20 June 2023

Climate wrecking oil and gas company Woodside has today made the decision to proceed with a new offshore oil field, once again demonstrating a complete disregard for investor demands to align with global climate goals.

Woodside today made the final investment decision (FID) on Trion, a massive new oil field it plans to develop in the Gulf of Mexico. Burning the oil contained in the Trion field would release 200 million tonnes of carbon dioxide,* equivalent to nearly half of Australia’s total annual emissions.

Woodside’s climate wrecking oil and gas expansion plans, including the Trion oil field, are enabled by ANZ, NAB and Westpac, as well as almost every super fund in Australia. Take action now by demanding that your super fund ditch its shares in Woodside.

Woodside’s decision to proceed with the Trion development flies in the face of the International Energy Agency’s warning that no new oil fields should be developed beyond those approved as of 2021 if the world is to have a chance of limiting global warming to 1.5°C.

This decision comes after significant investor backlash against Woodside’s climate strategy over the past two years, with 49% of investors voting against Woodside’s dodgy plan in 2022 and 35% of investors protesting the reelection of company director Ian Macfarlane this year. Yet in the face of climate science and significant investor dissent, Woodside is pushing ahead with yet another project out of line with the Paris climate goals and a safe climate future.

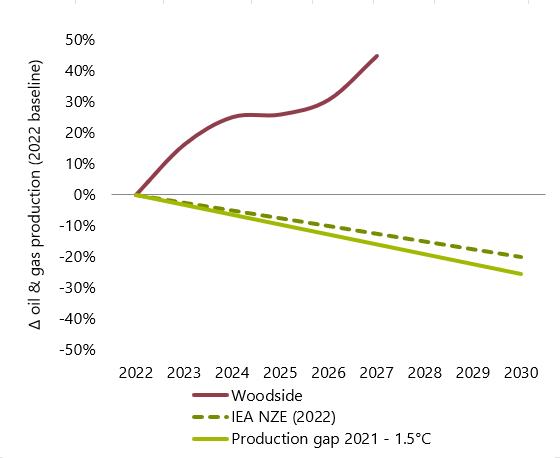

Trion is one of several new projects incompatible with the Paris climate goals that Woodside is pursuing. In fact, the company plans to increase oil and gas production by at least 45% by 2027, despite climate science telling us production must begin falling “immediately and steeply.”

Take action

Demand your super fund sell its shares in Woodside.

Figure 1: Woodside projected oil & gas production, 2022 to 2027

Woodside currently enjoys the financial backing of three of Australia’s ‘big four’ banks – ANZ, NAB and Westpac. In March 2022, these three banks all helped finance a $4.6 billion loan to Global Infrastructure Partners to acquire a 49% stake in Woodside’s Pluto 2 liquefied natural gas (LNG) project, and in July 2022, ANZ and Westpac each loaned $126 million to Woodside as part of a $1.8 billion general corporate loan.

Aside from a small group of ethical funds and industry fund NGS Super (which divested from Woodside last year), almost every super fund in Australia invests members’ retirement savings in Woodside, thereby enabling this climate wrecker to take decisions on new oil and gas projects like it has done today. Super funds have claimed for years that remaining invested in companies like Woodside gives them a ‘seat at the table,’ or the power to influence the climate strategies of companies with fossil fuel expansion plans. Yet a recent Market Forces report found super funds are failing to do so, and it’s clear that Woodside’s decision to proceed with a new oil field in 2023 means engagement from investors (including super funds) is failing to rein in the expansion plans of a company hell-bent on expanding oil and gas production.

Investors, including our super funds, must recognise their years of engagement with Woodside are failing to bring the company into line with global climate goals, as once again demonstrated by today’s FID on Trion. The time has come for investors to publicly withdraw capital from the company over its refusal to rein in its climate wrecking oil and gas expansion plans.

* Based on a stated 2C resource of 479 million barrels and using emissions factors from the Australian government.