3 September 2015

What a moment. There we were, sitting in a meeting at NAB along with Adrian Burragubba, traditional owner from the area we know as the Galilee Basin, who had just explained how Adani’s proposed Carmichael mega mine would devastate his ancestral land and threaten the culture of the Wangan and Jagalingou people.

And then the bank said it: NAB is not involved and has no plans to be involved in any financing for the Carmichael coal mine.

A quiet smile grew across Adrian’s face, as it was clear that this was a major victory for all those who had worked so hard for so long to get the Australian banks to rule out funding for the Galilee Basin coal export projects, not least the Wangan and Jagalingou traditional owners of the land where the Carmichael mine is proposed.

It took another day for the news to break publicly but when it did, boy did it make a splash! Check out the story here and you can share the images below on social media to spread the word.

Analysis: what NAB’s decision means for the Galilee Basin

NAB is the fourteenth bank to distance themselves from finance for Galilee Basin coal export projects. More importantly, they are the second bank from Australia, after Commonwealth Bank exited its role as an adviser to Adani.

The two Australian banks that have distanced themselves from Adani’s Carmichael project are by far the most important. The Carmichael coal project is a 40 million tonne per year (increasing to 60 million tonnes per year) thermal coal mine, rail line and new coal export terminal at Abbot Point in the Great Barrier Reef World Heritage Area. The whole project costs over $16 billion and for a foreign company to enter Australia and do all of this without an Australian partner or supporter is almost unthinkable.

Then there’s the sheer volume of money we’re talking about already off the table. The 14 banks that have taken positions against Galilee Basin coal export projects have provided 26% of all fossil fuel lending in Australia since 2008, and 31% of the lending to coal mining. For a project as large and expensive as this, taking so many active lenders to fossil fuels in Australia out of the running makes it far more difficult for Adani to round up other banks. Putting a deal together will likely be more expensive, take longer and involve far more banks agreeing to support it.

After travelling the world, a win arrives close to home

We’ve travelled thousands of kilometres with Wangan and Jagalingou traditional owners this year. In June we met banks in Zurich, Wall Street and – probably most notably – London, where Standard Chartered were told in no uncertain terms that they were helping a project that would only proceed by breaching human rights law, as the W&J had said no to Adani.

We had no idea that our greatest moment so far would happen right here in Australia, as NAB took off the table any notion that they would finance the Carmichael coal mine.

