund’s total assets under management at that time were $67,002,788,000. |

| ↑3 | The Lancet Countdown on Health and Climate Change https://www.thelancet.com/countdown-health-climate |

| ↑4 | Climate Analytics, Warming Western Australia: How Woodside’s Scarborough and Pluto Project undermines the Paris Agreement (2021) https://climateanalytics.org/media/climateanalytics_scarboroughpluto_dec2021.pdf |

| ↑5 | Conservation Council of Western Australia, Why the Scarborough LNG development cannot proceed (2021) https://d3n8a8pro7vhmx.cloudfront.net/ccwa/pages/1/attachments/original/1622622008/Why_the_Scarborough_LNG_development_cannot_proceed_web_final.pdf?1622622008 |

| ↑6 | https://www.csgfreenorthwest.org.au/eis_expert_reviews_2 |