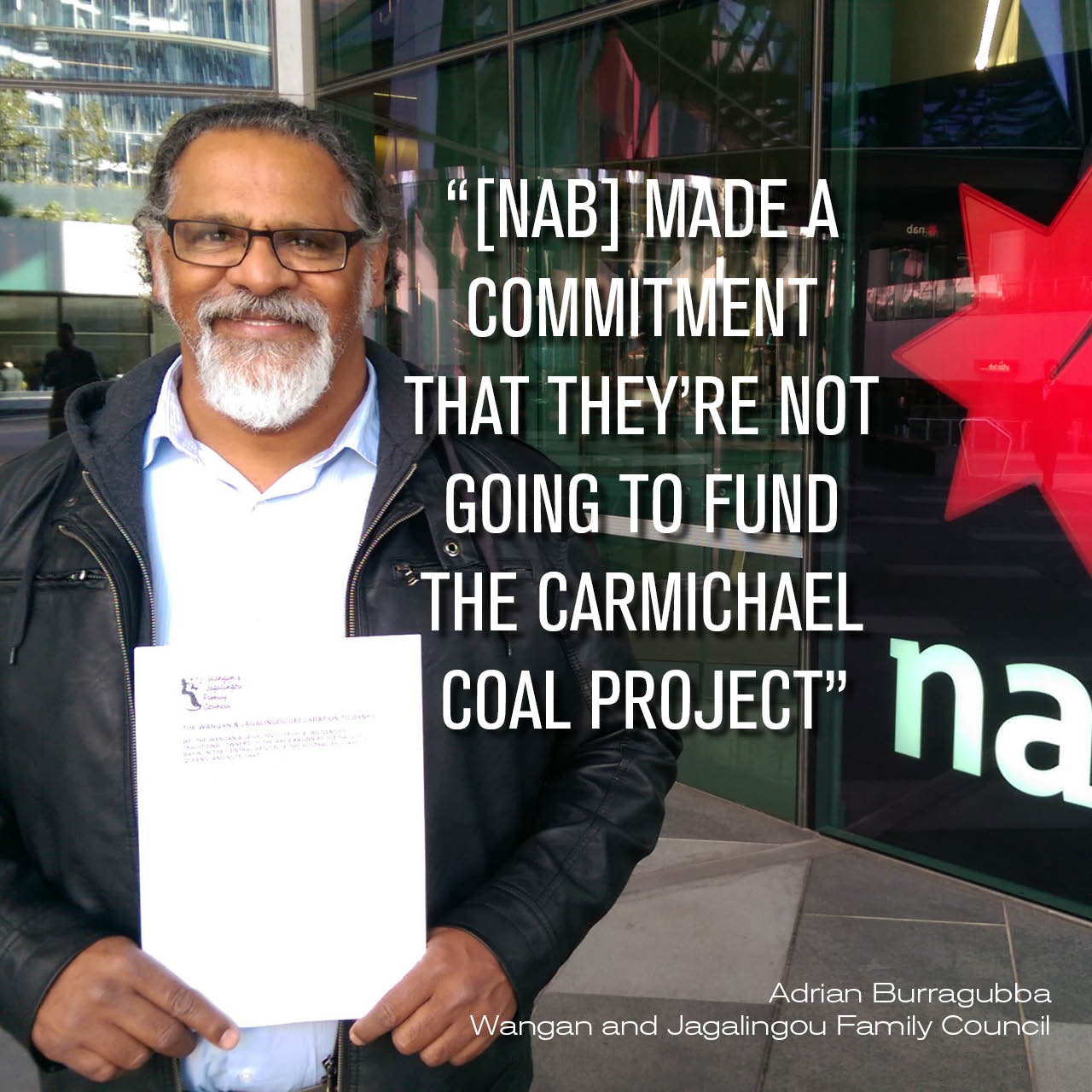

We had a chat to Adrian Burragubba after the meeting. Here’s what he had to say…

For more information on the work of the Wangan and Jagalingou traditional owners, and their campaign to defend their land from Galilee Basin coal miners, check out www.wanganjagalingou.com.au

Carmichael hanging by a thread. Time to snap that thread.

To be clear, the Carmichael coal project is in big trouble. But it still staggers on and while it remains an active proposal, there is a chance it will come back and once again threaten our land, water, air, environment and climate. We can’t afford to take any chances – after all, if Carmichael ends up going ahead it would open the door to the entire Galilee Basin potentially being mined, a situation that means we can kiss any chance of a safe climate future goodbye.

The Tony Abbott kiss of death…

One of the things that makes today’s news all the more beautiful was how last Friday, Tony Abbott called on businesses to get behind the Carmichael project. This is one of the reasons why we remain concerned about the Carmichael coal mine. The government clearly wants it to happen, and is even using Adani’s figures about jobs and economic benefits that have been found in court to be false.

The Abbott government’s increasingly hostile approach to climate change action and environmental protection is pushing them into extreme territory, putting distance between them and the business community. One commentator who waded into the debate today was Cameron Clyne, the former NAB CEO. He had previously written about how damaging the government’s climate policy was on Australia and our economy and said today:

NAB today ruling out involvement with the Adani Carmichael coal megamine seems proper. This project, by all accounts, doesn’t seem to stack up economically and appears unlikely to ever turn a profit. NAB’s statement today seems an entirely sensible decision and prudent for NAB’s shareholders. You would be hard pressed to find a financial institution that would make a different call to NAB’s today.Cameron Clyne

The divide between the Abbott government, the community and business over the Galilee Basin and the future of coal is becoming increasingly clear. In fact, not only did NAB come out as publicly against the idea of financing the Carmichael mine, just a few hours earlier LG had revealed that their letter of intent to purchase coal from Adani no longer applied. While most of us want to move on from the threat of new coal mines and see Australia well placed to be part of a world rapidly decarbonising, the government’s policies continue to drag the chain. We’re becoming isolated politically and economically.